United Insurance Co Of America

In the ever-evolving landscape of the insurance industry, United Insurance Co. of America has established itself as a prominent player, offering a comprehensive range of insurance solutions tailored to meet the diverse needs of its clientele. With a rich history spanning several decades, this insurance giant has solidified its position as a trusted partner for individuals and businesses alike. This article delves into the intricacies of United Insurance Co. of America, exploring its offerings, impact, and the key factors contributing to its success.

A Legacy of Protection and Innovation

United Insurance Co. of America traces its roots back to the early 1900s, a period characterized by rapid industrialization and a burgeoning need for insurance coverage. Founded by a visionary group of entrepreneurs, the company set out with a clear mission: to provide reliable insurance solutions that would protect individuals and businesses from unforeseen risks.

Over the years, United Insurance Co. of America has grown exponentially, expanding its reach across the nation and establishing a strong presence in key markets. The company's journey has been marked by a relentless pursuit of innovation, adapting to the changing needs of its customers and staying ahead of industry trends.

Core Values and Corporate Culture

At the heart of United Insurance Co. of America’s success lies a set of core values that guide its operations and decision-making processes. Integrity, customer-centricity, and a commitment to excellence are deeply ingrained in the company’s culture, shaping every aspect of its business.

United Insurance Co. of America fosters a collaborative and inclusive work environment, empowering its employees to contribute their unique skills and perspectives. This culture of empowerment has led to a highly motivated and dedicated workforce, driving the company's success and ensuring its continued growth.

Comprehensive Insurance Solutions

United Insurance Co. of America boasts a diverse portfolio of insurance products, catering to a wide array of customer needs. From individuals seeking personal protection to businesses requiring comprehensive commercial coverage, the company offers tailored solutions that provide peace of mind and financial security.

Personal Insurance

In the realm of personal insurance, United Insurance Co. of America offers a comprehensive suite of products, including:

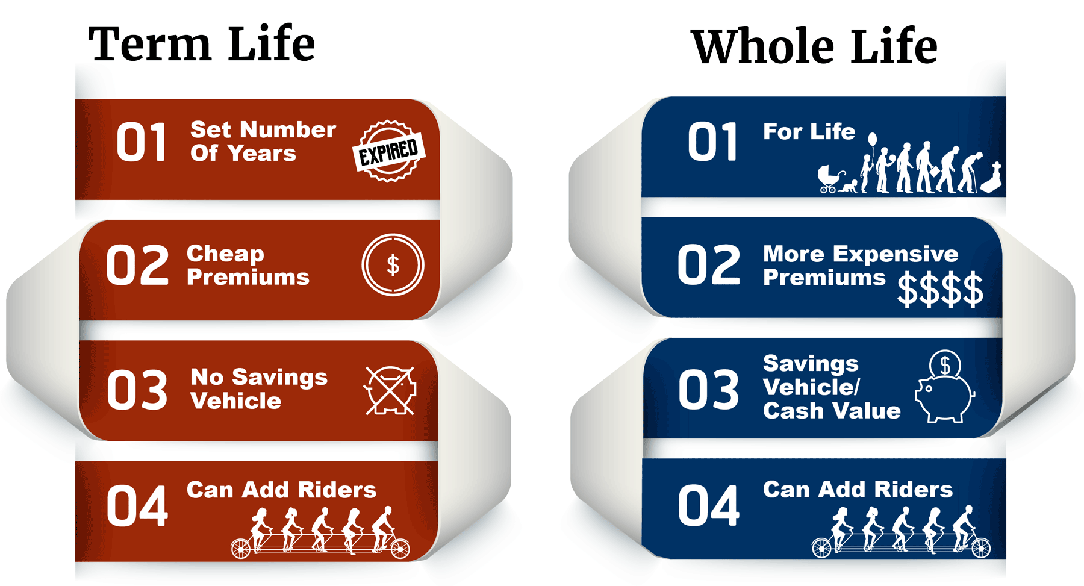

- Life Insurance: The company provides a range of life insurance plans, from term life to whole life policies, ensuring financial protection for loved ones in the event of unforeseen circumstances.

- Health Insurance: With a focus on affordable and accessible healthcare, United Insurance Co. of America offers various health insurance plans, covering medical expenses and providing peace of mind during times of illness or injury.

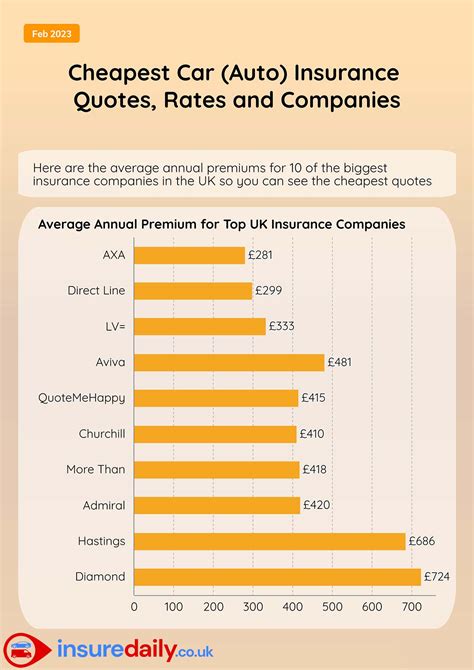

- Auto Insurance: Whether it's comprehensive coverage for vehicle repairs or liability protection, the company's auto insurance policies are designed to meet the diverse needs of drivers, ensuring they remain protected on the road.

- Homeowners Insurance: From protecting against natural disasters to covering liability claims, United Insurance Co. of America's homeowners insurance policies provide comprehensive coverage for one of life's most significant investments.

Commercial Insurance

For businesses, United Insurance Co. of America offers a range of commercial insurance solutions, including:

- Business Owners Policy (BOP): A cost-effective solution that combines property and liability coverage, tailored to the unique needs of small and medium-sized businesses.

- General Liability Insurance: Protecting businesses from a wide range of liability claims, this coverage is essential for any business looking to mitigate legal risks.

- Commercial Property Insurance: United Insurance Co. of America provides coverage for physical assets, including buildings, inventory, and equipment, ensuring businesses can recover from losses caused by fires, storms, or other disasters.

- Workers' Compensation Insurance: This vital coverage ensures that employees receive medical benefits and wage replacement in the event of work-related injuries or illnesses, protecting both employees and the business.

Industry Recognition and Awards

United Insurance Co. of America’s commitment to excellence and customer satisfaction has not gone unnoticed. The company has garnered numerous accolades and awards over the years, solidifying its position as an industry leader.

Some of the notable awards include:

- Best Insurance Provider: Recognized by industry publications and customer satisfaction surveys, United Insurance Co. of America has consistently ranked among the top insurance providers in the nation.

- Excellence in Innovation: The company's innovative approach to insurance solutions has been celebrated, with awards recognizing its ability to adapt and deliver cutting-edge products and services.

- Customer Service Excellence: United Insurance Co. of America's dedication to providing exceptional customer service has been acknowledged, with awards highlighting its responsive and personalized approach to client interactions.

Community Engagement and Philanthropy

Beyond its insurance offerings, United Insurance Co. of America actively engages in community initiatives and philanthropic endeavors. The company believes in giving back to the communities it serves, fostering positive change and making a meaningful impact.

Some of the company's notable community initiatives include:

- Supporting local charities and non-profit organizations through financial donations and volunteer programs.

- Sponsoring educational programs and initiatives aimed at promoting financial literacy and insurance awareness among youth and underserved communities.

- Partnering with environmental organizations to promote sustainable practices and reduce the company's carbon footprint.

- Organizing community events and fundraisers to raise awareness and support for social causes, such as disaster relief and healthcare access.

The Future of United Insurance Co. of America

As the insurance industry continues to evolve, United Insurance Co. of America remains committed to staying at the forefront of innovation. The company is investing heavily in technology and data analytics to enhance its operational efficiency and deliver even more personalized insurance solutions.

With a focus on digital transformation, United Insurance Co. of America is developing cutting-edge platforms and tools to streamline the insurance experience for its customers. From online policy management and claims processing to real-time risk assessment, the company is leveraging technology to provide faster, more efficient service.

Additionally, United Insurance Co. of America is exploring new avenues of growth, including expanding its international presence and developing innovative insurance products to meet the evolving needs of its customers. The company's dedication to continuous improvement and its customer-centric approach position it for continued success in the years to come.

What sets United Insurance Co. of America apart from its competitors?

+United Insurance Co. of America stands out for its comprehensive range of insurance products, tailored to meet the unique needs of its clients. The company’s focus on innovation, customer satisfaction, and community engagement further distinguishes it as a trusted and responsible insurance provider.

How does United Insurance Co. of America ensure customer satisfaction?

+United Insurance Co. of America prioritizes customer satisfaction through a dedicated customer service team, offering responsive and personalized support. The company also conducts regular customer surveys and feedback sessions to continuously improve its products and services.

What are the key benefits of choosing United Insurance Co. of America for personal insurance needs?

+United Insurance Co. of America offers a wide range of personal insurance products, including life, health, auto, and homeowners insurance. The company’s policies provide comprehensive coverage, competitive pricing, and excellent customer service, ensuring peace of mind and financial security for individuals and their families.

How does United Insurance Co. of America support businesses with their insurance needs?

+United Insurance Co. of America offers a variety of commercial insurance solutions tailored to the unique risks and needs of businesses. From general liability and property insurance to workers’ compensation and business owners policies, the company provides comprehensive coverage to protect businesses and their assets.

What is United Insurance Co. of America’s approach to community engagement and philanthropy?

+United Insurance Co. of America believes in giving back to the communities it serves. The company actively engages in community initiatives, supports local charities, and sponsors educational programs. By fostering positive change and making a meaningful impact, United Insurance Co. of America strengthens its connection with the communities it serves.