Top Best Health Insurance In Us

Health insurance is an essential aspect of healthcare access and financial protection in the United States. With a vast array of options available, navigating the market can be daunting. This comprehensive guide aims to shed light on the top health insurance providers in the US, highlighting their unique features, coverage options, and customer satisfaction levels.

Understanding the Health Insurance Landscape in the US

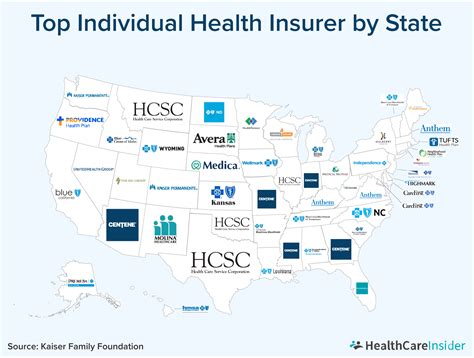

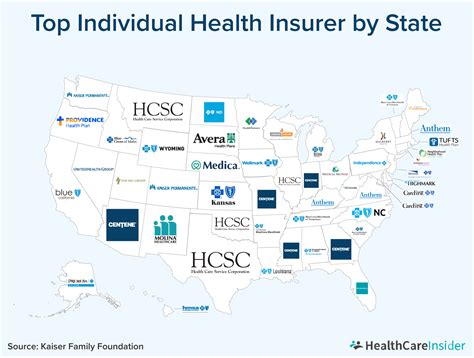

The US healthcare system is complex, with a mix of private and public insurance options. Private insurance companies dominate the market, offering various plans to individuals, families, and employers. Meanwhile, public insurance programs like Medicaid and Medicare provide coverage for specific populations, such as low-income individuals, the elderly, and people with disabilities.

When choosing a health insurance plan, factors like premium costs, deductibles, copayments, and coverage limits come into play. Additionally, the availability of providers and prescription drug coverage are critical considerations. Understanding these aspects is crucial for making an informed decision about health insurance.

The Top Health Insurance Providers in the US

Now, let’s delve into the top health insurance providers in the US, exploring their key features and what sets them apart.

UnitedHealthcare

UnitedHealthcare is one of the largest health insurance providers in the US, offering a comprehensive range of plans. They excel in providing nationwide coverage, with an extensive network of healthcare providers. Their plans often include additional benefits like vision and dental coverage, making them a popular choice for families.

Key Features:

- Network Size: UnitedHealthcare boasts one of the largest provider networks in the country, ensuring ease of access to healthcare services.

- Plan Flexibility: They offer a variety of plan types, including HMO, PPO, and EPO, catering to different preferences and needs.

- Additional Benefits: Many of their plans include vision, dental, and even wellness programs, providing a holistic approach to healthcare.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is a renowned name in the health insurance industry, with a presence in all 50 states. BCBS operates as a federation of independent companies, each serving a specific region. This localized approach allows them to tailor plans to the unique healthcare needs of each area.

Key Features:

- Regional Expertise: BCBS companies understand the specific healthcare challenges and preferences of their regions, offering tailored plans.

- Wide Coverage: Despite being regional, BCBS companies collectively provide nationwide coverage, making them a convenient choice for travelers.

- Preventative Care Focus: Many BCBS plans emphasize preventative care, offering incentives and reduced costs for regular check-ups and screenings.

Cigna

Cigna is a global health service company, offering not just insurance but also various healthcare services. They are known for their innovative approach, leveraging technology to enhance the customer experience.

Key Features:

- Digital Tools: Cigna provides mobile apps and online platforms for easy plan management and access to healthcare resources.

- Wellness Programs: Their plans often include wellness incentives, encouraging healthy lifestyles and preventative care.

- Global Coverage: Cigna offers international coverage, making them an ideal choice for those who frequently travel or work abroad.

Aetna

Aetna is another prominent player in the US health insurance market, known for its comprehensive coverage options. They cater to individuals, families, and employers, offering a range of plans to suit different needs.

Key Features:

- Wide Network: Aetna has a vast provider network, ensuring ease of access to healthcare services across the country.

- Health Management Tools: They provide online tools and resources to help members manage their health and navigate their plans effectively.

- Value-Based Care: Aetna promotes value-based care, rewarding providers for quality and outcomes rather than quantity of services.

Kaiser Permanente

Kaiser Permanente is a unique health insurance provider, operating as an integrated healthcare system. They own and operate their own hospitals, medical centers, and clinics, allowing for seamless coordination of care.

Key Features:

- Integrated Care: Kaiser Permanente's integrated system ensures a coordinated approach to healthcare, with all providers working together.

- Preventative Focus: They emphasize preventative care and wellness, offering educational resources and incentives for healthy living.

- Electronic Health Records: Kaiser Permanente utilizes advanced electronic health records, allowing for efficient and secure management of patient information.

Comparing Coverage and Costs

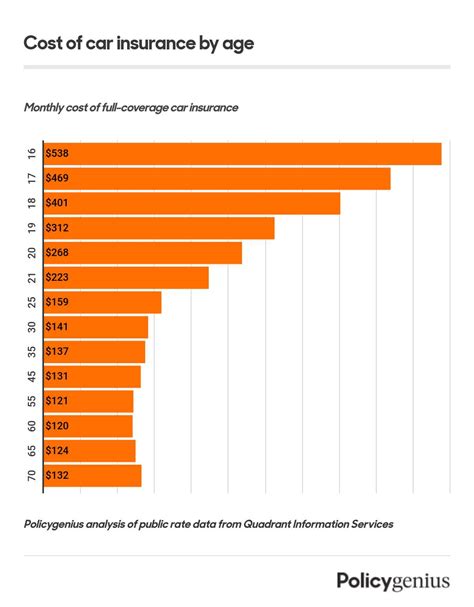

When comparing health insurance plans, it's crucial to consider the coverage and costs involved. Here's a table providing a snapshot of the top providers' coverage types and average monthly premiums:

| Provider | Coverage Type | Average Monthly Premium |

|---|---|---|

| UnitedHealthcare | PPO, HMO, EPO | $450 - $600 |

| Blue Cross Blue Shield | PPO, HMO, POS | $400 - $550 |

| Cigna | PPO, HMO, EPO | $420 - $580 |

| Aetna | PPO, HMO, POS | $430 - $570 |

| Kaiser Permanente | HMO, PPO | $480 - $620 |

It's important to note that these averages can vary significantly based on factors like age, location, and the specific plan chosen. Always review the details of each plan to ensure it aligns with your healthcare needs and budget.

Customer Satisfaction and Industry Recognition

In addition to coverage and costs, customer satisfaction is a key indicator of a health insurance provider’s quality. Here’s a look at how the top providers fare in terms of customer satisfaction and industry recognition:

UnitedHealthcare

UnitedHealthcare consistently ranks among the top health insurance providers in terms of customer satisfaction. They have received numerous accolades for their comprehensive plans and wide network of providers. Their commitment to innovation and customer service has earned them a solid reputation in the industry.

Blue Cross Blue Shield

BCBS companies have a strong track record of customer satisfaction, often ranking highly in regional surveys. Their localized approach allows them to tailor plans to meet the specific needs and preferences of their communities. This attention to regional healthcare challenges has contributed to their success.

Cigna

Cigna’s innovative approach to healthcare has garnered attention and recognition. Their focus on digital tools and wellness programs has set them apart, earning them awards for their forward-thinking strategies. Customers appreciate Cigna’s efforts to simplify healthcare management and promote healthy lifestyles.

Aetna

Aetna is renowned for its comprehensive coverage options and customer-centric approach. They have received numerous awards for their commitment to quality care and member satisfaction. Aetna’s plans are designed to meet a wide range of needs, making them a popular choice among individuals and employers alike.

Kaiser Permanente

Kaiser Permanente’s integrated healthcare system has earned them a unique reputation in the industry. Their focus on preventative care and seamless coordination of services has resulted in high customer satisfaction. Kaiser Permanente’s innovative approach to healthcare delivery has been recognized with various awards and accolades.

The Future of Health Insurance in the US

The health insurance landscape in the US is evolving, driven by advancements in technology, changing healthcare needs, and policy reforms. Here are some key trends and implications for the future of health insurance:

Telehealth and Digital Health

The rise of telehealth and digital health technologies is transforming the way healthcare is delivered and accessed. Health insurance providers are increasingly incorporating telehealth services into their plans, allowing for remote consultations and convenient access to healthcare professionals. This trend is expected to continue, offering greater flexibility and accessibility to members.

Value-Based Care

Value-based care models, which focus on quality and outcomes rather than the quantity of services, are gaining traction in the industry. Health insurance providers are shifting towards these models, incentivizing providers to deliver high-quality, cost-effective care. This shift is expected to improve healthcare outcomes and control costs in the long run.

Focus on Preventative Care

There is a growing emphasis on preventative care and wellness programs within the health insurance industry. Providers are recognizing the importance of promoting healthy lifestyles and preventing illnesses before they occur. By investing in preventative measures, health insurance companies can potentially reduce long-term healthcare costs and improve overall population health.

Integration of Data and Analytics

The integration of advanced data analytics and artificial intelligence is revolutionizing healthcare. Health insurance providers are leveraging these technologies to improve risk assessment, identify trends, and personalize care plans. By analyzing large datasets, providers can make more informed decisions, enhance efficiency, and deliver targeted interventions to members.

Conclusion

Choosing the right health insurance provider is a critical decision that impacts your access to healthcare and financial well-being. The top health insurance providers in the US, including UnitedHealthcare, Blue Cross Blue Shield, Cigna, Aetna, and Kaiser Permanente, offer a range of comprehensive plans tailored to different needs. With their wide networks, innovative approaches, and focus on customer satisfaction, these providers are leading the way in the ever-evolving health insurance landscape.

As the industry continues to evolve, embracing digital health, value-based care, and data analytics, the future of health insurance looks promising. These advancements have the potential to improve healthcare outcomes, enhance accessibility, and control costs. By staying informed and choosing the right provider, individuals can navigate the complex healthcare system with confidence and peace of mind.

How do I choose the right health insurance plan for me?

+Choosing the right health insurance plan involves considering factors such as your healthcare needs, budget, and provider preferences. Assess your regular healthcare requirements, whether it’s routine check-ups, specialist care, or prescription medications. Evaluate the costs, including premiums, deductibles, and copayments, to ensure the plan aligns with your financial situation. Research the provider network to ensure easy access to your preferred healthcare professionals. Finally, compare the benefits and coverage limits to find a plan that offers the right balance of coverage and affordability for your needs.

What is the difference between HMO, PPO, and EPO plans?

+HMO (Health Maintenance Organization) plans typically require you to choose a primary care physician and obtain referrals for specialist care. They often have lower out-of-pocket costs but a more restricted network of providers. PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to visit any healthcare provider, though costs may be higher. EPO (Exclusive Provider Organization) plans are similar to PPOs but have a more limited network of providers.

Are there any government-assisted health insurance programs available?

+Yes, the US government offers several health insurance programs, including Medicaid for low-income individuals and families, Medicare for individuals aged 65 and older or with certain disabilities, and the Children’s Health Insurance Program (CHIP) for children from low-income families. These programs provide affordable or no-cost healthcare coverage to eligible individuals.