Travel Insurance For Canadians

Travel insurance is an essential consideration for Canadians embarking on journeys abroad. With the unpredictable nature of travel, having the right coverage can provide peace of mind and financial protection. In this comprehensive guide, we will delve into the world of travel insurance for Canadians, exploring the key aspects, benefits, and considerations to ensure you make informed decisions when planning your next adventure.

Understanding Travel Insurance Coverage for Canadians

Travel insurance for Canadians is designed to address a wide range of potential travel-related issues. It offers protection against unforeseen circumstances that may arise during your trip, ensuring you receive the necessary medical care, assistance with trip cancellations or interruptions, and coverage for lost or stolen belongings. Let’s explore the crucial components of travel insurance tailored for Canadian travelers.

Medical Emergency Coverage

One of the primary concerns for Canadians traveling abroad is access to adequate medical care. Medical emergency coverage is a vital component of travel insurance, providing financial protection in the event of unexpected illnesses or injuries. Here’s what you need to know:

- Coverage Limits: Medical coverage limits can vary significantly between insurance providers. It’s essential to choose a plan that offers sufficient coverage for your specific needs. Consider factors such as the destination, duration of your trip, and any pre-existing medical conditions you may have.

- Pre-Existing Conditions: Many travel insurance policies have provisions for pre-existing conditions. However, the coverage may be subject to specific terms and conditions. It’s crucial to declare any pre-existing conditions accurately to ensure you receive the appropriate coverage.

- Repatriation: Repatriation coverage ensures that, in the event of a serious medical emergency, you can be transported back to Canada for further treatment. This coverage is especially important for long-duration trips or when traveling to remote destinations.

- Dental Emergencies: Dental emergencies can be costly, and travel insurance with dental coverage can provide much-needed financial relief. Ensure your chosen policy includes dental coverage, with clear terms and limits specified.

Trip Cancellation and Interruption

Travel plans can sometimes be disrupted due to unforeseen circumstances. Trip cancellation and interruption coverage safeguards your investment and provides financial protection in such situations. Here’s an overview:

- Reasons for Cancellation: Travel insurance policies cover cancellations for various reasons, including severe weather events, natural disasters, terrorism, or personal emergencies. Review the policy’s terms to understand the specific circumstances covered.

- Trip Interruption: If your trip is interrupted due to a covered event, trip interruption coverage reimburses you for the unused portion of your trip. This can include accommodation, transportation, and other prepaid expenses.

- Trip Delay: Trip delay coverage compensates you for additional expenses incurred if your trip is delayed by a covered event. This can include extended hotel stays, meals, and other necessary expenses.

| Policy Feature | Description |

|---|---|

| Medical Emergency | Covers unexpected illnesses or injuries, including repatriation. |

| Trip Cancellation | Reimburses prepaid expenses in case of covered cancellation reasons. |

| Trip Interruption | Provides reimbursement for unused trip expenses due to interruptions. |

| Trip Delay | Compensates for additional expenses incurred due to trip delays. |

Selecting the Right Travel Insurance Provider

With numerous travel insurance providers in the market, choosing the right one can be a daunting task. Here are some key considerations to guide you in selecting the most suitable provider for your needs:

Reputation and Financial Stability

Opt for established and reputable insurance providers with a solid track record in the industry. Check their financial stability ratings to ensure they have the resources to honor your claims in the event of a covered loss. Reputable providers are more likely to offer comprehensive coverage and provide reliable customer service.

Policy Coverage and Exclusions

Carefully review the policy’s coverage and exclusions to ensure it aligns with your specific travel needs. Consider factors such as:

- Medical coverage limits and any specific exclusions for pre-existing conditions.

- Trip cancellation and interruption coverage, including the reasons covered.

- Adventure sports coverage if you plan to engage in high-risk activities.

- Baggage and personal effects coverage for lost or stolen items.

- Emergency assistance services and 24⁄7 customer support.

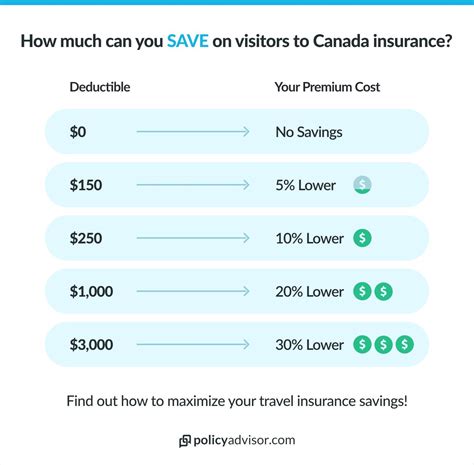

Comparing Premiums and Deductibles

Travel insurance premiums can vary significantly between providers. While it’s essential to find a competitive rate, ensure you’re not compromising on coverage. Compare policies based on the value they offer, considering the coverage limits, deductibles, and any additional benefits provided.

Claims Process and Customer Service

A smooth claims process and responsive customer service are vital when it comes to travel insurance. Research the provider’s reputation for handling claims efficiently. Look for providers with a dedicated claims team and 24⁄7 customer support to assist you during your travels.

Additional Benefits and Perks

Some travel insurance providers offer unique benefits or perks that can enhance your travel experience. These may include:

- Travel assistance services, such as emergency travel arrangements or legal assistance.

- Identity theft protection and recovery services.

- Trip cancellation coverage for any reason (often with additional costs).

- Rental car damage coverage.

- Accidental death and dismemberment coverage.

Real-Life Travel Insurance Scenarios

Understanding the practical applications of travel insurance can help illustrate its importance. Let’s explore a couple of real-life scenarios where travel insurance proved to be a lifesaver for Canadian travelers.

Medical Emergency During a European Adventure

Imagine a Canadian couple, John and Emily, embarking on a European tour. During their trip, Emily suddenly falls ill and requires immediate medical attention. With their travel insurance policy, they are able to access quality healthcare without worrying about the financial burden. The insurance provider coordinates her treatment, covers the medical expenses, and even arranges for her safe return to Canada once she is well enough to travel.

Trip Interruption Due to Natural Disaster

Consider a group of Canadian friends planning a tropical getaway to a Caribbean island. Unfortunately, a hurricane strikes the island just days before their departure. With their travel insurance policy, they are able to cancel their trip without incurring significant financial losses. The insurance provider reimburses them for their prepaid expenses, including flights, accommodations, and tours, allowing them to reschedule their trip for a later date.

Tips for Maximizing Your Travel Insurance Experience

To ensure a smooth and stress-free travel insurance journey, consider the following tips:

Review Your Policy Thoroughly

Before purchasing a travel insurance policy, take the time to read and understand the fine print. Familiarize yourself with the coverage limits, exclusions, and any specific conditions that may apply to your trip. This knowledge will empower you to make informed decisions and take advantage of the benefits offered by your policy.

Disclose All Relevant Information

When applying for travel insurance, it’s crucial to provide accurate and complete information about your health, travel plans, and any pre-existing conditions. Failure to disclose relevant details may result in denied claims or reduced coverage. Be honest and transparent to ensure you receive the full benefits of your policy.

Document and Report Incidents Promptly

In the event of a covered incident, promptly document and report the details to your insurance provider. Take photographs, collect receipts, and maintain a record of all relevant communications. This documentation will streamline the claims process and increase your chances of a successful claim.

Understand Your Policy’s Exclusions

While travel insurance offers comprehensive coverage, it’s important to be aware of the exclusions. Some common exclusions include participation in high-risk activities without prior notification, traveling against medical advice, or engaging in criminal activities. Familiarize yourself with the exclusions to avoid any surprises during your trip.

Stay Informed and Prepare

Stay updated on travel advisories and any potential risks associated with your destination. Be prepared for unexpected situations by packing essential items and having a contingency plan. Consider downloading travel apps or subscribing to travel alerts to stay informed during your journey.

Future Trends in Travel Insurance

The travel insurance industry is constantly evolving to meet the changing needs of travelers. Here are some emerging trends and developments to watch out for:

Digitalization and Mobile Apps

Insurance providers are increasingly embracing digital platforms and mobile apps to enhance the customer experience. From purchasing policies online to filing claims through dedicated apps, travelers can now access insurance services conveniently and efficiently.

Personalized Coverage Options

Travelers now have the option to customize their travel insurance policies based on their specific needs. Whether it’s enhanced medical coverage, adventure sports coverage, or additional trip cancellation benefits, personalized coverage options allow travelers to tailor their policies to their unique circumstances.

Expanded Coverage for Digital Nomads

With the rise of remote work and digital nomadism, travel insurance providers are expanding their coverage options to cater to this growing demographic. These policies often include extended durations, coverage for working remotely, and flexible cancellation policies to accommodate the dynamic nature of digital nomad lifestyles.

Environmental and Sustainability Considerations

As travelers become more environmentally conscious, insurance providers are incorporating sustainability and eco-friendly practices into their offerings. This may include carbon offset programs, incentives for eco-friendly travel choices, or coverage for sustainability-related activities.

How much does travel insurance typically cost for Canadians?

+The cost of travel insurance for Canadians can vary depending on several factors, including the duration of the trip, the destination, the age of the traveler, and the level of coverage desired. On average, basic travel insurance policies for Canadians can range from $20 to $50 per week of travel. However, more comprehensive policies with higher coverage limits and additional benefits can cost significantly more. It's essential to compare quotes from different providers to find the best value for your specific needs.

Can I purchase travel insurance after my trip has started?

+While it's possible to purchase travel insurance after your trip has commenced, it's generally more advantageous to secure coverage before your departure. Most travel insurance policies have specific conditions regarding the timing of purchase, and purchasing insurance after the trip has started may limit your coverage options. It's best to plan ahead and purchase insurance as early as possible to ensure comprehensive protection throughout your journey.

What happens if I need to make a claim during my trip?

+In the event that you need to make a claim during your trip, the first step is to contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves submitting relevant documentation, such as medical reports, receipts, or police reports, depending on the nature of your claim. It's important to keep all necessary documents and maintain clear records to support your claim. Your insurance provider will then assess the claim and determine the appropriate compensation based on the terms of your policy.

In conclusion, travel insurance is an indispensable companion for Canadians embarking on international adventures. By understanding the coverage options, selecting the right provider, and maximizing your insurance experience, you can ensure a stress-free and protected journey. With the right travel insurance policy, you can focus on creating unforgettable memories while knowing you’re covered for any unexpected twists and turns along the way.