Quote Comparison Car Insurance

Welcome to our comprehensive guide on Quote Comparison for Car Insurance, an essential aspect of ensuring you get the best coverage for your vehicle. In today's digital age, comparing car insurance quotes has become more accessible and crucial than ever. This guide will delve into the world of car insurance, exploring the factors that influence your premium, the benefits of quote comparison, and the steps to finding the ideal policy for your needs.

Understanding the Importance of Quote Comparison

In the realm of car insurance, every driver’s situation is unique. Whether you’re a seasoned driver with a pristine record or a new driver just hitting the roads, the insurance landscape can be complex and daunting. This is where quote comparison steps in as a powerful tool to navigate the intricate web of insurance providers and policies.

Factors Influencing Your Car Insurance Quote

Several key factors play a role in determining your car insurance premium. These include your driving history, with a clean record often leading to more favorable rates. The type of vehicle you drive is another critical factor; sports cars and luxury vehicles, for instance, may attract higher premiums due to their cost and potential risk.

Your age and gender also come into play, with younger drivers and those in certain age brackets often facing higher premiums due to statistical risk factors. Additionally, the location where you reside and drive can significantly impact your quote, as insurance providers consider local crime rates, accident statistics, and even weather conditions.

Other factors include your credit score, with a higher score often leading to better rates, and the coverage level you choose, as more comprehensive coverage naturally results in higher premiums.

| Factor | Impact on Premium |

|---|---|

| Driving History | A clean record leads to lower rates. |

| Vehicle Type | Sports/luxury cars often attract higher premiums. |

| Age and Gender | Certain age groups and genders may face higher risks and premiums. |

| Location | Local crime, accident, and weather statistics influence rates. |

| Credit Score | A higher credit score can result in better rates. |

| Coverage Level | More comprehensive coverage means higher premiums. |

The Benefits of Quote Comparison

Quote comparison offers a multitude of advantages, allowing you to:

- Save Money: By comparing quotes, you can identify the most affordable options tailored to your specific needs, potentially saving hundreds of dollars annually.

- Find the Right Coverage: Each insurance provider offers a unique set of coverages and add-ons. Comparison allows you to identify the policy that provides the best coverage for your vehicle and driving habits.

- Understand Market Trends: Regular quote comparisons keep you informed about market changes, helping you stay aware of new offerings and potential savings opportunities.

- Negotiate with Your Current Provider: Having multiple quotes in hand can give you leverage when discussing rates with your current insurer. You might be able to negotiate a better deal without switching providers.

The Step-by-Step Guide to Effective Quote Comparison

Now, let’s walk through the process of effectively comparing car insurance quotes.

Step 1: Define Your Needs and Preferences

Before you begin comparing quotes, it’s crucial to understand your specific needs and preferences. Consider factors such as the level of coverage you desire, your budget, and any unique requirements you might have, such as coverage for specific driving conditions or add-ons like roadside assistance.

Step 2: Gather Quotes from Multiple Providers

The next step is to collect quotes from a variety of insurance providers. Online quote comparison tools can be immensely helpful, allowing you to input your details once and receive multiple quotes. Alternatively, you can visit individual insurer websites or speak directly with insurance agents.

When gathering quotes, ensure you provide consistent information across all providers. This includes details about your vehicle, driving history, and desired coverage levels. Inconsistencies can lead to inaccurate quotes.

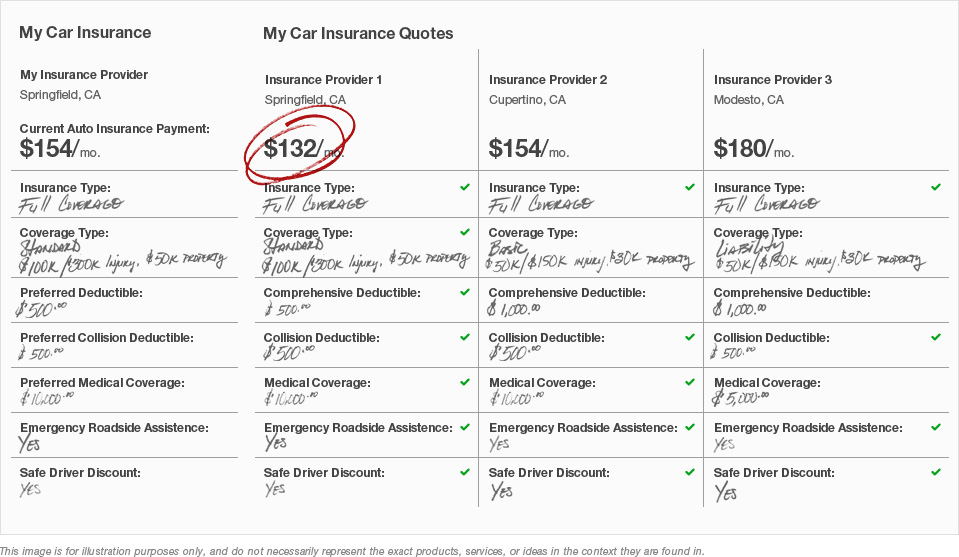

Step 3: Analyze and Compare the Quotes

With a collection of quotes in hand, it’s time to analyze and compare them. Look beyond just the premium amounts. Consider the coverage limits, deductibles, and any additional benefits or perks offered by each provider.

Evaluate the financial stability and reputation of the insurance companies. Check customer reviews and ratings to get an idea of their service quality and claim handling processes. It's also essential to understand the fine print and any exclusions or limitations in the policies.

Step 4: Tailor the Quotes to Your Needs

Once you’ve analyzed the quotes, it’s time to tailor them to your specific needs. Consider adding or removing coverages based on your requirements. For instance, if you live in an area prone to natural disasters, you might want to include comprehensive coverage to protect against such events.

Experiment with different deductibles to see how they impact your premium. Higher deductibles can lead to lower premiums, but you'll have to pay more out-of-pocket in the event of a claim.

Step 5: Make an Informed Decision

With your analysis and tailoring complete, you’re now ready to make an informed decision. Choose the quote that offers the best combination of coverage, price, and service. Remember, the cheapest option isn’t always the best, and the most expensive might offer features you don’t need.

Advanced Strategies for Quote Comparison

For those seeking an edge in their quote comparison journey, here are some advanced strategies to consider.

Using Technology to Your Advantage

Leverage the power of technology to streamline your quote comparison process. There are numerous online tools and apps designed specifically for this purpose. These platforms often provide comprehensive quotes from multiple insurers, allowing for easy side-by-side comparisons.

Additionally, many insurance companies offer digital tools and resources to help you understand and manage your coverage. These tools can provide valuable insights into your policy and potential savings opportunities.

Understanding Insurance Jargon

The world of insurance is filled with specialized jargon and terms. To make an informed decision, it’s essential to understand these terms. Resources like insurance company websites and online forums can help decipher complex insurance terminology.

Understanding insurance jargon empowers you to ask the right questions and make more informed choices when comparing quotes.

Regularly Review and Update Your Policy

Car insurance is not a set-it-and-forget-it proposition. Your circumstances and the insurance landscape can change over time. Regularly review your policy and compare quotes to ensure you’re still getting the best deal. This is especially important if you’ve made significant life changes, such as getting married, moving to a new location, or purchasing a new vehicle.

Conclusion: Empowering Your Car Insurance Journey

Quote comparison for car insurance is a powerful tool that empowers you to make informed decisions about your coverage. By understanding the factors that influence your premium, the benefits of comparison, and the steps to an effective comparison process, you can navigate the complex world of car insurance with confidence.

Remember, the right car insurance policy is one that provides adequate coverage at a price that fits your budget. With the knowledge and strategies outlined in this guide, you're well-equipped to find that ideal policy.

What is the best way to start the quote comparison process for car insurance?

+Begin by assessing your specific needs and preferences. Consider factors like the level of coverage you desire, your budget, and any unique requirements. Then, utilize online quote comparison tools or reach out to insurance agents to gather quotes from multiple providers.

How often should I compare car insurance quotes?

+It’s recommended to compare quotes at least once a year, especially when your policy is up for renewal. However, you should also consider comparing quotes whenever you experience significant life changes, such as moving to a new location, purchasing a new vehicle, or getting married.

What are some common mistakes to avoid when comparing car insurance quotes?

+Common mistakes include providing inconsistent information across different quotes, failing to read the fine print, and focusing solely on the premium amount without considering coverage limits and deductibles. It’s also important to avoid the temptation of choosing the cheapest quote without considering the quality of coverage and service provided.