Types Of Insurance For Cars

In today's world, owning a car is a significant investment, and protecting that investment is crucial. Car insurance is an essential aspect of vehicle ownership, offering financial protection and peace of mind. With a wide range of insurance options available, it's important to understand the different types to ensure you choose the coverage that best suits your needs.

Comprehensive Car Insurance

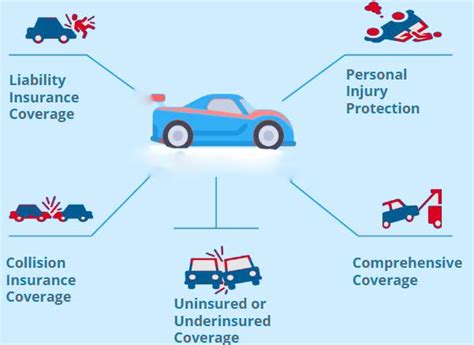

Comprehensive car insurance is the most extensive form of coverage available. It provides protection for a wide array of incidents and situations, ensuring your vehicle is safeguarded against a variety of risks. This type of insurance typically covers:

- Damage caused by collisions, regardless of fault.

- Vandalism, theft, and other malicious acts.

- Natural disasters like storms, floods, or earthquakes.

- Fire, falling objects, and explosions.

- Animal-related accidents, such as collisions with deer.

Comprehensive insurance often includes additional benefits, such as roadside assistance and rental car coverage. It is an excellent choice for those who want maximum protection for their vehicle.

Collision Coverage

Collision coverage is a vital component of comprehensive insurance. It specifically addresses damage to your vehicle resulting from a collision with another vehicle or object. This coverage is particularly useful for situations where you are at fault or when the other driver is uninsured or underinsured.

In the event of a collision, your insurance provider will assess the damage and determine the repair or replacement cost. Collision coverage typically comes with a deductible, which is the amount you pay out of pocket before the insurance kicks in. The higher the deductible, the lower the insurance premium.

| Collision Coverage Example | Deductible Options |

|---|---|

| Standard | 500, 1000 |

| High Deductible | 1500, 2000 |

Liability Coverage

Liability insurance is a critical aspect of car insurance, as it protects you from financial losses arising from accidents where you are at fault. This coverage has two main components:

- Bodily Injury Liability: Covers medical expenses and lost wages for individuals injured in an accident caused by you.

- Property Damage Liability: Pays for damages to other people’s property, such as their vehicle or other structures, resulting from an accident you caused.

Most states have minimum liability coverage requirements, but it’s often recommended to exceed these limits to ensure adequate protection. Liability insurance is essential for protecting your assets and providing financial security in the event of an accident.

Additional Insurance Options

Beyond the standard insurance types, there are several additional coverages to consider, depending on your specific needs and circumstances.

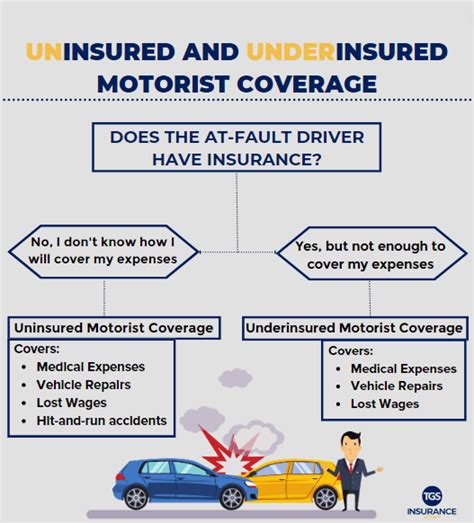

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is designed to protect you in the event of an accident with a driver who has no insurance or insufficient insurance. This coverage pays for your medical expenses and property damage, ensuring you’re not left financially burdened.

In states with a high number of uninsured drivers, this coverage is particularly valuable. It provides an added layer of protection, ensuring you’re not left paying out of pocket for damages caused by others.

Medical Payments Coverage

Medical payments coverage, also known as “MedPay,” is an optional insurance that covers medical expenses for you and your passengers, regardless of fault. This coverage is particularly useful for quick reimbursement of medical bills after an accident, allowing you to focus on your recovery rather than financial concerns.

MedPay often has a low deductible and can be a valuable addition to your insurance policy, providing swift and efficient coverage for medical expenses.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a broad coverage that extends beyond medical expenses. It includes lost wages, funeral expenses, and even child care costs arising from an accident. PIP is mandatory in some states and is often a good choice for comprehensive coverage of accident-related expenses.

PIP coverage can be customized to fit your needs, ensuring you have the right level of protection for you and your family.

Gap Insurance

Gap insurance is a valuable option for those who lease their vehicles or have a car loan. It covers the difference between the actual cash value of your car and the amount you still owe on your loan or lease. This coverage is essential if your car is totaled or stolen, as it ensures you’re not left with a large, unexpected debt.

Gap insurance is especially beneficial for those who make low down payments or have long loan terms, as these factors can increase the likelihood of owing more on the vehicle than it’s worth.

Choosing the Right Insurance

Selecting the appropriate car insurance involves a careful consideration of your needs, budget, and the value of your vehicle. It’s essential to review your policy annually and adjust your coverage as your circumstances change.

Working with an insurance agent can be beneficial, as they can guide you through the process and help you understand the nuances of each coverage type. Additionally, comparing quotes from multiple insurers can ensure you’re getting the best value for your insurance needs.

Conclusion

Car insurance is a vital aspect of vehicle ownership, offering financial protection and peace of mind. By understanding the different types of insurance available, you can make informed decisions to ensure your vehicle and your assets are adequately protected. Remember, the right insurance policy is tailored to your specific needs, so take the time to review and adjust your coverage as necessary.

What is the average cost of car insurance?

+The average cost of car insurance can vary significantly based on factors such as your location, driving record, and the type of vehicle you own. As of 2023, the national average for car insurance is around $1,674 per year. However, it’s important to get personalized quotes to understand the specific cost for your situation.

Can I bundle my car insurance with other policies to save money?

+Yes, many insurance providers offer discounts when you bundle multiple policies, such as car insurance with homeowners or renters insurance. Bundling can result in significant savings, so it’s worth exploring this option with your insurer.

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy annually or whenever your circumstances change, such as a move to a new state, a change in marital status, or the addition of a teen driver to your policy. Regular reviews ensure your coverage remains adequate and up-to-date.