Purchasing Home Insurance

Home insurance is a crucial aspect of safeguarding your most valuable asset—your home. It provides financial protection and peace of mind, ensuring that you and your loved ones are covered in the event of unforeseen circumstances such as natural disasters, accidents, or theft. In this comprehensive guide, we will delve into the world of home insurance, exploring its benefits, coverage options, and the process of selecting the right policy for your specific needs.

Understanding the Importance of Home Insurance

Your home is likely the largest investment you will ever make. It serves as a sanctuary, a place where memories are created, and a source of stability. However, unexpected events can occur at any time, threatening the security and integrity of your home. Home insurance acts as a safety net, offering protection against a wide range of risks and helping you rebuild and recover in the face of adversity.

Consider the following scenarios where home insurance can prove invaluable:

- Natural Disasters: From hurricanes and floods to wildfires and earthquakes, these unpredictable forces of nature can cause extensive damage to your home. Home insurance can provide the necessary financial support to repair or rebuild your property.

- Fire and Smoke Damage: A house fire can be devastating, not only destroying your belongings but also rendering your home uninhabitable. Home insurance policies often cover the cost of repairs, temporary housing, and even the replacement of personal items.

- Burglary and Theft: Burglaries and theft can result in the loss of valuable possessions and a sense of violation. Home insurance can help you replace stolen items and make the necessary repairs to secure your home again.

- Liability Claims: Accidents can happen, and if someone is injured on your property, you may be held liable. Home insurance typically includes liability coverage, protecting you from potential lawsuits and legal expenses.

- Water Damage: Burst pipes, roof leaks, or sewage backups can lead to costly repairs. Home insurance policies often cover water damage, ensuring that you have the means to address these issues promptly.

By investing in home insurance, you gain the confidence that, should the worst happen, you will have the financial resources to get your life back on track. It's an essential component of responsible homeownership, providing stability and protection for you and your family.

Evaluating Your Home Insurance Needs

When it comes to selecting a home insurance policy, understanding your unique needs is paramount. Every home and household is different, and the coverage you require will depend on various factors. Here are some key considerations to help you evaluate your insurance needs:

The Value of Your Home

Start by assessing the current market value of your home. This includes not only the structure itself but also any permanent fixtures and improvements you’ve made. Accurate valuation is crucial as it determines the amount of coverage you need to fully protect your investment.

| Property Value | Recommended Coverage |

|---|---|

| $200,000 | $200,000 - $250,000 |

| $350,000 | $350,000 - $400,000 |

| $500,000 | $500,000 - $600,000 |

| ... | ... |

It's important to note that your home's value may fluctuate over time due to market conditions and improvements. Regularly reviewing and updating your coverage ensures that you always have adequate protection.

Your Belongings and Personal Property

Home insurance policies often provide coverage for your personal belongings, such as furniture, electronics, and clothing. However, the extent of this coverage can vary. Consider the value of your possessions and whether you need additional protection, especially for high-value items like jewelry or art.

Liability and Legal Protection

Liability coverage is a vital component of home insurance. It safeguards you against potential lawsuits and legal expenses arising from accidents or injuries that occur on your property. Assess the level of liability coverage you need based on your lifestyle and the number of visitors you typically host.

Specific Risks and Additional Coverage

Depending on your location and circumstances, you may face unique risks. For example, if you live in an area prone to natural disasters like hurricanes or earthquakes, you may require specialized coverage. Similarly, if you own valuable collectibles or operate a home-based business, additional coverage might be necessary.

Renters vs. Homeowners

If you’re a renter, your insurance needs are slightly different. While homeowners need coverage for their property and possessions, renters primarily require protection for their belongings and liability coverage. Renters insurance is a cost-effective way to ensure your possessions are covered in the event of a loss.

Comparing Home Insurance Policies

With a clear understanding of your insurance needs, it’s time to compare different policies and providers. Shopping around is essential to find the best coverage at the most competitive price. Here are some key factors to consider when comparing home insurance options:

Coverage Options and Limits

Examine the specific coverage options offered by each policy. Look for policies that align with your identified needs, whether it’s comprehensive coverage for your home’s structure, adequate protection for your belongings, or sufficient liability limits.

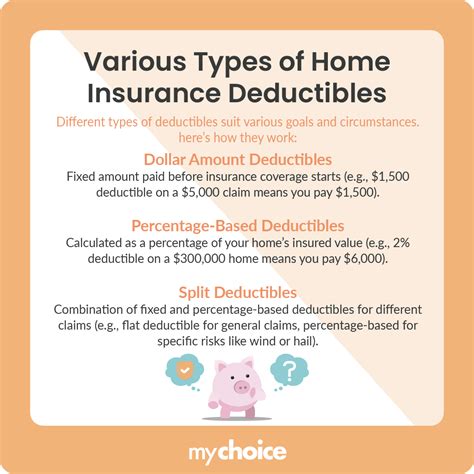

Deductibles and Premiums

Deductibles and premiums are crucial considerations. A higher deductible can lead to a lower premium, but it means you’ll pay more out of pocket in the event of a claim. Find a balance that suits your financial situation and risk tolerance.

Policy Add-ons and Endorsements

Many home insurance policies offer add-ons or endorsements that can enhance your coverage. These might include coverage for specific risks like water backup, identity theft protection, or increased limits for high-value items. Evaluate which add-ons are necessary for your situation.

Provider Reputation and Customer Service

The reputation and reliability of the insurance provider are critical. Research the company’s track record, customer reviews, and financial stability. Ensure they have a good claims process and offer excellent customer service, as these factors can significantly impact your experience should you need to file a claim.

Discounts and Bundling Options

Look for potential discounts and bundling opportunities. Many insurers offer discounts for various factors, such as having multiple policies with the same company (e.g., auto and home insurance), installing security systems, or being a loyal customer. Bundling policies can often result in significant savings.

The Home Insurance Shopping Process

Now that you have a solid understanding of your insurance needs and have compared different policies, it’s time to take the next steps in the purchasing process.

Obtaining Quotes

Request quotes from multiple insurance providers. This can be done online, over the phone, or by visiting their physical offices. Provide accurate and detailed information about your home, belongings, and any additional coverage requirements to ensure you receive precise quotes.

Reviewing Policy Details

Once you have obtained quotes, carefully review the policy documents. Pay close attention to the coverage limits, deductibles, exclusions, and any fine print. Ensure that the policy aligns with your needs and expectations.

Seeking Professional Advice

If you have complex insurance needs or are unsure about certain aspects, consider consulting an insurance broker or agent. These professionals can provide expert guidance, answer your questions, and help you navigate the often-confusing world of insurance policies.

Making an Informed Decision

With all the necessary information at hand, it’s time to make a decision. Choose the policy that best suits your needs, offers comprehensive coverage, and provides value for your money. Remember, home insurance is a long-term commitment, so select a provider you trust and feel comfortable with.

The Future of Home Insurance

The home insurance industry is continually evolving to meet the changing needs and risks of homeowners. As technology advances, insurers are leveraging data analytics and innovative technologies to offer more personalized and efficient coverage. Here’s a glimpse into the future of home insurance:

Digital Transformation

Insurance companies are embracing digital tools and platforms to enhance the customer experience. From online quote comparisons to mobile apps for policy management and claim submissions, the insurance process is becoming more streamlined and convenient.

Data-Driven Insights

Advanced data analytics and artificial intelligence are being used to assess risk more accurately. Insurers can now analyze vast amounts of data to identify patterns and trends, allowing for more precise pricing and coverage recommendations.

Customized Coverage

The future of home insurance lies in personalized policies. With access to detailed data, insurers can offer tailored coverage options that cater to individual needs. This means you may receive coverage recommendations based on your specific home, location, and lifestyle.

Sustainability and Green Initiatives

As environmental concerns grow, insurers are exploring ways to support sustainable practices. This may include incentives for homeowners who adopt energy-efficient measures or discounts for those who invest in renewable energy systems.

Conclusion

Purchasing home insurance is a responsible decision that safeguards your financial well-being and provides peace of mind. By understanding your unique needs, comparing policies, and staying informed about industry advancements, you can make an informed choice that protects your most valuable asset. Remember, home insurance is not just a necessity; it’s an investment in your future and the security of your loved ones.

How often should I review my home insurance policy?

+It’s recommended to review your policy annually or whenever significant changes occur in your life, such as home renovations, the addition of valuable possessions, or changes in your family’s needs. Regular reviews ensure that your coverage remains adequate and up-to-date.

What should I do if I need to file a claim?

+Contact your insurance provider as soon as possible to initiate the claims process. Provide them with detailed information about the incident and any supporting documentation. They will guide you through the steps to ensure a smooth and efficient claims experience.

Can I switch insurance providers if I find a better deal?

+Absolutely! Shopping around for insurance is a wise practice. If you find a more suitable policy with better coverage or a lower premium, you can switch providers. Just ensure that you have the new policy in place before canceling the old one to avoid any gaps in coverage.