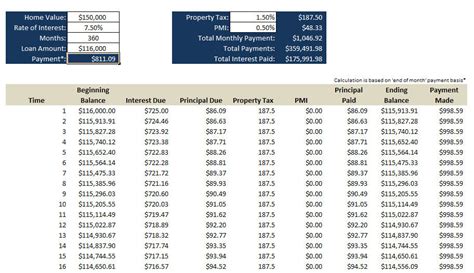

Property Mortgage Insurance Rates

Property mortgage insurance, often referred to as PMI, is a common requirement for homebuyers with a down payment of less than 20% of the property's purchase price. This insurance protects the lender in case the borrower defaults on their mortgage payments. While PMI rates can vary based on numerous factors, understanding these rates is crucial for prospective homebuyers to make informed decisions about their mortgage options.

Understanding Property Mortgage Insurance Rates

Property mortgage insurance rates are influenced by a combination of factors, including the borrower’s credit score, the loan-to-value (LTV) ratio, and the type of mortgage being obtained. PMI rates are typically expressed as a percentage of the loan amount and can be paid monthly, annually, or in a single upfront payment.

For instance, consider a borrower with a credit score of 750 who is purchasing a property with a 15% down payment. Based on their creditworthiness and the LTV ratio, their PMI rate might be approximately 0.5% to 1% of the loan amount annually. This means that for a $300,000 mortgage, the borrower could expect to pay $1,500 to $3,000 annually in PMI premiums.

However, it's important to note that PMI rates can vary significantly based on the lender and the specific mortgage program. Some lenders might offer competitive rates for borrowers with excellent credit, while others might have higher rates for borrowers with lower credit scores or higher LTV ratios. It's essential for borrowers to shop around and compare PMI rates from multiple lenders to find the most favorable terms.

Factors Affecting PMI Rates

Several key factors influence the PMI rates a borrower is offered. These include:

- Credit Score: A higher credit score often leads to lower PMI rates. Lenders view borrowers with strong credit as less risky, which can result in more favorable PMI terms.

- Loan-to-Value Ratio: The LTV ratio is the amount of the loan compared to the property's value. A lower LTV ratio, indicating a larger down payment, typically results in lower PMI rates.

- Mortgage Type: Different mortgage programs have varying PMI requirements. For instance, conventional loans often require PMI for loans with less than 20% down, while government-backed loans like FHA loans have their own mortgage insurance requirements.

- Loan Amount: The size of the loan can also impact PMI rates. Larger loans might be associated with higher PMI premiums.

- Property Type: The type of property being purchased can affect PMI rates. For example, condos or properties in certain locations might have different PMI requirements.

By understanding these factors, borrowers can make more informed decisions about their mortgage and PMI options. It's also worth noting that while PMI is often required for conventional loans with low down payments, there are alternative options, such as piggyback loans or government-backed loans, which might offer different insurance requirements or structures.

Comparing PMI Rates and Strategies

When comparing PMI rates, it’s essential to consider not just the initial PMI cost but also the long-term impact on your mortgage. PMI can significantly increase the overall cost of your mortgage, so finding ways to minimize or eliminate PMI can be financially beneficial.

Strategies to Minimize PMI Costs

Here are some strategies borrowers can consider to reduce or eliminate PMI costs:

- Increase Down Payment: The most straightforward way to reduce PMI is to increase your down payment. By putting down at least 20% of the property's value, you can often avoid PMI altogether.

- Improve Credit Score: A higher credit score can lead to lower PMI rates. Before applying for a mortgage, take steps to improve your credit score, such as paying down debt, ensuring timely payments, and disputing any errors on your credit report.

- Shop Around for Lenders: Different lenders offer different PMI rates and terms. By shopping around and comparing offers, you can find the lender with the most competitive PMI rates for your situation.

- Consider Alternative Loan Programs: Explore alternative mortgage programs, such as piggyback loans or government-backed loans like FHA, VA, or USDA loans. These programs might have different insurance requirements or structures that could be more favorable for your financial situation.

- Refinance: If you already have a mortgage with PMI, refinancing to a new loan with a lower LTV ratio or a different loan program can help you eliminate PMI. However, it's important to consider the costs and benefits of refinancing, as there might be fees and other considerations involved.

It's crucial to carefully evaluate your financial situation and long-term goals when considering these strategies. While minimizing or eliminating PMI can save you money in the long run, it might not always be the best option depending on your circumstances.

The Impact of PMI on Your Mortgage

Property mortgage insurance can significantly impact the overall cost of your mortgage. While PMI protects the lender, it adds an additional cost to your monthly payments, which can make it more challenging to afford your mortgage in the short term. However, it’s important to view PMI in the context of your overall financial goals and the benefits it provides.

Pros and Cons of PMI

Here are some key considerations regarding the impact of PMI on your mortgage:

- Pros:

- Access to Homeownership: PMI allows borrowers with limited funds for a down payment to still purchase a home. This can be particularly beneficial for first-time homebuyers or those with limited savings.

- Lower Barrier to Entry: With PMI, borrowers can enter the housing market with a smaller down payment, which can be a more affordable option, especially in competitive real estate markets.

- Flexible Financing: PMI provides flexibility in financing options, allowing borrowers to choose between different loan programs and terms to find the best fit for their financial situation.

- Cons:

- Increased Monthly Payments: PMI adds an additional cost to your monthly mortgage payments, which can make it more challenging to afford your mortgage, especially for those with tight budgets.

- Long-Term Cost: Over the life of your mortgage, PMI can significantly increase the overall cost of your loan. For instance, a $300,000 mortgage with a 0.5% PMI rate for 30 years could result in over $45,000 in PMI premiums alone.

- Potential for Cancellation: PMI can often be canceled once you reach a certain equity threshold in your home, typically 20%. However, the process and requirements for cancellation can vary based on your loan type and lender.

Ultimately, the decision to accept PMI or seek alternative options depends on your individual financial situation and goals. It's essential to carefully evaluate the short-term and long-term costs and benefits of PMI to make an informed decision.

Future Implications and Considerations

As the housing market continues to evolve, it’s essential to consider the future implications of property mortgage insurance. PMI rates and requirements can change based on economic conditions, government policies, and lender practices. Understanding these potential changes can help borrowers make more informed decisions about their mortgage options and financial strategies.

Potential Changes in PMI Rates and Requirements

Here are some key considerations regarding future changes in PMI rates and requirements:

- Economic Conditions: PMI rates and requirements can be influenced by economic factors such as interest rates, inflation, and the overall health of the housing market. During periods of economic uncertainty or recession, lenders might increase PMI rates or tighten their requirements to mitigate risk.

- Government Policies: Government policies can also impact PMI rates and requirements. For instance, changes in regulations or tax policies related to mortgage insurance can affect the cost and availability of PMI for borrowers.

- Lender Practices: Lenders have discretion in setting their PMI rates and requirements. As competition among lenders increases, some might offer more favorable PMI terms to attract borrowers. Conversely, during periods of high demand or limited capacity, lenders might increase their PMI rates or tighten their requirements.

- Technological Advancements: Technological advancements in the mortgage industry, such as the use of AI and data analytics, could potentially impact PMI rates and requirements. Lenders might use advanced algorithms to more accurately assess risk and set PMI rates, which could lead to more personalized and competitive offers for borrowers.

It's crucial for borrowers to stay informed about these potential changes and how they might impact their mortgage options. By staying aware of market trends and lender practices, borrowers can make more strategic decisions about their mortgage, whether it involves seeking the best PMI rates or exploring alternative options to avoid PMI altogether.

Conclusion

Property mortgage insurance rates are an essential consideration for homebuyers, as they can significantly impact the overall cost of a mortgage. Understanding the factors that influence PMI rates, such as credit score, LTV ratio, and mortgage type, is crucial for borrowers to make informed decisions about their mortgage options. By comparing rates and exploring alternative strategies, borrowers can find the most favorable terms and potentially minimize or eliminate PMI costs.

While PMI provides access to homeownership for many borrowers, it's important to carefully evaluate the short-term and long-term financial implications. By considering the pros and cons of PMI and staying informed about potential future changes in PMI rates and requirements, borrowers can make more strategic decisions about their mortgage and financial future.

How do I know if my PMI can be canceled?

+The ability to cancel PMI depends on your loan type and lender. For conventional loans, PMI can typically be canceled once you reach 20% equity in your home. However, the exact process and requirements for cancellation can vary. It’s important to review your loan documents and consult with your lender to understand the specific terms and conditions for canceling PMI.

Are there any downsides to canceling PMI early?

+Canceling PMI early can save you money in the long run by reducing your monthly mortgage payments. However, it’s important to consider the potential fees and costs associated with refinancing or modifying your loan to cancel PMI. Additionally, if you plan to sell your home in the near future, canceling PMI might not provide significant savings, as you would need to reach the 20% equity threshold again for the new buyer’s mortgage.

Can I negotiate PMI rates with my lender?

+While PMI rates are generally set by the lender based on their risk assessment and market conditions, it doesn’t hurt to ask about potential negotiation options. Some lenders might be willing to offer more favorable rates or terms if you have a strong credit profile or are bringing a substantial down payment. It’s worth discussing your options with your lender to see if there’s room for negotiation.