State Farm Insurance Agencies

State Farm Insurance, a household name in the world of insurance, is renowned for its vast network of local agencies across the United States. With a strong focus on community-based service, State Farm has become a trusted partner for millions of Americans seeking comprehensive insurance solutions. This article delves into the intricacies of State Farm Insurance Agencies, exploring their structure, services, and impact on the insurance landscape.

The State Farm Agency Model: A Unique Approach

State Farm operates on a unique agency model, distinct from many other insurance providers. At its core, this model emphasizes local presence and personalized service. Rather than a centralized, corporate-driven structure, State Farm empowers individual agents to build their businesses and foster deep connections within their communities.

Each State Farm agency is an independent entity, owned and operated by a licensed agent or agency owner. These individuals, often deeply rooted in their local areas, understand the unique needs and challenges of their community members. This localized approach allows State Farm to offer tailored insurance solutions that resonate with diverse client profiles.

The agency model also promotes a high level of flexibility and customization. Agents can adapt their services to meet the specific demands of their clients, offering a personalized touch that is often lacking in larger, national insurance providers. This adaptability has been a key driver of State Farm's success and customer satisfaction.

The Role of State Farm Agents: More Than Just Insurance

State Farm agents play a multifaceted role, extending far beyond the traditional scope of insurance sales. They are trusted advisors, providing guidance and support to their clients through various life stages and situations.

As local experts, agents are well-versed in the unique risks and opportunities within their communities. They can offer tailored advice on insurance coverage, helping clients protect their homes, vehicles, businesses, and assets against potential losses. This advisory role is particularly valuable for individuals and businesses seeking comprehensive risk management strategies.

State Farm agents also facilitate claims processes, ensuring that their clients receive the support they need during challenging times. Their familiarity with local regulations and procedures can streamline the claims process, providing a more efficient and less stressful experience for policyholders.

Furthermore, agents often foster strong relationships with local businesses and organizations, becoming integral parts of their community's fabric. This network allows them to connect clients with additional services and resources, further enhancing the value they bring to their communities.

Services Offered by State Farm Agencies: A Comprehensive Portfolio

State Farm Agencies offer a comprehensive range of insurance products and financial services, designed to meet the diverse needs of their clients.

Insurance Products

The insurance portfolio at State Farm is extensive, covering a broad spectrum of needs. Here’s a glimpse into some of the key offerings:

- Auto Insurance: State Farm is renowned for its auto insurance, offering coverage for a range of vehicles, including cars, motorcycles, and RVs. Policies can be customized to include comprehensive, collision, and liability coverage, ensuring vehicles are protected against accidents, theft, and other damages.

- Home Insurance: From single-family homes to condominiums and rental properties, State Farm provides a variety of home insurance options. These policies can cover structural damages, personal belongings, liability, and additional living expenses in the event of a covered loss.

- Life Insurance: State Farm offers term life and permanent life insurance policies, providing financial protection for families and loved ones in the event of an untimely death. These policies can be tailored to meet specific needs, offering coverage amounts and durations that align with individual circumstances.

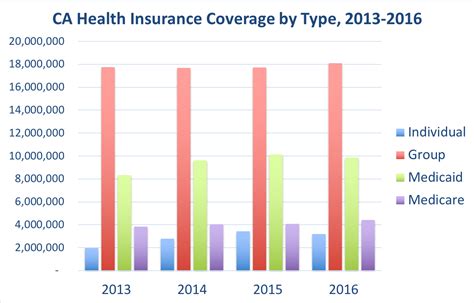

- Health Insurance: State Farm's health insurance plans provide coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs. With a range of plan options, individuals and families can find affordable coverage that meets their healthcare needs.

- Business Insurance: State Farm caters to the unique needs of small businesses, offering policies that cover property damage, liability, business interruption, and other risks. These policies can be customized to protect businesses of all sizes and industries.

Financial Services

In addition to insurance, State Farm Agencies provide a range of financial services to help clients achieve their financial goals.

- Banking Services: State Farm Bank offers a variety of banking products, including checking and savings accounts, certificates of deposit (CDs), and money market accounts. These services provide convenient and secure ways for clients to manage their finances.

- Retirement Planning: State Farm's financial advisors can assist clients in planning for their retirement. This includes advice on investment strategies, 401(k) and IRA contributions, and other ways to ensure a comfortable retirement.

- Annuities: State Farm offers annuities, which are financial products that provide a stream of payments to individuals, either immediately or in the future. These can be a valuable tool for retirement planning, offering guaranteed income and tax benefits.

- Mutual Funds and Investments: State Farm's investment services provide clients with access to a range of mutual funds and other investment opportunities. These can help clients grow their wealth and achieve long-term financial goals.

The Impact of State Farm Agencies: A Community-Centric Approach

State Farm’s agency model has had a profound impact on both the insurance industry and the communities it serves. By empowering local agents, State Farm has fostered a culture of community engagement and personalized service.

The localized approach allows State Farm to adapt its services to meet the unique needs of different regions. Whether it's understanding the risks associated with natural disasters in a particular area or providing tailored coverage for local businesses, State Farm agents are equipped to offer relevant and valuable solutions.

Furthermore, the community-centric nature of State Farm agents has fostered a deep sense of trust and loyalty among clients. This trust extends beyond insurance transactions, with agents often becoming integral parts of their clients' lives, providing support and guidance through various milestones and challenges.

Community Engagement and Philanthropy

State Farm agents are often deeply involved in community initiatives and philanthropic efforts. This involvement extends the brand’s reach beyond insurance services, positioning State Farm as a trusted community partner.

Many agents sponsor local events, support charities, and participate in community development projects. This engagement not only strengthens the bond between State Farm and its communities but also contributes to the overall well-being and resilience of these areas.

| Community Initiative | Description |

|---|---|

| State Farm Neighborhood of Good | A program that encourages and supports community service initiatives, providing resources and recognition for local heroes making a positive impact. |

| State Farm Youth Advisory Board | A platform for young people to engage in community leadership, offering grants and resources for youth-led projects and initiatives. |

| State Farm Good Neighbor Scholarships | Scholarship programs that recognize and reward students who demonstrate outstanding community involvement and leadership. |

Future Prospects and Innovations

State Farm continues to evolve and innovate to meet the changing needs of its clients and stay ahead in the competitive insurance market.

Digital Transformation

State Farm has embraced digital technologies to enhance its services and improve customer experience. The company has invested in digital tools and platforms that allow clients to manage their policies, file claims, and access information more conveniently and efficiently.

The State Farm mobile app, for instance, provides a seamless way for clients to access their policies, pay bills, and report claims. This digital transformation has not only improved efficiency but also opened up new channels for customer engagement and service delivery.

Expanding Services and Partnerships

State Farm is continuously expanding its service offerings and partnerships to provide a more comprehensive suite of solutions for its clients. This includes collaborations with other financial institutions and service providers to offer a wider range of products and services.

Additionally, State Farm is exploring new insurance products and services, such as pet insurance and identity theft protection, to cater to the evolving needs of its clients.

Focus on Customer Experience

Customer experience remains a top priority for State Farm. The company is committed to delivering exceptional service and building long-lasting relationships with its clients. This focus on customer satisfaction has contributed to State Farm’s reputation as a trusted and reliable insurance provider.

How can I find a State Farm agent near me?

+You can use the State Farm agency locator on their website. Simply enter your zip code, and you’ll be provided with a list of nearby agents along with their contact details and office locations.

What makes State Farm agents different from other insurance agents?

+State Farm agents are deeply rooted in their local communities, allowing them to understand the unique needs and risks of their clients. This localized approach, combined with State Farm’s comprehensive range of insurance products and financial services, sets them apart from other agents.

How can I become a State Farm agent?

+To become a State Farm agent, you’ll need to meet certain qualifications and undergo a rigorous selection process. This typically involves having a valid insurance license, relevant experience in the industry, and demonstrating strong leadership and business management skills. State Farm provides comprehensive training and support to help agents succeed.