Aarp Supplemental Insurance Plans

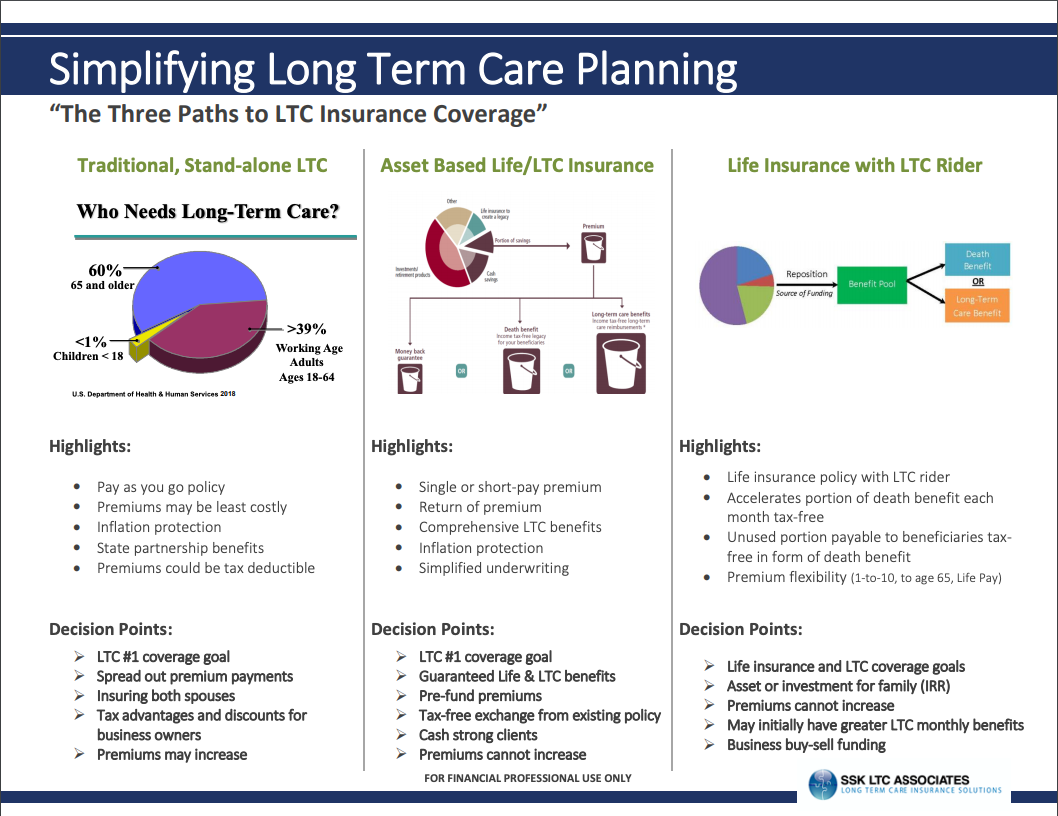

Supplemental insurance plans offered by AARP are an essential topic for many individuals seeking comprehensive healthcare coverage. These plans are designed to fill the gaps left by traditional Medicare or other insurance policies, providing an extra layer of financial protection and peace of mind. In this article, we will delve into the specifics of AARP's supplemental insurance plans, exploring their features, benefits, and how they can enhance your overall healthcare experience.

Understanding AARP Supplemental Insurance

The American Association of Retired Persons (AARP) is a well-known organization that advocates for the needs and interests of older adults. One of their key offerings is a range of insurance products, including supplemental insurance plans. These plans are tailored to address the unique healthcare requirements of seniors and individuals with specific health conditions.

Supplemental insurance, often referred to as Medigap or Medicare Supplement insurance, is designed to cover the costs that original Medicare does not. It can help with expenses such as deductibles, copayments, and coinsurance, which can significantly reduce your out-of-pocket healthcare expenses.

AARP’s Approach to Supplemental Insurance

AARP has partnered with reputable insurance providers to offer a variety of supplemental insurance plans to its members. These plans are available to individuals who are enrolled in Medicare Part A and Part B, and they aim to make healthcare more affordable and accessible.

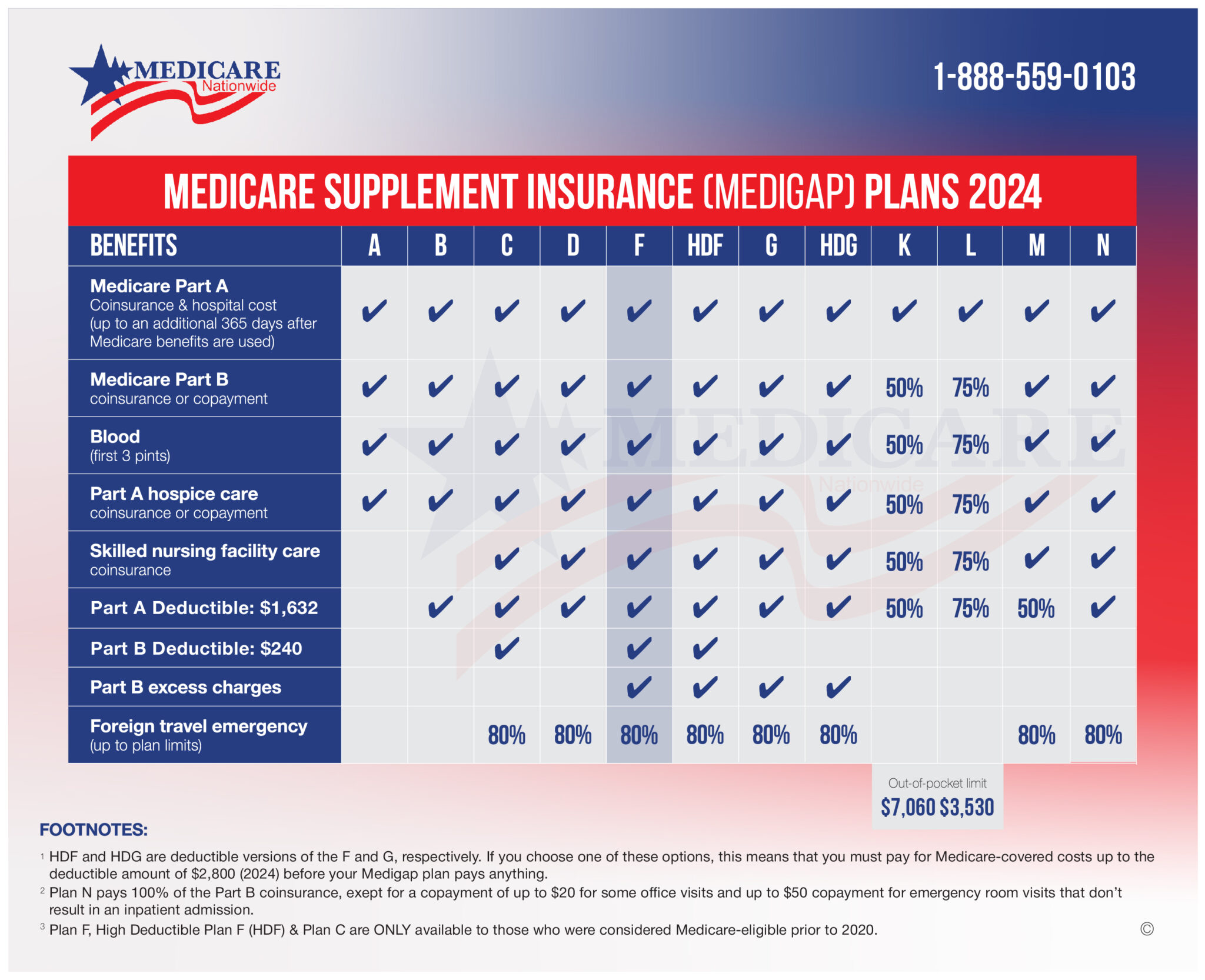

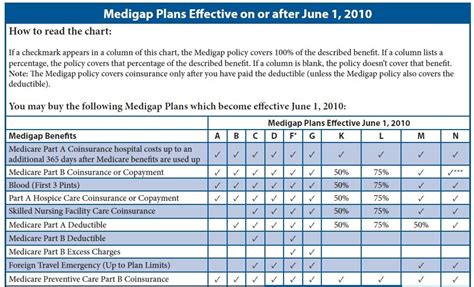

One of the key advantages of AARP's supplemental insurance plans is their flexibility. Depending on your specific needs and budget, you can choose from different plan options, each with its own set of benefits and coverage limits. This customization ensures that you receive the coverage that aligns with your personal healthcare requirements.

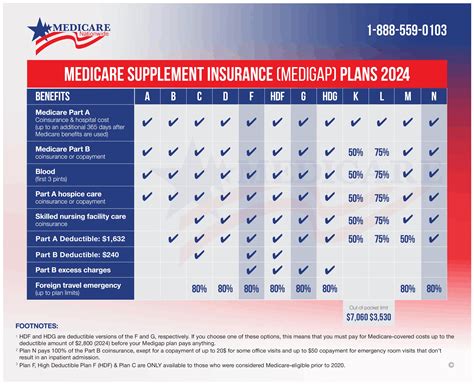

| Plan Type | Coverage Highlights |

|---|---|

| Plan A | Covers basic Medicare gaps, including Part A deductible and Part B coinsurance. |

| Plan B | Includes additional benefits like blood transfusions and skilled nursing facility care. |

| Plan F | Comprehensive coverage, including Part B deductible, foreign travel emergency care, and more. |

| Plan G | Similar to Plan F, but with the Part B deductible not covered. |

| Plan N | Offers cost-sharing benefits, providing lower premiums in exchange for certain cost-sharing. |

Each plan has its own set of standard benefits, as defined by the Centers for Medicare & Medicaid Services (CMS). These benefits ensure a consistent level of coverage across different insurance providers.

The Benefits of AARP Supplemental Insurance

Choosing an AARP supplemental insurance plan can bring numerous advantages to your healthcare journey. Here are some key benefits to consider:

Reduced Out-of-Pocket Costs

One of the primary goals of supplemental insurance is to minimize your out-of-pocket expenses. By covering Medicare’s deductibles, copayments, and coinsurance, these plans ensure that you have more predictable and manageable healthcare costs.

For example, let's say you have an accident and require hospitalization. With a supplemental insurance plan, you might only have to pay a small copayment, whereas without it, you could be facing thousands of dollars in medical bills.

Wide Network of Healthcare Providers

AARP’s supplemental insurance plans often come with extensive provider networks. This means you have a larger pool of healthcare professionals and facilities to choose from, ensuring convenient access to quality care.

Additionally, these plans typically cover services provided by both in-network and out-of-network providers, giving you even more flexibility in your healthcare choices.

Peace of Mind and Stress Reduction

Knowing that you have comprehensive healthcare coverage can significantly reduce stress and anxiety related to medical expenses. With an AARP supplemental insurance plan, you can focus on your health and well-being without worrying about financial strain.

Moreover, these plans often include valuable benefits like foreign travel emergency coverage, which can provide peace of mind when traveling abroad.

Customizable Coverage Options

As mentioned earlier, AARP offers a variety of supplemental insurance plans to cater to different needs. Whether you’re looking for basic coverage or more comprehensive protection, there’s a plan that fits your requirements.

For instance, if you anticipate frequent doctor visits and medical procedures, a plan with higher coverage limits might be the best choice. On the other hand, if you're seeking cost-effective coverage, a plan with lower premiums and cost-sharing benefits could be ideal.

Performance Analysis and Real-World Examples

To illustrate the impact of AARP supplemental insurance plans, let’s consider a real-life scenario. Meet John, a 65-year-old retiree who recently enrolled in Medicare.

John has a history of heart-related issues and wants to ensure he has adequate healthcare coverage. He chooses an AARP supplemental insurance plan (Plan G) to supplement his Medicare coverage.

A few months later, John experiences chest pain and is rushed to the emergency room. The ER visit and subsequent tests and procedures result in a substantial medical bill. However, with his supplemental insurance plan, John only has to pay a small copayment, and the rest of the costs are covered by his insurance.

This real-world example highlights how AARP's supplemental insurance plans can provide significant financial relief during unexpected medical emergencies.

Comparative Analysis and Expert Insights

When comparing AARP’s supplemental insurance plans to other similar offerings, it’s important to consider a few key factors:

Premium Costs

AARP’s plans are generally known for their competitive pricing. They often offer lower premiums compared to other insurance providers, making them an attractive option for budget-conscious individuals.

Network Flexibility

AARP’s plans typically have larger provider networks, giving you more options for healthcare services. This flexibility can be especially beneficial if you frequently travel or have a preferred healthcare provider.

Plan Customization

AARP provides a range of plan options, allowing you to tailor your coverage to your specific needs. This level of customization is not always available with other insurance providers, making AARP a preferred choice for those seeking personalized healthcare solutions.

Expert Recommendation

According to industry experts, AARP’s supplemental insurance plans are a reliable and cost-effective choice for individuals seeking comprehensive healthcare coverage. Their focus on customization and competitive pricing makes them a top recommendation for retirees and seniors.

Additionally, AARP's strong reputation and advocacy for the well-being of older adults further reinforces the trustworthiness of their insurance offerings.

Future Implications and Industry Trends

The landscape of healthcare insurance is constantly evolving, and AARP is well-positioned to adapt to these changes. Here are some key trends and future implications to consider:

Focus on Preventive Care

There is a growing emphasis on preventive healthcare measures, and AARP’s supplemental insurance plans are likely to continue supporting these initiatives. By encouraging regular check-ups and preventive services, these plans can help reduce the likelihood of more costly medical emergencies down the line.

Digital Health Innovations

The integration of technology in healthcare is an ongoing trend. AARP might explore partnerships or develop platforms that leverage digital health solutions, such as telemedicine or remote patient monitoring, to enhance the convenience and accessibility of healthcare services for its members.

Customized Wellness Programs

In the future, we can expect to see AARP offering more personalized wellness programs tailored to individual health needs. These programs could include tailored exercise routines, nutritional guidance, and mental health support, all aimed at improving overall well-being and reducing healthcare costs.

Conclusion

AARP’s supplemental insurance plans are a valuable asset for individuals seeking comprehensive and customizable healthcare coverage. With their range of plan options, competitive pricing, and focus on member well-being, AARP continues to be a trusted partner for seniors and retirees. By choosing an AARP supplemental insurance plan, you can ensure that your healthcare needs are met with financial security and peace of mind.

Can I enroll in an AARP supplemental insurance plan if I’m not an AARP member?

+While AARP offers these plans, you do not need to be an AARP member to enroll. Anyone enrolled in Medicare Part A and Part B can apply for an AARP supplemental insurance plan.

What is the difference between Medigap and Medicare Advantage plans?

+Medigap (or Medicare Supplement) plans, like those offered by AARP, are designed to supplement original Medicare coverage. They fill in the gaps left by Medicare Part A and Part B. On the other hand, Medicare Advantage plans (Part C) are an alternative to original Medicare, often including prescription drug coverage (Part D) and additional benefits, but they may have networks and rules.

Are AARP supplemental insurance plans only for seniors?

+No, while AARP primarily caters to older adults, their supplemental insurance plans are available to anyone enrolled in Medicare Part A and Part B. This includes individuals of all ages who are eligible for Medicare due to disability or end-stage renal disease.

Can I switch my supplemental insurance plan if I find a better option?

+Yes, you have the flexibility to switch your supplemental insurance plan during specific periods, such as during the Open Enrollment Period or if you have a qualifying life event. It’s important to review your options carefully to ensure you find the plan that best suits your needs.