Texas Cheapest Car Insurance

When it comes to car insurance, Texas residents have a wide range of options to choose from. With a diverse insurance market, it's important to understand the factors that influence insurance rates and how to find the cheapest car insurance policy that suits your needs. This article will delve into the specifics of car insurance in Texas, offering a comprehensive guide to help you make an informed decision.

Understanding Car Insurance Rates in Texas

Texas is known for its competitive insurance market, which means that insurance rates can vary significantly between providers. The cost of car insurance is influenced by a multitude of factors, including your location within the state, driving history, vehicle type, and coverage options. Understanding these variables will help you navigate the insurance landscape and find the best deal.

The average cost of car insurance in Texas is $1,497 annually, according to data from the Insurance Information Institute (III). However, this average can vary greatly depending on your specific circumstances. Let's explore some of the key factors that impact insurance rates in Texas.

Location Matters

One of the primary factors influencing insurance rates is your location within Texas. Urban areas like Houston, Dallas, and San Antonio tend to have higher insurance costs due to increased traffic congestion, accident rates, and theft risks. Conversely, rural areas generally have lower insurance rates, as there are fewer vehicles on the road and a reduced risk of accidents.

| City | Average Annual Premium |

|---|---|

| Houston | $1,592 |

| Dallas | $1,465 |

| San Antonio | $1,438 |

| Austin | $1,420 |

If you live in one of these major cities, it's worth exploring options to reduce your insurance costs, such as increasing your deductible or opting for a higher-rated insurance company that offers more competitive rates.

Your Driving Record

Your driving history plays a significant role in determining your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower insurance costs. Conversely, if you have a history of accidents or moving violations, your insurance rates will likely be higher. It’s important to maintain a safe driving record to keep your insurance costs down.

Additionally, the number of years you've been driving can impact your rates. Newer drivers, especially those under 25 years old, are often considered high-risk and may pay higher premiums. As you gain more driving experience and maintain a clean record, your insurance rates are likely to decrease.

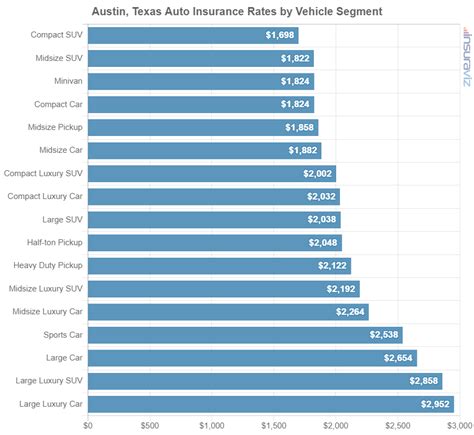

Vehicle Type and Usage

The type of vehicle you drive and how you use it can also influence your insurance rates. More expensive vehicles, such as luxury cars or sports cars, generally have higher insurance costs due to their higher replacement and repair costs. Similarly, vehicles that are frequently involved in accidents or are prone to theft may also result in higher insurance premiums.

Your vehicle's usage also matters. If you primarily use your car for personal transportation, your insurance rates will likely be lower compared to those who use their vehicles for business purposes or commute long distances. Insurance companies consider the frequency and purpose of your driving when calculating your rates.

Coverage Options

The level of coverage you choose is another critical factor in determining your insurance rates. Texas has a minimum liability insurance requirement, which is 30/60/25 for bodily injury and property damage. However, many experts recommend purchasing higher liability limits to provide adequate protection in the event of an accident. The more coverage you choose, the higher your insurance premiums are likely to be.

Additionally, you can opt for optional coverage types such as collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. These additional coverages can increase your insurance costs, but they provide valuable protection in specific situations. It's essential to assess your needs and budget to determine the right coverage options for you.

Tips for Finding the Cheapest Car Insurance in Texas

Now that we’ve explored the factors influencing insurance rates, let’s dive into some practical tips to help you find the cheapest car insurance in Texas.

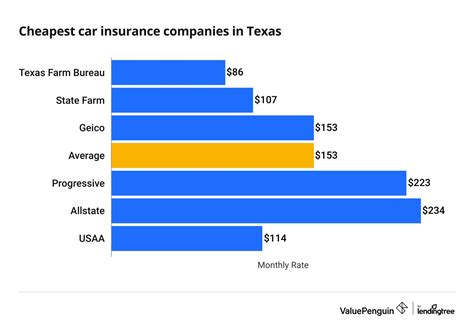

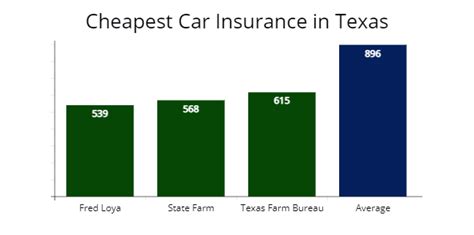

Compare Quotes from Multiple Insurers

The insurance market in Texas is highly competitive, so it’s crucial to compare quotes from multiple insurers to find the best deal. Request quotes from at least three to five different insurance companies to get a good understanding of the range of rates available. You can use online comparison tools or directly contact insurance providers to request quotes.

When comparing quotes, ensure you're comparing apples to apples. Make sure the quotes you receive include the same coverage limits and deductibles so you can accurately assess the differences in cost. Don't be afraid to negotiate with insurance providers to see if they can offer a better rate based on your specific circumstances.

Understand Your Coverage Options

As mentioned earlier, the level of coverage you choose will impact your insurance rates. It’s essential to understand your coverage options and select the right ones for your needs. Consider the following when choosing your coverage:

- Liability Coverage: Ensure you meet the minimum liability requirements in Texas, but also consider increasing your limits to provide adequate protection in case of an accident.

- Collision and Comprehensive Coverage: These coverages protect your vehicle in the event of an accident, theft, or natural disaster. Weigh the cost of these coverages against the value of your vehicle to determine if they're worthwhile.

- Personal Injury Protection (PIP): PIP coverage provides medical benefits to you and your passengers in the event of an accident, regardless of fault. It's a valuable coverage to have, especially if you don't have health insurance.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has little or no insurance. It's an important coverage to have, as it ensures you're protected even if the other driver is at fault.

Explore Discounts and Savings

Insurance companies often offer a variety of discounts to help reduce your insurance premiums. Some common discounts include:

- Safe Driver Discount: If you have a clean driving record, you may be eligible for a safe driver discount.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in significant savings.

- Good Student Discount: If you're a student or have a young driver in your household, maintaining good grades can lead to a discount on your insurance.

- Loyalty Discount: Some insurance companies offer discounts for long-term customers.

- Defensive Driving Course Discount: Completing a defensive driving course can sometimes result in a discount on your insurance.

Be sure to ask your insurance provider about any available discounts and ensure you meet the requirements to take advantage of them.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an alternative insurance model that bases your premiums on your actual driving behavior. This type of insurance can be beneficial for low-mileage drivers or those with safe driving habits. By tracking your driving behavior, insurance companies can offer more accurate and potentially lower premiums.

Usage-based insurance programs often use telematics devices or smartphone apps to monitor your driving habits, such as mileage, braking habits, and time of day driven. If you're a safe and cautious driver, this type of insurance could result in significant savings.

Shop Around Regularly

Insurance rates can change over time, and what was the cheapest option a year ago might not be the best deal today. It’s important to regularly shop around and compare quotes to ensure you’re getting the most competitive rates. Consider reviewing your insurance options annually or whenever you experience a significant life event, such as getting married, buying a new car, or moving to a new location.

The Future of Car Insurance in Texas

The insurance landscape in Texas is constantly evolving, and there are several trends and developments that could impact the future of car insurance in the state.

Autonomous Vehicles

The rise of autonomous vehicles is likely to have a significant impact on car insurance. As self-driving cars become more prevalent, there could be a reduction in accidents caused by human error, potentially leading to lower insurance rates. However, there are also concerns about the cybersecurity risks associated with autonomous vehicles, which could result in increased insurance costs.

Electric Vehicles

The increasing popularity of electric vehicles (EVs) is another trend that could influence insurance rates. EVs generally have lower maintenance costs and are often considered safer than traditional gasoline-powered vehicles. This could result in lower insurance premiums for EV owners. However, the initial cost of purchasing an EV is still higher than traditional vehicles, which could impact insurance rates in the short term.

Telematics and Usage-Based Insurance

The use of telematics and usage-based insurance is likely to become more prevalent in the future. As insurance companies gain access to more data about driving behavior, they can offer more personalized and accurate insurance rates. This could benefit safe drivers who are willing to share their driving data, but it may also result in higher rates for those with riskier driving habits.

Regulatory Changes

Changes in state regulations can also impact insurance rates. For example, if Texas were to implement stricter liability limits or introduce new insurance mandates, it could lead to an increase in insurance costs. It’s important to stay informed about any potential regulatory changes that could affect your insurance rates.

Conclusion

Finding the cheapest car insurance in Texas requires a combination of understanding the factors that influence insurance rates and shopping around for the best deal. By comparing quotes from multiple insurers, understanding your coverage options, and exploring discounts, you can find an affordable insurance policy that meets your needs.

As the insurance landscape continues to evolve, it's important to stay informed about the latest trends and developments. Keep an eye on the impact of autonomous and electric vehicles, as well as changes in usage-based insurance and state regulations. By staying informed and regularly reviewing your insurance options, you can ensure you're getting the best value for your car insurance in Texas.

What is the minimum liability insurance requirement in Texas?

+The minimum liability insurance requirement in Texas is 30/60/25 for bodily injury and property damage. This means you must have liability coverage of at least 30,000 for injury or death to one person, 60,000 for injury or death to two or more people, and $25,000 for property damage.

Can I get car insurance without a driver’s license in Texas?

+While it is generally required to have a valid driver’s license to purchase car insurance, there are some exceptions. If you own a vehicle but do not drive it, you can still obtain car insurance. However, if you are caught driving without a valid license, your insurance coverage may be affected, and you may face legal consequences.

How does my credit score impact my car insurance rates in Texas?

+In Texas, insurance companies are allowed to use credit-based insurance scores when determining your insurance rates. Generally, individuals with higher credit scores are considered lower risk and may qualify for lower insurance premiums. However, the impact of your credit score on your insurance rates can vary depending on the insurance company and other factors.