Quote On Homeowners Insurance

Homeowners insurance is an essential financial safeguard for property owners, protecting against a range of risks and offering peace of mind. However, the complexities of insurance policies and the myriad of coverage options can be daunting for many homeowners. In this article, we will delve into the intricacies of homeowners insurance, exploring its coverage, costs, and the key factors that influence policy quotations.

Understanding Homeowners Insurance

Homeowners insurance is a contract between an insurance provider and a policyholder, designed to protect the policyholder’s home and its contents against various perils. These perils can include natural disasters like hurricanes, fires, and floods, as well as man-made risks such as theft, vandalism, and liability claims. The policy also covers the cost of temporary accommodation if a home becomes uninhabitable due to an insured event.

A standard homeowners insurance policy typically provides coverage for the following:

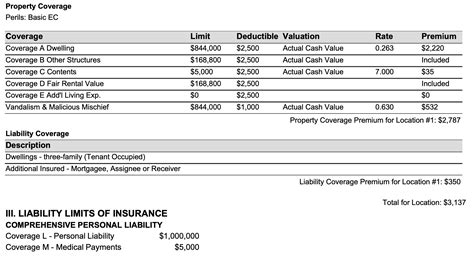

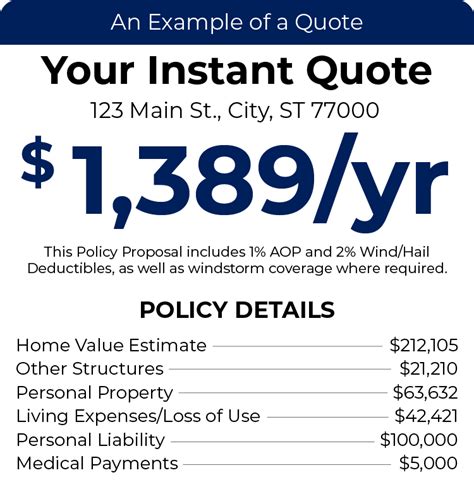

- Dwelling Coverage: This covers the physical structure of the home, including the walls, roof, and permanent fixtures.

- Personal Property Coverage: Provides protection for the policyholder's personal belongings like furniture, electronics, and clothing.

- Liability Coverage: Safeguards the policyholder against legal liability for bodily injury or property damage caused to others.

- Additional Living Expenses: Covers the cost of temporary housing and additional living expenses if the home becomes uninhabitable due to a covered loss.

- Medical Payments: Pays for medical expenses for injuries sustained on the insured property, regardless of fault.

Factors Influencing Insurance Quotes

Insurance providers use a variety of factors to assess the risk associated with insuring a home and determine the appropriate premium. These factors can vary based on location, the home’s construction, and the policyholder’s personal circumstances. Here are some key considerations that impact insurance quotes:

Location

The geographical location of a home is a significant factor in determining insurance rates. Areas prone to natural disasters like hurricanes, earthquakes, or floods generally command higher premiums. Additionally, neighborhoods with higher crime rates may also see increased insurance costs due to the heightened risk of theft or vandalism.

Home Construction and Age

The construction and age of a home can significantly impact insurance rates. Homes built with modern, fire-resistant materials and equipped with safety features like smoke detectors and sprinkler systems may qualify for lower premiums. Similarly, newer homes are often viewed as less risky than older homes, which may have outdated electrical or plumbing systems, increasing the likelihood of accidents or damage.

Claim History

Insurance providers consider the claim history of both the property and the policyholder. Homes with a history of frequent claims, such as those prone to water damage or vandalism, may face higher premiums. Similarly, policyholders who have made multiple claims in the past may also be considered a higher risk, resulting in increased premiums.

Policy Deductibles

The deductible is the amount the policyholder agrees to pay out-of-pocket before the insurance coverage kicks in. Choosing a higher deductible can lower insurance premiums, as it reduces the financial risk for the insurance provider. However, it’s important to note that a higher deductible also means the policyholder will have to pay more in the event of a claim.

Credit Score

In many states, insurance providers are allowed to consider the credit score of policyholders when determining insurance rates. Generally, individuals with higher credit scores are viewed as lower risk, which can lead to more favorable insurance quotes. Improving your credit score can, therefore, be a strategy to potentially reduce insurance costs.

Obtaining an Accurate Quote

To obtain an accurate homeowners insurance quote, it’s essential to provide detailed and honest information to your insurance provider. Here are some steps to help you get the most accurate quote:

- Gather all relevant information about your home, including its age, construction materials, and any recent renovations or improvements.

- Have a list of the personal belongings you wish to insure, including their estimated value.

- Consider the level of coverage you require. Do you need additional coverage for valuables like jewelry or art? Are there specific liabilities you wish to insure against, such as pool or dog-related incidents?

- Be transparent about any known risks associated with your home, such as frequent flooding or the presence of older electrical systems.

- Shop around and compare quotes from multiple insurance providers. Different providers may offer varying rates and coverage options.

It's important to note that insurance quotes are estimates and can change based on various factors, including any changes to your home or personal circumstances. Regularly reviewing and updating your insurance policy can help ensure you maintain adequate coverage at a competitive rate.

Comparing Coverage and Premiums

When comparing homeowners insurance policies, it’s crucial to look beyond just the premium costs. While cost is an important consideration, the level of coverage and the financial strength of the insurance provider are equally vital. Here’s a table outlining the key factors to consider when comparing homeowners insurance policies:

| Coverage | Premiums | Financial Strength |

|---|---|---|

| Check the policy's coverage limits and deductibles. Ensure it provides adequate protection for your home and belongings. | Compare the annual premiums, but also consider the potential costs of different deductibles and the impact on your out-of-pocket expenses in the event of a claim. | Research the financial stability and claims-paying ability of the insurance provider. Look for ratings from reputable agencies like A.M. Best, Moody's, or Standard & Poor's. |

Remember, a lower premium doesn't always mean better value. It's essential to find a balance between affordable premiums and comprehensive coverage that meets your specific needs. Additionally, consider the reputation and customer service of the insurance provider, as prompt and efficient claims handling can be crucial in times of need.

Future Outlook and Industry Trends

The homeowners insurance industry is continuously evolving, driven by changing consumer needs, technological advancements, and shifting risk landscapes. Here are some key trends and future implications to consider:

Climate Change and Natural Disasters

The increasing frequency and severity of natural disasters due to climate change are expected to have a significant impact on homeowners insurance. Insurance providers are likely to adjust their risk assessments and pricing models to account for these changing risks. Policyholders in high-risk areas may face higher premiums or even difficulty obtaining coverage in the future.

Technological Advancements

Advancements in technology are transforming the insurance industry. The use of big data and analytics is enabling insurance providers to more accurately assess risks and price policies. Additionally, the integration of smart home technology, such as water leak detectors and fire sensors, can provide real-time data to insurance companies, potentially leading to more accurate risk assessments and tailored coverage options.

Changing Consumer Expectations

Consumers are increasingly demanding more personalized and efficient insurance experiences. Insurance providers are investing in digital platforms and mobile apps to streamline the insurance process, from quoting to claims handling. The focus on customer experience and convenience is expected to continue, with insurance providers offering more flexible and tailored coverage options to meet diverse consumer needs.

Regulatory Changes

The insurance industry is subject to various regulations and legislative changes, which can impact homeowners insurance. For instance, changes in building codes or environmental regulations can influence the risk landscape and, consequently, insurance coverage and premiums. Staying informed about relevant regulatory developments can help policyholders understand potential changes to their coverage and costs.

Conclusion

Homeowners insurance is a vital tool for protecting your home and belongings, offering financial security and peace of mind. By understanding the factors that influence insurance quotes and being proactive in your policy selection, you can ensure you have adequate coverage at a competitive rate. As the insurance industry continues to evolve, staying informed about emerging trends and changes in the risk landscape will be essential for making informed decisions about your homeowners insurance.

How often should I review my homeowners insurance policy?

+It’s recommended to review your homeowners insurance policy annually, or whenever there are significant changes to your home or personal circumstances. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I customize my homeowners insurance policy to suit my specific needs?

+Yes, homeowners insurance policies can be customized to meet your specific needs. You can choose additional coverage options, such as coverage for high-value items or specific liabilities. It’s important to discuss your needs with your insurance provider to ensure you have the right coverage.

What should I do if I’m unsure about the coverage limits in my policy?

+If you’re uncertain about the coverage limits in your policy, it’s best to consult with your insurance agent or broker. They can help you understand the limits and ensure they align with your needs. You may also consider obtaining a second opinion from another insurance provider to compare coverage and premiums.