Progressive Auto Insurance Login

Welcome to our comprehensive guide on Progressive Auto Insurance Login. In today's fast-paced world, managing your insurance needs online has become more crucial than ever. Progressive, a leading insurance provider, offers a seamless and efficient login process to access your auto insurance account. This article will take you through the entire login journey, from understanding the benefits of online access to exploring the features and tools available once you're logged in. By the end, you'll be an expert at navigating your Progressive Auto Insurance account with ease.

Understanding the Progressive Auto Insurance Login

Progressive Auto Insurance’s online login portal is designed to empower policyholders with quick and convenient access to their insurance information. With just a few clicks, you can manage various aspects of your auto insurance policy, from making payments to updating your personal details. Let’s delve into the process step by step.

Step-by-Step Guide to Logging In

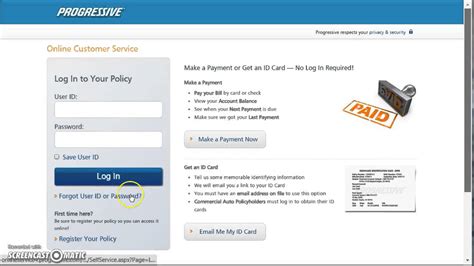

- Open your preferred web browser and navigate to the Progressive Auto Insurance website. You can type “progressive.com” into the address bar or use a search engine to find the official website.

- Once you’re on the homepage, locate the “Login” button, usually found at the top right corner of the page. Clicking on it will open a new window or tab.

- In the login window, you’ll see two fields: one for your username and another for your password. If you’re an existing customer, enter your credentials accurately.

- If you’re a new user or have forgotten your login details, click on the “Forgot Username or Password” link. This will guide you through the recovery process, allowing you to reset your credentials securely.

- After entering your credentials, click on the “Login” button. Progressive’s secure system will verify your information, and you’ll be redirected to your personalized dashboard.

Key Benefits of Progressive Auto Insurance Login

- Convenience and Accessibility: Access your insurance account from anywhere with an internet connection, eliminating the need for physical visits or phone calls.

- Real-Time Updates: Stay informed about your policy details, coverage changes, and renewal dates without waiting for mail or phone notifications.

- Paperless Management: Reduce paper clutter by viewing and managing your insurance documents digitally, contributing to a more sustainable environment.

- Quick Claims Processing: Submit claims online, upload necessary documents, and track the progress of your claim, ensuring a faster and more efficient resolution process.

- Policy Customization: Easily adjust your coverage limits, add or remove drivers, and make other policy changes to suit your evolving needs.

Exploring the Progressive Auto Insurance Dashboard

Once you’ve successfully logged in, you’ll be greeted by a user-friendly dashboard that serves as your command center for all things related to your auto insurance policy. Let’s explore the key features and functionalities it offers.

Account Overview

The dashboard provides a comprehensive overview of your auto insurance policy, including:

- Policy Details: View your policy number, coverage limits, effective dates, and other important policy information at a glance.

- Billing Information: Access your billing history, make payments, and set up automatic payments to ensure timely premium payments.

- Coverage Options: Explore different coverage types and limits, allowing you to customize your policy to match your specific needs.

Claims Management

The “Claims” section is a one-stop shop for all your claims-related activities. Here’s what you can do:

- Submit a Claim: Initiate the claims process by providing details about the incident and uploading relevant documents.

- Track Claim Progress: Stay updated on the status of your claim, from the initial assessment to the final settlement.

- Review Claim History: Access a detailed record of all your past claims, including dates, amounts, and resolutions.

Policy Updates and Add-Ons

Progressive’s online platform makes it easy to make changes to your policy. You can:

- Add or Remove Vehicles: Update your policy to reflect changes in your vehicle ownership or usage.

- Modify Coverage Limits: Adjust your liability, collision, and comprehensive coverage limits to ensure adequate protection.

- Explore Optional Add-Ons: Discover additional coverage options, such as rental car reimbursement or roadside assistance, to enhance your policy.

Payment Options and History

Managing your payments is straightforward with Progressive’s online system. You can:

- Make One-Time Payments: Pay your premiums conveniently using various payment methods, including credit cards, debit cards, or electronic checks.

- Set Up Recurring Payments: Schedule automatic payments to ensure your premiums are paid on time without any hassle.

- View Payment History: Access a detailed record of all your past payments, including dates, amounts, and payment methods.

Advanced Features and Tools

Progressive’s commitment to innovation extends beyond the basic login and dashboard features. The platform offers several advanced tools to enhance your insurance experience.

Progressive Snapshot

Progressive Snapshot is a unique program that rewards safe drivers with personalized insurance rates. Here’s how it works:

- Sign Up for Snapshot: Enroll in the program through your online account, and Progressive will provide you with a small device to plug into your vehicle’s diagnostic port.

- Monitor Your Driving Habits: The Snapshot device tracks your driving behavior, including speed, braking, and time of day, to calculate a safe driving score.

- Receive Discounts: Based on your safe driving habits, Progressive may offer you discounts on your auto insurance premiums, saving you money.

Online Resources and Education

Progressive’s online platform provides a wealth of resources to help you better understand auto insurance and make informed decisions. You can access:

- Insurance Guides: Comprehensive guides explaining different aspects of auto insurance, from coverage types to claim processes.

- Interactive Tools: Fun and educational tools, such as a coverage calculator, to help you determine the right level of coverage for your needs.

- Community Forums: Engage with other Progressive policyholders, share experiences, and seek advice on various insurance-related topics.

Frequently Asked Questions (FAQ)

How often should I update my policy information online?

+

It’s a good practice to review and update your policy information annually or whenever there are significant changes in your personal or vehicle details. Regular updates ensure that your coverage remains accurate and tailored to your needs.

Can I access my Progressive Auto Insurance account on my mobile device?

+

Absolutely! Progressive offers a mobile-optimized website and a dedicated mobile app, making it convenient to manage your insurance on the go. Simply visit the website on your mobile browser or download the app from the App Store or Google Play.

What should I do if I forget my login credentials?

+

If you forget your username or password, click on the “Forgot Username or Password” link during the login process. You’ll be guided through a secure process to reset your credentials. Progressive prioritizes account security, so you’ll need to provide certain details to verify your identity.

How can I contact Progressive’s customer support if I have further questions or need assistance?

+

Progressive offers multiple channels for customer support. You can reach out via phone, email, or live chat through their website. Additionally, the “Contact Us” section on their website provides detailed information on how to get in touch with their support team.

Conclusion

Progressive Auto Insurance’s online login platform is a powerful tool for policyholders to manage their insurance needs efficiently. By understanding the step-by-step login process and exploring the various features and tools available, you can make the most of your Progressive Auto Insurance account. From policy updates to claims management and educational resources, Progressive’s online platform ensures a seamless and informative insurance experience.