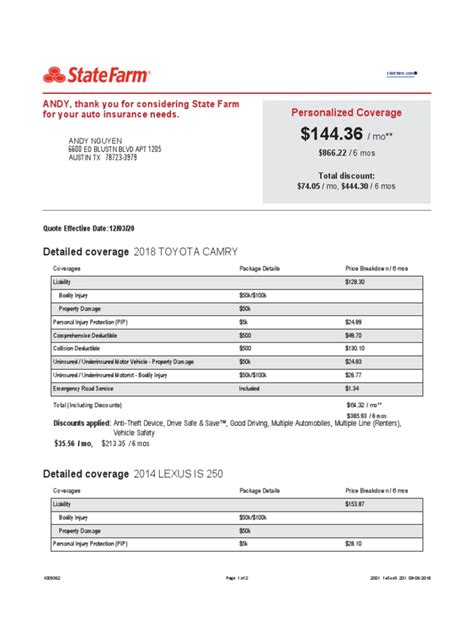

State Farm Auto Insurance Discounts

In the world of auto insurance, finding the right coverage and saving money is a top priority for many drivers. State Farm, a leading insurance provider, understands this and offers a wide range of discounts to help customers lower their premiums. In this comprehensive guide, we will delve into the various State Farm auto insurance discounts, providing you with valuable insights and strategies to maximize your savings.

Unveiling State Farm’s Auto Insurance Discounts

State Farm recognizes that responsible and safety-conscious drivers deserve rewards. Their discount program is designed to cater to a diverse range of customers, ensuring that nearly every policyholder can benefit from reduced premiums. Let’s explore the key discounts and understand how they can impact your auto insurance costs.

Safe Driver Discounts

State Farm rewards drivers who maintain a clean driving record. Here are some key discounts under this category:

- Accident-Free Discount: Drivers who go a certain number of years without an at-fault accident may be eligible for this discount. The number of years and the specific discount vary based on your state and driving history.

- Defensive Driving Course Discount: Completing an approved defensive driving course can lead to a discount on your premium. State Farm often partners with local organizations to offer these courses, ensuring accessibility.

- Good Student Discount: Students under 25 who maintain a certain GPA or academic standing may qualify for this discount. This incentive encourages academic excellence and safe driving habits.

Vehicle Safety Discounts

Your choice of vehicle and its safety features can impact your insurance rates. State Farm offers the following discounts related to vehicle safety:

- Anti-Theft Device Discount: Installing approved anti-theft devices in your vehicle can result in savings. These devices deter theft and reduce the risk of insurance claims, making you eligible for this discount.

- New Vehicle Discount: If you own a new vehicle, you may qualify for a discount. Newer models often come with advanced safety features, which can lead to reduced insurance costs.

- Vehicle Safety Package Discount: Certain vehicles equipped with advanced safety features like lane departure warning, collision avoidance systems, and adaptive headlights may be eligible for this discount. State Farm recognizes the added safety these features provide.

| Safety Feature | Discount Potential |

|---|---|

| Anti-lock Brakes | Up to 5% savings |

| Airbags | Potential for reduced bodily injury liability costs |

| Stability Control | Improved safety, leading to potential discounts |

Multi-Policy and Loyalty Discounts

State Farm encourages customers to bundle their insurance needs. By doing so, you can take advantage of the following discounts:

- Multi-Policy Discount: Combining your auto insurance with other State Farm policies, such as home or renters insurance, can result in substantial savings. This discount rewards customers for their loyalty and trust in State Farm’s comprehensive coverage.

- Longevity Discount: The longer you’ve been with State Farm, the more likely you are to receive a loyalty discount. This incentive rewards customers who maintain a long-term relationship with the company.

Usage-Based Discounts

State Farm’s innovative usage-based programs allow drivers to save based on their actual driving behavior. These programs include:

- Drive Safe & Save: This program uses a mobile app or a small device plugged into your vehicle’s onboard diagnostics port to track your driving habits. Safe driving behaviors, such as smooth acceleration and avoiding hard braking, can lead to discounts.

- Mileage Discount: If you drive fewer miles annually, you may be eligible for a mileage-based discount. State Farm understands that lower mileage often correlates with reduced accident risk.

Additional Discounts

State Farm offers a variety of other discounts, including:

- Military Discount: Active duty military personnel, veterans, and their spouses may qualify for this discount. State Farm values the service of our military members and extends this appreciation through insurance savings.

- Student Away at School Discount: If your student driver is away at school and not driving your insured vehicle, you may be eligible for this discount. It’s important to inform State Farm of this change in circumstance to ensure accurate coverage and savings.

- Association Discounts: State Farm often partners with various professional and alumni associations to offer exclusive discounts to their members. Check with your association to see if you’re eligible for these savings.

Maximizing Your Savings: A Step-by-Step Guide

Now that we’ve explored the various State Farm auto insurance discounts, let’s delve into a strategic approach to maximize your savings.

Step 1: Understand Your Eligibility

Start by reviewing your driving history, vehicle safety features, and any applicable memberships or associations. This initial assessment will give you a clear idea of the discounts you may already qualify for.

Step 2: Optimize Your Coverage

Review your current auto insurance policy with your State Farm agent. Ensure that your coverage limits and deductibles are appropriate for your needs. Optimizing your coverage can lead to savings without compromising your protection.

Step 3: Enroll in Usage-Based Programs

If you haven’t already, consider enrolling in State Farm’s usage-based programs. These programs can provide significant savings, especially if you’re a safe and cautious driver. The data collected will give you insights into your driving habits and areas where you can improve.

Step 4: Maintain a Safe Driving Record

State Farm rewards safe driving. Maintain a clean driving record by practicing defensive driving techniques and avoiding distractions. Regularly review your driving habits and strive for continuous improvement.

Step 5: Bundle Your Policies

If you haven’t already, consider bundling your auto insurance with other State Farm policies. This simple step can lead to substantial savings and provide you with a more comprehensive coverage package.

Step 6: Stay Informed and Up-to-Date

State Farm’s discount programs may evolve over time. Stay informed about any new discounts or changes to existing programs. Regularly review your policy and discuss any potential savings opportunities with your State Farm agent.

The Future of Auto Insurance Discounts

As technology advances and driving behaviors evolve, the landscape of auto insurance discounts is likely to change. State Farm, being a forward-thinking insurer, is well-positioned to adapt and offer innovative discounts that reflect the changing nature of driving.

In the coming years, we can expect to see discounts related to electric and hybrid vehicles, as well as incentives for adopting advanced driver-assistance systems (ADAS). Additionally, as more vehicles become connected, State Farm may leverage this data to offer discounts based on real-time driving behavior analysis.

Furthermore, with the rise of autonomous vehicles, State Farm may develop new discount programs that cater to this emerging technology. These discounts could incentivize the adoption of autonomous safety features and reward drivers for utilizing these advanced systems.

Conclusion: Saving with State Farm

State Farm’s comprehensive auto insurance discount program offers a wide range of opportunities for policyholders to save. By understanding your eligibility, optimizing your coverage, and staying informed, you can make the most of these discounts and reduce your insurance costs significantly.

Remember, saving on auto insurance is not just about the discounts; it's about finding the right balance between coverage and cost. With State Farm's expertise and your proactive approach, you can achieve this balance and drive with confidence, knowing you're protected and saving money.

How often can I review my discounts with State Farm?

+You can review your discounts with your State Farm agent annually or whenever your circumstances change. It’s important to keep your agent informed about any changes in your driving habits, vehicle, or personal situation to ensure you’re receiving all applicable discounts.

Are State Farm’s discounts available nationwide?

+While State Farm offers a comprehensive discount program, the availability and specifics of discounts may vary by state. It’s essential to discuss your eligibility with your local State Farm agent to understand the discounts available in your area.

Can I combine multiple discounts on my State Farm auto insurance policy?

+Yes, State Farm allows policyholders to combine multiple discounts, provided they meet the eligibility criteria for each. This can lead to substantial savings, making it crucial to explore all available discount opportunities.

How do I know if my vehicle’s safety features qualify for discounts?

+You can refer to State Farm’s website or discuss your vehicle’s safety features with your agent. They can provide guidance on which features qualify for discounts and help you maximize your savings based on your vehicle’s specific safety equipment.