Quote Motorcycle Insurance

Securing motorcycle insurance is a crucial step for every rider, offering essential protection against potential financial losses and ensuring peace of mind on the road. The process of obtaining a motorcycle insurance quote involves several key considerations, from understanding coverage options to evaluating factors that influence policy costs. This comprehensive guide aims to delve into the intricacies of motorcycle insurance, empowering riders with the knowledge needed to make informed decisions about their coverage.

Understanding Motorcycle Insurance Coverage

Motorcycle insurance serves as a vital safety net, providing financial support in the event of accidents, theft, or other unforeseen circumstances. The coverage offered by insurance providers typically encompasses several key components, each designed to address specific risks associated with motorcycle ownership and usage.

Liability Coverage

Liability coverage is a fundamental aspect of motorcycle insurance, safeguarding policyholders against claims arising from accidents they may cause. This coverage is especially crucial, as it helps to cover the costs of injuries sustained by others and property damage resulting from an accident for which the insured rider is deemed responsible. It’s a legal requirement in many regions and a critical component of a comprehensive insurance policy.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and compensation for injuries sustained by individuals involved in an accident caused by the insured rider. |

| Property Damage Liability | Pays for repairs or replacement of damaged property, including other vehicles, structures, or personal belongings, resulting from an accident caused by the insured rider. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are additional layers of protection that offer more comprehensive financial assistance in various scenarios. Collision coverage specifically addresses the costs of repairing or replacing the insured motorcycle following an accident, regardless of fault. This coverage is particularly beneficial for riders concerned about the financial burden of repairing their motorcycles after collisions.

Comprehensive coverage, on the other hand, provides a broader range of protection, covering damages or losses resulting from non-collision events. This can include theft, vandalism, fire, or natural disasters. By including comprehensive coverage in their policy, riders can ensure they are prepared for a wide array of unexpected situations that could impact their motorcycles.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, is an optional addition to motorcycle insurance policies that can provide valuable peace of mind. This coverage specifically caters to the medical expenses incurred by the insured rider and any passengers in the event of an accident, regardless of who is at fault. It offers swift access to financial support for medical treatments, which can be crucial in ensuring timely and effective care without the immediate strain of out-of-pocket expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is a critical component of motorcycle insurance, designed to protect riders in situations where they are involved in an accident with a driver who either lacks insurance or has insufficient coverage to compensate for the damages caused. This coverage ensures that the insured rider is not left financially vulnerable in such circumstances, providing a safety net against potential losses that could arise from inadequate insurance coverage on the part of the at-fault driver.

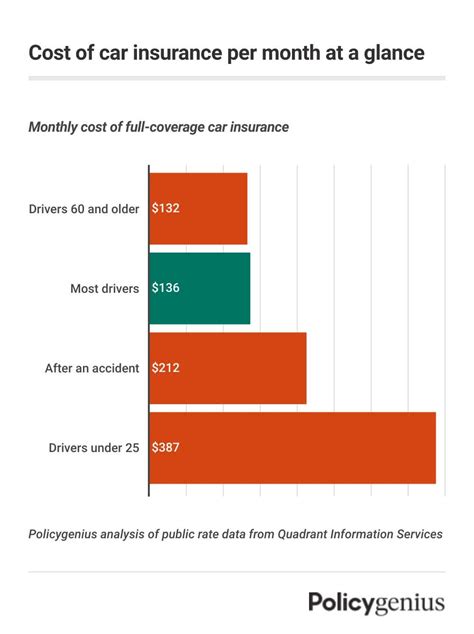

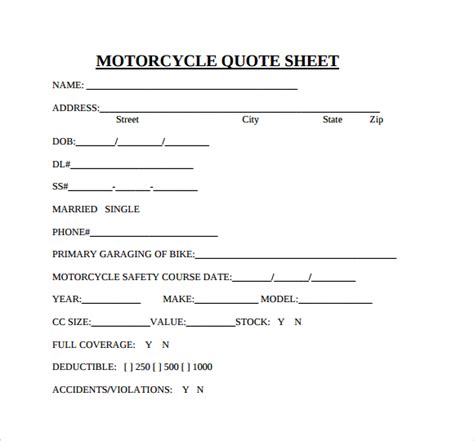

Factors Influencing Motorcycle Insurance Quotes

The process of obtaining a motorcycle insurance quote involves an assessment of various factors that contribute to the overall cost of the policy. These factors are unique to each rider and can significantly impact the final insurance premium. Understanding these influences is essential for riders to make informed decisions about their coverage and to potentially negotiate better rates.

Riding Experience and Record

An individual’s riding experience and record play a pivotal role in determining insurance quotes. Insurance providers often offer discounts to riders with extensive experience, recognizing that a longer riding history can indicate a lower risk profile. Additionally, a clean driving record, free from accidents or traffic violations, is highly favorable and can lead to significant cost savings on insurance premiums.

Conversely, riders with limited experience or a history of accidents or violations may face higher insurance quotes. This is because insurance companies view these factors as indicators of increased risk, necessitating higher premiums to offset potential claims. It's important for riders to be aware of how their experience and record impact their insurance costs, as it can guide their decisions about when to seek coverage and which providers to consider.

Motorcycle Type and Usage

The type of motorcycle being insured and its intended usage are critical factors in determining insurance quotes. Insurance providers carefully consider the make, model, and horsepower of the motorcycle, as these characteristics can influence the risk associated with the vehicle. For instance, high-performance motorcycles or those with a reputation for frequent accidents may attract higher insurance premiums.

Additionally, the intended usage of the motorcycle is a significant consideration. Riders who primarily use their motorcycles for commuting or pleasure riding may benefit from more affordable insurance rates, as these activities are generally associated with lower risk. On the other hand, those who engage in high-risk activities like racing or off-road riding may face higher insurance costs due to the increased likelihood of accidents and claims.

Location and Storage

The geographical location where a motorcycle is primarily ridden and stored can significantly impact insurance quotes. Insurance providers analyze regional data, including accident rates, crime statistics, and weather conditions, to assess the risk associated with insuring motorcycles in specific areas. Riders in regions with higher accident rates or a higher incidence of motorcycle theft may face higher insurance premiums.

Furthermore, the storage arrangement for the motorcycle is another critical factor. Insurance providers often offer discounts for motorcycles stored in secure locations, such as garages or locked storage facilities. This is because secure storage reduces the risk of theft or vandalism, which can lead to insurance claims. By taking measures to ensure the security of their motorcycles, riders can potentially negotiate better insurance rates.

Coverage Options and Deductibles

The specific coverage options chosen by riders and the deductibles they select can have a substantial impact on insurance quotes. Riders who opt for comprehensive coverage with high limits, including collision, liability, and medical payments coverage, may incur higher premiums due to the increased level of protection provided. Conversely, riders who choose more limited coverage or higher deductibles can often reduce their insurance costs, as these choices reflect a willingness to assume more financial responsibility in the event of a claim.

It's important for riders to carefully evaluate their coverage needs and financial situation when selecting coverage options and deductibles. While higher coverage limits and lower deductibles can provide more comprehensive protection, they may result in higher insurance premiums. Conversely, lower coverage limits and higher deductibles can lead to reduced premiums, but they may require riders to pay more out of pocket in the event of a claim. Finding the right balance between coverage and cost is a key consideration in the insurance selection process.

Tips for Obtaining the Best Motorcycle Insurance Quote

Securing the most favorable motorcycle insurance quote involves a combination of careful research, strategic planning, and negotiation. By following these expert tips, riders can navigate the insurance landscape with confidence, maximizing their coverage while minimizing costs.

Compare Multiple Quotes

Obtaining multiple insurance quotes is a fundamental step in the process, allowing riders to compare coverage options and premiums from different providers. Online insurance comparison tools can be particularly useful for this purpose, providing a quick and convenient way to gather quotes from a variety of insurers. By evaluating quotes side by side, riders can identify the best value for their specific needs and budget.

Explore Discount Opportunities

Insurance providers often offer a range of discounts to policyholders, and riders should take advantage of these opportunities to reduce their insurance costs. Common discounts include those for safe riding courses, anti-theft devices, and multi-policy or loyalty incentives. Riders should inquire about available discounts when obtaining quotes and ensure they are receiving all applicable reductions.

Bundle Policies for Savings

Bundling motorcycle insurance with other policies, such as auto or home insurance, can lead to significant savings. Many insurance providers offer discounts when multiple policies are purchased through the same carrier. This strategy not only simplifies the insurance process but also can result in substantial cost savings, making it a financially prudent choice for riders.

Negotiate and Customize Coverage

Riders should actively engage with insurance providers to negotiate the terms of their policies. By discussing their specific needs and concerns, riders can work with insurers to customize coverage that aligns with their individual circumstances. This may involve adjusting coverage limits, deductibles, or optional endorsements to achieve the right balance of protection and affordability.

Maintain a Clean Riding Record

A clean riding record is a powerful tool for obtaining favorable insurance quotes. Riders should strive to maintain a record free from accidents and traffic violations, as this demonstrates a low-risk profile to insurance providers. By practicing safe riding habits and adhering to traffic laws, riders can position themselves for more competitive insurance rates over time.

Case Study: Impact of Coverage Choices on Insurance Costs

To illustrate the practical implications of coverage choices on insurance costs, consider the following case study. Rider A, a 35-year-old with 15 years of riding experience and a clean record, is seeking insurance for their 2022 Harley-Davidson Sportster. Rider A has the following options for coverage and deductibles:

| Coverage Option | Deductible | Estimated Annual Premium |

|---|---|---|

| Liability Only | $1,000 | $450 |

| Liability with Collision and Comprehensive | $500 | $850 |

| Liability, Collision, Comprehensive, and Medical Payments | $250 | $1,200 |

As demonstrated by this case study, the choice of coverage options and deductibles has a substantial impact on the annual insurance premium. Rider A's decision to opt for comprehensive coverage with a $250 deductible results in a premium that is nearly three times higher than the liability-only option. This example underscores the importance of carefully evaluating coverage needs and financial constraints when selecting insurance policies.

Future Trends in Motorcycle Insurance

The landscape of motorcycle insurance is continually evolving, driven by advancements in technology, changes in consumer behavior, and shifts in regulatory environments. As we look ahead, several key trends are expected to shape the future of motorcycle insurance, offering both challenges and opportunities for riders and insurers alike.

Telematics and Usage-Based Insurance

The integration of telematics and usage-based insurance is poised to revolutionize the motorcycle insurance industry. Telematics devices, which track riding behavior and vehicle performance, provide insurers with real-time data that can be used to more accurately assess risk and set insurance premiums. This technology has the potential to reward safe riders with lower premiums, as their riding habits can be objectively measured and rewarded.

Digital Transformation and Customer Experience

The digital transformation of the insurance industry is ongoing, with a growing emphasis on enhancing the customer experience through digital channels. This trend is particularly relevant for motorcycle insurance, as riders increasingly expect convenient, user-friendly interfaces for obtaining quotes, managing policies, and filing claims. Insurance providers that invest in robust digital platforms and streamline the insurance journey are likely to gain a competitive edge in the market.

Regulatory Changes and Industry Consolidation

Regulatory changes and industry consolidation are expected to play a significant role in shaping the future of motorcycle insurance. As governments and regulatory bodies continue to update insurance laws and guidelines, insurers must adapt to remain compliant and competitive. Additionally, industry consolidation through mergers and acquisitions may lead to shifts in market dynamics, potentially impacting the range of insurance options available to riders.

Environmental Considerations and Sustainable Practices

The growing emphasis on environmental sustainability is likely to influence the motorcycle insurance industry in the coming years. As more riders opt for electric motorcycles or embrace eco-friendly riding practices, insurance providers may respond by offering specialized coverage or incentives for sustainable choices. This trend reflects a broader shift towards environmentally conscious practices across various industries.

Risk Assessment and Underwriting Innovations

Advancements in risk assessment and underwriting methodologies are expected to enhance the accuracy and efficiency of insurance processes. Insurers are increasingly leveraging data analytics and machine learning to more precisely evaluate risk profiles and set insurance premiums. These innovations can lead to more tailored insurance offerings, ensuring that riders receive coverage that aligns with their specific needs and risk factors.

Conclusion

Obtaining a motorcycle insurance quote is a critical step in the journey of responsible riding, offering protection against financial risks and providing peace of mind on the open road. By understanding the various coverage options, evaluating the factors that influence insurance costs, and exploring strategies to obtain the best quotes, riders can make informed decisions about their insurance policies. As the motorcycle insurance landscape continues to evolve, riders and insurers alike can look forward to a future shaped by technological advancements, digital innovations, and a growing emphasis on sustainability.

What is the average cost of motorcycle insurance per year?

+The average annual cost of motorcycle insurance varies significantly depending on various factors such as coverage options, riding experience, and location. As a rough estimate, basic liability coverage can range from 200 to 500 per year, while more comprehensive policies with additional coverage types can exceed $1,000 annually. It’s essential to obtain multiple quotes to determine the average cost specific to your circumstances.

Do I need motorcycle insurance if I only ride occasionally?

+Even if you ride your motorcycle infrequently, insurance is highly recommended. Unexpected accidents or incidents can occur at any time, and having insurance provides crucial financial protection. Additionally, many states require motorcycle insurance by law, so it’s important to comply with local regulations.

Can I get discounts on my motorcycle insurance premium?

+Yes, insurance providers often offer a range of discounts to policyholders. Common discounts include those for safe riding courses, anti-theft devices, multi-policy bundling, and loyalty incentives. It’s worth inquiring about available discounts when obtaining insurance quotes to maximize potential savings.