Oregon Marketplace Health Insurance

In the state of Oregon, healthcare is a crucial aspect of daily life, and understanding the intricacies of health insurance is essential for residents to make informed decisions about their coverage. The Oregon Health Insurance Marketplace, also known as Cover Oregon, provides a platform for individuals and families to access affordable healthcare plans. Let's delve into the specifics of Oregon Marketplace Health Insurance, exploring its features, benefits, and the impact it has on the lives of Oregonians.

Understanding Oregon Marketplace Health Insurance

Oregon’s commitment to providing accessible healthcare is reflected in its comprehensive health insurance marketplace. Cover Oregon, established under the Affordable Care Act (ACA), offers a range of insurance plans tailored to meet the diverse needs of the state’s population. By centralizing insurance options, the marketplace simplifies the process of comparing and enrolling in health coverage, ensuring a seamless experience for consumers.

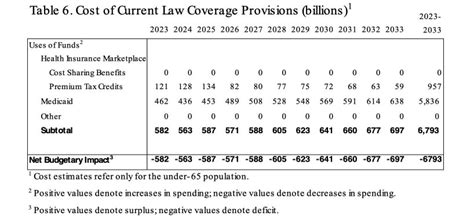

One of the key advantages of Oregon Marketplace Health Insurance is the availability of subsidies and tax credits. These financial aids make insurance more affordable, especially for low- and middle-income households. The marketplace calculates these subsidies based on factors like income, family size, and local insurance rates, ensuring that healthcare remains within reach for all Oregonians.

Furthermore, Oregon's healthcare marketplace prioritizes consumer protection. It ensures that insurance providers adhere to strict guidelines, preventing discriminatory practices and guaranteeing essential health benefits. This commitment to consumer rights empowers individuals to make confident choices, knowing their rights are upheld.

Navigating the Marketplace: A Step-by-Step Guide

For those new to Oregon’s health insurance landscape, navigating the marketplace can be a complex task. Here’s a detailed guide to help you through the process:

Step 1: Determine Your Eligibility

The first step is to assess your eligibility for Oregon Marketplace Health Insurance. This primarily depends on your citizenship status, residency, and income. U.S. citizens and lawfully present residents are eligible, and the income threshold varies based on family size and local guidelines.

For instance, a single individual with an annual income below $52,200 (2023 data) may qualify for premium tax credits, making insurance more affordable. Families and individuals with higher incomes may still find suitable plans, as the marketplace offers a range of options.

Step 2: Choose Your Plan

Once eligible, you can explore the various insurance plans available on the marketplace. These plans are categorized into metal tiers (bronze, silver, gold, and platinum) based on the level of coverage and cost-sharing. Bronze plans typically have lower premiums but higher out-of-pocket costs, while platinum plans offer the opposite.

Consider your healthcare needs and budget when selecting a plan. For example, if you anticipate frequent doctor visits and prescriptions, a silver or gold plan might be more suitable, as they often cover a higher percentage of costs.

Step 3: Enroll and Manage Your Coverage

After choosing your plan, the next step is to enroll. This can be done online, by phone, or in-person with the assistance of navigators and certified application counselors. The enrollment period typically runs from November 1st to December 15th each year, with special enrollment periods available for qualifying life events.

Once enrolled, it's essential to manage your coverage effectively. Keep track of your policy documents, understand your benefits and exclusions, and ensure timely premium payments. The marketplace also provides resources and tools to help you navigate any changes or challenges during your coverage period.

The Impact of Oregon Marketplace Health Insurance

Oregon’s health insurance marketplace has had a profound impact on the well-being of its residents. By making healthcare more accessible and affordable, the marketplace has contributed to improved health outcomes and financial security for many Oregonians.

Improved Access to Healthcare

Before the implementation of Cover Oregon, many individuals and families struggled to afford comprehensive health insurance. The marketplace has bridged this gap, providing an accessible platform for Oregonians to secure the coverage they need. As a result, more people have access to preventive care, reducing the burden of untreated health issues.

Financial Relief and Security

The availability of subsidies and tax credits has been a game-changer for many households. These financial aids have made insurance more manageable, reducing the financial strain on families. With more affordable coverage, individuals can seek necessary medical treatments without fear of overwhelming costs, leading to better overall financial health.

Consumer Empowerment and Protection

Oregon’s commitment to consumer protection ensures that insurance providers act fairly and ethically. This empowers consumers to make informed choices, knowing their rights are respected. The marketplace’s focus on transparency and accountability has fostered a culture of trust, benefiting both consumers and providers.

Real-Life Stories: Oregon Marketplace Health Insurance in Action

To understand the true impact of Oregon Marketplace Health Insurance, let’s hear from some real-life Oregonians who have benefited from the program:

Sarah’s Story: A Young Professional’s Peace of Mind

“As a recent college graduate, I was nervous about finding affordable health insurance. The Oregon Marketplace made the process straightforward. I was able to secure a silver plan that fit my budget, and the process was hassle-free. Now, I have peace of mind knowing I’m covered.”

Michael’s Journey: Navigating Chronic Illness

“Living with a chronic condition, I knew finding the right insurance was crucial. The marketplace’s comprehensive plan options and consumer protection gave me confidence. With my gold plan, I can access the specialized care I need without worrying about high costs. It’s made a world of difference in managing my health.”

The Smith Family’s Experience: Financial Relief

“As a family of four, health insurance was a significant expense. The Oregon Marketplace helped us find a bronze plan that suited our needs and budget. With the tax credits, we saved a substantial amount. This financial relief has allowed us to focus on other family priorities, knowing we have adequate healthcare coverage.”

Future Implications and Ongoing Developments

As Oregon continues to refine its healthcare system, the marketplace is poised for further growth and improvement. Here are some key developments and future implications to watch for:

- Expanding Coverage Options: Oregon is exploring ways to enhance the diversity of insurance plans, ensuring even more tailored coverage for residents.

- Technology Integration: The marketplace aims to leverage technology for a more seamless and efficient user experience, making enrollment and management processes even simpler.

- Community Outreach: Ongoing efforts to reach underserved communities and provide education about health insurance will continue, ensuring that all Oregonians have access to the information they need.

Oregon's dedication to accessible and affordable healthcare is evident in the success of its health insurance marketplace. By empowering residents to take control of their healthcare choices, the state has made significant strides in improving the overall well-being of its population. As the marketplace evolves, it will continue to play a vital role in shaping the health and financial security of Oregonians.

How often can I enroll in Oregon Marketplace Health Insurance?

+

The general open enrollment period is from November 1st to December 15th each year. However, you may qualify for a special enrollment period due to certain life events, such as losing other coverage, getting married, or having a baby. During these special circumstances, you can enroll outside of the standard open enrollment window.

What happens if I miss the open enrollment period?

+

If you miss the open enrollment period and do not qualify for a special enrollment period, you may need to wait until the next open enrollment to enroll in a new plan. However, it’s important to note that you may still be eligible for Medicaid or the Children’s Health Insurance Program (CHIP) at any time, regardless of the enrollment period.

Can I change my health insurance plan during the year?

+

Yes, you can change your health insurance plan during the year if you experience a qualifying life event, such as getting married, having a baby, or losing other coverage. These events trigger a special enrollment period, allowing you to make changes to your coverage outside of the standard open enrollment window.