Tmobile Insurance Clam

T-Mobile Insurance is a popular service offered by the telecommunications giant to protect customers' mobile devices from unexpected damage or theft. The insurance plan, which is often referred to as the "T-Mobile Insurance Clam," has become a key component of T-Mobile's post-purchase experience, providing customers with peace of mind and a comprehensive solution for device protection. In this article, we will delve into the intricacies of T-Mobile Insurance, exploring its coverage, claims process, and the benefits it brings to T-Mobile subscribers.

Understanding T-Mobile Insurance: Coverage and Benefits

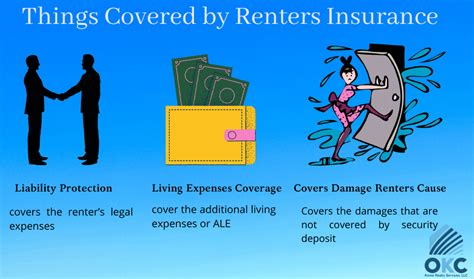

T-Mobile Insurance, or the T-Mobile Protection Plan as it is officially known, is a comprehensive insurance program designed to safeguard mobile devices purchased through T-Mobile’s network. This insurance plan covers a wide range of devices, including smartphones, tablets, and even wearable technology.

One of the key advantages of T-Mobile Insurance is its broad coverage. The plan typically includes protection against accidental damage, theft, and even mechanical or electrical failure. This means that if your device is dropped, spilled on, or experiences an unexpected hardware issue, T-Mobile Insurance has you covered.

Furthermore, T-Mobile Insurance offers a unique feature known as Lost Device Protection. This aspect of the plan provides subscribers with assistance in locating a lost or stolen device and, if necessary, remotely locking or wiping the device to protect personal data. This level of protection adds an extra layer of security for T-Mobile customers, ensuring that their sensitive information remains safe even in the event of device loss.

The benefits of T-Mobile Insurance extend beyond coverage. The plan also offers convenient and flexible payment options, allowing customers to choose between monthly or annual premiums. This flexibility ensures that the insurance plan is accessible and affordable for a wide range of customers.

Coverage Breakdown:

- Accidental Damage: Covers repairs or replacements due to drops, spills, or other accidents.

- Theft: Provides reimbursement or replacement for stolen devices.

- Mechanical/Electrical Failure: Covers repairs or replacements for internal hardware issues.

- Lost Device Protection: Assists in locating lost devices and provides remote locking/wiping capabilities.

Additionally, T-Mobile Insurance offers a Zero Deductible option for certain devices, making the claims process even more attractive to customers. This feature eliminates the need for out-of-pocket expenses when filing a claim, providing a truly comprehensive protection plan.

The Claims Process: Step-by-Step Guide

Understanding the claims process is essential for any T-Mobile Insurance subscriber. Here’s a detailed, step-by-step guide to help you navigate the process smoothly:

Step 1: Report the Incident

The first step in filing a claim is to report the incident to T-Mobile. You can do this by contacting T-Mobile’s customer support team via phone, email, or live chat. Be prepared to provide details about the incident, including the date, location, and circumstances leading to the damage or loss.

Step 2: Verify Eligibility

Once you’ve reported the incident, T-Mobile will verify your eligibility for the insurance claim. This involves checking your insurance plan details, ensuring your device is covered, and confirming that the incident falls within the scope of your coverage.

Step 3: Submit Supporting Documentation

To support your claim, you may be required to provide additional documentation. This could include photographs of the damaged device, a police report in the case of theft, or any other relevant evidence. T-Mobile will guide you through the documentation process to ensure a smooth and efficient claims journey.

Step 4: Choose Your Repair or Replacement Option

Once your claim is approved, you’ll have the option to choose between repairing or replacing your device. T-Mobile offers a network of authorized repair centers where you can take your device for repairs. If repair is not feasible or if you prefer a replacement, T-Mobile will provide you with a similar or upgraded device, depending on availability.

Step 5: Track Your Claim’s Progress

T-Mobile understands the importance of keeping customers informed throughout the claims process. You can track the progress of your claim by logging into your T-Mobile account online or through the T-Mobile app. This feature provides real-time updates, allowing you to stay informed and manage your claim efficiently.

| Claim Stage | Expected Timeline |

|---|---|

| Report Incident | Immediate |

| Verify Eligibility | Within 24 hours |

| Submit Documentation | Dependent on claim type |

| Repair or Replacement | Varies based on device and location |

Real-World Scenarios: Success Stories and Customer Experiences

To further illustrate the benefits of T-Mobile Insurance, let’s explore some real-world scenarios and success stories from T-Mobile subscribers:

Scenario 1: Accidental Damage

Sarah, a T-Mobile customer, accidentally dropped her smartphone in a pool during a family gathering. The device was completely submerged, and she feared it was damaged beyond repair. However, with T-Mobile Insurance, she was able to file a claim and receive a replacement device within just a few days. The insurance plan covered the cost of the replacement, and Sarah was back to enjoying her device without any additional expense.

Scenario 2: Theft Recovery

John, a frequent traveler, had his smartphone stolen while on a business trip. He immediately contacted T-Mobile and utilized the Lost Device Protection feature. With the help of T-Mobile’s support team, he was able to locate his device and remotely lock it, preventing unauthorized access to his personal data. The insurance plan’s theft coverage ensured that John received a replacement device, allowing him to continue his work without disruption.

Scenario 3: Mechanical Failure

Emily, a long-time T-Mobile subscriber, experienced a sudden hardware issue with her tablet. The device’s screen became unresponsive, and she couldn’t use it effectively. With T-Mobile Insurance, she was able to schedule a repair at a nearby authorized service center. The repair was covered under her insurance plan, and she received her tablet back in perfect working condition within a week.

Comparative Analysis: T-Mobile Insurance vs. Other Carriers

When it comes to mobile device insurance, T-Mobile’s Protection Plan stands out as a comprehensive and competitive option. Let’s take a closer look at how T-Mobile Insurance compares to similar plans offered by other major carriers:

Coverage Comparison

T-Mobile Insurance offers a wide range of coverage, including accidental damage, theft, and mechanical/electrical failure. While most carriers provide similar coverage, T-Mobile’s plan is particularly notable for its Lost Device Protection feature, which is a unique and valuable addition.

Pricing and Payment Options

T-Mobile Insurance allows customers to choose between monthly and annual payment plans, providing flexibility and affordability. In comparison, some carriers offer only annual plans, which may not be as accessible to all customers. Additionally, T-Mobile’s Zero Deductible option for certain devices sets it apart, as it eliminates out-of-pocket expenses during claims.

Claims Process and Customer Support

T-Mobile’s claims process is designed to be user-friendly and efficient. The company provides multiple channels for customers to report incidents and track their claims, ensuring a seamless experience. Furthermore, T-Mobile’s customer support team is known for its responsiveness and expertise, making the claims journey less stressful for subscribers.

| Carrier | Coverage | Pricing | Claims Process |

|---|---|---|---|

| Carrier A | Standard coverage, limited options | Annual plan only | Average response time, limited support channels |

| Carrier B | Comprehensive coverage, including theft | Monthly and annual plans available | Efficient claims process, good customer support |

| Carrier C | Basic coverage, excludes accidental damage | Monthly plan with higher premiums | Complex claims process, limited support |

| T-Mobile | Comprehensive coverage, Lost Device Protection | Flexible payment options, Zero Deductible available | User-friendly, responsive customer support |

Future Implications and Innovations

As technology continues to advance, T-Mobile is committed to staying at the forefront of device protection. The company is constantly evaluating and improving its insurance offerings to ensure they remain relevant and beneficial to customers.

Emerging Technologies

With the rise of wearable technology and Internet of Things (IoT) devices, T-Mobile is exploring ways to extend its insurance coverage to these emerging categories. This would provide customers with protection for a wider range of devices, ensuring they can stay connected and secure regardless of the technology they choose.

Enhanced Customer Experience

T-Mobile is dedicated to enhancing the overall customer experience, especially when it comes to insurance claims. The company is investing in innovative technologies and streamlined processes to make the claims journey even more efficient and hassle-free. This includes further integrating digital tools and AI-powered solutions to provide real-time assistance and support.

Industry Partnerships

To stay ahead of the curve, T-Mobile is actively seeking partnerships with leading technology and insurance providers. These collaborations aim to bring cutting-edge solutions to T-Mobile customers, ensuring they have access to the latest advancements in device protection and support.

FAQ Section

How do I enroll in T-Mobile Insurance?

+You can enroll in T-Mobile Insurance when purchasing a new device through T-Mobile’s network. Simply add the insurance plan to your purchase, and you’ll be covered from the moment you activate your device.

What devices are eligible for T-Mobile Insurance coverage?

+T-Mobile Insurance covers a wide range of devices, including smartphones, tablets, and wearables. However, certain devices may have specific coverage limitations, so it’s essential to review the plan details carefully.

Can I transfer my T-Mobile Insurance to a new device?

+Yes, you can transfer your T-Mobile Insurance to a new device. Simply contact T-Mobile’s customer support team, and they will guide you through the process of updating your insurance plan to cover your new device.

What happens if my claim is denied?

+If your claim is denied, T-Mobile will provide a detailed explanation of the reasons for the denial. In some cases, you may be able to appeal the decision or explore alternative options, such as out-of-pocket repairs or purchasing a new device.

T-Mobile Insurance, or the T-Mobile Protection Plan, is a comprehensive and customer-centric solution for device protection. With its broad coverage, flexible payment options, and efficient claims process, T-Mobile has set a high standard for mobile device insurance. As the company continues to innovate and adapt to emerging technologies, T-Mobile Insurance is poised to remain a leading choice for subscribers seeking peace of mind and reliable device protection.