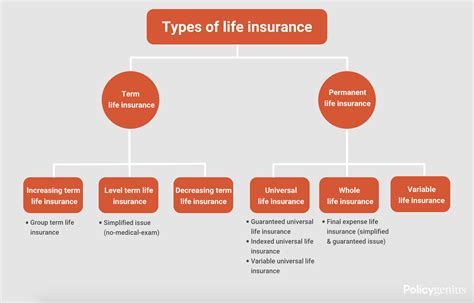

Types Of Life Insurance Plans

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their loved ones. With various life insurance plans available, understanding the different types and their unique features is essential for making informed decisions. In this comprehensive guide, we will delve into the world of life insurance, exploring the key plan types, their benefits, and how they can cater to specific needs.

Term Life Insurance

Term life insurance is one of the most common and straightforward types of life insurance plans. It offers coverage for a specific period, typically ranging from 10 to 30 years, during which the policyholder pays regular premiums. If the insured individual passes away within the term, the beneficiaries receive a lump-sum payment known as the death benefit. Term life insurance is often chosen for its affordability and flexibility.

Key Features and Benefits of Term Life Insurance

- Affordable Protection: Term life insurance policies are generally more cost-effective compared to other types. They provide substantial coverage at a lower price point, making it accessible to a wider range of individuals.

- Customizable Terms: Policyholders can choose the duration of their term, allowing them to align the coverage with their specific needs. For example, a young family might opt for a 20-year term to cover their children’s education and mortgage payments.

- Renewal Options: Many term life policies offer the option to renew the coverage at the end of the term, often at a higher premium. This ensures that individuals can maintain their protection even as their circumstances change.

- Level Premiums: In most cases, term life insurance premiums remain constant throughout the policy term, providing stability and predictability in financial planning.

| Term Length | Common Uses |

|---|---|

| 10 Years | Covering short-term financial obligations, such as car loans or small business debts. |

| 20 Years | Providing financial support for children's education and family's basic needs. |

| 30 Years | Ensuring long-term protection, suitable for mortgage payments and covering retirement planning. |

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the insured individual’s entire life. Unlike term life, whole life policies offer a guaranteed death benefit and build cash value over time. This type of insurance combines financial protection with a savings component, making it a popular choice for long-term financial planning.

Understanding Whole Life Insurance

Whole life insurance policies typically have higher premiums compared to term life, as they provide lifelong coverage and build cash value. The cash value component grows on a tax-deferred basis, allowing policyholders to borrow against it or withdraw funds in certain situations.

Key Advantages of Whole Life Insurance

- Guaranteed Death Benefit: The policy guarantees a payout upon the insured’s death, regardless of when it occurs.

- Cash Value Accumulation: Whole life insurance policies accumulate cash value over time, providing a savings element that can be used for various financial goals.

- Fixed Premiums: Premiums remain the same throughout the policy, offering long-term financial predictability.

- Tax Benefits: The cash value growth is tax-deferred, and withdrawals or loans taken against the policy may have tax advantages.

| Whole Life Insurance Features | Description |

|---|---|

| Death Benefit | A guaranteed amount paid to beneficiaries upon the insured's death. |

| Cash Value | A savings component that grows over time, offering financial flexibility. |

| Level Premiums | Fixed premiums that remain constant throughout the policy. |

| Dividends (Participating Policies) | Some policies offer dividends, providing additional cash value or premium reduction. |

Universal Life Insurance

Universal life insurance is a flexible permanent life insurance option that offers policyholders control over their premiums and death benefits. It combines the protection of whole life insurance with the flexibility of term life, making it an attractive choice for those seeking customization.

Key Characteristics of Universal Life Insurance

- Flexible Premiums: Policyholders can adjust their premium payments within certain limits, allowing for financial flexibility.

- Variable Death Benefit: The death benefit can be adjusted, providing the option to increase or decrease coverage based on changing needs.

- Cash Value Accumulation: Similar to whole life, universal life policies build cash value, offering a savings component.

- Policy Owner Control: Policyholders have more control over their policy, including the ability to make changes to premiums and death benefits.

Types of Universal Life Insurance

There are two main types of universal life insurance:

- Guaranteed Universal Life: This type offers a guaranteed death benefit and fixed premiums, providing a balance between flexibility and stability.

- Variable Universal Life: Variable universal life policies allow policyholders to invest a portion of their premiums in separate accounts, offering the potential for higher returns but also carrying more risk.

| Universal Life Insurance Features | Description |

|---|---|

| Flexible Premiums | Policyholders can adjust premium payments within limits. |

| Variable Death Benefit | The death benefit can be increased or decreased. |

| Cash Value | Builds cash value, offering a savings component. |

| Policy Owner Control | Policyholders have more control over premiums and death benefits. |

Final Thoughts and Considerations

Choosing the right life insurance plan depends on individual needs, financial goals, and circumstances. Term life insurance is ideal for those seeking temporary coverage at an affordable cost, while whole life and universal life insurance provide lifelong protection and savings opportunities.

When considering life insurance, it's essential to evaluate your specific needs, consult with financial advisors or insurance professionals, and carefully review the terms and conditions of each policy. Each type of life insurance plan has its unique advantages and considerations, so it's crucial to make an informed decision that aligns with your long-term financial strategy.

Frequently Asked Questions

Can I convert my term life insurance to a permanent policy?

+Yes, many term life insurance policies offer a conversion option, allowing you to convert your term policy into a permanent life insurance policy, such as whole life or universal life, without having to undergo a new medical exam.

What happens if I miss a premium payment on my whole life insurance policy?

+Missing a premium payment on a whole life insurance policy can have consequences. The policy may enter a grace period, allowing you a certain amount of time to make the payment. If the grace period expires, the policy may lapse, and you may lose your coverage and any accumulated cash value.

How does universal life insurance compare to variable universal life insurance?

+Universal life insurance offers flexibility in premiums and death benefits, with a guaranteed minimum interest rate on the cash value. Variable universal life insurance provides investment options for a portion of the premiums, potentially offering higher returns but also carrying more investment risk.