Travel Insurance State Farm

Embarking on a journey, whether it's a leisurely vacation or a business trip, comes with its fair share of excitement and anticipation. However, the unpredictable nature of travel can sometimes throw unexpected curveballs. This is where travel insurance steps in as your dependable partner, offering a safety net for those unforeseen circumstances. State Farm, a renowned name in the insurance industry, understands the value of peace of mind and has crafted comprehensive travel insurance plans to cater to your unique needs.

In this comprehensive guide, we delve into the world of State Farm's travel insurance, exploring its features, benefits, and how it can enhance your travel experiences. Join us as we uncover the intricacies of this essential service, ensuring you make the most informed decisions for your next adventure.

The Importance of Travel Insurance: A Safeguard for Your Adventures

Travel insurance is not just a luxury; it's an essential component of responsible travel planning. It provides a financial safety net, protecting you from unexpected expenses that can arise during your trip. From medical emergencies to trip cancellations or delays, travel insurance offers coverage for a wide range of situations, ensuring you're not left footing the bill for unforeseen circumstances.

Consider this scenario: You're on a dream vacation to an exotic destination, but unfortunately, you fall ill and require immediate medical attention. Without travel insurance, you might be faced with hefty medical bills and the stress of arranging funds in a foreign country. With State Farm's travel insurance, you can have the assurance that your medical expenses will be covered, allowing you to focus on getting well and enjoying the rest of your trip.

Understanding State Farm's Travel Insurance: A Comprehensive Overview

State Farm's travel insurance is designed to offer a robust protection plan, catering to various travel needs. The company understands that every trip is unique, and thus, their insurance policies are highly customizable. Whether you're planning a quick weekend getaway or an extended international adventure, State Farm has a plan tailored to your specific requirements.

Key Features of State Farm's Travel Insurance

State Farm's travel insurance boasts an array of features that set it apart in the market:

- Comprehensive Coverage: Their policies cover a wide range of travel-related incidents, including medical emergencies, trip cancellations, lost luggage, and more. This all-encompassing approach ensures you're protected from various potential pitfalls.

- Customizable Plans: State Farm understands that one-size-fits-all policies may not cater to everyone's needs. Their customizable plans allow you to choose the coverage options that best suit your trip, ensuring you're not paying for unnecessary add-ons.

- 24/7 Assistance: In the event of an emergency, State Farm provides round-the-clock assistance. Their dedicated team is always ready to help, offering support and guidance whenever and wherever you need it.

- Trip Cancellation and Interruption Protection: State Farm's policies include coverage for trip cancellations due to unforeseen circumstances, such as severe weather or personal emergencies. They also provide protection in case your trip is interrupted, ensuring you're not left stranded.

- Medical and Dental Coverage: Medical emergencies can be costly, especially when traveling abroad. State Farm's travel insurance includes coverage for medical and dental expenses, ensuring you receive the necessary care without breaking the bank.

- Baggage and Personal Effects Protection: Lost or stolen luggage can ruin a trip. State Farm's policies provide coverage for such incidents, helping you replace essential items and continue your journey without inconvenience.

Benefits of Choosing State Farm for Your Travel Insurance Needs

Selecting State Farm for your travel insurance needs offers several advantages:

- Reputation and Trustworthiness: State Farm is a well-established insurance provider with a solid reputation for reliability and customer satisfaction. Their years of experience in the industry speak to their commitment to providing quality service.

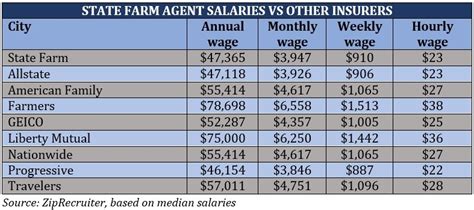

- Competitive Pricing: State Farm offers competitive rates for their travel insurance policies, ensuring you get value for your money. Their customizable plans allow you to find the right balance between coverage and cost.

- Expertise and Knowledge: With their extensive industry knowledge, State Farm's team can offer valuable insights and guidance when it comes to selecting the right travel insurance plan. They understand the nuances of travel and can tailor recommendations to your specific trip.

- Flexible Payment Options: State Farm provides flexible payment options, allowing you to choose a plan that fits your budget. Whether you prefer monthly payments or a one-time payment, they offer convenient solutions to suit your financial needs.

- Customer Support: State Farm prides itself on its exceptional customer support. Their team is always ready to assist, whether it's answering questions, helping with claims, or providing general travel advice. They ensure you have a smooth and stress-free experience.

Real-Life Scenarios: How State Farm's Travel Insurance Comes to the Rescue

To illustrate the real-world impact of State Farm's travel insurance, let's explore a couple of hypothetical scenarios:

Scenario 1: Medical Emergency Abroad

Imagine you're on a hiking trip in a remote region of South America when you sustain a serious injury. Without travel insurance, you might be faced with limited medical options and the financial burden of expensive treatments. However, with State Farm's travel insurance, you can access quality medical care, with the assurance that your expenses are covered.

Scenario 2: Trip Cancellation Due to Natural Disaster

You've planned an exciting trip to a tropical paradise, but just before your departure, a severe hurricane hits the region. Without travel insurance, you might be left with the dilemma of either traveling to a potentially unsafe destination or forgoing the trip altogether and losing your non-refundable expenses. With State Farm's trip cancellation coverage, you can cancel your trip and receive reimbursement for your pre-paid expenses, allowing you to reschedule your adventure for a safer time.

Performance Analysis: Why State Farm's Travel Insurance Delivers

State Farm's travel insurance stands out for several key reasons:

- Wide Coverage Options: State Farm offers a comprehensive range of coverage options, ensuring you can find a plan that aligns with your travel needs. Whether you're seeking medical coverage, trip cancellation protection, or baggage insurance, they've got you covered.

- Customizable Plans: The ability to customize your travel insurance plan is a significant advantage. State Farm understands that every traveler is unique, and their customizable plans allow you to tailor your coverage to your specific trip, ensuring you're not paying for unnecessary add-ons.

- Exceptional Customer Service: State Farm's dedication to customer satisfaction is evident in their exceptional customer service. Their team is readily available to assist with any queries or concerns, providing guidance and support throughout your travel journey.

- Financial Stability: As a well-established insurance provider, State Farm boasts financial stability, assuring you that they will be there to honor your claims when needed. Their reputation for reliability is a testament to their commitment to their customers.

Future Implications: The Evolving Landscape of Travel Insurance

The travel insurance industry is constantly evolving, and State Farm is at the forefront of these advancements. As travel patterns and consumer needs change, State Farm remains committed to staying ahead of the curve, ensuring their policies remain relevant and beneficial.

One of the key future implications is the increasing focus on digital transformation. State Farm recognizes the importance of providing convenient and accessible services, and they continue to invest in their digital platforms to enhance the customer experience. From online policy management to seamless claim processes, State Farm is committed to making travel insurance more efficient and user-friendly.

Additionally, State Farm is actively exploring new coverage options to address emerging travel trends. With the rise of adventure travel and unique experiences, they are developing policies that cater to these niche markets. This includes coverage for activities like extreme sports, eco-tours, and cultural immersion experiences, ensuring travelers can pursue their passions with peace of mind.

Moreover, State Farm is dedicated to staying informed about global health and safety issues. As the world navigates through evolving health concerns, they are adapting their policies to provide comprehensive coverage for medical emergencies and travel-related health risks. This commitment to staying abreast of global developments ensures that travelers can have the confidence to explore the world without worry.

Conclusion: Why State Farm is Your Go-To Choice for Travel Insurance

State Farm's travel insurance is a testament to their commitment to providing exceptional service and protection. With their customizable plans, comprehensive coverage, and exceptional customer support, they offer a reliable and trusted solution for your travel needs.

As you plan your next adventure, consider the peace of mind that State Farm's travel insurance can bring. Whether it's safeguarding your medical expenses, protecting your trip investment, or providing assistance in times of need, State Farm is there to ensure your journey is as seamless and stress-free as possible.

Remember, travel insurance is not just an added expense; it's an investment in your travel experiences. With State Farm, you can have the confidence to explore the world, knowing you're covered every step of the way.

What are the different types of travel insurance plans offered by State Farm?

+State Farm offers a range of travel insurance plans, including Comprehensive, Basic, and Premium plans. Each plan offers different levels of coverage and benefits, catering to various travel needs and budgets.

How can I purchase State Farm’s travel insurance?

+You can purchase State Farm’s travel insurance online through their website or by contacting their customer service team. They offer a convenient and straightforward process to help you choose the right plan and complete the purchase.

What happens if I need to file a claim while traveling?

+In the event of a covered incident, you can contact State Farm’s 24⁄7 assistance line to report the claim. Their team will guide you through the process, ensuring a smooth and efficient resolution. They may request documentation and provide instructions on how to proceed.

Can I customize my travel insurance plan with State Farm?

+Absolutely! State Farm understands that every trip is unique, and they offer customizable plans to cater to your specific needs. You can choose the coverage options that best suit your trip, allowing you to tailor your insurance to your preferences.