State Farm Term Life Insurance

In the vast landscape of insurance options, making informed choices is paramount. Today, we delve into the world of term life insurance, specifically exploring State Farm's offering. With a focus on providing comprehensive coverage during crucial life stages, State Farm's Term Life Insurance aims to protect your loved ones' future. Let's uncover the key features, benefits, and considerations to guide you in your decision-making process.

Understanding State Farm’s Term Life Insurance

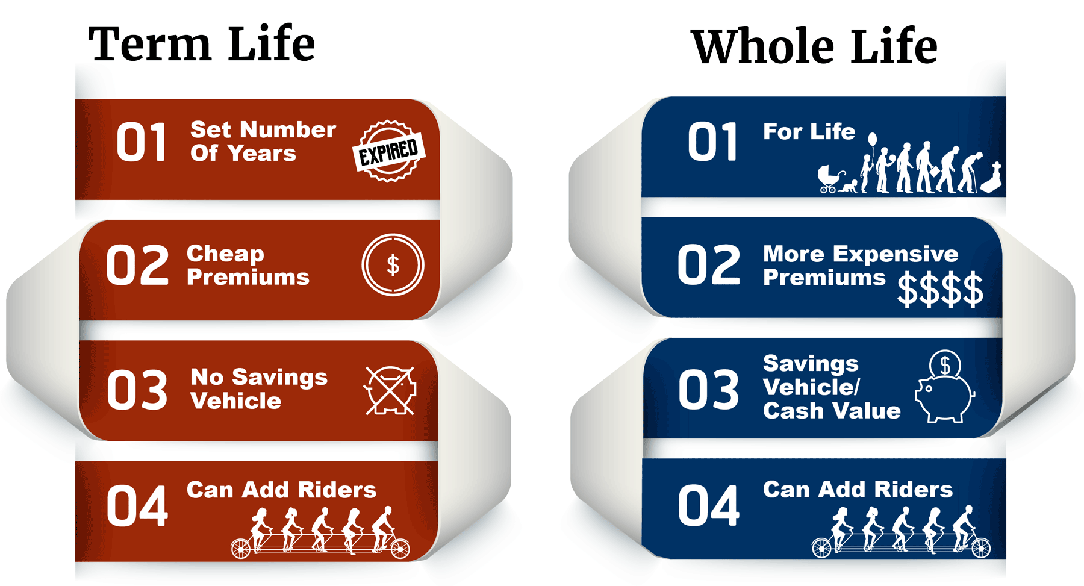

State Farm’s Term Life Insurance is a policy designed to offer financial protection during specific periods of your life. Unlike permanent life insurance, which provides coverage for your entire life, term life insurance focuses on offering affordable coverage for a set period, typically ranging from 10 to 30 years. This makes it an attractive option for individuals seeking cost-effective coverage during critical stages, such as raising a family, paying off a mortgage, or starting a business.

Key Features and Benefits

State Farm’s Term Life Insurance offers a range of features tailored to meet diverse needs. Here’s an overview of some of its key advantages:

- Affordable Coverage: One of the primary attractions of term life insurance is its affordability. State Farm’s policies offer competitive rates, making it accessible for individuals and families to secure substantial coverage without straining their finances.

- Flexible Terms: State Farm provides flexibility in choosing the term length. Whether you opt for a 10-year term to cover a specific financial goal or a longer 30-year term for more extensive protection, the choice is tailored to your needs.

- Convertible Options: Many State Farm term policies offer the benefit of conversion. This means you can convert your term policy into a permanent life insurance policy without undergoing a medical exam. This feature is especially valuable if your financial or health circumstances change over time.

- Accelerated Benefit Riders: State Farm offers riders that can be added to your policy, providing additional benefits. For instance, the Accelerated Benefit Rider allows you to access a portion of your death benefit if you’re diagnosed with a terminal illness, helping you cover medical expenses and other costs.

- Child Riders: State Farm also provides the option to add child riders to your policy. This rider offers a small amount of coverage for your children, ensuring they’re protected in case of unforeseen circumstances.

Performance and Customer Experience

State Farm’s Term Life Insurance has consistently received positive reviews from customers and industry experts alike. The company’s commitment to customer service and satisfaction is evident in its approach to claims processing. State Farm prides itself on its efficient and empathetic handling of claims, ensuring that beneficiaries receive the financial support they need during challenging times.

Furthermore, State Farm's financial strength and stability are well-regarded. With a strong financial foundation, the company can ensure the longevity of its policies and the fulfillment of its commitments to policyholders. This stability is a crucial factor for individuals seeking long-term protection and peace of mind.

Comparative Analysis

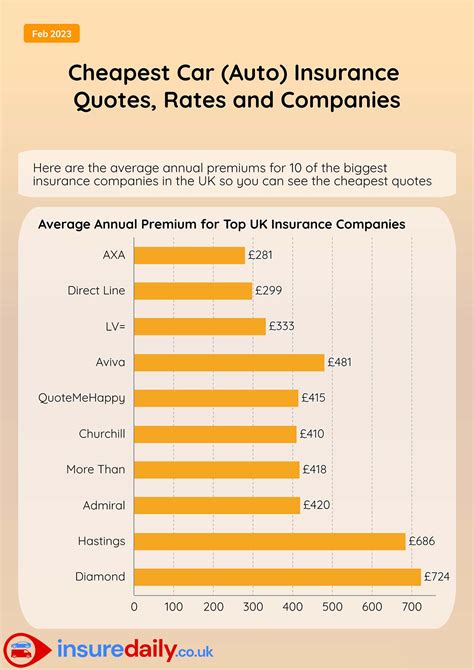

When considering term life insurance, it’s essential to explore various options. While State Farm’s Term Life Insurance offers a range of benefits, it’s worthwhile to compare it with other leading providers. Factors to consider include premium costs, policy features, and the financial strength of the insurer.

| Provider | Premium Cost | Policy Features | Financial Strength |

|---|---|---|---|

| State Farm | Competitive rates | Flexible terms, conversion options, riders | Strong financial foundation |

| Company X | Slightly higher premiums | Enhanced death benefit options, online policy management | Excellent financial stability rating |

| Company Y | Lower premiums for similar coverage | Simplified issue process, no medical exam required | Good financial rating, but lower than State Farm |

Each provider offers unique advantages, so it's crucial to assess your specific needs and preferences. State Farm's Term Life Insurance stands out for its comprehensive features and customer-centric approach, but other providers may offer specific benefits that align better with your individual circumstances.

Considerations and Expert Insights

While State Farm’s Term Life Insurance offers a compelling package, there are a few considerations to keep in mind:

- Term Length: Choosing the right term length is crucial. Consider your financial goals and the period during which you anticipate needing coverage. Opting for a longer term may provide more extended protection but could result in higher premiums.

- Riders and Add-ons: Riders can enhance your policy’s benefits, but they also come at an additional cost. Assess which riders are essential for your needs and budget accordingly.

- Financial Strength: State Farm’s financial strength is a significant advantage. However, it’s essential to regularly review the insurer’s financial ratings to ensure ongoing stability.

Conclusion: Empowering Your Financial Future

State Farm’s Term Life Insurance is a robust option for individuals seeking affordable, flexible protection during critical life stages. With its range of features, competitive pricing, and commitment to customer satisfaction, State Farm stands out as a trusted provider. However, as with any financial decision, it’s crucial to tailor your choice to your unique circumstances and needs.

Remember, life insurance is a vital component of your financial plan, providing peace of mind and ensuring your loved ones' financial security. By thoroughly researching and comparing options, you can make an informed decision that empowers you to navigate life's uncertainties with confidence.

What is the typical coverage amount for State Farm’s Term Life Insurance policies?

+

State Farm offers a range of coverage amounts, typically starting from 100,000 and going up to 10 million or more, depending on the applicant’s needs and qualifications.

Can I renew my State Farm Term Life Insurance policy when the term expires?

+

Yes, State Farm allows policyholders to renew their term life insurance policies, although the premium rates may increase with age.

Are there any health requirements or medical exams for State Farm’s Term Life Insurance policies?

+

State Farm offers both traditional term life insurance policies that require a medical exam and simplified issue policies that may have fewer health requirements or no medical exam.