Typical Homeowners Insurance Rates

Understanding homeowners insurance rates is crucial for every homeowner as it ensures protection against financial losses and provides peace of mind. While the average cost of homeowners insurance can vary significantly based on several factors, having a clear idea of what influences these rates can help homeowners make informed decisions about their coverage.

Factors Influencing Homeowners Insurance Rates

Homeowners insurance rates are determined by a complex interplay of various factors, each contributing to the overall cost. Let’s delve into these factors to gain a comprehensive understanding.

1. Location and Climate

The geographic location of your home plays a pivotal role in determining insurance rates. Areas prone to natural disasters like hurricanes, earthquakes, or floods typically face higher insurance premiums. For instance, homes located in hurricane-prone regions along the Atlantic and Gulf coasts often pay a premium due to the increased risk of damage.

| Region | Average Annual Premium |

|---|---|

| Southeast Coast | $2,200 |

| Northeast | $1,800 |

| Midwest | $1,300 |

Additionally, the local crime rate and proximity to fire stations and hydrants can also impact insurance costs. Homes in high-crime areas or with limited access to fire protection resources may incur higher premiums.

2. Home Value and Construction

The value of your home, including its construction type and age, significantly influences insurance rates. Homes with higher replacement costs, due to their size, materials, or unique architectural features, will generally have higher insurance premiums. For example, a custom-built, high-end home with expensive finishes and materials will likely command a higher insurance rate compared to a standard, mass-produced home.

3. Coverage Amount and Deductibles

The amount of coverage you choose for your home and personal belongings directly affects your insurance premium. Opting for higher coverage limits will naturally result in a higher premium. Additionally, the deductible you select can also impact your rate. A higher deductible means you pay more out-of-pocket in the event of a claim, but it can lower your overall insurance premium.

4. Claim History and Credit Score

Insurance companies consider your claim history when setting rates. A history of multiple claims, even for minor incidents, can lead to higher premiums. Similarly, your credit score can impact your insurance rate, as it’s seen as an indicator of financial responsibility. Maintaining a good credit score can potentially lower your insurance costs.

5. Security Features and Home Improvements

Implementing security measures like burglar alarms, smoke detectors, and sprinkler systems can lead to reduced insurance premiums. These features lower the risk of theft and fire damage, making your home a safer investment for insurance companies. Additionally, making home improvements to reinforce against natural disasters, such as hurricane shutters or reinforced roofs, can also result in lower insurance rates.

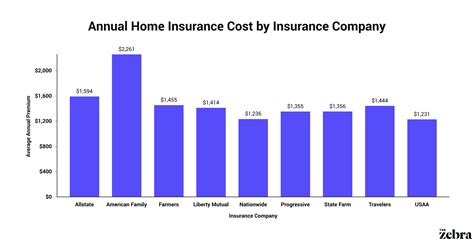

6. Insurance Company and Policy Type

Different insurance companies offer varying rates and coverage options. Shopping around and comparing quotes from multiple insurers can help you find the best deal. Furthermore, the type of policy you choose, such as a standard HO-3 policy or a more comprehensive HO-5 policy, will impact your premium.

Typical Homeowners Insurance Rates

Now that we’ve explored the factors influencing insurance rates, let’s examine the typical range of homeowners insurance premiums across the United States.

National Averages

According to the latest data from the National Association of Insurance Commissioners (NAIC), the average annual premium for homeowners insurance in the United States is approximately $1,312. However, this average can vary significantly based on the factors we discussed earlier.

| State | Average Annual Premium |

|---|---|

| Louisiana | $2,800 |

| Florida | $2,200 |

| Oklahoma | $1,900 |

| Texas | $1,700 |

| Alabama | $1,600 |

States like Louisiana, Florida, and Oklahoma, which are susceptible to hurricanes and tornadoes, have some of the highest average insurance premiums in the country. Conversely, states like Idaho, Iowa, and Nebraska, which have lower natural disaster risks, enjoy some of the lowest insurance rates.

Regional Variations

Regional variations in insurance rates are substantial. For instance, the average annual premium in the Northeast region is around 1,800</strong>, while the Midwest region sees an average premium of <strong>1,300. These differences are largely due to the varying levels of natural disaster risk and cost of living across regions.

Individual Home Variations

Even within the same state or region, individual homes can have significantly different insurance rates based on their unique characteristics. A high-value home with expensive furnishings in a high-crime area may pay double or even triple the premium of a standard home in a safe neighborhood with similar construction.

Tips for Lowering Your Insurance Rates

While insurance rates are influenced by various factors, there are strategies homeowners can employ to potentially lower their premiums. Here are some tips to consider:

- Bundle Your Policies: Combining your homeowners insurance with other policies, like auto insurance, from the same insurer can often result in discounted rates.

- Raise Your Deductible: Increasing your deductible, the amount you pay out-of-pocket before insurance coverage kicks in, can lower your premium. Just ensure you can afford the higher deductible in the event of a claim.

- Review Your Coverage Regularly: Regularly assess your insurance coverage to ensure it aligns with your current needs. Overinsuring your home can lead to unnecessary costs, while underinsuring can leave you vulnerable.

- Implement Home Safety Measures: Investing in home safety features like burglar alarms, smoke detectors, and fire sprinklers can not only protect your home but also qualify you for insurance discounts.

- Shop Around: Don't settle for the first insurance quote you receive. Compare quotes from multiple insurers to find the best coverage at the most competitive rate.

Conclusion: Understanding and Managing Your Insurance Costs

Homeowners insurance is an essential investment to protect your most valuable asset - your home. By understanding the factors that influence insurance rates and adopting strategies to manage these costs, you can ensure you’re getting the best value for your insurance dollar. Remember, the key to successful insurance management is staying informed, proactive, and engaged with your policy.

How often should I review my homeowners insurance policy?

+It’s recommended to review your policy annually or whenever significant changes occur in your home or personal circumstances. This ensures your coverage remains adequate and up-to-date.

Can I negotiate my homeowners insurance rates?

+While insurance rates are largely set based on actuarial calculations, you can negotiate certain aspects of your policy, such as coverage limits or deductibles, which can indirectly impact your premium.

What factors can lead to an increase in my insurance rates?

+Factors like a history of claims, a drop in your credit score, or changes in your home’s value or construction can lead to an increase in your insurance rates. It’s essential to keep your insurer informed of any significant changes.