The General Car Insurance Quotes

When it comes to protecting your vehicle and ensuring peace of mind, car insurance is a vital aspect of responsible vehicle ownership. The General Car Insurance is a well-known provider in the industry, offering comprehensive coverage options to suit various driver profiles. In this expert guide, we delve into the world of The General Car Insurance Quotes, exploring the factors that influence rates, the coverage options available, and the steps to obtain accurate quotes tailored to your specific needs.

Understanding The General Car Insurance Quotes

The General Car Insurance prides itself on providing affordable and flexible insurance solutions to drivers across the United States. Their quote process is designed to be straightforward and transparent, allowing individuals to obtain personalized quotes based on their unique circumstances.

The company offers a range of coverage options, including liability, collision, comprehensive, personal injury protection (PIP), uninsured/underinsured motorist coverage, and more. Each type of coverage serves a specific purpose, and understanding these options is crucial when seeking an accurate quote.

Factors Influencing The General Car Insurance Quotes

Several factors play a significant role in determining the cost of car insurance quotes from The General. Here are some key considerations:

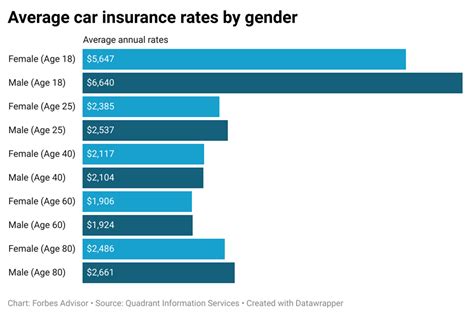

- Driver Profile: Your age, gender, driving record, and years of driving experience are important factors. Younger drivers or those with a history of accidents or violations may face higher premiums.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how and where you use it, can impact your quote. High-performance cars or vehicles driven for business purposes may attract higher rates.

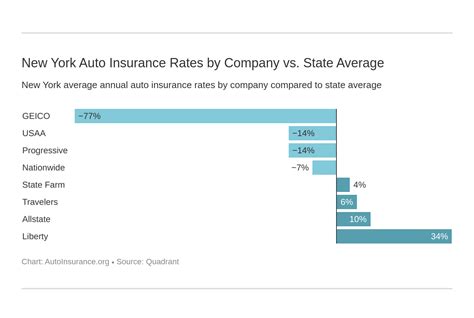

- Location: Your state and zip code can affect insurance rates due to variations in traffic conditions, crime rates, and weather patterns.

- Coverage Selection: The level of coverage you choose, such as liability-only or comprehensive, will influence your quote. Higher coverage limits typically result in higher premiums.

- Discounts: The General offers various discounts, including multi-policy, good student, safe driver, and loyalty discounts. These can significantly reduce your overall insurance costs.

Obtaining Accurate Quotes from The General

To ensure you receive precise quotes from The General Car Insurance, consider the following steps:

- Gather Information: Before requesting a quote, gather essential details about your vehicle, driving history, and coverage preferences. This includes your vehicle's make, model, and VIN, as well as any existing coverage limits and deductibles.

- Explore Coverage Options: Understand the different types of coverage offered by The General. Consider your specific needs and risks to determine the most suitable coverage options for your situation.

- Compare Quotes: Obtain quotes from multiple insurance providers, including The General. This allows you to assess and compare rates, coverage limits, and additional benefits offered by each company.

- Evaluate Discounts: Explore the discounts available to you. The General may offer discounts based on your driving record, vehicle safety features, or other factors. Apply these discounts to your quote to see the potential savings.

- Contact an Agent: Consider reaching out to a licensed insurance agent who specializes in The General's policies. They can provide personalized guidance, answer your questions, and help you tailor your coverage to your needs.

Coverage Options and Benefits

The General Car Insurance offers a comprehensive range of coverage options to cater to different driver needs. Here’s an overview of some key coverages and their benefits:

Liability Coverage

Liability coverage is a fundamental component of car insurance. It protects you financially in the event you are at fault for an accident that causes bodily injury or property damage to others. This coverage is typically divided into bodily injury liability and property damage liability.

| Bodily Injury Liability | Property Damage Liability |

|---|---|

| Covers medical expenses and lost wages for individuals injured in an accident caused by you. | Pays for repairs or replacement of vehicles or property damaged in an accident caused by you. |

Collision Coverage

Collision coverage is essential for protecting your vehicle in the event of an accident. It covers the cost of repairs or replacement if your vehicle is damaged in a collision, regardless of fault.

Comprehensive Coverage

Comprehensive coverage provides protection for your vehicle against non-collision-related incidents. This includes damage caused by theft, vandalism, natural disasters, falling objects, and more.

Personal Injury Protection (PIP)

PIP coverage, often mandatory in certain states, provides medical benefits to the insured and their passengers regardless of fault. It covers medical expenses, lost wages, and other related costs.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages. It ensures you receive compensation for your injuries and property damage.

Performance Analysis and Customer Satisfaction

The General Car Insurance has established a strong reputation in the industry, with a focus on providing affordable coverage to a diverse range of drivers. Their commitment to customer satisfaction and transparent pricing has garnered positive feedback from policyholders.

According to recent surveys, The General boasts a high customer satisfaction rating, with many individuals praising their competitive rates, efficient claims process, and excellent customer service. The company's dedication to offering customized insurance solutions has contributed to its success in catering to various driver profiles.

Furthermore, The General's focus on digital innovation has enhanced the overall customer experience. Their online platform allows users to easily obtain quotes, manage policies, and file claims, providing a convenient and user-friendly experience.

The General’s Competitive Advantages

- Affordable Rates: The General is known for offering competitive and affordable insurance rates, making it an attractive option for budget-conscious drivers.

- Flexible Coverage Options: They provide a wide range of coverage choices, allowing customers to tailor their policies to their specific needs and preferences.

- Quick Claims Process: The company prioritizes timely claim resolution, ensuring customers receive prompt assistance and compensation when needed.

- Customer-Centric Approach: The General’s focus on customer satisfaction is evident through their responsive and knowledgeable customer service team.

The Future of The General Car Insurance

As the insurance industry continues to evolve, The General Car Insurance remains committed to staying at the forefront of technological advancements. They are actively exploring innovative solutions to enhance the overall customer experience and streamline their operations.

One area of focus for The General is the integration of telematics and usage-based insurance (UBI) programs. These initiatives aim to provide customers with more personalized and accurate insurance rates based on their individual driving behaviors and habits. By leveraging data-driven insights, The General can offer customized policies that reward safe driving practices and promote road safety.

Additionally, The General is investing in digital transformation to improve efficiency and convenience for its customers. They are enhancing their online platforms and mobile applications, enabling policyholders to easily manage their policies, file claims, and access important information anytime, anywhere. This digital shift empowers customers to take control of their insurance journey and make informed decisions about their coverage.

In conclusion, The General Car Insurance is a trusted provider offering comprehensive and affordable coverage options to drivers across the United States. By understanding the factors influencing their quotes, exploring coverage options, and utilizing their online resources, individuals can obtain precise and tailored insurance solutions. With a focus on customer satisfaction, innovative technologies, and a commitment to road safety, The General is well-positioned to continue serving the diverse needs of its policyholders in the future.

Can I get a quote from The General Car Insurance online?

+Yes, The General offers a convenient online quoting process. You can visit their website, provide the necessary information, and receive a personalized quote within minutes.

What factors determine my insurance rates with The General?

+Your insurance rates with The General are influenced by various factors, including your driving record, age, gender, vehicle type, location, and coverage preferences. The company considers these factors to provide accurate and competitive quotes.

Does The General offer any discounts on car insurance?

+Absolutely! The General provides a range of discounts to help reduce your insurance costs. These may include multi-policy discounts, good student discounts, safe driver discounts, and loyalty discounts. It’s worth exploring these options when obtaining your quote.