Purchase Workers Compensation Insurance

Understanding the Importance

Workers’ compensation insurance is an essential component of any business, providing crucial financial protection for both employers and employees in the event of work-related injuries, illnesses, or fatalities. This insurance serves as a safety net, ensuring that injured workers receive the medical care and compensation they deserve while shielding employers from potential legal and financial burdens. In this comprehensive guide, we will delve into the intricacies of workers’ compensation insurance, exploring its purpose, coverage, and the benefits it brings to businesses and their workforce.

Workers' compensation insurance, often referred to as "workers' comp," is a form of insurance that is mandated by law in most states. It is designed to provide financial support to employees who suffer work-related injuries or illnesses, ensuring they receive the necessary medical treatment and compensation for lost wages. This insurance acts as a critical safeguard, protecting both employees and employers from the potentially devastating consequences of workplace accidents or illnesses.

The primary objective of workers' compensation is to foster a safe and healthy work environment while offering prompt and adequate support to injured or ill workers. By providing a structured system for managing workplace injuries, workers' compensation insurance promotes the well-being of employees and helps businesses maintain their operations with minimal disruption.

The Benefits of Workers’ Compensation Insurance

1. Financial Protection for Employees:

Workers’ compensation insurance ensures that employees receive timely medical care and compensation for their injuries or illnesses. This coverage provides a safety net, enabling employees to focus on their recovery without worrying about mounting medical bills or lost income.

2. Legal Protection for Employers:

In the event of a workplace injury or illness, workers’ compensation insurance acts as a legal shield for employers. It limits their liability and prevents employees from suing the company for damages, providing a clear and structured framework for resolving such incidents.

3. Prompt and Efficient Claims Process:

Workers’ compensation insurance offers a streamlined claims process, ensuring that injured employees receive the necessary benefits quickly and efficiently. This prompt response helps reduce the impact of injuries on both the employee’s life and the company’s operations.

4. Cost-Effectiveness:

While workers’ compensation insurance involves premiums, it is often more cost-effective than facing the financial and legal consequences of an uninsured workplace incident. The insurance provides a predictable and manageable financial burden, allowing businesses to budget effectively for potential workplace risks.

5. Risk Management and Prevention:

Workers’ compensation insurance promotes a culture of safety and risk management within organizations. By incentivizing employers to implement safety measures and training programs, this insurance helps prevent workplace accidents and illnesses, ultimately reducing the frequency and severity of claims.

How Workers’ Compensation Insurance Works

1. Coverage and Benefits:

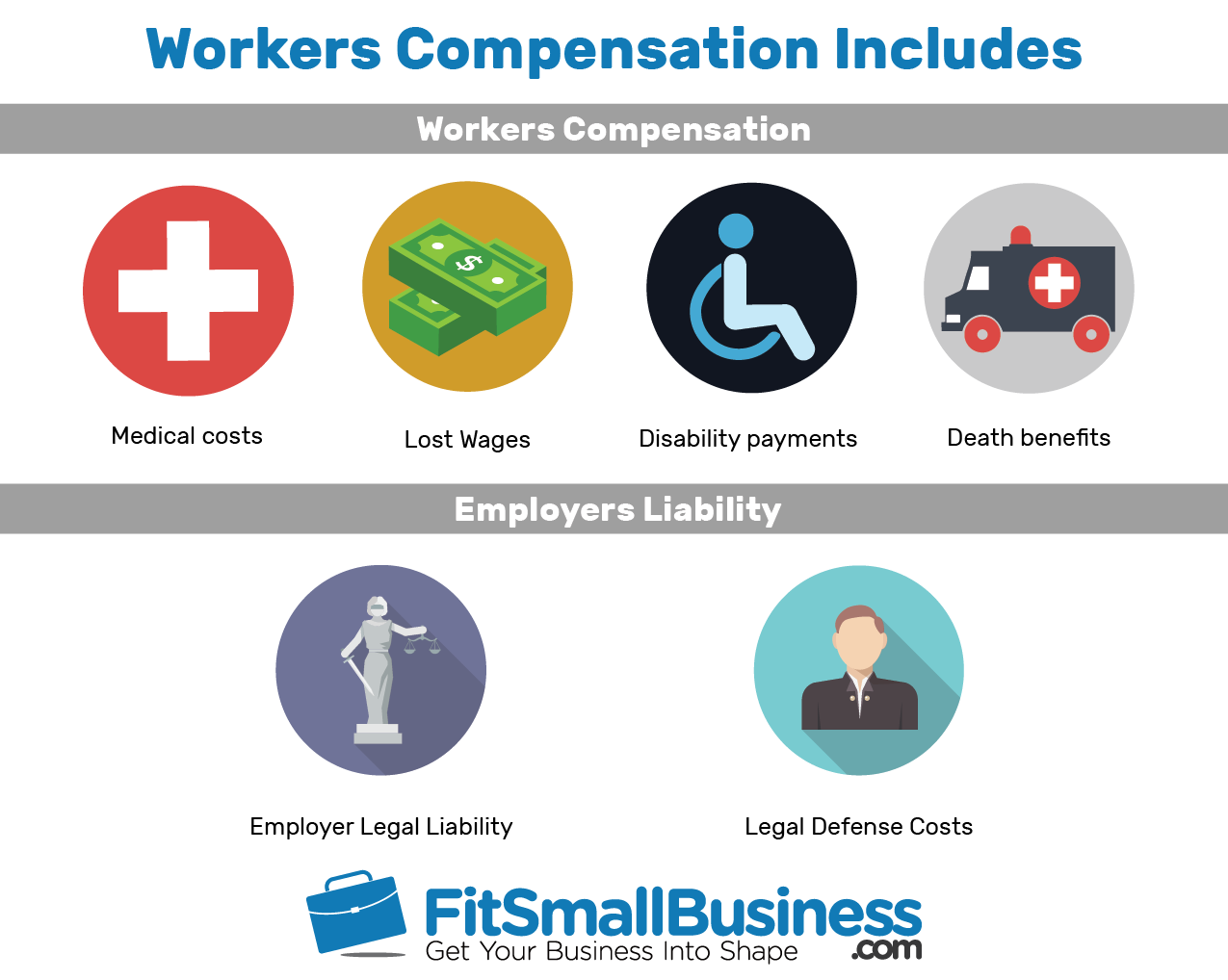

Workers’ compensation insurance covers a wide range of work-related injuries and illnesses, including accidents, repetitive strain injuries, occupational diseases, and even certain mental health conditions resulting from workplace stress or trauma. The benefits provided typically include medical expenses, wage replacement, and in severe cases, death benefits for the families of deceased workers.

2. Eligibility and Exclusions:

Not all employees are automatically covered by workers’ compensation insurance. In most states, employers are required to provide coverage for their full-time and part-time employees, but there may be exemptions for certain types of workers, such as independent contractors or sole proprietors. It’s crucial for businesses to understand the specific eligibility criteria in their state to ensure compliance.

3. The Claims Process:

When an employee sustains a work-related injury or becomes ill, they must report the incident to their employer as soon as possible. The employer then initiates the claims process, notifying the insurance provider and ensuring that the injured worker receives the necessary medical attention. The insurance company assesses the claim, determines eligibility, and authorizes the appropriate benefits, which are then provided to the injured worker.

Choosing the Right Workers’ Compensation Insurance

1. Assessing Your Business Needs:

Before selecting a workers’ compensation insurance provider, it’s essential to evaluate your business’s unique needs and risks. Consider factors such as the nature of your industry, the size of your workforce, the potential hazards associated with your operations, and your historical claims data. This assessment will help you choose an insurance plan that offers adequate coverage without unnecessary expenses.

2. Comparing Insurance Providers:

Research and compare multiple insurance providers to find the one that best suits your business. Look for companies with a strong track record in workers’ compensation, positive customer reviews, and a reputation for prompt claim processing. Consider their financial stability, as this is crucial for ensuring they can meet their obligations in the event of a significant claim.

3. Customizing Your Policy:

Most workers’ compensation insurance policies can be customized to fit your business’s specific needs. Work closely with your insurance provider to tailor the policy, ensuring that it covers all relevant risks and provides the appropriate level of protection for your employees. This customization may include adding endorsements or riders to address unique circumstances or high-risk areas within your organization.

Navigating Workers’ Compensation Claims

1. Reporting and Documenting Injuries:

Prompt reporting of workplace injuries is crucial. Encourage your employees to report any work-related injuries or illnesses immediately, ensuring that the incident is properly documented. Accurate and detailed documentation will streamline the claims process and help resolve disputes if they arise.

2. Managing the Claims Process:

As an employer, it’s your responsibility to guide injured employees through the claims process. Provide them with the necessary forms and information, and ensure they understand their rights and the steps involved. Stay involved throughout the process, communicating regularly with the insurance provider and advocating for your employee’s well-being.

3. Return-to-Work Programs:

Implementing a return-to-work program can benefit both your business and your employees. This program aims to facilitate a safe and timely return to work for injured employees, reducing the financial burden of long-term disability claims and helping your workforce stay engaged and productive.

The Future of Workers’ Compensation Insurance

As workplace safety regulations evolve and new technologies emerge, workers’ compensation insurance is likely to adapt and innovate. Here are some potential future developments:

1. Digitalization and Automation:

The insurance industry is increasingly embracing digital technologies, and workers’ compensation is no exception. Expect to see more online platforms and mobile apps that streamline the claims process, making it more efficient and accessible for both employers and employees.

2. Data-Driven Risk Management:

Advanced analytics and data-driven insights will play a larger role in workers’ compensation. Insurance providers will leverage big data and artificial intelligence to identify trends, predict risks, and develop targeted interventions to prevent workplace injuries and illnesses.

3. Expanded Coverage and Benefits:

As societal awareness of mental health issues grows, workers’ compensation insurance may expand its coverage to include more comprehensive mental health support. This could involve providing access to counseling services, stress management programs, and other resources to address the rising prevalence of work-related psychological conditions.

Conclusion

Workers’ compensation insurance is a vital component of any responsible business strategy. By providing financial protection and legal support, this insurance fosters a culture of safety and well-being within organizations. As the landscape of work evolves, staying informed about the latest developments in workers’ compensation and actively managing your policy will ensure your business remains protected and your workforce thrives.

FAQ

What happens if an employee sustains a work-related injury, but the employer doesn’t have workers’ compensation insurance?

+

If an employer fails to provide workers’ compensation insurance as required by law, injured employees may be entitled to pursue legal action against the company. This can result in significant financial penalties and legal consequences for the employer. It’s crucial for businesses to prioritize obtaining the necessary insurance coverage to avoid such situations.

Are there any instances where an injured employee might not be eligible for workers’ compensation benefits?

+

Yes, there are certain circumstances where an injured employee may not be eligible for workers’ compensation benefits. These include situations where the injury was self-inflicted, the employee was under the influence of drugs or alcohol, or the injury occurred while engaging in illegal activities. Additionally, some states have specific exemptions for certain types of workers, such as independent contractors or volunteers.

Can employers be held liable for workplace injuries even if they have workers’ compensation insurance in place?

+

While workers’ compensation insurance provides a legal shield for employers, there are certain situations where they may still be held liable. For example, if an employer intentionally causes harm to an employee or if the employer fails to maintain a safe work environment, they may be subject to additional legal action. It’s important for employers to prioritize workplace safety and comply with all relevant regulations to minimize liability risks.