Quote For Car Insurance Online

In today's fast-paced digital world, obtaining a quote for car insurance online has become a convenient and efficient process. With just a few clicks, you can explore various options, compare prices, and find the best coverage to suit your needs. This article aims to guide you through the online car insurance quoting process, offering insights and tips to ensure you make an informed decision.

Understanding the Online Quoting Process

The online quoting process for car insurance involves providing detailed information about yourself, your vehicle, and your driving history. This information is used by insurance providers to assess your risk level and determine the appropriate premium. Here’s a step-by-step breakdown of the process:

Step 1: Gather Relevant Information

Before starting your online quote, ensure you have the necessary details readily available. This includes your:

- Personal Information: Name, date of birth, contact details, and social security number.

- Vehicle Details: Make, model, year, vehicle identification number (VIN), and any modifications.

- Driving History: Past accidents, claims, and violations.

- Coverage Preferences : Desired coverage types and limits.

Step 2: Choose a Reputable Insurance Provider

Select a reputable insurance company with a strong online presence. Research their customer reviews, financial stability, and the range of coverage options they offer. Some popular choices include:

- State Farm: Known for their comprehensive coverage and excellent customer service.

- Geico: Offers competitive rates and a user-friendly online quoting process.

- Progressive: Provides a wide range of coverage options and innovative features.

- Allstate: Renowned for their customizable policies and convenient digital tools.

Step 3: Start the Online Quote Process

Visit the chosen insurance provider’s website and locate the “Get a Quote” or “Quote” section. Here, you’ll be guided through a series of questions to provide the necessary information. Ensure you answer truthfully and accurately to receive an accurate quote.

Step 4: Provide Vehicle and Driver Details

You’ll be asked to input details about your vehicle, such as its make, model, year, and usage. Additionally, you’ll need to provide information about the primary and additional drivers, including their driving records and any previous insurance claims.

Step 5: Choose Coverage Options

At this stage, you’ll select the types of coverage you require. Common options include liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Consider your specific needs and budget when making these choices.

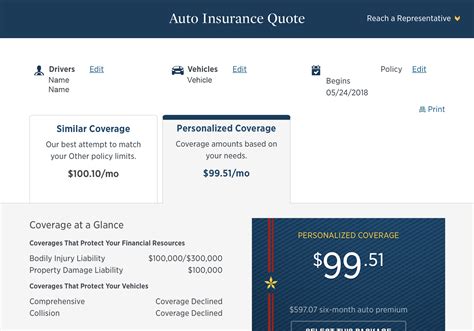

Step 6: Review and Customize Your Quote

Once you’ve provided all the necessary details, the insurance provider will generate a quote based on your information. Review the quote carefully, ensuring that the coverage limits and deductibles align with your preferences. You can often customize your quote by adjusting these parameters to find the best balance between coverage and cost.

Step 7: Compare Quotes and Make a Decision

If you’re shopping around, obtain quotes from multiple insurance providers to compare rates and coverage options. Consider factors such as customer service, claim handling reputation, and additional perks or discounts offered. Choose the provider that best suits your needs and budget.

Tips for a Smooth Online Quoting Experience

To ensure a seamless and successful online quoting process, keep the following tips in mind:

- Have All Necessary Documents Ready: Gather all the required documents and information before starting the quote process to avoid interruptions.

- Be Honest: Provide accurate and truthful information about your driving history and vehicle details. Misrepresentations can lead to issues with your coverage.

- Compare Multiple Quotes: Don’t settle for the first quote you receive. Compare quotes from different providers to find the best deal.

- Understand Coverage Options: Familiarize yourself with the different types of coverage and their benefits to make informed decisions.

- Read the Fine Print: Pay attention to the policy’s terms and conditions, including exclusions and limitations.

- Ask Questions: If you have any doubts or queries, don’t hesitate to contact the insurance provider’s customer support for clarification.

Performance Analysis and Future Implications

The online quoting process for car insurance has revolutionized the industry, offering convenience and transparency to consumers. As more people embrace digital platforms, insurance providers are investing in innovative technologies to enhance the quoting experience. Expect to see further advancements, such as:

- Artificial Intelligence (AI) Integration: AI-powered chatbots and virtual assistants will provide real-time assistance, guiding customers through the quoting process and answering queries.

- Enhanced Data Analysis: Insurance companies will leverage advanced analytics to assess risk more accurately, leading to fairer and more personalized quotes.

- Digital Verification: Digital tools for verifying vehicle and driver information will streamline the quoting process, reducing the need for manual input.

- Personalized Recommendations: Insurance providers will utilize customer data to offer tailored coverage recommendations, ensuring individuals receive the most suitable policies.

Conclusion

Obtaining a quote for car insurance online has become an accessible and efficient way to explore coverage options. By following the steps outlined in this article and staying informed about industry developments, you can navigate the quoting process with confidence and find the right insurance policy to protect your vehicle and yourself.

FAQ

Can I get a quote for car insurance online without providing personal information?

+While some insurance providers may offer preliminary quotes without personal details, a full and accurate quote will require information such as your name, date of birth, and driving history. Providing truthful information ensures you receive an appropriate quote.

How long does it take to get an online car insurance quote?

+The quoting process typically takes around 10 to 15 minutes, depending on the complexity of your vehicle and driving history. However, some providers offer instant quotes based on basic information.

Are online car insurance quotes accurate?

+Online quotes are generally accurate if you provide truthful and complete information. However, the final premium may vary slightly during the policy issuance process as insurance providers verify your details.