State Farm Automobile Insur

Welcome to an in-depth exploration of State Farm Automobile Insurance, a leading name in the insurance industry with a rich history and a vast range of services. This article aims to provide a comprehensive understanding of State Farm's automobile insurance offerings, their unique features, and the impact they have on policyholders.

State Farm, founded over a century ago in 1922, has grown to become one of the largest insurance providers in the United States. Their journey began with a focus on auto insurance, and today, they continue to innovate and adapt, offering a comprehensive suite of insurance products and financial services. With a customer-centric approach, State Farm strives to provide tailored solutions, making insurance more accessible and understandable for all.

The Evolution of State Farm’s Automobile Insurance

State Farm’s automobile insurance has come a long way since its inception. The company’s early days were marked by a pioneering spirit, with a focus on providing affordable and reliable coverage to a growing number of car owners. As the automobile industry evolved, so did State Farm, keeping pace with changing needs and emerging technologies.

In the 1950s, State Farm introduced the concept of "No-Fault Insurance," a groundbreaking idea that aimed to simplify the claims process and reduce legal disputes. This innovation laid the foundation for modern automobile insurance practices, showcasing State Farm's commitment to customer satisfaction and industry leadership.

Fast forward to the digital age, and State Farm has embraced technology to enhance the insurance experience. Their online platform offers policyholders a convenient way to manage their insurance, file claims, and even receive personalized quotes. The integration of artificial intelligence and data analytics has further streamlined processes, ensuring a faster and more efficient service.

Key Milestones in State Farm’s Automobile Insurance Journey

- 1922: State Farm is founded by George J. Mecherle, offering affordable auto insurance to farmers and rural motorists.

- 1944: State Farm introduces the first insurance policy with no mileage limit, a significant advancement in coverage.

- 1950s: The “No-Fault Insurance” concept is pioneered, revolutionizing the claims process.

- 1967: State Farm becomes the first auto insurer to offer Uninsured Motorist Coverage, providing protection against uninsured drivers.

- 1990s: State Farm launches its online services, allowing policyholders to manage their insurance digitally.

- 2010s: The company embraces telematics, offering usage-based insurance and discount programs that reward safe driving habits.

Through these milestones, State Farm has consistently demonstrated its ability to adapt and innovate, ensuring that its automobile insurance offerings remain relevant and beneficial to its customers.

State Farm’s Comprehensive Automobile Insurance Coverage

State Farm’s automobile insurance is renowned for its comprehensive coverage options, designed to meet the diverse needs of policyholders. Whether it’s liability protection, collision coverage, or comprehensive protection against various risks, State Farm offers a tailored approach to ensure customers receive the coverage they require.

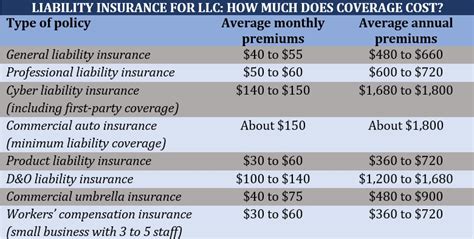

Liability Coverage

Liability insurance is a fundamental aspect of automobile insurance, protecting policyholders against financial loss if they are found legally responsible for an accident. State Farm offers multiple liability coverage options, including bodily injury liability and property damage liability, ensuring policyholders can choose the level of coverage that suits their needs and budget.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injuries caused to others in an accident. |

| Property Damage Liability | Provides coverage for damage caused to others' property, such as vehicles or structures, in an accident. |

Collision and Comprehensive Coverage

State Farm’s collision and comprehensive coverage options provide an additional layer of protection for policyholders. Collision coverage helps cover the cost of repairs or replacements when a vehicle is damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, protects against a wide range of non-collision incidents, including theft, vandalism, natural disasters, and more.

| Coverage Type | Description |

|---|---|

| Collision Coverage | Covers vehicle repairs or replacements after an accident, regardless of fault. |

| Comprehensive Coverage | Protects against non-collision incidents, including theft, vandalism, and natural disasters. |

Unique Features and Benefits of State Farm’s Automobile Insurance

Beyond the standard coverage options, State Farm’s automobile insurance boasts several unique features and benefits that set it apart in the industry.

Safe Driver Rewards

State Farm recognizes the importance of safe driving and rewards policyholders who maintain a clean driving record. Their Safe Driver Rewards program offers discounts and incentives for accident-free driving, encouraging safer road behavior and providing financial benefits to responsible drivers.

Usage-Based Insurance

State Farm’s usage-based insurance program, known as Drive Safe & Save, utilizes telematics technology to monitor driving habits. Policyholders can potentially save on their premiums by demonstrating safe and responsible driving behavior, as the program takes into account factors like miles driven, time of day, and braking habits.

Roadside Assistance

State Farm’s roadside assistance program provides policyholders with peace of mind while on the road. This service offers emergency support, including towing, flat tire changes, battery jumps, and even fuel delivery, ensuring that policyholders can get back on the road quickly and safely.

Accident Forgiveness

Accident forgiveness is a unique feature offered by State Farm, which waives the first at-fault accident from a policyholder’s driving record. This means that even if a policyholder is at fault in an accident, their premiums will not increase as a result, providing added financial protection and peace of mind.

State Farm’s Claims Process and Customer Satisfaction

State Farm’s commitment to customer satisfaction extends beyond the coverage they offer. The company’s claims process is designed to be efficient and customer-centric, ensuring that policyholders receive the support they need during challenging times.

With a dedicated claims team, State Farm strives to provide timely and accurate assessments, offering guidance and assistance throughout the claims process. Their online and mobile platforms further enhance the experience, allowing policyholders to track their claims, upload necessary documents, and stay informed every step of the way.

Customer Testimonials and Recognition

State Farm’s dedication to customer satisfaction has not gone unnoticed. The company consistently receives high marks in customer satisfaction surveys, with policyholders praising the ease of the claims process, the professionalism of their claims adjusters, and the overall support they receive during challenging times.

Moreover, State Farm's commitment to customer service has been recognized by industry experts. The company has received numerous awards and accolades, including being named one of the "World's Most Admired Companies" by Fortune magazine, further solidifying its reputation as a trusted and reliable insurance provider.

Future Outlook and Innovations in Automobile Insurance

As the insurance industry continues to evolve, State Farm remains at the forefront, embracing new technologies and innovative solutions. The company is constantly exploring ways to enhance its automobile insurance offerings, ensuring that policyholders receive the best possible protection and service.

Emerging Technologies and Their Impact

State Farm recognizes the potential of emerging technologies like artificial intelligence, machine learning, and blockchain. These technologies are being leveraged to improve risk assessment, streamline claims processes, and offer more personalized insurance solutions. By integrating these innovations, State Farm aims to provide a more efficient and customer-centric insurance experience.

Focus on Sustainability and Social Responsibility

State Farm is also committed to sustainability and social responsibility. The company is actively involved in various initiatives aimed at reducing its environmental impact and supporting local communities. By embracing sustainable practices and supporting social causes, State Farm demonstrates its commitment to being a responsible corporate citizen.

Continued Innovation and Customer Focus

Looking ahead, State Farm is poised to continue its legacy of innovation and customer-centricity. With a deep understanding of the evolving needs of policyholders, the company is dedicated to providing comprehensive, accessible, and tailored insurance solutions. Through a combination of technological advancements, industry expertise, and a customer-first approach, State Farm is well-positioned to remain a leader in the automobile insurance industry for years to come.

How can I get a quote for State Farm automobile insurance?

+Getting a quote for State Farm automobile insurance is easy. You can start by visiting their official website and using their online quote tool. Alternatively, you can contact a local State Farm agent, who can provide personalized guidance and assistance in finding the right coverage for your needs.

What are the key benefits of State Farm’s Safe Driver Rewards program?

+State Farm’s Safe Driver Rewards program offers several benefits, including discounts on your premiums for maintaining a clean driving record. The program encourages safer driving habits and rewards policyholders for their responsible behavior on the road.

How does State Farm’s usage-based insurance program work?

+State Farm’s usage-based insurance program, Drive Safe & Save, utilizes telematics technology to monitor your driving habits. By demonstrating safe and responsible driving behavior, you may be eligible for discounts on your premiums. The program considers factors like miles driven, time of day, and braking habits to assess your driving risk.

Related Terms:

- State Farm customer service

- State Farm insurance

- State Farm login

- State farm automobile insur contact

- Auto insurance