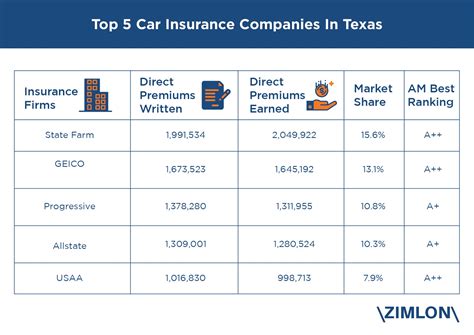

Top Car Insurance Companies In Texas

When it comes to finding the best car insurance in Texas, drivers have a wide range of options to choose from. The Lone Star State is home to numerous insurance providers, each offering unique policies and coverage options. In this comprehensive guide, we will delve into the top car insurance companies in Texas, providing you with the insights and information needed to make an informed decision for your automotive insurance needs.

The Leading Car Insurance Providers in Texas

Texas is known for its diverse insurance market, catering to the unique needs of its residents. Let’s explore some of the top-rated car insurance companies operating in the state:

1. State Farm

State Farm is a prominent player in the Texas car insurance landscape, offering a wide array of coverage options and a strong focus on customer satisfaction. With a comprehensive suite of products, including auto, home, and life insurance, State Farm provides Texans with a one-stop shop for their insurance needs. The company’s strong financial stability and commitment to personalized service have earned it a reputation as a trusted provider.

Key features of State Farm’s car insurance include:

- Competitive Rates: State Farm is known for offering competitive pricing, making it an attractive option for budget-conscious drivers.

- Discounts: The company provides a variety of discounts, such as the good student discount and the safe driver discount, allowing customers to save on their premiums.

- Claim Satisfaction: State Farm has a track record of handling claims efficiently and providing excellent customer service during the claims process.

2. GEICO

GEICO, an acronym for Government Employees Insurance Company, has made its mark in the Texas car insurance market with its competitive rates and comprehensive coverage options. Known for its catchy marketing campaigns, GEICO has successfully captured the attention of Texas drivers, offering a range of benefits and discounts.

Here are some notable aspects of GEICO’s car insurance in Texas:

- Digital Convenience: GEICO provides a seamless digital experience, allowing customers to manage their policies, make payments, and file claims online or through its mobile app.

- Discounts Galore: From multi-policy discounts to military and federal employee discounts, GEICO offers a wide range of savings opportunities for Texas residents.

- Excellent Customer Service: The company’s customer support team is highly regarded for its prompt and friendly assistance, ensuring a positive experience for policyholders.

3. USAA

USAA, or United Services Automobile Association, is a highly respected car insurance provider in Texas, catering specifically to military members, veterans, and their families. With a strong focus on military service, USAA offers exclusive benefits and discounts to its members, making it a top choice for those who have served our country.

Key benefits of USAA’s car insurance include:

- Military-Focused Benefits: USAA provides specialized coverage options and discounts tailored to the unique needs of military personnel, such as deployment coverage and discounted rates.

- Exceptional Claims Service: USAA is renowned for its efficient and empathetic claims handling, ensuring a smooth and stress-free process for its members.

- Comprehensive Coverage: USAA offers a wide range of coverage options, including rental car coverage, gap insurance, and new car replacement, providing peace of mind to its policyholders.

4. Progressive

Progressive is a well-established car insurance company that has gained popularity in Texas due to its innovative approach and customer-centric offerings. With a focus on customization and flexibility, Progressive allows drivers to build a policy that suits their specific needs and budget.

Progressive’s car insurance in Texas offers the following advantages:

- Name Your Price® Tool: This unique feature lets customers set their desired monthly budget and receive customized policy options, ensuring they get the coverage they need without breaking the bank.

- Snapshot® Program: Progressive’s usage-based insurance program rewards safe drivers with discounts, as it analyzes driving behavior and offers personalized rates based on actual driving habits.

- Wide Range of Coverage Options: From liability coverage to comprehensive and collision insurance, Progressive provides a comprehensive suite of products to protect Texas drivers and their vehicles.

5. Allstate

Allstate is a trusted name in the insurance industry, offering a comprehensive range of car insurance products to Texas residents. With a focus on providing personalized coverage and excellent customer service, Allstate has become a go-to choice for many drivers in the state.

Here’s what sets Allstate apart in the Texas car insurance market:

- Drivewise® Program: Allstate’s usage-based insurance program encourages safe driving by offering discounts based on individual driving behavior. Customers can save by installing the Drivewise device, which tracks their driving habits and provides feedback on areas for improvement.

- Wide Network of Agents: Allstate maintains a strong presence in Texas through its network of local agents, providing personalized assistance and guidance to policyholders.

- Customizable Coverage: Allstate offers a range of optional coverage endorsements, allowing customers to tailor their policy to their specific needs and preferences.

Factors to Consider When Choosing Car Insurance in Texas

When evaluating car insurance options in Texas, it’s essential to consider various factors to find the best fit for your needs. Here are some key considerations:

Coverage Options

Review the coverage options offered by each insurance provider. Ensure that the policy includes liability coverage, collision coverage, comprehensive coverage, and any additional coverage you may require, such as uninsured/underinsured motorist coverage or rental car reimbursement.

Pricing and Discounts

Compare the prices and available discounts offered by different companies. Look for discounts based on factors such as safe driving records, multiple policies, good student status, or membership in certain organizations. These discounts can significantly reduce your premium costs.

Claims Process and Customer Service

Research the reputation of each insurance company when it comes to handling claims and providing customer support. Read reviews and seek recommendations from friends and family to ensure you choose a provider with a strong track record of prompt and fair claims processing and excellent customer service.

Policy Customization

Evaluate the flexibility and customization options provided by each insurer. Some drivers may prefer a more tailored approach, allowing them to choose specific coverage limits and optional endorsements to suit their individual needs and budget.

Financial Stability

Assess the financial strength and stability of the insurance companies you are considering. Look for providers with solid financial ratings from reputable agencies such as A.M. Best, Standard & Poor’s, or Moody’s. A stable financial foundation ensures that the company will be able to fulfill its obligations and provide long-term protection.

Understanding Car Insurance Requirements in Texas

Texas has specific laws and regulations regarding car insurance coverage. It’s crucial to understand these requirements to ensure you are complying with state laws and protecting yourself financially in the event of an accident.

In Texas, the minimum liability coverage required by law is:

- Bodily Injury Liability: $30,000 per person / $60,000 per accident

- Property Damage Liability: $25,000 per accident

However, it's important to note that these minimum limits may not provide sufficient protection in the event of a severe accident. Many experts recommend purchasing higher liability limits to ensure you have adequate coverage for potential damages and injuries.

Additionally, Texas law requires all registered vehicles to carry proof of financial responsibility, which can be satisfied through various methods, including car insurance, self-insurance, or a certificate of deposit.

Additional Tips for Finding the Best Car Insurance in Texas

To further assist you in your search for the ideal car insurance provider in Texas, here are some additional tips and considerations:

- Compare Quotes: Obtain multiple quotes from different insurance companies to compare rates and coverage options. Online quote comparison tools can be a convenient way to get a snapshot of the market.

- Bundle Policies: Consider bundling your car insurance with other policies, such as home or renters insurance, to potentially save money through multi-policy discounts.

- Review Your Driving Record: Regularly check your driving record to ensure there are no errors or discrepancies that could impact your insurance rates. A clean driving record can help you secure more favorable rates.

- Understand Your Coverage Needs: Assess your specific coverage needs based on your driving habits, vehicle type, and personal circumstances. Consider factors such as the value of your vehicle, the risk of theft or damage in your area, and any personal injury risks.

- Read the Fine Print: Carefully review the policy terms and conditions, including exclusions and limitations, to ensure you fully understand the coverage provided. Pay attention to any deductibles, limits, and restrictions that may apply.

Conclusion

Choosing the right car insurance provider in Texas is an important decision that can impact your financial security and peace of mind. By considering the top insurance companies mentioned above, evaluating their coverage options, pricing, and customer service, you can make an informed choice that best suits your needs and budget. Remember to tailor your policy to your specific circumstances and always review your coverage regularly to ensure it remains up-to-date and adequate.

What is the average cost of car insurance in Texas?

+

The average cost of car insurance in Texas varies depending on several factors, including the driver’s age, driving record, vehicle type, and coverage options. According to recent data, the average annual premium for minimum liability coverage in Texas is around 700, while full coverage policies can range from 1,200 to $2,000 or more.

Are there any discounts available for Texas car insurance policies?

+

Yes, Texas car insurance providers offer a variety of discounts to help policyholders save on their premiums. Common discounts include safe driver discounts, good student discounts, multi-policy discounts, and loyalty discounts. Additionally, some companies provide discounts for certain vehicle safety features, such as anti-theft devices or advanced driver-assistance systems.

How can I reduce my car insurance costs in Texas?

+

To reduce your car insurance costs in Texas, you can consider shopping around for multiple quotes, comparing rates and coverage options from different providers. Additionally, maintaining a clean driving record, increasing your deductible, and opting for higher liability limits can help lower your premiums. You may also explore discounts offered by insurance companies, such as those mentioned earlier.