Top 5 Car Insurance Companies

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers around the world. With numerous insurance companies offering a range of policies and services, choosing the right provider can be a daunting task. This article aims to delve into the world of car insurance, presenting a comprehensive analysis of the top 5 car insurance companies, their offerings, and the factors that set them apart.

Exploring the Top Car Insurance Providers

In the competitive landscape of the insurance industry, several companies have established themselves as leaders, offering comprehensive coverage and innovative services. Here, we present an in-depth review of the top 5 car insurance companies, analyzing their unique features, customer satisfaction, and financial stability.

State Farm: A Trusted Leader

State Farm is a name synonymous with reliability and customer satisfaction in the insurance industry. With a rich history spanning over a century, the company has solidified its position as one of the leading car insurance providers in the United States. Their comprehensive coverage options, competitive pricing, and exceptional customer service have earned them a reputation for excellence.

One of the standout features of State Farm is their personalized approach to insurance. The company offers a wide range of coverage options, allowing drivers to tailor their policies to their specific needs. From liability coverage to comprehensive and collision insurance, State Farm provides flexible plans that cater to different driving profiles.

Furthermore, State Farm’s commitment to customer service is evident in their network of local agents. These agents are dedicated to providing personalized assistance, guiding customers through the insurance process, and offering expert advice. This level of support ensures that policyholders receive the guidance they need, whether it’s understanding their coverage or filing a claim.

In terms of financial stability, State Farm boasts an impressive record. The company has consistently maintained a strong financial position, earning top ratings from reputable agencies such as A.M. Best and Standard & Poor’s. This stability provides policyholders with the assurance that their insurance provider is financially secure and capable of meeting their obligations.

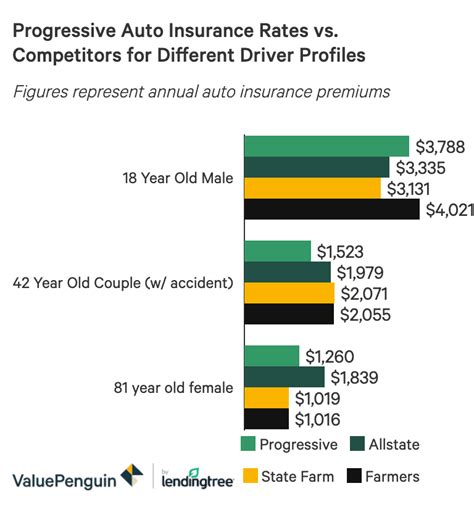

Progressive: Innovative Solutions

Progressive Insurance is renowned for its innovative approach to car insurance, offering a wide range of coverage options and unique features that cater to modern drivers. With a focus on technology and customer convenience, Progressive has established itself as a top choice for those seeking comprehensive and flexible insurance solutions.

One of the standout features of Progressive is its online quoting tool, which allows customers to obtain instant quotes and compare different coverage options with ease. This user-friendly platform provides a transparent and efficient way to explore insurance plans, empowering drivers to make informed decisions about their coverage.

In addition to its online convenience, Progressive offers a wide range of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) insurance. The company also provides specialized coverage for high-risk drivers, classic car owners, and those with unique driving needs. This versatility ensures that Progressive can cater to a diverse range of customers.

Progressive’s commitment to customer satisfaction is evident in its comprehensive claims process. The company offers a streamlined approach to filing claims, with a dedicated team of professionals who guide policyholders through the process. This support ensures that customers receive the assistance they need during challenging times, providing peace of mind and expediting the claims settlement process.

Geico: Competitive Pricing and Convenience

Geico, an acronym for Government Employees Insurance Company, has solidified its position as one of the leading car insurance providers in the United States. With a focus on competitive pricing and convenient services, Geico has attracted a loyal customer base seeking affordable and reliable insurance options.

One of Geico’s key strengths lies in its online presence and digital capabilities. The company has invested heavily in developing a user-friendly website and mobile app, allowing customers to manage their policies, obtain quotes, and file claims with ease. This digital approach has revolutionized the insurance experience, providing customers with 24⁄7 access to their insurance information and services.

In addition to its digital convenience, Geico offers competitive pricing that appeals to a wide range of drivers. The company provides multiple discounts and incentives, such as multi-policy discounts, good student discounts, and safe driving rewards. These incentives encourage responsible behavior and provide customers with opportunities to save on their insurance premiums.

Furthermore, Geico’s customer service is highly regarded, with a dedicated team of professionals who are available around the clock to assist policyholders. Whether it’s answering questions, providing guidance, or offering support during claims processes, Geico’s customer service representatives ensure a positive and efficient experience for their customers.

Allstate: Comprehensive Coverage and Assistance

Allstate Insurance is a trusted name in the car insurance industry, known for its comprehensive coverage options and dedicated customer assistance. With a focus on providing a wide range of insurance products and services, Allstate has established itself as a reliable choice for drivers seeking peace of mind and financial protection.

One of Allstate’s standout features is its Drivewise program, which utilizes telematics technology to monitor driving behavior and offer discounts based on safe driving habits. This innovative program encourages responsible driving and provides policyholders with an opportunity to save on their insurance premiums. By incentivizing safe driving, Allstate promotes a culture of road safety and reduces the risk of accidents.

In addition to its telematics-based program, Allstate offers a wide range of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) insurance. The company also provides specialized coverage for high-risk drivers, classic car owners, and those with unique driving needs. This versatility ensures that Allstate can cater to a diverse range of customers and their specific insurance requirements.

Allstate’s commitment to customer assistance is evident in its network of local agents and dedicated customer service representatives. These professionals are trained to provide personalized support, guiding customers through the insurance process and offering expert advice. Whether it’s answering questions, assisting with policy changes, or providing guidance during claims processes, Allstate’s customer service team ensures a positive and seamless experience for its policyholders.

Esurance: Digital Convenience and Personalized Experience

Esurance is a forward-thinking car insurance company that has revolutionized the industry with its focus on digital convenience and personalized experiences. By leveraging technology and innovative approaches, Esurance has established itself as a top choice for tech-savvy drivers seeking efficient and tailored insurance solutions.

One of Esurance’s key strengths lies in its digital platform, which provides customers with a seamless and intuitive experience. The company’s website and mobile app allow policyholders to manage their policies, obtain quotes, and file claims with just a few clicks. This digital convenience saves time and effort, empowering customers to take control of their insurance needs.

In addition to its digital capabilities, Esurance offers a personalized approach to insurance. The company utilizes advanced algorithms and data analytics to tailor coverage options to individual drivers. By considering factors such as driving history, vehicle type, and personal preferences, Esurance provides customized quotes and coverage recommendations, ensuring that policyholders receive the most suitable and cost-effective insurance plans.

Furthermore, Esurance’s claims process is streamlined and efficient. The company utilizes advanced technology to expedite claims handling, allowing customers to track the progress of their claims online. This transparency and convenience provide peace of mind during challenging times, ensuring that policyholders receive timely and accurate support.

Comparative Analysis: Key Factors to Consider

When comparing car insurance companies, several key factors come into play. These factors include coverage options, pricing, customer service, and financial stability. By analyzing these aspects, drivers can make informed decisions and choose the insurance provider that best aligns with their needs and preferences.

Firstly, coverage options play a crucial role in selecting an insurance company. Different drivers have unique requirements, and it’s essential to find a provider that offers a comprehensive range of coverage types. Whether it’s liability, collision, comprehensive, or specialized coverage, having a diverse selection ensures that drivers can tailor their policies to their specific needs.

Secondly, pricing is a significant consideration. While insurance is essential, finding a provider that offers competitive rates without compromising on coverage is crucial. Drivers should compare quotes from multiple companies and consider factors such as discounts, incentives, and payment plans to find the most affordable option that suits their budget.

Additionally, customer service is a critical aspect of the insurance experience. Having a dedicated and responsive team to assist with policy questions, claims processes, and general inquiries can make a significant difference. Drivers should evaluate the availability and quality of customer support, ensuring that they can receive timely assistance when needed.

Lastly, financial stability is an important factor to consider when choosing an insurance provider. A financially stable company ensures that policyholders’ claims will be honored and that the provider can weather any economic challenges. Reputable insurance companies typically maintain high financial ratings from independent agencies, providing assurance and peace of mind to their customers.

Conclusion: Making an Informed Decision

Choosing the right car insurance company is a crucial decision that can impact your financial well-being and peace of mind. By understanding the unique offerings, coverage options, and customer satisfaction levels of the top 5 car insurance companies, you can make an informed choice that aligns with your specific needs and preferences.

Whether you prioritize personalized coverage, competitive pricing, digital convenience, or exceptional customer service, there is a top-rated insurance provider that can cater to your requirements. Take the time to research, compare, and evaluate the options available to ensure you select the best car insurance company for your driving needs.

How do I choose the right car insurance company for me?

+When selecting a car insurance company, consider your specific needs and preferences. Evaluate factors such as coverage options, pricing, customer service, and financial stability. Research and compare multiple providers to find the one that offers the best combination of these aspects, ensuring you receive comprehensive coverage and a positive insurance experience.

What are some common car insurance coverage options?

+Common car insurance coverage options include liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each type of coverage serves a specific purpose, protecting policyholders from various risks and financial liabilities.

How can I save money on my car insurance premiums?

+To save money on car insurance premiums, consider factors such as your driving record, vehicle type, and insurance provider. Explore discounts offered by insurance companies, such as multi-policy discounts, safe driver discounts, and good student discounts. Additionally, compare quotes from multiple providers to find the most competitive rates.

What should I do if I’m involved in a car accident?

+If you’re involved in a car accident, the first step is to ensure your safety and the safety of others involved. Exchange contact and insurance information with the other driver(s) and document the scene by taking photos and collecting witness statements. Contact your insurance company promptly to report the accident and initiate the claims process. Follow their guidance and provide any necessary documentation to facilitate a smooth claims settlement.