Wellness Insurance For Pets

The concept of providing insurance coverage for our beloved pets has gained significant traction in recent years, reflecting a growing awareness of the importance of pet health and the desire to ensure their well-being. Pet owners are increasingly seeking ways to safeguard their furry companions against unforeseen illnesses or injuries, and wellness insurance has emerged as a valuable tool in this endeavor.

Wellness insurance plans offer a comprehensive approach to pet healthcare, covering not just emergency treatments but also routine care and preventive measures. By investing in these plans, pet owners can access a range of benefits that contribute to the overall health and longevity of their pets. This article delves into the world of wellness insurance for pets, exploring its features, benefits, and how it can be a game-changer for pet owners.

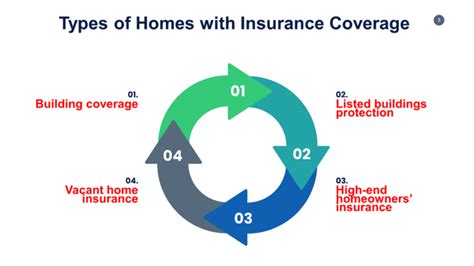

Understanding Wellness Insurance for Pets

Wellness insurance for pets, often referred to as pet wellness plans or routine care insurance, is a unique type of insurance policy designed to cover the costs associated with routine veterinary care and preventive treatments. Unlike traditional pet insurance, which primarily focuses on accident and illness coverage, wellness plans offer a proactive approach to pet healthcare.

These plans are tailored to meet the specific needs of pet owners who wish to prioritize preventive care and ensure their pets receive regular check-ups, vaccinations, and other essential treatments. By incorporating wellness insurance into their pet care routine, owners can maintain their pets' health, detect potential issues early on, and provide the best possible care.

Key Features of Wellness Insurance Plans

Wellness insurance plans typically offer a range of benefits, which may include:

- Annual Check-Ups: Covering the cost of annual comprehensive examinations, including physical checks, blood tests, and other diagnostic procedures.

- Vaccinations: Providing financial support for essential vaccinations to protect pets against common diseases and viruses.

- Parasite Control: Offering coverage for flea, tick, and worm treatments to maintain pet health and prevent infestations.

- Dental Care: Including routine dental cleanings and check-ups to ensure optimal oral hygiene.

- Spaying/Neutering: Covering the costs associated with these procedures to promote responsible pet ownership and prevent overpopulation.

- Wellness Treatments: Some plans may also offer coverage for alternative therapies like acupuncture or chiropractic care.

It's important to note that the specific coverage and benefits of wellness insurance plans can vary widely depending on the provider and the chosen plan. Pet owners should carefully review the terms and conditions to ensure the plan aligns with their pet's needs and their own financial capabilities.

Benefits of Wellness Insurance for Pets

Investing in wellness insurance for pets offers a multitude of advantages, not only for the pets themselves but also for their owners. Here are some key benefits:

1. Proactive Healthcare

Wellness insurance encourages a proactive approach to pet healthcare. By scheduling regular check-ups and staying on top of preventive treatments, pet owners can catch potential health issues early on. Early detection often leads to more effective and less costly treatments, ensuring the pet’s well-being and reducing the financial burden on the owner.

2. Cost Savings

The cost of veterinary care can quickly add up, especially when unexpected illnesses or injuries occur. Wellness insurance plans help pet owners budget for their pet’s healthcare needs by spreading the costs over time. Additionally, by covering routine care, these plans can prevent more serious and costly health issues down the line.

3. Peace of Mind

Knowing that their pet’s routine care is covered can provide pet owners with significant peace of mind. They no longer have to worry about financial constraints affecting their pet’s health. This assurance allows owners to focus on providing the best possible care without compromising their pet’s well-being.

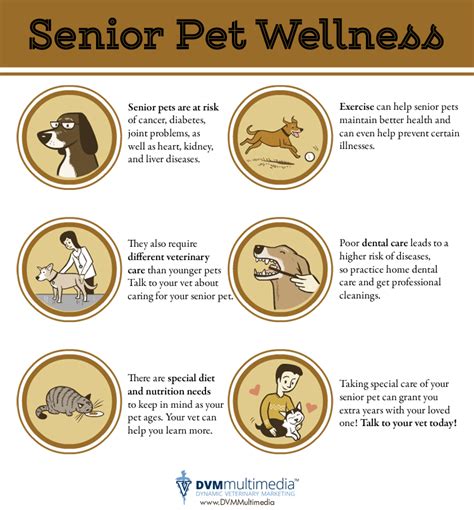

4. Improved Pet Health

Regular check-ups and preventive measures are vital for maintaining optimal pet health. Wellness insurance plans ensure that pets receive the necessary vaccinations, parasite control, and dental care, reducing the risk of diseases and promoting overall wellness. A healthy pet is a happy pet, and this can lead to a stronger bond between the owner and their furry companion.

Choosing the Right Wellness Insurance Plan

Selecting the most suitable wellness insurance plan for your pet requires careful consideration. Here are some factors to keep in mind:

1. Pet’s Age and Health History

The age and health status of your pet play a significant role in determining the right plan. Younger, healthier pets may require a more basic plan, while older pets or those with pre-existing conditions might benefit from a more comprehensive coverage.

2. Coverage Options

Review the coverage options offered by different providers. Ensure that the plan covers the essential treatments your pet requires, such as vaccinations, dental care, and parasite control. Some plans may also offer additional benefits like coverage for alternative therapies or discounts on pet supplies.

3. Cost and Deductibles

Consider your financial capabilities and choose a plan that fits within your budget. Compare the costs, deductibles, and any additional fees associated with the plans. Remember that the cheapest plan may not always be the best option if it doesn’t provide adequate coverage.

4. Provider Reputation

Research the reputation and reliability of the insurance provider. Look for reviews and feedback from other pet owners to ensure the provider has a good track record of honoring claims and providing excellent customer service.

| Provider | Coverage Options | Annual Premium |

|---|---|---|

| PetCare Plus | Annual check-ups, vaccinations, dental care | $450 |

| VetWellness | All-inclusive plan with alternative therapies | $600 |

| Healthy Paws | Basic coverage with customizable add-ons | $380 |

Real-Life Examples of Wellness Insurance in Action

Let’s explore a couple of real-life scenarios where wellness insurance made a significant difference in pet owners’ lives and their pets’ well-being.

Scenario 1: Fluffy’s Dental Dilemma

Mr. Johnson, a proud owner of a 7-year-old cat named Fluffy, had enrolled his pet in a wellness insurance plan that covered annual check-ups and dental care. During Fluffy’s routine examination, the veterinarian noticed signs of dental disease. Thanks to the insurance coverage, Mr. Johnson was able to proceed with the recommended dental cleaning and treatment without worrying about the financial burden. Fluffy’s dental health improved significantly, and Mr. Johnson felt relieved knowing he could provide the necessary care without breaking the bank.

Scenario 2: Rover’s Preventive Measures

Ms. Smith, a dedicated dog owner, opted for a wellness plan for her energetic Labrador, Rover. The plan covered annual vaccinations, flea and tick treatments, and spaying. With the insurance in place, Ms. Smith could ensure that Rover received all the necessary preventive care without any financial stress. This proactive approach kept Rover healthy and happy, and Ms. Smith appreciated the peace of mind that came with knowing her beloved companion was well-protected.

The Future of Pet Wellness Insurance

The pet wellness insurance industry is evolving, and we can expect several trends and advancements in the coming years. Here’s a glimpse into the future:

1. Digitalization and Telehealth

With the rise of technology, pet wellness insurance providers are likely to embrace digital platforms and telehealth services. This would allow pet owners to access veterinary advice and consultations remotely, making it more convenient and efficient to manage their pet’s health.

2. Personalized Plans

Insurance providers may move towards offering more personalized plans based on individual pet needs. By analyzing data and understanding a pet’s specific health risks, providers can create tailored plans that offer optimal coverage for each unique pet.

3. Expanded Coverage

As pet owners become more aware of the benefits of wellness insurance, we can anticipate that providers will expand their coverage options. This may include additional benefits such as coverage for obesity management, mental health support for pets, and specialized diets for certain health conditions.

4. Integration with Pet Technology

The integration of pet wellness insurance with emerging pet technology is another exciting prospect. This could involve insurance plans offering discounts or incentives for pet owners who utilize health-tracking devices or wearable technology for their pets.

How do I choose the right wellness insurance plan for my pet?

+When selecting a wellness insurance plan, consider your pet's age, health history, and specific needs. Review the coverage options, ensure they align with your requirements, and compare costs and deductibles. Choose a reputable provider with a good track record.

Are wellness insurance plans suitable for all pets?

+Wellness insurance plans are designed to benefit a wide range of pets, from young and healthy to older pets with specific health concerns. The key is to choose a plan that caters to your pet's unique needs and provides adequate coverage.

Can I combine wellness insurance with traditional pet insurance?

+Yes, you can combine wellness insurance with traditional pet insurance to provide comprehensive coverage for your pet. This ensures that both routine care and unexpected illnesses or injuries are covered, giving you maximum peace of mind.

What happens if my pet requires additional treatments not covered by the wellness plan?

+In such cases, you would need to pay for the additional treatments out of pocket. However, having a wellness plan in place can still be beneficial as it ensures your pet receives the necessary routine care, which can prevent more serious and costly health issues.

Are there any exclusions or limitations I should be aware of with wellness insurance plans?

+Yes, it's important to carefully review the terms and conditions of your chosen plan. Some plans may have exclusions for pre-existing conditions or may only cover certain types of treatments. Always read the fine print to understand the limitations and ensure they don't conflict with your pet's specific needs.

Wellness insurance for pets is an innovative and valuable solution for pet owners seeking to provide the best possible care for their furry companions. By offering coverage for routine veterinary care and preventive measures, these plans promote proactive healthcare, cost savings, and peace of mind. As the industry continues to evolve, we can expect even more advanced and personalized wellness insurance options, ensuring our pets live happy, healthy lives.