Trip Insurance

In today's fast-paced and unpredictable world, travel plans can often be disrupted by unforeseen circumstances. From natural disasters to unexpected medical emergencies, the need for trip insurance has become increasingly essential for travelers seeking peace of mind and financial protection. Trip insurance acts as a safety net, offering coverage for various travel-related situations and providing travelers with the confidence to explore new destinations without worry.

This comprehensive guide delves into the world of trip insurance, uncovering its intricacies, benefits, and real-world applications. By the end of this article, you'll have a clear understanding of why trip insurance is an indispensable tool for modern travelers and how it can safeguard your adventures, ensuring you can focus on creating unforgettable memories rather than worrying about potential setbacks.

Understanding Trip Insurance: Coverage and Benefits

Trip insurance, often referred to as travel insurance, is a comprehensive policy designed to cover a wide range of potential issues that may arise before or during your trip. These policies typically include coverage for trip cancellations, interruptions, delays, medical emergencies, and other unforeseen events. Understanding the coverage and benefits of trip insurance is crucial for travelers to make informed decisions and select the policy that best suits their needs.

Trip Cancellation and Interruption Coverage

One of the primary benefits of trip insurance is the protection it provides against trip cancellations and interruptions. Whether it’s due to a family emergency, severe weather conditions, or a medical issue, trip insurance can reimburse you for non-refundable expenses such as airfare, hotel bookings, and tour packages. This coverage ensures that you don’t incur significant financial losses if your travel plans are disrupted.

Additionally, trip interruption coverage steps in when an unforeseen event occurs during your trip, causing you to cut your journey short. In such cases, trip insurance can cover additional expenses incurred to return home early, as well as reimburse you for any pre-paid and non-refundable costs associated with the interrupted portion of your trip.

| Trip Cancellation Coverage | Trip Interruption Coverage |

|---|---|

| Reimburses non-refundable expenses | Covers additional expenses for early return |

| Protects against unforeseen events before departure | Assists when an emergency arises during the trip |

| Offers financial protection for trip planning | Provides peace of mind during travel |

Medical and Emergency Assistance

Another critical aspect of trip insurance is its medical coverage and emergency assistance benefits. When traveling, unexpected illnesses or injuries can occur, and having medical coverage can be a lifesaver. Trip insurance policies often include coverage for emergency medical treatment, hospital stays, and even medical evacuation if necessary. This ensures that you receive the necessary care without incurring astronomical medical bills.

Furthermore, many trip insurance policies offer 24/7 emergency assistance services. This means that travelers have access to a dedicated team who can provide medical advice, coordinate treatments, and even assist with locating suitable medical facilities in unfamiliar locations. This level of support can be invaluable in times of crisis, ensuring that travelers receive the best possible care and support.

Travel Delay and Baggage Coverage

Travel delays and lost or damaged baggage are common frustrations for travelers. Trip insurance policies often include coverage for these scenarios as well. If your trip is significantly delayed due to adverse weather, mechanical issues, or other covered events, trip insurance can reimburse you for additional expenses such as meals, accommodations, and transportation costs incurred during the delay.

Additionally, baggage coverage provides reimbursement for lost, stolen, or damaged luggage and personal effects. This coverage can help travelers replace essential items and minimize the financial impact of such incidents, allowing them to continue their journey without unnecessary stress.

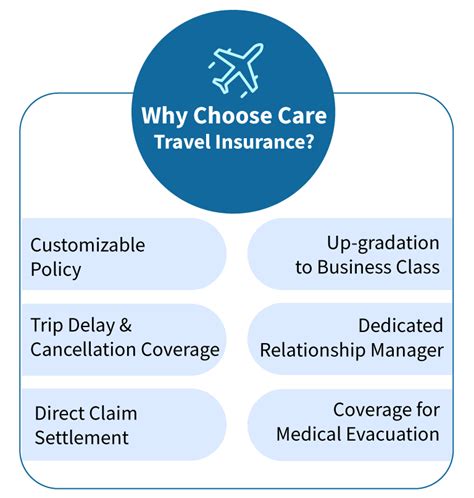

Additional Benefits and Customization

Trip insurance policies can be customized to meet the specific needs of different travelers. Depending on the policy, you may have the option to add coverage for adventure sports, rental car damage, or even trip cancellation due to job loss or bankruptcy. These additional benefits ensure that travelers can tailor their insurance to their unique circumstances and travel preferences.

Moreover, some trip insurance providers offer specialized policies for specific types of travel, such as cruise vacations, adventure tours, or student travel. These policies are designed to address the unique risks and challenges associated with each travel category, providing comprehensive coverage tailored to the traveler's needs.

Real-World Applications and Case Studies

To truly understand the value of trip insurance, it’s beneficial to explore real-world applications and case studies. Here are a few scenarios where trip insurance proved to be a lifesaver for travelers:

Case Study 1: Unexpected Medical Emergency

Sarah, an avid traveler, planned a dream vacation to Europe. Unfortunately, a few days before her departure, she suffered a sudden illness that required hospitalization. With trip insurance in place, Sarah was able to cancel her trip without incurring financial losses. The insurance policy reimbursed her for the cost of the non-refundable airfare and hotel bookings, allowing her to focus on her recovery without the added stress of financial burden.

Case Study 2: Natural Disaster Disruption

John and his family were excited for their annual beach vacation, but their plans were abruptly halted when a hurricane hit their destination. Trip insurance came to their rescue, covering the cost of their canceled accommodations and providing reimbursement for the non-refundable portion of their airfare. With the insurance proceeds, they were able to quickly book an alternative vacation spot, ensuring their much-needed family getaway wasn’t completely ruined.

Case Study 3: Adventure Travel Protection

Emma, an adventurous soul, embarked on a trekking expedition in the mountains. During her journey, she sustained a minor injury that required medical attention. Fortunately, her trip insurance policy included coverage for adventure sports. Emma received prompt medical care, and the insurance company even coordinated her evacuation to a nearby hospital, ensuring she received the necessary treatment without delay.

Selecting the Right Trip Insurance Policy

With a vast array of trip insurance options available, selecting the right policy can be daunting. Here are some key considerations to help you make an informed decision:

Coverage Limits and Deductibles

Review the coverage limits and deductibles of each policy. Ensure that the limits are sufficient to cover your potential losses and that the deductibles are reasonable. Higher deductibles can reduce the premium, but it’s important to strike a balance that aligns with your financial comfort.

Policy Exclusions and Fine Print

Carefully read the policy exclusions and fine print. Some policies may have specific exclusions for certain activities or situations. Understanding these exclusions beforehand can help you avoid unexpected surprises and ensure that your coverage is comprehensive.

Provider Reputation and Customer Service

Research the reputation and customer service track record of the insurance provider. Look for reviews and testimonials from other travelers to gauge the provider’s reliability and responsiveness. A reputable provider with excellent customer service can make a significant difference in how your claims are handled and resolved.

Policy Customization and Add-ons

Consider your specific travel needs and preferences. If you plan to engage in adventure sports or have unique requirements, explore policies that offer customization and add-on options. These additional coverages can provide the tailored protection you need for a worry-free trip.

The Future of Trip Insurance: Evolving Trends and Innovations

As the travel industry continues to evolve, so does the world of trip insurance. Here are some emerging trends and innovations shaping the future of this essential travel companion:

Digital Transformation and Instant Claims

The digital age has brought about significant advancements in trip insurance, with many providers embracing technology to enhance the customer experience. Digital platforms and mobile apps now allow travelers to purchase policies, manage their coverage, and file claims with ease. Instant claim submission and real-time updates ensure a seamless and efficient claims process, providing travelers with faster reimbursements and greater convenience.

Personalized Coverage and Data Analytics

With the power of data analytics, trip insurance providers are now able to offer personalized coverage options. By analyzing travel patterns, destinations, and individual preferences, providers can tailor policies to meet the unique needs of each traveler. This level of customization ensures that travelers receive the right coverage for their specific journeys, maximizing the benefits and minimizing unnecessary costs.

Incorporating Sustainability and Ethical Travel

As sustainability and ethical travel practices gain prominence, trip insurance providers are beginning to incorporate these values into their offerings. Some providers now offer eco-friendly travel insurance policies that support sustainable tourism initiatives. These policies may include coverage for eco-adventures, carbon offset programs, and even incentives for travelers who choose environmentally conscious accommodations and transportation options.

Enhanced Medical Assistance and Telemedicine

The integration of telemedicine services is revolutionizing medical assistance for travelers. With trip insurance policies that include telemedicine benefits, travelers can now access medical advice and consultations remotely, even when they are in remote destinations. This innovation ensures that travelers receive timely medical attention and guidance, reducing the need for physical clinic visits and improving overall healthcare accessibility during their travels.

How much does trip insurance typically cost?

+

The cost of trip insurance can vary depending on several factors, including the duration of your trip, your destination, the level of coverage you choose, and your age. On average, trip insurance policies range from 4% to 8% of the total trip cost. It’s advisable to obtain quotes from multiple providers to find the best coverage at a competitive price.

What happens if I need to file a claim for trip cancellation or interruption?

+

If you need to file a claim for trip cancellation or interruption, the first step is to contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves submitting supporting documentation such as medical reports, travel receipts, and any other relevant information. It’s essential to keep detailed records of all expenses and communication related to the canceled or interrupted trip.

Are there any exclusions or limitations to trip insurance coverage?

+

Yes, trip insurance policies often have exclusions and limitations. Common exclusions may include pre-existing medical conditions, participation in high-risk activities without additional coverage, and travel to regions with known political instability or natural disasters. It’s crucial to carefully review the policy’s terms and conditions to understand any exclusions that may apply to your specific circumstances.

Can I purchase trip insurance after I’ve already booked my trip?

+

In most cases, it’s best to purchase trip insurance as soon as you book your trip. Some policies may have a specific deadline for purchasing coverage, usually within a certain number of days after booking. However, it’s always worth checking with the insurance provider to see if they offer any options for purchasing coverage after the initial booking period.

What should I look for when comparing trip insurance policies?

+

When comparing trip insurance policies, it’s important to consider factors such as the level of coverage, policy exclusions, the reputation of the insurance provider, and the ease of claims processing. Look for policies that offer comprehensive coverage tailored to your specific needs and ensure that the provider has a strong track record of prompt and fair claim settlements.