Small Business Health Insurance For 1 Employee

Small business owners often face unique challenges when it comes to providing health insurance for their employees. With rising healthcare costs and limited resources, finding an affordable and comprehensive health insurance plan for a single employee can be a daunting task. However, understanding the options available and navigating the healthcare landscape can help small businesses make informed decisions and offer competitive benefits to their valued team members.

Understanding the Need for Health Insurance

In today’s business world, health insurance is no longer considered a luxury but a necessity. It provides employees with the peace of mind that their healthcare needs are covered, ensuring they can focus on their work and personal well-being. For small businesses, offering health insurance can be a powerful tool to attract and retain talented individuals, especially in competitive industries.

Let's delve into the world of small business health insurance, specifically tailored for businesses with one employee, and explore the options, benefits, and considerations to make this process smoother and more accessible.

Exploring Health Insurance Options for Small Businesses

Small businesses have a range of options when it comes to providing health insurance. Understanding these options is crucial to making an informed decision that aligns with the business’s budget and the employee’s needs.

Group Health Insurance Plans

Group health insurance plans are a popular choice for small businesses with multiple employees. These plans offer comprehensive coverage and can be more cost-effective due to the group discount. However, for businesses with only one employee, the group plan may not be feasible or cost-efficient.

Individual Health Insurance Plans

Individual health insurance plans are designed for single employees or self-employed individuals. These plans offer flexibility and can be tailored to the employee’s specific needs. While they may be more expensive than group plans, they provide comprehensive coverage and can be a great option for small businesses with a single employee.

Government-Sponsored Programs

Small businesses and their employees may also be eligible for government-sponsored health insurance programs. These programs, such as Medicaid or the Affordable Care Act (ACA) marketplaces, offer affordable coverage options and may provide financial assistance to eligible individuals. Exploring these options can be beneficial, especially for businesses with low-income employees.

Health Savings Accounts (HSAs)

Health Savings Accounts are tax-advantaged accounts that allow individuals to save money for qualified medical expenses. HSAs can be a great tool for small businesses to offer additional benefits to their employees. Employees can contribute pre-tax dollars to their HSA, which can be used to cover medical expenses, providing a cost-effective and flexible healthcare option.

Comparative Analysis

| Option | Pros | Cons |

|---|---|---|

| Group Health Insurance | Cost-effective for multiple employees, comprehensive coverage | May not be feasible for single employee businesses |

| Individual Health Insurance | Flexible, tailored to employee’s needs, comprehensive coverage | Can be more expensive than group plans |

| Government Programs | Affordable, may offer financial assistance | Eligibility criteria, limited choice of providers |

| Health Savings Accounts | Tax-advantaged, flexible, cost-effective | Requires careful planning and management |

When evaluating these options, small business owners should consider their budget, the employee's healthcare needs, and the long-term goals of the business. Each option has its advantages and disadvantages, and a thorough analysis can help determine the best fit.

Choosing the Right Health Insurance Provider

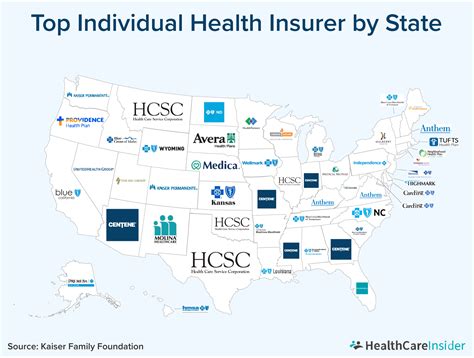

Once the type of health insurance plan is decided, the next step is to choose a reputable and reliable insurance provider. With numerous providers in the market, it’s essential to conduct thorough research to ensure the chosen provider offers quality coverage and excellent customer service.

Researching Insurance Providers

Start by creating a shortlist of potential insurance providers. Consider factors such as their reputation, financial stability, and the range of plans they offer. Online reviews and ratings can provide valuable insights into the provider’s performance and customer satisfaction.

Additionally, small business owners can seek recommendations from industry peers or consult with insurance brokers who specialize in small business health insurance. Brokers can offer expert advice and guide businesses through the complex world of healthcare insurance.

Assessing Plan Features and Benefits

When evaluating health insurance plans, pay close attention to the features and benefits they offer. Look for plans that provide comprehensive coverage, including essential health benefits such as preventive care, prescription drug coverage, and mental health services.

Consider the plan's network of healthcare providers. Ensure that the employee's preferred doctors and hospitals are included in the network to avoid out-of-network charges. Check for any limitations or exclusions that may impact the employee's specific healthcare needs.

Furthermore, assess the plan's out-of-pocket costs, including deductibles, copayments, and coinsurance. While lower premiums may be tempting, higher out-of-pocket costs can impact the employee's financial well-being, especially if they require frequent medical attention.

Negotiating for the Best Deal

Small business owners can leverage their negotiating power to secure the best deal for their health insurance plans. Start by gathering quotes from multiple providers and comparing the premiums, coverage, and benefits they offer. This comparison can help identify areas where costs can be reduced without compromising on essential coverage.

Consider bundling services or negotiating discounts for long-term commitments. Many insurance providers offer incentives for small businesses that demonstrate a commitment to providing quality healthcare for their employees. Additionally, explore the possibility of customizing the plan to fit the specific needs of the business and its employee.

Implementing and Managing Health Insurance for Small Businesses

Once the health insurance plan is selected and the provider is chosen, the next step is to implement and manage the plan effectively. This involves a series of administrative tasks and ongoing communication with the employee to ensure a smooth and beneficial experience.

Enrolling the Employee

Guide the employee through the enrollment process, providing clear and concise information about the chosen health insurance plan. Ensure that the employee understands the coverage, benefits, and any associated costs. Offer assistance and address any questions or concerns they may have.

Collect the necessary documents, such as the employee's personal information, dependent details (if applicable), and any required medical records. Verify the accuracy of the information to avoid delays or issues during the enrollment process.

Managing Premiums and Contributions

Determine the premium amount and the employee’s contribution towards the health insurance plan. Discuss the payment schedule and options, ensuring that the employee understands their financial obligations. Provide a clear breakdown of the costs to maintain transparency and build trust.

Set up a convenient and secure payment method for the employee's contributions. Consider offering direct deposit or automatic payments to streamline the process and reduce administrative burden.

Communication and Ongoing Support

Maintain open lines of communication with the employee throughout the health insurance journey. Provide regular updates on any changes to the plan, such as network updates, benefit adjustments, or premium increases. Ensure that the employee understands the impact of these changes and is aware of any actions they need to take.

Offer resources and educational materials to help the employee make informed decisions about their healthcare. This can include providing information on preventive care, understanding their benefits, and utilizing the plan's resources effectively. Regular check-ins and feedback sessions can also help identify any issues or concerns early on and address them promptly.

Monitoring and Evaluating the Plan’s Performance

Regularly monitor the performance of the health insurance plan to ensure it aligns with the business’s and employee’s expectations. Analyze claim data, utilization patterns, and overall satisfaction levels. This data can provide valuable insights into the plan’s effectiveness and help identify areas for improvement.

Stay updated on any changes in healthcare regulations or industry trends that may impact the plan. Stay in touch with the insurance provider to discuss any concerns or opportunities for optimization. Regular evaluations can help ensure that the health insurance plan remains competitive and provides the best value for the small business and its employee.

Future Implications and Trends in Small Business Health Insurance

The landscape of small business health insurance is constantly evolving, driven by technological advancements, changing healthcare regulations, and shifting market dynamics. Staying informed about these trends can help small businesses make proactive decisions and adapt to the changing healthcare environment.

Digital Health and Telemedicine

The rise of digital health and telemedicine has revolutionized the way healthcare is delivered and accessed. Small businesses can leverage these technologies to provide employees with convenient and cost-effective healthcare options. Telemedicine platforms allow employees to connect with healthcare professionals remotely, reducing the need for in-person visits and associated costs.

Value-Based Care and Preventive Measures

There is a growing emphasis on value-based care and preventive measures in the healthcare industry. Small businesses can encourage employees to adopt healthy lifestyles and utilize preventive services to reduce the risk of chronic diseases and costly treatments. Offering incentives for wellness programs and providing resources for employee education can be powerful tools in this regard.

Healthcare Technology Innovations

Advancements in healthcare technology, such as wearable devices and health tracking apps, are transforming the way we manage our health. Small businesses can explore partnerships with technology companies to offer employees access to these innovative tools. These technologies can provide real-time health insights, encourage healthy habits, and improve overall well-being.

Flexibility and Personalization

The future of small business health insurance lies in flexibility and personalization. With a growing focus on employee satisfaction and retention, businesses are exploring ways to tailor health insurance plans to individual needs. This may involve offering a menu of benefits and allowing employees to choose the options that best suit their unique circumstances.

Furthermore, the concept of defined contribution plans, where businesses contribute a fixed amount towards employee health insurance, is gaining traction. This approach empowers employees to make informed choices about their healthcare while providing businesses with a predictable budget for health insurance expenses.

What are the tax benefits of providing health insurance for small business employees?

+Small businesses can take advantage of tax incentives when providing health insurance to their employees. These incentives can reduce the business’s tax liability and make health insurance more affordable. It’s important to consult with a tax professional to understand the specific benefits and requirements in your jurisdiction.

How can small businesses afford health insurance for their employees?

+Affording health insurance for employees can be a challenge for small businesses. However, there are strategies to make it more manageable. Exploring group health insurance plans, negotiating with providers, and considering government-sponsored programs can help reduce costs. Additionally, educating employees about cost-sharing and encouraging preventive care can also contribute to overall cost-effectiveness.

Are there any legal requirements for small businesses to provide health insurance to their employees?

+The legal requirements for providing health insurance to employees vary by jurisdiction. Some regions have specific mandates, while others provide incentives or penalties. It’s crucial for small businesses to stay updated on the legal obligations in their area to ensure compliance and avoid any penalties.