Vin Number Insurance

Vehicle identification numbers (VINs) are unique codes assigned to every motor vehicle, serving as their digital fingerprints. These 17-character codes provide critical information about a vehicle's history, including its make, model, and production details. When it comes to insurance, VINs play a pivotal role in assessing risk and determining coverage. In this comprehensive guide, we will delve into the world of VIN number insurance, exploring its intricacies, benefits, and real-world applications.

Understanding VIN Number Insurance

VIN number insurance, also known as vehicle identification number insurance or VIN-based insurance, is a specialized form of coverage that utilizes the unique VIN of a vehicle to tailor insurance policies. This innovative approach to insurance offers a more precise and personalized assessment of risk, leading to potentially more accurate and fair premiums.

Traditional insurance policies often rely on broad categories such as vehicle make, model, and year to determine risk and pricing. While these factors provide a general idea, they may not capture the unique characteristics and history of an individual vehicle. VIN number insurance aims to bridge this gap by leveraging the wealth of information embedded within a vehicle's VIN.

The Benefits of VIN Number Insurance

By harnessing the power of VINs, insurance providers can gain a deeper understanding of a vehicle’s history, which can have significant implications for insurance coverage and pricing. Here are some key benefits of VIN number insurance:

- Accurate Risk Assessment: VINs provide detailed information about a vehicle's manufacturing specifications, including engine type, transmission, and safety features. This data allows insurers to assess risk more accurately, considering factors beyond the vehicle's make and model.

- Fraud Prevention: VINs act as a powerful tool in combating insurance fraud. By verifying the authenticity of a vehicle's identity, insurers can detect and prevent fraudulent claims, ensuring fair practices for all policyholders.

- Tailored Coverage: VIN number insurance enables insurers to offer customized policies based on a vehicle's specific attributes. This can result in more precise coverage options, catering to the unique needs of individual vehicles and their owners.

- Improved Claims Handling: In the event of a claim, VINs can expedite the claims process. Insurers can quickly access a vehicle's history, including previous claims and repairs, leading to faster and more efficient claim settlements.

- Enhanced Data Analysis: VIN data provides a wealth of information that can be leveraged for advanced analytics. Insurers can analyze trends, identify potential risks, and develop more sophisticated risk models, ultimately improving overall insurance practices.

Real-World Applications of VIN Number Insurance

VIN number insurance has found practical applications across various sectors, revolutionizing the way insurance is approached and delivered.

| Industry Sector | VIN Number Insurance Applications |

|---|---|

| Automotive Manufacturing | Manufacturers can use VINs to track vehicles throughout their production and distribution processes, ensuring quality control and facilitating efficient recalls when necessary. |

| Vehicle Sales and Resale | Dealers and private sellers can provide potential buyers with a comprehensive vehicle history report, increasing trust and transparency in the sales process. |

| Fleet Management | Fleet operators can leverage VIN data to optimize maintenance schedules, track vehicle usage, and make informed decisions about fleet composition and insurance coverage. |

| Law Enforcement | Law enforcement agencies can use VINs to identify stolen vehicles, track down criminals, and verify vehicle ownership, aiding in crime prevention and investigation. |

| Insurance Claims | Insurance companies can utilize VINs to validate claims, detect fraud, and provide accurate coverage for policyholders, ensuring fair and efficient claim settlements. |

VIN Number Insurance in Practice

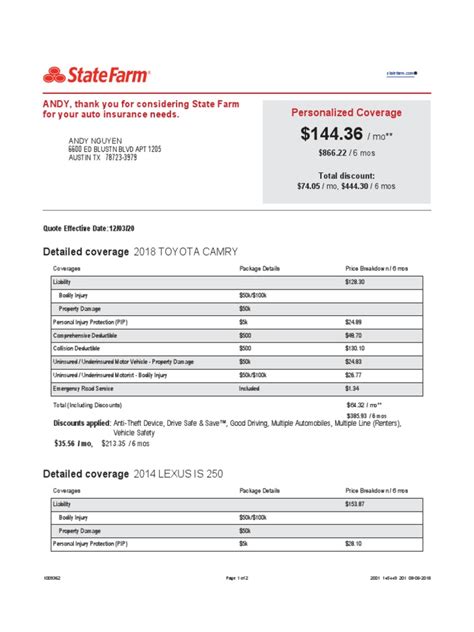

Let’s explore a real-world scenario to illustrate the practical implementation of VIN number insurance.

Scenario: Personal Auto Insurance

Imagine a driver named John who owns a 2018 Tesla Model 3. John is considering switching insurance providers to find a more competitive rate. He provides his current insurer with his vehicle’s VIN: 5YJ3E1EB5JF987452.

Using the VIN, the insurer accesses a wealth of information about John's vehicle. They can verify the make, model, and year, but they also gain insights into the vehicle's specific features, such as its all-wheel drive system, advanced driver-assistance technologies, and high-performance battery. This detailed information allows the insurer to accurately assess the risk associated with John's vehicle and offer a tailored insurance policy.

Based on the VIN data, the insurer may determine that John's Tesla Model 3 presents a lower risk profile compared to other vehicles of the same make and model. This could be due to the advanced safety features and technological advancements of the vehicle. As a result, John may receive a more favorable insurance rate, reflecting the reduced risk associated with his specific vehicle.

Furthermore, in the event of a claim, the insurer can quickly access John's vehicle history using the VIN. This enables them to verify the legitimacy of the claim, assess any previous damages or repairs, and provide a seamless claims experience for John. The VIN serves as a critical tool in ensuring accurate and efficient claim processing.

Future Implications and Industry Trends

As VIN number insurance continues to gain traction, it is shaping the future of the insurance industry in several significant ways.

- Data-Driven Insurance: The extensive data available through VINs is driving the insurance industry towards a more data-centric approach. Insurers are leveraging advanced analytics and machine learning to extract valuable insights from VIN data, leading to more accurate risk assessment and pricing models.

- Telematics and Usage-Based Insurance: VIN number insurance is often combined with telematics, which uses real-time vehicle data to assess driving behavior. This fusion of technologies enables usage-based insurance policies, where premiums are determined based on an individual's actual driving habits, further personalizing insurance coverage.

- Connected Vehicles and IoT: With the rise of connected vehicles and the Internet of Things (IoT), VIN number insurance is expected to integrate seamlessly with vehicle connectivity. Insurers can access real-time vehicle data, monitor driving behavior, and provide dynamic insurance policies that adapt to changing circumstances.

- Improved Customer Experience: VIN number insurance has the potential to revolutionize the customer experience. Policyholders can benefit from more accurate and transparent insurance policies, tailored to their specific vehicles. Additionally, the efficient claims process enabled by VIN data can enhance customer satisfaction and loyalty.

FAQs

How can I find my vehicle’s VIN number?

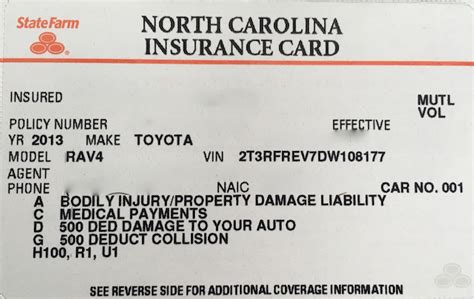

+You can typically find your vehicle’s VIN number on the driver’s side dashboard, visible through the windshield. It is a 17-character code that uniquely identifies your vehicle. You can also find the VIN on your vehicle registration, insurance documents, or on a sticker inside the driver’s side doorjamb.

Can VIN number insurance reduce my insurance premiums?

+Yes, VIN number insurance can potentially lead to reduced insurance premiums. By providing more accurate risk assessment based on your vehicle’s specific attributes, insurers may offer lower rates compared to traditional insurance policies. However, the extent of premium reduction can vary depending on various factors, including your driving history and the vehicle’s overall risk profile.

Is VIN number insurance available for all types of vehicles?

+VIN number insurance is generally available for a wide range of vehicles, including cars, motorcycles, and even commercial vehicles. However, the availability and specific coverage options may vary depending on your location and the insurance provider you choose. It is recommended to check with your insurer or multiple providers to determine the availability and suitability of VIN number insurance for your vehicle.

How does VIN number insurance impact fraud detection?

+VIN number insurance plays a crucial role in fraud detection by providing a unique and verifiable identity for each vehicle. Insurers can use the VIN to access a vehicle’s comprehensive history, including previous ownership, accidents, and repairs. This information helps insurers identify potential fraudulent activities, such as vehicle cloning or falsified claims, ensuring fair practices and protecting honest policyholders.

Can I switch to VIN number insurance if I already have a traditional insurance policy?

+Absolutely! Many insurance providers now offer the option to switch to VIN number insurance, even if you already have a traditional policy in place. Contact your insurer to inquire about their VIN-based insurance offerings and the process for making the transition. It is advisable to compare rates and coverage options to ensure you find the best fit for your needs.