State Farm Insurance Pay Bill

Paying your insurance bill is a straightforward process, and State Farm Insurance offers various convenient methods to ensure a smooth and hassle-free experience. This article will guide you through the different options available to pay your State Farm insurance bill, providing step-by-step instructions and highlighting the benefits of each method. Whether you prefer online payments, mobile apps, or traditional mail, State Farm aims to make bill payment accessible and tailored to your preferences.

Online Bill Payment: Quick and Secure

State Farm’s online bill payment system is designed to be user-friendly and secure. Here’s how you can utilize this method:

Step-by-Step Guide

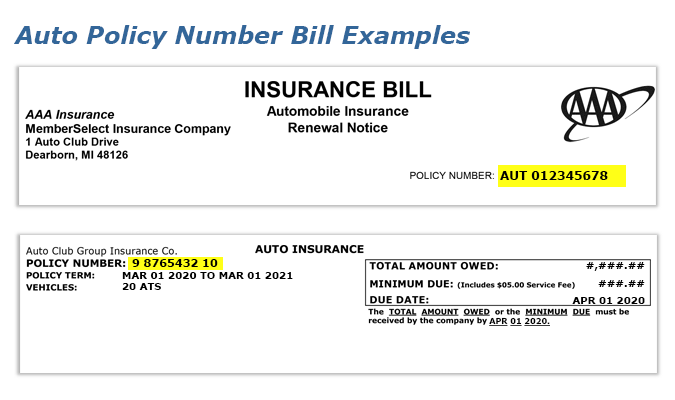

- Log in to Your Account: Visit the State Farm website and navigate to the “My Account” section. You will need your policy number and login credentials to access your account.

- Select “Make a Payment”: Once logged in, you’ll find the “Make a Payment” option in your dashboard. Click on it to proceed.

- Choose Payment Method: State Farm offers multiple payment options, including credit/debit cards and bank accounts. Select the method you prefer and enter the required details.

- Review and Confirm: Carefully review the payment amount, due date, and any additional information. Double-check that all details are correct before confirming the payment.

- Receive Confirmation: After successful payment, you’ll receive an email confirmation from State Farm. Keep this for your records.

Benefits of Online Payment

- Convenience: Pay your bill anytime, anywhere, without the need to visit a physical location.

- Security: State Farm employs advanced encryption technology to protect your financial information during online transactions.

- Real-Time Updates: Your payment is processed immediately, and you can view the updated balance in your account.

- Flexibility: You can choose the payment method that suits your preferences, whether it’s a credit card, bank transfer, or electronic check.

- Paperless Option: Online payments eliminate the need for paper bills, reducing clutter and contributing to environmental sustainability.

Mobile App Payment: On-the-Go Convenience

State Farm’s mobile app provides a seamless and efficient way to manage your insurance, including bill payments. Here’s how you can use the app to pay your insurance bill:

Step-by-Step Guide

- Download and Install the App: Visit your device’s app store (Apple App Store or Google Play Store) and download the State Farm mobile app. Install it on your smartphone or tablet.

- Log in to Your Account: Open the app and log in using your State Farm account credentials.

- Navigate to “Payments”: In the app’s main menu, select the “Payments” option. This will take you to the bill payment section.

- Choose Payment Method: Similar to the online method, you can choose to pay using your credit/debit card or bank account. Enter the required details securely.

- Review and Confirm: Carefully review the payment information, including the amount, due date, and any additional notes. Confirm the payment when you’re satisfied.

- Receive Confirmation: The app will display a confirmation message, and you’ll also receive a notification or email confirming the successful payment.

Advantages of Mobile App Payment

- Accessibility: Pay your bills from the convenience of your mobile device, whether you’re at home, on the commute, or running errands.

- Real-Time Updates: The app provides real-time updates on your payment status, ensuring you’re always informed.

- Push Notifications: You can enable push notifications to receive reminders about upcoming due dates, helping you stay on top of your payments.

- Quick and Easy: The mobile app’s user-friendly interface makes bill payment a breeze, saving you time and effort.

- Multiple Policy Management: If you have multiple policies with State Farm, you can manage and pay for all of them through the app, streamlining your insurance management.

Traditional Mail: A Reliable Option

For those who prefer a more traditional approach, State Farm accepts bill payments through the mail. While it may take a bit longer than online or mobile payments, it’s a reliable and secure method.

Step-by-Step Guide

- Obtain the Remittance Coupon: With your insurance bill, you’ll receive a remittance coupon. This coupon contains important information, including your policy number and the payment amount.

- Make the Payment: Prepare a check or money order payable to State Farm. Ensure you include the correct amount and write your policy number on the check or money order.

- Mail the Payment: Use the pre-addressed envelope provided with your bill or remittance coupon. Ensure proper postage and mail it to the address specified on the coupon.

- Track Your Payment: Consider sending your payment via certified mail with a return receipt. This way, you can track the delivery and ensure that State Farm receives your payment.

- Keep Records: Always keep a record of your payment, including the check or money order number, the date of mailing, and the tracking information if applicable.

Benefits of Traditional Mail Payment

- No Technology Required: If you prefer not to use online or mobile methods, traditional mail allows you to pay your bill without relying on technology.

- Security: State Farm takes the necessary precautions to ensure the secure handling of mailed payments.

- Flexibility: You can choose the payment method that aligns with your financial preferences, whether it’s a personal check, cashier’s check, or money order.

- Trackable: By using certified mail, you can track the delivery of your payment and have proof of delivery.

Additional Payment Methods

State Farm offers a range of additional payment methods to cater to different preferences and needs. These include:

- Automatic Payments: Set up automatic payments to have your insurance bill deducted from your bank account or charged to your credit card on a regular basis. This ensures timely payments without the need for manual intervention.

- Phone Payments: You can make a payment over the phone by calling State Farm's customer service number. A representative will guide you through the payment process and answer any questions you may have.

- In-Person Payments: Visit your local State Farm agent's office to make a payment in person. This option provides a personal touch and allows for face-to-face interactions if needed.

Frequently Asked Questions (FAQ)

How do I set up automatic payments for my State Farm insurance bill?

+

To set up automatic payments, log in to your State Farm account online or through the mobile app. Navigate to the “Payments” section and choose the “Automatic Payments” option. Follow the prompts to select your preferred payment method and schedule the recurring payments.

What are the fees associated with different payment methods?

+

State Farm does not charge fees for most payment methods, including online, mobile, and automatic payments. However, there may be fees associated with certain payment options, such as credit card payments. Review the payment method details carefully to understand any potential fees.

Can I make a partial payment for my insurance bill?

+

Yes, State Farm allows partial payments. When making a payment, you can specify the amount you wish to pay. Keep in mind that partial payments may impact your coverage or result in additional fees, so it’s important to discuss this option with your State Farm agent.

How long does it take for my payment to be processed?

+

The processing time for payments varies depending on the method used. Online and mobile payments are typically processed immediately, while mailed payments may take a few days to be received and processed. Automatic payments are processed on the scheduled due date.

What happens if I miss a payment?

+

If you miss a payment, State Farm will send you a reminder or notice. Late payments may result in additional fees or penalties, and in some cases, your coverage may be affected. It’s important to stay on top of your payments to avoid any disruptions in your insurance coverage.