Walgreens Prescription Prices With Insurance

In the vast landscape of healthcare, prescription medication plays a pivotal role in the management of various health conditions. For many individuals, navigating the complexities of prescription costs, especially when factoring in insurance coverage, can be a daunting task. Walgreens, a renowned name in the pharmacy industry, offers prescription services with the aim of providing accessible and affordable healthcare. This article delves into the specifics of Walgreens prescription prices, focusing on the crucial role insurance plays in determining these costs.

Understanding Walgreens Prescription Prices

Walgreens, with its extensive network of pharmacies across the United States, offers a comprehensive range of prescription medications. The cost of these medications can vary significantly based on several factors, including the type of medication, dosage, and the specific Walgreens store or pharmacy.

The pricing structure at Walgreens is designed to cater to a diverse range of customers, with options for both insured and uninsured individuals. For those without insurance, Walgreens provides a prescription savings club that offers discounted rates on a variety of medications. Members of this club can access reduced prices on both brand-name and generic drugs, making essential medications more affordable.

However, for those with insurance coverage, the pricing dynamics shift significantly. Insurance plans play a crucial role in determining the out-of-pocket expenses for prescription medications. Walgreens, being a preferred provider for numerous insurance companies, ensures that customers with insurance can benefit from the best possible prices as per their insurance plan.

Factors Influencing Prescription Prices at Walgreens

Several key factors contribute to the determination of prescription prices at Walgreens, especially when insurance is involved. These factors include:

- Insurance Plan Coverage: Different insurance plans offer varying levels of coverage for prescription medications. Some plans may cover a broader range of drugs, while others may have more restrictions. The specifics of an individual's insurance plan will directly impact the price they pay for their prescriptions.

- Formulary Lists: Insurance companies often maintain formulary lists, which are lists of medications that they cover and the corresponding tiers or levels of coverage. Medications on the formulary are typically more affordable for insured individuals, as they are negotiated rates between the insurance company and the pharmacy.

- Generic vs. Brand-Name Drugs: The choice between generic and brand-name medications can significantly affect prescription costs. Generic drugs, which contain the same active ingredients as their brand-name counterparts, are often much more cost-effective. Walgreens, like many pharmacies, promotes the use of generic drugs to help customers save money without compromising on quality.

- Discounts and Copayments: Insurance plans often offer discounts or fixed copayments for certain medications. These discounts can vary based on the type of drug, the dosage, and the individual's insurance coverage. Walgreens, in partnership with insurance companies, ensures that these discounts are applied accurately, benefiting customers with reduced prescription costs.

- Pharmacy Location and Pricing: The pricing of prescription medications can vary slightly across different Walgreens locations. This variation can be influenced by factors such as the cost of living in a particular area, competition from other pharmacies, and specific agreements with local insurance providers.

Understanding these factors is crucial for individuals to make informed decisions about their prescription medication purchases. It allows them to estimate costs more accurately and potentially explore options to reduce their out-of-pocket expenses.

The Role of Insurance in Walgreens Prescription Prices

Insurance coverage is a critical aspect of managing prescription medication costs. At Walgreens, insurance plays a significant role in determining the prices customers pay for their medications. Here’s a closer look at how insurance impacts prescription prices at Walgreens:

Insurance Coverage and Prescription Costs

When an individual has insurance coverage, their prescription costs are influenced by the specific details of their insurance plan. Insurance plans typically cover a portion of the medication cost, leaving the insured individual responsible for the remaining amount, often referred to as the out-of-pocket cost. This out-of-pocket cost can take various forms, including copayments, coinsurance, or deductibles.

Copayments, or copays, are fixed amounts that insured individuals pay for a prescription medication. This amount is usually set by the insurance company and can vary based on the type of medication and the individual's plan. Copays provide a predictable cost structure, making it easier for individuals to budget for their prescription needs.

Coinsurance, on the other hand, is a percentage of the medication cost that the insured individual is responsible for. For instance, if an individual has a 20% coinsurance for a particular medication, they would pay 20% of the total cost, while their insurance plan covers the remaining 80%. Coinsurance can vary depending on the medication and the individual's insurance plan.

Deductibles are another component of insurance coverage. A deductible is the amount an insured individual must pay out of pocket before their insurance coverage kicks in. Once the deductible is met, the insurance plan starts covering a portion of the medication costs. Deductibles can vary significantly between insurance plans and may reset annually.

Navigating Insurance Coverage for Prescriptions

Navigating insurance coverage for prescription medications can be complex, but Walgreens aims to simplify this process for its customers. Here are some key strategies and considerations for managing prescription costs with insurance:

- Understand Your Insurance Plan: It's essential to have a clear understanding of your insurance plan's coverage for prescription medications. Review your plan's details, including the formulary list, to know which medications are covered and at what level. This knowledge can help you make informed choices when filling prescriptions.

- Compare Prices: Walgreens, like many pharmacies, offers tools to compare prescription prices. By comparing prices across different pharmacies and drug stores, you can identify the most cost-effective options for your medications. This is especially beneficial if you have flexible spending accounts or health savings accounts that allow for certain levels of choice.

- Generic Medications: As mentioned earlier, generic medications are often significantly more affordable than their brand-name counterparts. Walgreens actively promotes the use of generic drugs, which can help reduce prescription costs. If your medication is available in a generic form, consider discussing this option with your healthcare provider.

- Pharmacy Discount Programs: Walgreens and other pharmacies often have discount programs or savings clubs that can provide additional savings on prescriptions. These programs may offer reduced prices on a wide range of medications, making them an attractive option for uninsured individuals or those with high-deductible insurance plans.

- Pharmacy Apps and Tools: Walgreens provides digital tools and apps that can help you manage your prescription costs. These tools often include features like prescription refills, price comparisons, and reminders for medication adherence. Utilizing these resources can streamline the prescription process and help you stay informed about costs.

By actively managing your prescription costs and understanding the role of insurance, you can make more informed decisions about your healthcare expenses. Walgreens, with its commitment to accessibility and affordability, aims to provide a seamless experience for customers navigating the complexities of prescription pricing.

Real-World Examples and Case Studies

To illustrate the impact of insurance on prescription prices at Walgreens, let’s examine a few real-world examples and case studies:

Case Study 1: Brand-Name vs. Generic Medication

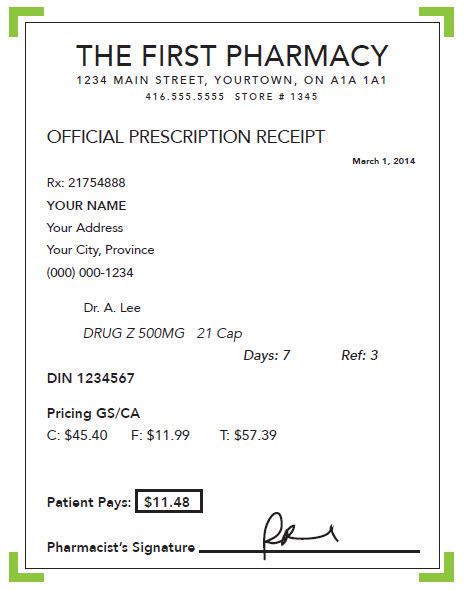

Consider an individual with a prescription for a brand-name medication, Medication A, which costs 150 per month without insurance. With insurance coverage, the individual's out-of-pocket cost for this medication is a fixed copayment of 30 per month. This is a significant savings compared to the uninsured price.

However, if the individual were to opt for the generic version of Medication A, which is priced at $80 per month without insurance, their copayment would likely be much lower. In this case, the generic option provides even greater savings, making it a more cost-effective choice.

Case Study 2: Tiered Formulary Lists

Imagine an individual with insurance coverage that has a tiered formulary list. Tier 1 medications have the lowest out-of-pocket costs, while Tier 3 medications have the highest. Medication B is on Tier 2 of this formulary list, with a coinsurance of 30% for the insured individual.

Without insurance, Medication B would cost $200 per month. With the 30% coinsurance, the individual's out-of-pocket cost would be $60 per month, while their insurance plan covers the remaining $140. This example highlights how insurance coverage can significantly reduce prescription costs based on the medication's tier.

Case Study 3: High-Deductible Plans

For individuals with high-deductible insurance plans, the prescription cost landscape can look quite different. These plans typically require individuals to meet a higher deductible before insurance coverage kicks in. During this period, prescription costs are paid out of pocket.

For instance, consider an individual with a high-deductible plan who has a prescription for Medication C, which costs $100 per month without insurance. Until they meet their deductible, they would pay the full $100 out of pocket. Once the deductible is met, their insurance plan would cover a portion of the cost, reducing their out-of-pocket expenses.

Future Trends and Innovations

The landscape of prescription pricing and insurance coverage is constantly evolving. As the healthcare industry adapts to changing needs and technologies, we can expect several trends and innovations that may impact prescription prices at Walgreens and other pharmacies:

Telehealth and Digital Prescriptions

The rise of telehealth services has already had an impact on prescription medication access. With telehealth, individuals can consult with healthcare providers remotely, often leading to faster and more convenient prescription processes. Digital prescriptions, which can be sent directly to pharmacies like Walgreens, may become more common, streamlining the prescription fulfillment process.

Expanded Use of Generics and Biosimilars

Generic medications and biosimilars (biologic drugs that are highly similar to already approved biologics) are often more affordable alternatives to brand-name drugs. As these alternatives become more widely available and accepted, we can expect to see a continued shift towards their use. This trend can drive down prescription costs, benefiting both insured and uninsured individuals.

Integration of Pharmacy Benefits Managers (PBMs)

Pharmacy Benefits Managers (PBMs) play a crucial role in negotiating prescription drug prices and managing drug benefits for insurance companies. As PBMs become more integrated into the healthcare system, they can negotiate better rates for prescription medications, potentially leading to lower costs for insured individuals.

Personalized Medicine and Precision Pricing

Advances in personalized medicine and precision health may lead to more tailored prescription treatments. This could result in more precise pricing structures, where medications are priced based on an individual’s specific health needs and genetic makeup. While this trend is still evolving, it has the potential to revolutionize prescription pricing in the future.

Conclusion

Understanding Walgreens prescription prices with insurance is crucial for individuals looking to manage their healthcare expenses effectively. The role of insurance in determining prescription costs cannot be overstated, as it can significantly impact an individual’s out-of-pocket expenses. By navigating insurance coverage, comparing prices, and exploring cost-saving options, individuals can make informed choices about their prescription medication needs.

As the healthcare industry continues to evolve, the dynamics of prescription pricing and insurance coverage will likely change as well. Staying informed about these trends and innovations can help individuals stay ahead of the curve when it comes to managing their prescription costs. Walgreens, with its commitment to accessibility and affordability, is well-positioned to adapt to these changes and continue providing valuable services to its customers.

How can I find out the exact price of my prescription with insurance at Walgreens?

+

To determine the exact price of your prescription with insurance at Walgreens, you can use their online tools or contact your local Walgreens pharmacy. You’ll need to provide details about your insurance plan and the specific medication you require. Walgreens can then calculate your out-of-pocket cost based on your insurance coverage.

What if my insurance plan is not accepted at Walgreens?

+

If your insurance plan is not accepted at Walgreens, you may still be able to use their services by paying out of pocket. Alternatively, you can explore other pharmacies that accept your insurance plan or consider switching to a different pharmacy benefit manager (PBM) within your insurance network.

Are there any discounts or savings programs available for uninsured individuals at Walgreens?

+

Yes, Walgreens offers a Prescription Savings Club for uninsured individuals. This program provides discounted rates on a wide range of medications, both brand-name and generic. It can be a cost-effective option for those without insurance coverage.

Can I use my Walgreens prescription savings with other discounts or coupons?

+

In most cases, Walgreens prescription savings are exclusive and cannot be combined with other discounts or coupons. However, it’s always worth checking with your local Walgreens pharmacy or consulting their website for the latest information on potential stacking opportunities.