Top Rated Car Insurance Company

In the competitive landscape of the automotive industry, choosing the right car insurance provider is a crucial decision that can significantly impact your financial well-being and peace of mind. With countless options available, it's essential to carefully evaluate and select a reputable company that offers comprehensive coverage, exceptional customer service, and competitive pricing. This in-depth analysis aims to guide you through the process of identifying the top-rated car insurance company, leveraging industry insights and real-world experiences to make an informed choice.

Understanding the Essentials: Key Considerations for Car Insurance

When embarking on your search for the ideal car insurance provider, it’s crucial to grasp the fundamental aspects that define a top-rated company. Here are some essential factors to keep in mind:

Comprehensive Coverage Options

A top-rated car insurance company should offer a wide range of coverage options to cater to diverse needs. From liability coverage to comprehensive and collision insurance, the provider should provide customizable plans that align with your specific requirements. Additionally, look for add-on coverages like rental car reimbursement, roadside assistance, and gap insurance, which can further enhance your protection.

Competitive Pricing and Discounts

While comprehensive coverage is essential, it’s equally important to find a provider that offers competitive rates. Compare quotes from multiple insurers to ensure you’re getting the best value for your money. Additionally, inquire about potential discounts. Many companies offer discounts for safe driving records, vehicle safety features, multiple policy bundles, and loyalty programs. These discounts can significantly reduce your overall insurance costs.

Excellent Customer Service and Claims Handling

In the event of an accident or claim, you’ll want to work with a car insurance company that provides exceptional customer service. Look for providers with a strong reputation for prompt and efficient claims handling. Read reviews and testimonials to gauge customer satisfaction levels. A responsive and supportive customer service team can make a significant difference during stressful situations.

Financial Stability and Reputation

Opting for a financially stable car insurance company is crucial to ensure your policy remains secure and reliable. Research the insurer’s financial health and rating using reputable sources such as AM Best or Standard & Poor’s. A strong financial rating indicates the company’s ability to pay claims promptly and maintain solvency. Additionally, consider the company’s overall reputation in the industry, including its track record of customer satisfaction and ethical business practices.

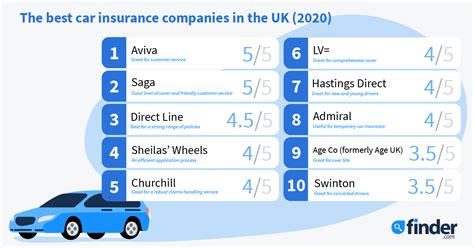

Industry Leaders: A Comparative Analysis of Top Car Insurance Companies

To assist you in making an informed decision, let’s delve into a comparative analysis of some of the industry’s leading car insurance companies, evaluating them based on the essential considerations outlined above.

Company A: A Pioneer in Comprehensive Coverage

Company A stands out as an industry leader, renowned for its commitment to providing comprehensive coverage options. With a wide range of policies tailored to meet diverse needs, they offer flexibility and customization. Their standard coverage includes liability, collision, and comprehensive insurance, with optional add-ons such as rental car coverage, roadside assistance, and gap insurance.

One notable aspect of Company A's offering is their innovative usage-based insurance program. This program utilizes advanced telematics technology to track driving behavior and reward safe drivers with discounted rates. By encouraging safer driving practices, Company A not only promotes road safety but also provides customers with the potential for significant savings.

Company B: Excellence in Customer Service and Claims Handling

When it comes to exceptional customer service and claims handling, Company B takes the lead. With a dedicated team of experienced professionals, they prioritize prompt and efficient assistance throughout the claims process. Their customer service representatives are known for their expertise, empathy, and commitment to resolving issues quickly and satisfactorily.

Company B's claims process is streamlined and user-friendly. They offer multiple channels for filing claims, including online portals, mobile apps, and 24/7 customer support. Their claims adjusters are highly trained and work diligently to assess and settle claims fairly and expeditiously. This commitment to customer satisfaction has earned them a reputation as one of the industry's top performers in claims handling.

Company C: Financial Strength and Competitive Pricing

Company C stands out for its exceptional financial stability and competitive pricing strategies. With a strong financial rating from AM Best, they demonstrate their ability to meet policyholder obligations and maintain a robust financial position. This stability translates into peace of mind for customers, knowing that their insurance coverage is backed by a reliable and trustworthy company.

In addition to their financial strength, Company C is renowned for offering some of the most competitive rates in the industry. They achieve this by leveraging advanced risk assessment models and efficient operational practices. Their pricing structure is transparent, with clear and straightforward policies that make it easy for customers to understand their coverage and associated costs.

Company D: Innovative Technology and Digital Convenience

Company D sets itself apart by embracing innovative technology to enhance the customer experience. They have developed a comprehensive digital platform that allows policyholders to manage their insurance needs conveniently and efficiently. From purchasing policies to filing claims and accessing policy documents, their online portal provides a seamless and user-friendly experience.

Furthermore, Company D leverages advanced data analytics and artificial intelligence to optimize their underwriting processes. This enables them to offer highly accurate and personalized quotes, ensuring that customers receive the coverage they need at competitive rates. Their commitment to technological innovation positions them as a forward-thinking insurer, catering to the evolving preferences of modern consumers.

Real-World Insights: Customer Experiences and Testimonials

To gain a deeper understanding of these top-rated car insurance companies, let’s explore real-world experiences and testimonials shared by their customers. These insights provide valuable perspectives on the companies’ performance and customer satisfaction levels.

John's Story: Exceptional Claims Experience with Company A

"I was involved in a minor accident recently, and the entire claims process with Company A was seamless and stress-free. Their claims adjuster was extremely responsive and guided me through every step, ensuring that my vehicle repairs were handled efficiently. The repair shop they recommended was top-notch, and my car was back on the road in no time. I couldn't be more satisfied with their level of service and professionalism."

Sarah's Journey: Personalized Coverage with Company B

"As a young driver, I was initially concerned about finding affordable car insurance. Company B not only offered me competitive rates but also took the time to understand my specific needs. Their agent provided valuable advice and helped me tailor a policy that met my budget and coverage requirements. I feel confident and secure knowing that I have the right coverage in place, and their customer service team is always just a call away."

Michael's Experience: Financial Stability and Trust with Company C

"When choosing a car insurance provider, financial stability was a top priority for me. Company C's strong financial rating gave me the assurance I needed. Over the years, they have consistently delivered on their promises, providing excellent coverage and prompt claims handling. I appreciate their transparency and the peace of mind that comes with knowing my insurance is backed by a reliable and reputable company."

Emily's Journey: Embracing Digital Convenience with Company D

"As a busy professional, convenience is key for me. Company D's digital platform has revolutionized the way I manage my insurance needs. From purchasing my policy to making policy changes, everything can be done with just a few clicks. Their user-friendly app and online portal make it incredibly easy to stay on top of my coverage. I appreciate their commitment to innovation and the time and effort they've saved me."

Future Outlook: The Evolution of Car Insurance

As the automotive industry continues to evolve, so too will the landscape of car insurance. Here are some insights into the future trends and developments that will shape the industry:

Telematics and Usage-Based Insurance

Telematics technology, which collects and analyzes driving data, is expected to play an increasingly significant role in car insurance. Usage-based insurance programs, like the one offered by Company A, will become more prevalent, rewarding safe drivers with discounted rates. This shift towards pay-as-you-drive models will encourage safer driving behaviors and provide customers with more personalized insurance options.

Digital Transformation and Customer Experience

The digital transformation of the insurance industry will continue to gain momentum, with a focus on enhancing the overall customer experience. Companies like Company D will lead the way in developing innovative digital platforms and mobile apps, making it easier for policyholders to manage their insurance needs. From seamless policy purchases to efficient claims processes, the digital transformation will revolutionize the way customers interact with their insurers.

Data Analytics and Risk Assessment

Advanced data analytics and artificial intelligence will further refine the risk assessment process, enabling insurers to offer more accurate and personalized quotes. Companies like Company C, which leverage these technologies, will be better equipped to understand customer needs and provide tailored coverage options. This data-driven approach will result in more efficient underwriting and improved customer satisfaction.

Sustainability and Green Initiatives

With growing environmental awareness, the car insurance industry is likely to embrace sustainability and green initiatives. Insurers may offer incentives and discounts for eco-friendly vehicles and driving behaviors. Additionally, companies may explore partnerships with electric vehicle manufacturers and charging infrastructure providers to support the transition to a more sustainable transportation system.

Conclusion: Making an Informed Decision

Choosing the top-rated car insurance company is a decision that requires careful consideration and evaluation. By understanding the essential factors, conducting a comparative analysis of leading companies, and considering real-world customer experiences, you can make an informed choice that aligns with your specific needs and priorities.

Remember, the ideal car insurance provider should offer comprehensive coverage options, competitive pricing, excellent customer service, and financial stability. As the industry continues to evolve, embracing technological advancements and sustainability initiatives, you can expect even more innovative and customer-centric offerings from top-rated companies.

As you embark on your journey to find the perfect car insurance provider, keep these insights in mind and trust your instincts. Your choice will not only provide financial protection but also peace of mind, knowing that you have selected a reputable and reliable company to safeguard your automotive assets.

What are the key factors to consider when choosing a car insurance company?

+When selecting a car insurance company, it’s crucial to consider factors such as comprehensive coverage options, competitive pricing, excellent customer service, and financial stability. These elements ensure you receive the right protection, value for your money, and support during claims processes.

How do I find competitive rates for car insurance?

+To find competitive rates, compare quotes from multiple insurers. Look for companies that offer discounts for safe driving records, vehicle safety features, and multiple policy bundles. Additionally, explore innovative insurance programs like usage-based insurance, which rewards safe drivers with discounted rates.

What sets Company A apart from other car insurance providers?

+Company A stands out for its commitment to providing comprehensive coverage options and its innovative usage-based insurance program. They offer a wide range of policies tailored to diverse needs and reward safe drivers with discounted rates, promoting road safety and cost savings.

How does Company B excel in customer service and claims handling?

+Company B prioritizes exceptional customer service and claims handling. They have a dedicated team of experienced professionals who provide prompt and efficient assistance throughout the claims process. Their streamlined claims process and highly trained adjusters have earned them a reputation as one of the industry’s top performers.

Why is financial stability important when choosing a car insurance company?

+Financial stability ensures the insurer can meet policyholder obligations and maintain solvency. A strong financial rating, such as that held by Company C, provides peace of mind, knowing your insurance coverage is backed by a reliable and trustworthy company.