Small Busines Insurance

In the world of small business ownership, understanding and securing adequate insurance coverage is paramount. It is a critical step in safeguarding your venture, protecting your assets, and ensuring the longevity and success of your enterprise. This comprehensive guide aims to unravel the complexities of small business insurance, providing an insightful and practical roadmap for entrepreneurs.

Unveiling the Layers: A Comprehensive Overview of Small Business Insurance

Small business insurance is a multifaceted domain, offering a range of policies designed to address the unique risks faced by entrepreneurs. From general liability to property insurance, each type serves a distinct purpose in shielding your business from potential financial losses and legal liabilities.

General Liability Insurance: The Foundation of Protection

At the core of any small business insurance portfolio is general liability insurance. This coverage acts as a safety net, offering protection against a myriad of potential claims, including bodily injury, property damage, and personal and advertising injury. For instance, if a customer trips and falls in your store, general liability insurance can cover the medical expenses and potential legal costs.

Consider the real-world example of a small café. A customer spills hot coffee on themselves due to a slippery floor, leading to burns and medical bills. General liability insurance would step in to cover these expenses, preventing the business owner from incurring significant financial losses.

| Coverage Type | Key Benefits |

|---|---|

| Bodily Injury | Covers medical expenses and legal costs if a customer or visitor is injured on your premises. |

| Property Damage | Provides compensation if your business activities cause damage to someone else's property. |

| Personal and Advertising Injury | Protects against claims of defamation, copyright infringement, or other similar offenses committed through advertising or business operations. |

Property Insurance: Safeguarding Your Assets

Another critical aspect of small business insurance is property insurance. This coverage ensures that your business’s physical assets, such as buildings, equipment, and inventory, are protected against damage or loss due to various perils, including fire, theft, and natural disasters.

Imagine a bakery that suffers a fire due to an electrical fault. Property insurance would cover the cost of repairing or replacing the damaged building, equipment, and stock, allowing the business to recover and resume operations more swiftly.

| Coverage Type | Perils Covered |

|---|---|

| Building Coverage | Protects against fire, lightning, explosion, windstorm, hail, smoke, vandalism, and more. |

| Business Personal Property Coverage | Covers equipment, furniture, inventory, and other business assets. |

| Business Income Coverage | Provides compensation for lost income and ongoing expenses if your business is forced to close due to a covered peril. |

Other Essential Coverages for Small Businesses

While general liability and property insurance form the backbone of small business insurance, there are several other coverages that are equally important, depending on the nature of your business.

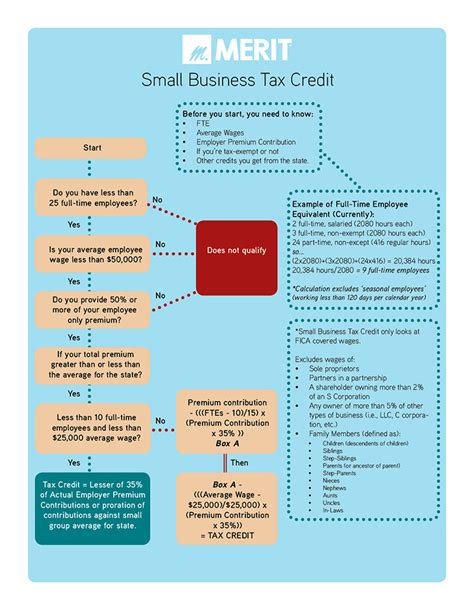

- Commercial Auto Insurance: If your business owns vehicles, this coverage is essential to protect against accidents, theft, and other vehicle-related risks.

- Workers' Compensation Insurance: Mandated by law in most states, this insurance provides coverage for employees who are injured or become ill due to work-related causes.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this coverage protects professionals against claims of negligence, errors, or omissions in providing services.

- Cyber Liability Insurance: With the increasing prevalence of cyber threats, this coverage safeguards your business against data breaches, hacking, and other cyber risks.

The Process of Acquiring Small Business Insurance

Navigating the process of acquiring small business insurance can be complex, but with the right approach and guidance, it can be a straightforward and beneficial endeavor.

Assessing Your Business’s Unique Risks

The first step in securing the right insurance coverage is to thoroughly assess the specific risks faced by your business. This involves understanding the potential liabilities and perils that your industry or business model is susceptible to. For instance, a construction company will have different risk profiles compared to a software development firm.

Consider the unique aspects of your business, such as the location, the nature of your products or services, the number of employees, and any specific industry regulations. These factors will influence the types of insurance coverage you need and the level of protection required.

Choosing the Right Insurance Provider

With a myriad of insurance providers in the market, selecting the right one for your small business can be daunting. It’s crucial to opt for a provider that not only offers comprehensive coverage but also provides excellent customer service and has a solid financial standing.

Research and compare different providers, considering their reputation, the range of policies they offer, and their claims handling process. Look for providers who specialize in small business insurance, as they are likely to have more tailored and flexible options.

Customizing Your Insurance Portfolio

Small business insurance is not a one-size-fits-all solution. It’s essential to customize your insurance portfolio to align with the specific needs and risks of your business. This involves selecting the right combination of policies and adjusting coverage limits and deductibles to suit your business’s financial capabilities and risk tolerance.

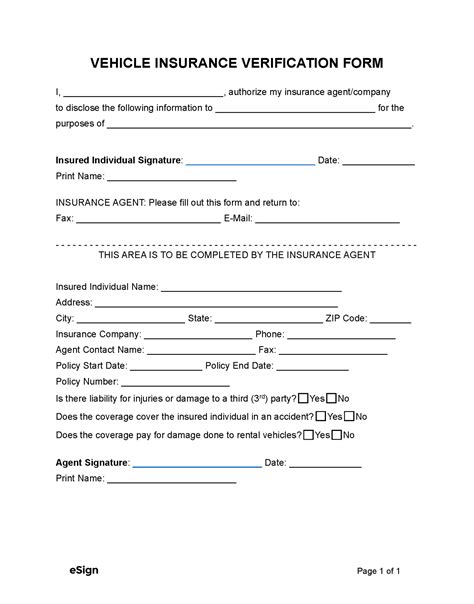

Work closely with your insurance agent or broker to understand the nuances of each policy and how they can be tailored to your business. They can guide you in making informed decisions and ensure you have the right coverage in place.

Regularly Review and Update Your Coverage

Small businesses are dynamic entities, and their insurance needs can change over time. It’s crucial to regularly review and update your insurance coverage to ensure it continues to provide adequate protection.

Factors such as business growth, changes in operations, new regulations, or even personnel changes can impact your insurance needs. Regularly assess these factors and consult with your insurance provider to make any necessary adjustments to your coverage.

The Benefits and Impact of Adequate Small Business Insurance

Securing adequate small business insurance brings a host of benefits that extend beyond mere financial protection. It plays a pivotal role in fostering business growth, enhancing operational efficiency, and ensuring long-term sustainability.

Financial Protection and Peace of Mind

At its core, small business insurance provides a vital layer of financial protection. It safeguards your business against potential losses arising from a wide range of perils, from natural disasters to lawsuits. By transferring these risks to your insurance provider, you can protect your business’s financial stability and ensure its long-term viability.

The peace of mind that comes with adequate insurance coverage cannot be overstated. It allows business owners to focus on their core operations, innovate, and grow their enterprises without the constant worry of unforeseen liabilities or financial setbacks.

Enhancing Business Reputation and Customer Trust

In today’s competitive business landscape, building and maintaining a strong reputation is crucial. Small business insurance plays a significant role in this aspect by demonstrating your commitment to professionalism and accountability.

By having the right insurance coverage in place, you signal to your customers, partners, and stakeholders that you take your responsibilities seriously and are prepared to handle any unforeseen circumstances. This can enhance your business's credibility and trustworthiness, leading to stronger relationships and increased customer loyalty.

Fostering Business Growth and Expansion

Adequate small business insurance is not just about protection; it’s also a catalyst for growth. By providing a safety net against financial risks, insurance coverage allows businesses to take calculated risks and pursue growth opportunities with confidence.

For instance, with the right insurance coverage, a small business can feel more secure about expanding into new markets, launching innovative products or services, or even acquiring competitors. Insurance provides the financial backing needed to navigate these growth strategies successfully.

The Future of Small Business Insurance: Trends and Innovations

The landscape of small business insurance is constantly evolving, driven by technological advancements, changing risk profiles, and evolving consumer expectations. Keeping abreast of these trends is crucial for small business owners to ensure they remain protected and competitive.

The Rise of Digital Insurance Solutions

The digital transformation of the insurance industry is well underway, with a growing number of insurance providers offering digital-first solutions. This trend is particularly beneficial for small businesses, as it provides convenient and accessible insurance options that can be tailored to their unique needs.

Digital insurance platforms often provide real-time quotes, streamlined applications, and self-service options, making it easier and faster for small businesses to secure the coverage they need. Additionally, these platforms often leverage data analytics to offer more accurate and personalized coverage recommendations.

The Impact of Climate Change and Environmental Risks

Climate change is presenting new and evolving risks for businesses, particularly in the form of natural disasters and extreme weather events. Small businesses, often with limited resources to recover from such events, are particularly vulnerable.

As a result, there is a growing focus on insurance solutions that address these environmental risks. This includes specialized policies that cover flood, wildfire, and other climate-related perils, as well as broader initiatives to help businesses mitigate these risks through resilience and adaptation strategies.

The Role of Technology in Risk Mitigation

Technology is not just transforming the way insurance is delivered; it’s also playing a critical role in risk mitigation. Advanced analytics, artificial intelligence, and the Internet of Things (IoT) are enabling insurers to more accurately assess and manage risks, leading to more effective and efficient coverage.

For instance, IoT devices can be used to monitor and manage risks in real time, providing early warnings and prevention measures. This not only helps businesses mitigate risks but also provides insurers with more accurate data to underwrite policies and manage claims.

Conclusion: Empowering Small Businesses Through Insurance

Small business insurance is a powerful tool that empowers entrepreneurs to protect their ventures, manage risks, and pursue growth opportunities with confidence. By understanding the various types of coverage available and tailoring a portfolio to their unique needs, small business owners can ensure they are adequately protected.

As the business landscape continues to evolve, staying informed about the latest trends and innovations in small business insurance is crucial. By embracing digital solutions, addressing environmental risks, and leveraging technology for risk mitigation, small businesses can ensure they remain resilient and well-positioned for the future.

How much does small business insurance cost?

+

The cost of small business insurance can vary significantly depending on several factors, including the type of business, its size, location, and the specific coverage needed. On average, small businesses can expect to pay between 500 to 2,000 per year for a basic general liability policy. However, the cost can increase or decrease based on the additional coverage options selected and the level of risk associated with the business.

What factors influence the cost of small business insurance?

+

The cost of small business insurance is influenced by a variety of factors, including the nature of the business (e.g., high-risk vs. low-risk industries), the business’s location (e.g., areas prone to natural disasters), the number of employees, the value of assets to be insured, and the business’s past claims history. Additionally, the level of coverage and deductibles chosen can also impact the cost.

How can small businesses save on insurance costs?

+

Small businesses can explore various strategies to reduce their insurance costs. This includes comparing quotes from multiple insurers, bundling multiple policies with the same provider, increasing deductibles (while being mindful of financial capabilities), and implementing risk management strategies to mitigate potential losses. Regularly reviewing and adjusting coverage based on business changes can also help optimize costs.