Progressive Automobile Insurance Quote

Progressive, a well-established insurance provider, offers a range of auto insurance plans designed to cater to diverse driver profiles. Understanding the importance of personalized coverage, Progressive has developed an innovative quoting process to ensure individuals receive tailored quotes reflecting their unique circumstances.

A Comprehensive Guide to Progressive’s Automobile Insurance Quote

Securing affordable and comprehensive automobile insurance is a crucial aspect of responsible vehicle ownership. Progressive Insurance, a prominent player in the industry, recognizes the importance of offering tailored solutions to meet the diverse needs of its customers. This guide delves into the comprehensive process of obtaining a Progressive automobile insurance quote, highlighting the key factors that influence the quote and exploring the unique features that set Progressive apart in the market.

Understanding Progressive’s Quoting Process

Progressive’s quoting process is designed to be straightforward and efficient, allowing customers to obtain personalized quotes with minimal effort. The process begins with a simple online form that collects essential information about the vehicle, driver, and desired coverage.

One of the standout features of Progressive's quoting process is its real-time pricing. This means that as you input your details, you receive an immediate estimate of your insurance costs. This real-time feedback ensures transparency and helps customers make informed decisions about their coverage.

Additionally, Progressive offers a mobile app that simplifies the quoting process even further. With the app, you can conveniently access your quote, make adjustments, and even complete the purchase process directly from your smartphone.

Factors Influencing Your Progressive Quote

Several factors come into play when Progressive calculates your automobile insurance quote. Understanding these factors can help you anticipate the costs and make informed choices about your coverage.

Vehicle Details

The make, model, and year of your vehicle are essential considerations. Progressive takes into account the vehicle’s safety features, repair costs, and historical claims data to determine the base rate for your insurance.

For instance, if your vehicle has advanced safety features like lane departure warning or automatic emergency braking, you may be eligible for discounts, reducing your overall insurance costs.

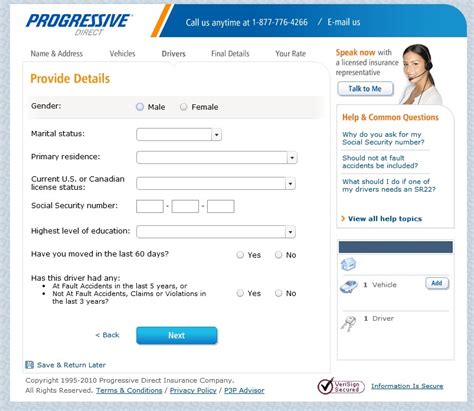

Driver Information

Your driving record and personal details play a significant role in determining your insurance quote. Progressive considers factors such as your age, gender, driving history, and credit score when calculating your rates.

If you have a clean driving record with no accidents or violations, you can expect more favorable rates. Progressive also offers discounts for safe driving, encouraging responsible behavior on the road.

Coverage Preferences

Progressive allows you to customize your insurance coverage to fit your specific needs. The type and level of coverage you select will directly impact your quote. Common coverage options include liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage.

It's essential to strike a balance between the coverage you need and the cost. Progressive's quoting process provides a detailed breakdown of each coverage option, helping you make informed decisions.

Progressive’s Unique Features and Benefits

Progressive is known for its innovative approach to insurance, offering a range of unique features and benefits that set it apart from traditional insurance providers.

Snapshot® Program

The Snapshot® program is a revolutionary feature that allows Progressive to tailor your insurance rates based on your actual driving behavior. By installing a small device in your vehicle or using a mobile app, Progressive can track your driving habits, such as miles driven, time of day, and hard braking incidents.

Based on this data, Progressive can offer personalized discounts to safe drivers, rewarding those who practice responsible driving habits. This program provides an incentive for drivers to improve their driving skills and potentially save on their insurance costs.

Usage-Based Insurance (UBI)

Progressive’s UBI program takes the Snapshot® concept a step further by offering insurance rates based on your individual driving patterns. This means that if you drive fewer miles or at lower-risk times, you may be eligible for even more significant discounts.

UBI provides an excellent opportunity for low-mileage drivers or those who primarily drive during off-peak hours to save on their insurance costs. It's a tailored approach that recognizes the unique driving habits of individuals.

Bundling Options

Progressive encourages customers to bundle their insurance policies to save even more. By combining your auto insurance with other policies, such as homeowners or renters insurance, you can take advantage of bundling discounts, reducing your overall insurance costs.

Bundling not only saves you money but also simplifies your insurance management, as you can handle all your policies through a single provider.

Claims Handling

Progressive is known for its efficient and customer-centric claims handling process. In the event of an accident, Progressive offers a 24⁄7 claims reporting system, ensuring prompt assistance whenever you need it.

The company also provides a dedicated claims team to guide you through the entire claims process, making it as smooth and stress-free as possible. Progressive's commitment to customer satisfaction extends to every aspect of their insurance services.

Additional Services

Progressive offers a range of additional services to enhance your insurance experience. These include roadside assistance, rental car coverage, and accident forgiveness options. These services provide added peace of mind and ensure you have the support you need in various situations.

For instance, roadside assistance can be a lifesaver if you ever find yourself stranded with a vehicle issue. Progressive's network of service providers ensures prompt assistance, minimizing any inconveniences.

Comparative Analysis: Progressive vs. Other Insurers

When considering automobile insurance, it’s essential to compare Progressive’s offerings with those of other prominent insurers. Here’s a comparative analysis to help you understand how Progressive stacks up against the competition.

Coverage Options

Progressive offers a comprehensive range of coverage options, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. These options provide flexibility and allow customers to tailor their insurance plans to their specific needs.

While other insurers also offer similar coverage options, Progressive's unique features, such as the Snapshot® program and UBI, set it apart by providing more personalized and tailored coverage.

Pricing and Discounts

Progressive is known for its competitive pricing and generous discounts. The Snapshot® program and UBI options can lead to significant savings for eligible customers. Additionally, Progressive offers a variety of other discounts, including those for safe driving, bundling policies, and loyalty.

When compared to other insurers, Progressive often provides more opportunities for customers to save on their insurance premiums. However, it's important to note that pricing can vary based on individual circumstances and the specific coverage chosen.

Customer Service and Claims Handling

Progressive prides itself on its customer-centric approach, offering a dedicated claims team and 24⁄7 claims reporting. This level of service ensures that customers receive prompt assistance and support during the claims process.

While many insurers provide similar levels of customer service, Progressive's commitment to customer satisfaction and its innovative use of technology, such as the mobile app, enhance the overall customer experience.

Additional Benefits and Services

Progressive’s additional services, such as roadside assistance and accident forgiveness, provide added value to customers. These services offer peace of mind and ensure that customers receive comprehensive support beyond just insurance coverage.

While other insurers may offer similar services, Progressive's integration of these benefits into its insurance packages demonstrates a commitment to providing a well-rounded and supportive insurance experience.

Performance Analysis: Progressive’s Track Record

Progressive’s performance in the insurance market is a testament to its commitment to customer satisfaction and innovative approaches. The company has consistently ranked highly in customer satisfaction surveys, reflecting its focus on delivering quality service.

Additionally, Progressive's financial stability and strong claims-paying ability have been recognized by leading rating agencies. This stability ensures that Progressive can meet its obligations to policyholders, providing peace of mind and security.

Customer Satisfaction

Progressive has consistently received high marks for customer satisfaction in independent surveys. Customers appreciate the company’s transparent quoting process, efficient claims handling, and personalized insurance options.

The Snapshot® program and UBI have been particularly well-received, as they empower customers to take control of their insurance costs based on their individual driving habits. This customer-centric approach has contributed to Progressive's strong reputation.

Financial Strength

Leading rating agencies, such as AM Best and Standard & Poor’s, have assigned Progressive high financial strength ratings. These ratings indicate that Progressive has the financial resources to meet its obligations and pay claims promptly.

Financial stability is crucial in the insurance industry, as it ensures that policyholders can rely on their insurer in times of need. Progressive's strong financial position provides a sense of security and trust for its customers.

Future Implications and Industry Insights

As the insurance industry continues to evolve, Progressive’s innovative approach and commitment to customer satisfaction position it well for the future. The company’s focus on technology and data-driven solutions is likely to shape the industry’s direction.

Technology and Data

Progressive’s use of technology, such as the Snapshot® program and mobile app, has already revolutionized the insurance industry. These tools have empowered customers and provided more personalized insurance experiences.

Looking ahead, Progressive is likely to continue leveraging technology to enhance its services. This may include further advancements in usage-based insurance, predictive analytics, and digital claim processing, making insurance more accessible and efficient.

Industry Trends

The insurance industry is experiencing a shift towards more personalized and data-driven approaches. Progressive’s success with programs like Snapshot® and UBI has set a precedent for other insurers to follow.

As the industry adopts more technology-driven solutions, customers can expect more tailored insurance options and greater control over their coverage and costs. Progressive's leadership in this area will likely influence the direction of the entire industry.

Environmental and Social Responsibility

Progressive has demonstrated a commitment to environmental and social responsibility, which is increasingly important to customers and stakeholders.

The company has implemented sustainable practices, such as paperless billing and digital claim processing, to reduce its environmental impact. Additionally, Progressive supports various social initiatives and causes, demonstrating its dedication to making a positive impact beyond insurance services.

Can I get a Progressive insurance quote without providing my personal information?

+While Progressive does not require all personal information upfront, providing basic details about your vehicle and driving history will help generate an accurate quote. However, for a more precise estimate, it’s recommended to share your personal information.

How often should I review my Progressive insurance quote?

+It’s a good practice to review your insurance quote annually or whenever your circumstances change significantly. This ensures you have the most up-to-date coverage and rates based on your current needs.

What factors can I control to potentially lower my Progressive insurance quote?

+You can influence your insurance quote by maintaining a clean driving record, driving fewer miles, and opting for safety features in your vehicle. Additionally, taking advantage of Progressive’s Snapshot® program can lead to personalized discounts.