Quote For Homeowners Insurance

Protecting your home and valuables is a top priority for any homeowner, and homeowners insurance is an essential tool to safeguard your assets. In this comprehensive guide, we will delve into the world of homeowners insurance, providing you with expert insights, real-world examples, and the knowledge you need to make informed decisions about your insurance coverage. From understanding the basic principles to exploring the intricacies of policy options, we will ensure you have a clear understanding of how to obtain a quote for homeowners insurance that suits your unique needs.

Understanding Homeowners Insurance

Homeowners insurance is a contract between you, the policyholder, and an insurance company. This contract outlines the specific coverage, limits, deductibles, and exclusions of your policy. It is designed to protect you from financial losses resulting from various perils, such as fire, theft, vandalism, and natural disasters.

The primary goal of homeowners insurance is to provide financial protection and peace of mind. It ensures that you can rebuild, repair, or replace your home and belongings if they are damaged or destroyed. Additionally, it offers liability coverage, which can protect you from lawsuits if someone is injured on your property or if you accidentally cause damage to someone else's property.

The Importance of Adequate Coverage

Choosing the right homeowners insurance coverage is crucial. It is not a one-size-fits-all policy, and your needs may vary based on factors like the value of your home, the location, and your personal belongings. Here’s why adequate coverage is essential:

- Protection of Your Investment: Your home is likely one of your most significant investments. Homeowners insurance ensures that if your home is damaged or destroyed, you can afford to rebuild or repair it without incurring substantial financial strain.

- Liability Protection: Accidents can happen, and if someone gets injured on your property, you could be held liable. Homeowners insurance provides liability coverage, which can cover medical expenses and legal fees in such cases.

- Peace of Mind: Knowing that you have adequate insurance coverage gives you the peace of mind to enjoy your home without worrying about unforeseen circumstances.

Obtaining a Quote: The Process

Obtaining a quote for homeowners insurance is a straightforward process, but it requires some preparation and consideration. Here’s a step-by-step guide to help you navigate the process effectively:

Step 1: Assess Your Needs

Before requesting quotes, take the time to evaluate your specific needs. Consider the following factors:

- Home Value: Determine the current market value of your home. This information is crucial for calculating the appropriate coverage limits.

- Location: The location of your home plays a significant role in insurance rates. Areas prone to natural disasters or with higher crime rates may have higher premiums.

- Personal Belongings: Make an inventory of your valuable possessions. This will help you assess the amount of personal property coverage you require.

- Liability Concerns: Evaluate any potential liability risks associated with your property, such as a swimming pool or a home-based business.

Step 2: Research Insurance Providers

Explore the market and research reputable insurance providers. Consider factors such as financial stability, customer satisfaction, and the range of coverage options they offer. Online reviews and industry ratings can provide valuable insights.

Some well-known insurance providers in the United States include:

- State Farm: One of the largest insurance providers, offering a wide range of coverage options.

- Allstate: Known for its innovative digital tools and customizable policies.

- Liberty Mutual: Provides comprehensive coverage and personalized service.

- USAA: Highly regarded for its military-focused policies and excellent customer service.

Step 3: Gather Necessary Information

To obtain accurate quotes, you'll need to provide specific information to insurance providers. This typically includes:

- Home Details: The address, square footage, and year built of your home.

- Personal Information: Your name, date of birth, and contact details.

- Coverage Preferences : Your desired coverage limits and any additional coverage options you wish to explore.

- Claims History: Any previous insurance claims you or previous homeowners have made.

Step 4: Compare Quotes

Once you have obtained quotes from multiple providers, it's time to compare them. Consider the following aspects:

- Coverage Limits: Ensure that the coverage limits match your assessed needs. Higher limits often result in higher premiums, so find a balance that suits your requirements.

- Deductibles: Deductibles are the amount you pay out of pocket before your insurance kicks in. Lower deductibles mean you pay less upfront but may result in higher premiums.

- Additional Coverages: Compare the availability and cost of optional coverages, such as flood insurance or earthquake coverage, based on your specific needs.

- Discounts: Many providers offer discounts for various reasons, such as loyalty, bundling policies, or safety features in your home. Inquire about available discounts to reduce your premiums.

Key Considerations for Your Quote

When obtaining a quote for homeowners insurance, there are several key considerations to keep in mind. These factors can significantly impact your coverage and premiums:

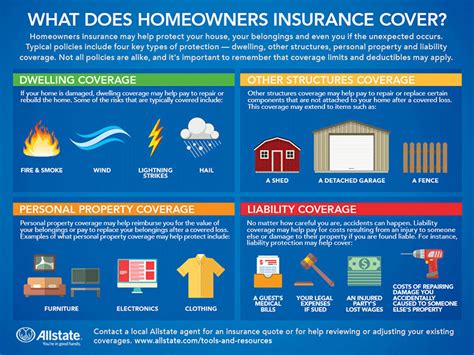

Dwelling Coverage

Dwelling coverage refers to the protection provided for the physical structure of your home. It covers the cost of repairing or rebuilding your home in the event of a covered loss. When obtaining a quote, ensure that the dwelling coverage limit is sufficient to cover the cost of rebuilding your home. Consider factors such as local construction costs and any unique features of your home.

| Dwelling Coverage | Amount |

|---|---|

| Example Home | $300,000 |

Personal Property Coverage

Personal property coverage protects your belongings, such as furniture, electronics, and clothing, in the event of a covered loss. When obtaining a quote, consider the value of your personal possessions and choose a coverage limit that adequately protects them. You can opt for actual cash value (ACV) or replacement cost coverage.

| Personal Property Coverage | Option |

|---|---|

| Recommended | Replacement Cost |

Liability Coverage

Liability coverage is a critical aspect of homeowners insurance. It protects you from financial losses if someone is injured on your property or if you accidentally cause damage to someone else’s property. When obtaining a quote, ensure that your liability coverage limit is sufficient to cover potential claims. Consider factors such as the value of your assets and your personal liability risks.

| Liability Coverage | Recommended Limit |

|---|---|

| Minimum | $100,000 |

Additional Coverages and Endorsements

Many homeowners insurance policies offer additional coverages and endorsements to enhance your protection. These can include:

- Flood Insurance: Standard homeowners insurance policies typically do not cover flood damage. Consider purchasing separate flood insurance if your home is located in a flood-prone area.

- Earthquake Coverage: Similarly, if you live in an earthquake-prone region, adding earthquake coverage to your policy can provide essential protection.

- Personal Injury Coverage: This coverage protects you from lawsuits arising from defamation, libel, or slander.

- Water Backup Coverage: Covers damage caused by backed-up water or sewage.

Discounts and Savings

Insurance providers often offer discounts to policyholders. When obtaining quotes, inquire about the following potential savings:

- Multi-Policy Discounts: Bundling your homeowners insurance with other policies, such as auto insurance, can result in significant savings.

- Loyalty Discounts: Some providers offer discounts to long-term customers.

- Safety Features Discounts: Having safety features like smoke detectors, fire extinguishers, or a security system in your home may qualify you for discounts.

- Homeowner Association (HOA) Discounts: Belonging to a homeowner association may provide access to group discounts on insurance.

Working with an Insurance Agent

When navigating the process of obtaining a quote for homeowners insurance, working with a knowledgeable insurance agent can be immensely beneficial. Insurance agents are licensed professionals who can guide you through the complexities of insurance coverage and help you make informed decisions.

The Role of an Insurance Agent

Insurance agents serve as intermediaries between insurance companies and policyholders. They possess extensive knowledge of the insurance industry and can provide personalized advice tailored to your specific needs. Here’s how an insurance agent can assist you:

- Assessment of Your Needs: An insurance agent will take the time to understand your unique circumstances, including the value of your home, your personal belongings, and any specific risks associated with your property. They will then recommend coverage options that align with your requirements.

- Market Comparison: Insurance agents have access to a wide range of insurance providers and can compare policies to find the best fit for your needs. They can provide quotes from multiple carriers, ensuring you have options to choose from.

- Expert Guidance: Agents are experts in insurance terminology and can explain complex concepts in simple terms. They can help you understand the nuances of different coverage options, deductibles, and exclusions, ensuring you make an informed decision.

- Claims Assistance: In the event of a claim, an insurance agent can be your advocate. They can guide you through the claims process, help you understand your coverage, and ensure that your claim is handled efficiently and fairly.

Choosing the Right Insurance Agent

When selecting an insurance agent, it’s essential to choose someone you trust and who has a strong understanding of the insurance market. Here are some tips to help you find the right agent:

- Ask for Referrals: Seek recommendations from friends, family, or colleagues who have had positive experiences with insurance agents. Personal referrals can be a great way to find a reputable agent.

- Check Credentials: Ensure that the agent is licensed and has the necessary qualifications to provide insurance advice. You can verify their credentials through your state’s insurance department.

- Research Online: Look for online reviews and ratings of insurance agents. While reviews should be taken with a grain of salt, they can provide valuable insights into an agent’s reputation and customer service.

- Interview Multiple Agents: Schedule meetings or calls with several agents to compare their knowledge, experience, and approach to insurance. Ask questions about their process, the insurance companies they represent, and their availability for support.

The Future of Homeowners Insurance

The homeowners insurance industry is constantly evolving, driven by technological advancements, changing consumer preferences, and emerging risks. As we look ahead, several trends and developments are shaping the future of homeowners insurance:

Digital Transformation

Insurance companies are increasingly embracing digital technologies to enhance the customer experience. From online quote comparisons to mobile apps for policy management, the industry is becoming more accessible and convenient. Policyholders can expect faster and more efficient processes, from obtaining quotes to filing claims.

Personalized Insurance

The rise of data analytics and artificial intelligence is enabling insurance providers to offer more personalized coverage options. By analyzing individual risk factors and behavior, insurance companies can tailor policies to specific needs, providing more accurate and cost-effective coverage.

Emerging Risks

As our world becomes more interconnected and vulnerable to new threats, insurance providers are adapting their policies to address emerging risks. Climate change, cybersecurity threats, and pandemic-related risks are all areas where insurance companies are developing innovative solutions to protect homeowners.

Collaborative Insurance Models

The traditional insurance model is evolving, with collaborative and community-based insurance models gaining traction. These models leverage the power of shared resources and data to offer more affordable and comprehensive coverage. Peer-to-peer insurance and parametric insurance are examples of innovative approaches that challenge traditional insurance structures.

Conclusion

Obtaining a quote for homeowners insurance is a critical step in protecting your home and valuables. By understanding the process, evaluating your needs, and working with knowledgeable insurance professionals, you can secure the right coverage at a competitive price. Remember, homeowners insurance is not a one-size-fits-all solution, and it’s essential to tailor your policy to your unique circumstances.

As the insurance landscape continues to evolve, staying informed and proactive is key. Embrace the digital transformation, explore personalized coverage options, and stay aware of emerging risks. By doing so, you can ensure that your homeowners insurance provides the protection and peace of mind you deserve.

How much does homeowners insurance typically cost?

+The cost of homeowners insurance can vary significantly depending on factors such as location, home value, and coverage limits. On average, policyholders in the United States pay around $1,200 annually for homeowners insurance. However, rates can range from a few hundred dollars to several thousand dollars per year. It’s essential to obtain multiple quotes to find the best coverage at a competitive price.

What factors can influence my homeowners insurance premiums?

+Several factors can impact your homeowners insurance premiums, including the location of your home, its age and construction, the value of your belongings, and your claims history. Additionally, the coverage limits and deductibles you choose will affect your premiums. It’s important to carefully consider these factors when obtaining quotes to find the right balance of coverage and affordability.

Can I customize my homeowners insurance policy?

+Yes, homeowners insurance policies can be customized to meet your specific needs. You can choose different coverage limits for dwelling, personal property, and liability. Additionally, you can add optional coverages for unique risks, such as flood or earthquake insurance. Working with an insurance agent can help you tailor your policy to your requirements.