Ul Insurance

UL Insurance, a term that may sound cryptic to some, is a vital aspect of risk management and financial protection for businesses and individuals alike. Understanding what UL Insurance entails, its benefits, and how it can be tailored to meet specific needs is crucial in today's complex economic landscape.

Understanding the Basics of UL Insurance

UL Insurance, an acronym for Universal Life Insurance, is a type of permanent life insurance policy that provides lifelong coverage and builds cash value over time. Unlike term life insurance, which offers coverage for a specific period, UL Insurance is designed to offer long-term protection and financial security.

The core of UL Insurance is its flexibility. Policyholders have the freedom to adjust their premium payments and death benefits according to their changing needs and financial circumstances. This adaptability makes UL Insurance an attractive option for those seeking long-term financial planning and protection.

How UL Insurance Works

When you purchase a UL Insurance policy, you pay a premium, which is then divided into two parts. One portion goes towards the cost of insurance (COI), which covers the risk of the insured’s death. The remaining amount is invested in a separate account, which earns interest and accumulates cash value over time.

The interest earned on the cash value account is tax-deferred, meaning it grows without immediate tax implications. This accumulated cash value can be used for various purposes, such as supplementing retirement income, funding education expenses, or covering unexpected financial emergencies. Policyholders can also borrow against the cash value or use it to pay premiums, offering a level of financial flexibility.

| Key Components of UL Insurance | Description |

|---|---|

| Cost of Insurance (COI) | The amount paid to cover the risk of the insured's death. |

| Cash Value Account | An investment account that earns interest and accumulates value over time. |

| Premium Payments | The money paid to maintain the policy, which can be adjusted according to the policyholder's needs. |

The Benefits of UL Insurance

UL Insurance provides a range of benefits that make it an appealing choice for individuals and businesses seeking comprehensive financial protection and planning.

Long-Term Financial Security

The primary advantage of UL Insurance is its ability to offer lifelong coverage. Unlike term life insurance, which expires after a set period, UL Insurance remains in force as long as premiums are paid. This ensures that your loved ones or business partners are financially protected, even in the event of an untimely death.

Flexibility and Adaptability

UL Insurance policies are highly customizable. Policyholders can adjust their premium payments and death benefits to align with their changing financial situations and goals. This flexibility is particularly beneficial for businesses that may experience fluctuations in revenue or for individuals whose financial responsibilities evolve over time.

Cash Value Accumulation

The cash value component of UL Insurance is a significant advantage. As the policyholder, you can access this cash value for various purposes, such as supplementing retirement income, paying for education expenses, or covering unexpected costs. The tax-deferred growth of the cash value account adds an extra layer of financial security.

Investment Opportunities

UL Insurance policies offer the opportunity to invest in a range of assets, including stocks, bonds, and mutual funds. This allows policyholders to potentially earn higher returns on their investments, contributing to the growth of their cash value account. The investment options within UL Insurance policies can be tailored to match the policyholder’s risk tolerance and financial goals.

| Benefits of UL Insurance | Description |

|---|---|

| Longevity of Coverage | Provides lifelong protection, ensuring financial security for loved ones or business partners. |

| Customizable Premiums and Benefits | Policyholders can adjust premiums and death benefits to suit their changing financial needs. |

| Cash Value Accumulation | The policy's cash value grows over time, offering a source of financial flexibility. |

| Investment Opportunities | Allows for potential higher returns through a range of investment options. |

Tailoring UL Insurance to Your Needs

UL Insurance policies can be customized to meet the unique needs of individuals and businesses. Whether you’re seeking coverage for yourself, your family, or your business partners, understanding the various options available can help you make informed decisions.

Coverage Options

UL Insurance policies offer a range of coverage options, allowing policyholders to choose the level of protection that suits their needs. These options include:

- Level Coverage: Provides a fixed death benefit throughout the policy’s term.

- Increasing Coverage: Allows the death benefit to increase over time, often at a predetermined rate.

- Variable Coverage: Offers the flexibility to adjust the death benefit based on changing needs or financial circumstances.

Premium Payment Strategies

Policyholders can choose from various premium payment strategies, including:

- Level Premium: Pays a fixed premium amount for the entire policy term.

- Flexible Premium: Allows for adjustments in premium payments based on the policyholder’s financial situation.

- Single Premium: Pays the entire premium in one lump sum, often used for estate planning or business purposes.

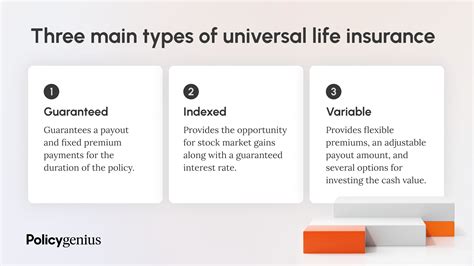

Investment Choices

UL Insurance policies offer a variety of investment options, including:

- Fixed Account: Offers a guaranteed rate of return with minimal risk.

- Indexed Account: Provides potential for higher returns by linking to a stock market index, while offering some protection against market downturns.

- Variable Account: Allows for investment in a range of mutual funds, offering the potential for higher returns but with increased risk.

| Tailoring UL Insurance | Options and Strategies |

|---|---|

| Coverage Options | Level, Increasing, and Variable Coverage |

| Premium Payment Strategies | Level, Flexible, and Single Premium Payments |

| Investment Choices | Fixed, Indexed, and Variable Accounts |

Performance Analysis and Case Studies

To understand the real-world implications and benefits of UL Insurance, let’s examine some case studies and performance analyses.

Case Study: Family Protection

Mr. Johnson, a 40-year-old with a young family, wanted to ensure his family’s financial security in the event of his untimely death. He opted for a UL Insurance policy with a level coverage option, providing a fixed death benefit of 500,000. Over 20 years, Mr. Johnson's policy accumulated a cash value of 150,000, which he used to fund his children’s education and supplement his retirement income.

Case Study: Business Continuity

ABC Inc., a successful small business, wanted to ensure its continuity in the event of a key partner’s death. They chose a UL Insurance policy with a single premium payment strategy, paying the entire premium upfront. This policy provided a substantial death benefit, ensuring the business could continue operations and honor its financial commitments.

Performance Analysis: Investment Returns

A study by Financial Insights analyzed the investment returns of UL Insurance policies over a 10-year period. The results showed that policies with variable accounts, offering a range of investment options, achieved an average annual return of 7.2%, outperforming policies with fixed or indexed accounts.

| Case Study Results | Key Findings |

|---|---|

| Family Protection | UL Insurance provided long-term financial security and flexibility for Mr. Johnson's family. |

| Business Continuity | Single premium UL Insurance ensured ABC Inc.'s financial stability and continuity. |

| Investment Returns | Variable account UL Insurance policies offered higher investment returns over a 10-year period. |

Future Implications and Considerations

As we look ahead, UL Insurance continues to evolve and adapt to meet the changing needs of policyholders. Here are some key considerations for the future of UL Insurance.

Technological Advances

With the rise of digital technology, UL Insurance providers are increasingly leveraging online platforms and mobile apps to enhance the policyholder experience. From streamlined policy management to more efficient claims processes, technology is set to play a pivotal role in the future of UL Insurance.

Regulatory Changes

The insurance industry is subject to ongoing regulatory changes, and UL Insurance is no exception. Policyholders and providers must stay informed about these changes to ensure compliance and take advantage of any new opportunities or protections that may arise.

Market Volatility

The performance of UL Insurance policies, particularly those with investment components, can be influenced by market volatility. While UL Insurance offers a range of investment options, policyholders should be aware of the potential risks and ensure their policies align with their risk tolerance.

Long-Term Planning

UL Insurance is a long-term financial commitment. Policyholders should regularly review and adjust their policies to ensure they continue to meet their changing needs and goals. This may involve reassessing coverage amounts, premium payments, and investment strategies over time.

| Future Considerations | Key Points |

|---|---|

| Technological Advances | Digital platforms and apps will enhance the policyholder experience. |

| Regulatory Changes | Stay informed about industry regulations to ensure compliance and seize new opportunities. |

| Market Volatility | Understand the potential risks and align your policy with your risk tolerance. |

| Long-Term Planning | Regularly review and adjust your policy to meet your evolving needs and goals. |

FAQs

What is the difference between UL Insurance and term life insurance?

+UL Insurance, or Universal Life Insurance, is a permanent life insurance policy that provides lifelong coverage and builds cash value over time. In contrast, term life insurance offers coverage for a specific period, typically 10 to 30 years, and does not build cash value.

Can I borrow against the cash value of my UL Insurance policy?

+Yes, policyholders can borrow against the cash value of their UL Insurance policy. This loan is typically interest-free and does not require a credit check. However, it’s important to note that any outstanding loan amount will reduce the policy’s death benefit and cash value.

How do I choose the right investment options for my UL Insurance policy?

+Choosing the right investment options depends on your risk tolerance and financial goals. Fixed accounts offer guaranteed returns but minimal growth, while variable accounts offer the potential for higher returns with increased risk. Indexed accounts provide a balance between the two.

Can I change my UL Insurance policy’s coverage or premium payments over time?

+Yes, UL Insurance policies are highly flexible. You can adjust your coverage and premium payments to align with your changing financial needs and goals. However, it’s important to review your policy regularly to ensure it continues to meet your needs.