Private Insurance Texas

The landscape of private insurance in Texas is vast and diverse, catering to the unique needs of its residents. With a population of over 30 million, Texas presents a significant market for private insurance companies, offering a wide range of options for individuals, families, and businesses.

Understanding Private Insurance in Texas

Private insurance in Texas encompasses various types of coverage, including health insurance, life insurance, auto insurance, and property insurance. Each category has its own set of regulations and guidelines, ensuring that Texans have access to comprehensive and tailored insurance plans.

The Texas Department of Insurance (TDI) plays a crucial role in regulating the insurance industry, ensuring compliance with state laws and protecting the rights of policyholders. TDI provides valuable resources and guidance for both insurance providers and consumers, making it a key player in the state's insurance ecosystem.

Health Insurance: A Focus on Affordability and Accessibility

Health insurance is a vital aspect of private insurance in Texas, given the state’s diverse population and unique healthcare needs. Texans have access to a range of health insurance plans, from individual and family policies to employer-sponsored group plans. The Affordable Care Act (ACA) has also influenced the health insurance market in Texas, with its provisions aimed at making healthcare more accessible and affordable.

One of the key challenges in Texas is the high cost of healthcare, which can make insurance premiums a significant expense for many families. To address this, the state has implemented various initiatives to make health insurance more affordable, such as offering subsidies and tax credits to eligible individuals and families. These efforts have helped increase the number of insured Texans, ensuring better access to essential healthcare services.

Furthermore, Texas has a robust network of healthcare providers, including hospitals, clinics, and specialists, which are vital to the effectiveness of health insurance plans. The state's insurance companies work closely with these providers to negotiate rates and ensure that policyholders have access to quality care.

| Insurance Category | Key Providers in Texas |

|---|---|

| Health Insurance | Blue Cross Blue Shield of Texas, UnitedHealthcare, Humana |

| Life Insurance | Prudential, MetLife, State Farm |

| Auto Insurance | Geico, State Farm, USAA |

| Property Insurance | Allstate, Farmers Insurance, Liberty Mutual |

Life Insurance: Protecting Your Loved Ones

Life insurance is an essential aspect of financial planning, providing peace of mind and security for your loved ones. In Texas, life insurance policies come in various forms, including term life insurance, whole life insurance, and universal life insurance. Each type has its own benefits and features, catering to different needs and budgets.

Term life insurance is often the most affordable option, offering coverage for a specific period, typically ranging from 10 to 30 years. It is ideal for individuals with short-term financial responsibilities, such as covering mortgage payments or providing for children's education. On the other hand, whole life and universal life insurance policies offer permanent coverage, building cash value over time, which can be accessed through loans or withdrawals.

When shopping for life insurance in Texas, it's crucial to consider factors such as your age, health, and financial goals. Insurance providers may offer different rates and policy features based on these factors, so it's essential to compare multiple options. Additionally, understanding the claims process and the financial strength of the insurance company is vital to ensure a smooth experience should the need for a claim arise.

Auto Insurance: Navigating Texas Roads Safely

Texas is known for its extensive road network, with drivers navigating busy highways and rural roads alike. Auto insurance is mandatory for all vehicle owners in the state, providing financial protection in the event of accidents, theft, or other vehicle-related incidents.

Texas has a unique auto insurance system, known as a "choice no-fault" state. This means that drivers have the option to choose between a traditional tort system, where at-fault drivers are responsible for damages, or a no-fault system, where drivers file claims with their own insurance company regardless of fault. This flexibility allows Texans to tailor their auto insurance coverage to their specific needs and preferences.

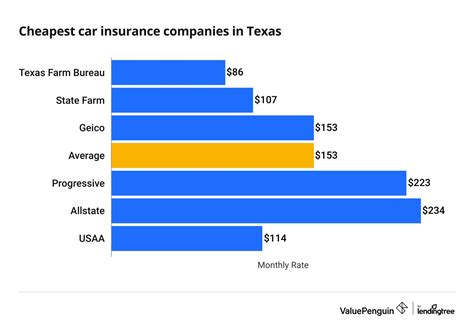

When it comes to auto insurance, Texans have a wide range of options. Major national insurers like Geico and State Farm compete with local providers, offering a variety of coverage types and discounts. From liability coverage to comprehensive and collision insurance, drivers can customize their policies to fit their driving habits and budget. Additionally, Texas offers unique discounts, such as the Good Driver Discount, which rewards safe driving habits with lower premiums.

Property Insurance: Safeguarding Your Texas Home

Texas is a state known for its diverse landscapes, from coastal regions to arid deserts. This diversity, coupled with the potential for severe weather events, makes property insurance an essential consideration for homeowners and renters alike.

Property insurance in Texas covers a range of perils, including fire, theft, and wind damage. Given the state's vulnerability to hurricanes and other severe weather, many policies also include coverage for flood damage, which is often excluded from standard policies. This additional protection is crucial for Texans living in high-risk areas.

When selecting property insurance, Texans should consider factors such as the replacement cost of their home, the value of their personal belongings, and the potential for natural disasters. Working with a reputable insurance provider, like Allstate or Farmers Insurance, can ensure that Texans have the right coverage to protect their homes and possessions.

The Future of Private Insurance in Texas

The private insurance market in Texas is constantly evolving, influenced by technological advancements, changing consumer preferences, and regulatory reforms. The rise of digital insurance platforms and telemedicine services, for instance, has transformed the way Texans access and manage their insurance plans.

Furthermore, the ongoing debate around healthcare reform and the potential for changes to the ACA could have significant implications for health insurance in Texas. Any shifts in federal policy could impact the availability and affordability of health insurance, prompting insurance companies to adapt their strategies and offerings.

Despite these challenges, the private insurance industry in Texas remains resilient, driven by a commitment to innovation and consumer satisfaction. By staying informed and engaged with the latest developments, Texans can continue to make informed choices about their insurance coverage, ensuring they have the protection they need for a secure future.

What are the minimum requirements for auto insurance in Texas?

+Texas requires all vehicle owners to carry liability insurance with minimum limits of 30,000 for bodily injury per person, 60,000 for bodily injury per accident, and $25,000 for property damage.

How can I find the best health insurance plan for my family in Texas?

+Consider your family’s healthcare needs, including regular doctor visits, prescription medications, and potential specialist care. Compare plans based on these needs, and don’t forget to factor in premiums, deductibles, and out-of-pocket costs.

What are some tips for choosing the right life insurance policy in Texas?

+First, assess your financial goals and the level of coverage you need. Term life insurance is often more affordable, but whole or universal life policies offer permanent coverage and build cash value. Compare quotes from multiple insurers and consider the company’s financial stability and customer service reputation.