Westfield Homeowners Insurance

In the world of homeownership, protecting your investment and ensuring peace of mind is paramount. One of the key aspects of safeguarding your home is securing the right homeowners insurance policy. Westfield Homeowners Insurance has long been a trusted name in the industry, offering comprehensive coverage tailored to the unique needs of homeowners. In this comprehensive article, we delve into the intricacies of Westfield's offerings, exploring the coverage options, policy features, and the benefits that make it a top choice for homeowners across the nation.

Understanding Westfield Homeowners Insurance

Westfield Insurance, a subsidiary of Westfield Bank, has been providing insurance solutions since 1982. With a rich history of serving communities, Westfield Insurance offers a range of insurance products, including homeowners insurance, which is designed to protect one of life’s most significant investments - your home.

Westfield Homeowners Insurance is committed to delivering personalized protection for homeowners. Their policies are crafted with attention to detail, ensuring that every aspect of your home, from the structure itself to the belongings within, is adequately covered. Here's a closer look at what sets Westfield apart in the competitive homeowners insurance market.

Comprehensive Coverage Options

Westfield Insurance understands that every homeowner has unique needs. That’s why they offer a variety of coverage options to cater to different situations. Whether you’re a first-time homeowner, a seasoned property owner, or a landlord, Westfield has a policy that fits your specific requirements.

- Dwelling Coverage: This core coverage protects the physical structure of your home, covering damages from perils like fire, windstorms, and vandalism. It ensures that your home's value is safeguarded, providing the financial means to rebuild or repair in case of an unfortunate event.

- Personal Property Coverage: Your home is filled with cherished belongings. Westfield's personal property coverage ensures that your furniture, electronics, clothing, and other personal items are protected. In the event of a loss, you'll receive compensation to replace or repair these items, offering peace of mind.

- Liability Protection: Accidents can happen, and Westfield's liability coverage provides a safety net. It covers legal expenses and compensates others for injuries or property damage caused by you or a covered family member. This protection extends beyond your home, offering financial security in various situations.

- Additional Living Expenses: In the event of a covered loss that renders your home uninhabitable, Westfield's policy includes coverage for additional living expenses. This means that you'll be reimbursed for temporary housing, meals, and other necessary expenses until your home is repaired or rebuilt.

Customizable Policies

One of the standout features of Westfield Homeowners Insurance is its flexibility. They recognize that homeowners have diverse needs, and thus, their policies can be tailored to fit specific situations. Here are some of the customizable aspects:

- Coverage Limits: You can adjust the coverage limits to match the value of your home and its contents. This ensures that you're not underinsured, which could lead to financial strain in the event of a claim.

- Deductibles: Westfield allows you to choose your deductible amount. A higher deductible can result in lower premiums, making it a cost-effective option for those who are comfortable with a slightly higher out-of-pocket expense in the event of a claim.

- Endorsements and Riders: For additional peace of mind, Westfield offers endorsements and riders that can be added to your policy. These optional coverages provide protection for specific situations, such as identity theft, water backup, or valuable items like jewelry or fine art.

Policy Benefits and Features

Westfield Homeowners Insurance is packed with benefits and features that go beyond basic coverage. These extras demonstrate Westfield’s commitment to providing a comprehensive insurance experience.

- 24/7 Claims Reporting: In the event of an emergency, Westfield understands the importance of timely action. Their policyholders can report claims 24 hours a day, 7 days a week, ensuring that the claims process begins promptly.

- Claim Satisfaction Guarantee: Westfield stands by their claims process, offering a satisfaction guarantee. If you're not satisfied with the resolution of your claim, they'll work with you to find a solution that meets your needs.

- Personalized Risk Assessments: Westfield's insurance professionals conduct personalized risk assessments for each policyholder. By identifying potential risks, they can provide tailored recommendations to mitigate those risks and potentially lower your insurance premiums.

- Discounts: Westfield offers a range of discounts to make their policies more affordable. These discounts include multi-policy discounts (when you bundle your homeowners insurance with other policies), loyalty discounts for long-term customers, and safety discounts for homes equipped with certain safety features.

Customer Service and Claims Handling

When it comes to insurance, the quality of customer service and claims handling can make a significant difference. Westfield Insurance prides itself on its dedicated and knowledgeable customer service team. Policyholders can expect prompt and friendly assistance, whether they have questions about their policy or need to navigate the claims process.

Westfield's claims handling process is designed to be efficient and stress-free. They understand that dealing with a loss can be emotionally and financially challenging, so they aim to make the claims process as straightforward as possible. Here's an overview of what you can expect:

- Claims Reporting: As mentioned earlier, policyholders can report claims around the clock. Westfield's claims team will guide you through the process, ensuring that all necessary information is gathered to initiate the claim.

- Claims Investigation: Once a claim is reported, Westfield's experienced adjusters will thoroughly investigate the incident. They'll assess the extent of the damage, determine the cause, and ensure that the claim is handled fairly and accurately.

- Claims Payment: Upon approval, Westfield strives to make timely payments to policyholders or directly to repair services, depending on the nature of the claim. They understand the urgency of getting your life back to normal, so prompt payment is a priority.

- Restoration Services: In certain situations, Westfield may offer assistance with restoration services. This can include connecting policyholders with trusted contractors or providing resources to help with the repair or rebuilding process.

Real-World Examples and Success Stories

To illustrate the effectiveness of Westfield Homeowners Insurance, let’s delve into a couple of real-world examples:

Case Study 1: Natural Disaster Protection

John and Emily, homeowners in a flood-prone area, chose Westfield's homeowners insurance policy with enhanced water backup coverage. Unfortunately, their home was affected by a severe storm, resulting in significant water damage. Westfield's policy covered the cost of repairs, including the replacement of damaged appliances and flooring. With Westfield's assistance, John and Emily were able to restore their home and get back on their feet quickly.

Case Study 2: Identity Theft Protection

Sarah, a tech-savvy homeowner, opted for Westfield's identity theft coverage endorsement. One day, she received a notification that someone had attempted to open a credit card in her name. With Westfield's help, she was able to quickly report the incident and receive guidance on mitigating the potential damage. Westfield's identity theft protection services provided peace of mind and assisted Sarah in resolving the issue promptly.

Conclusion: Why Choose Westfield Homeowners Insurance

Westfield Homeowners Insurance stands out in the competitive insurance landscape for several reasons. Their commitment to offering comprehensive coverage, flexible policies, and a range of benefits makes them a top choice for homeowners seeking reliable protection. With their personalized approach, dedicated customer service, and efficient claims handling, Westfield ensures that policyholders can focus on what matters most - their homes and the people they love.

As you consider your homeowners insurance options, Westfield's expertise and track record of excellence make them a trusted partner in safeguarding your home and providing the peace of mind that every homeowner deserves.

Frequently Asked Questions

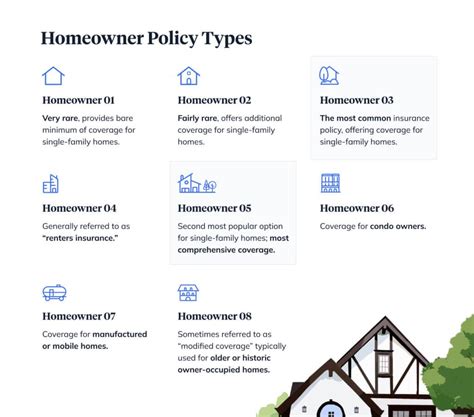

What types of homes does Westfield Homeowners Insurance cover?

+Westfield’s policies are designed to cover a wide range of homes, including single-family dwellings, condominiums, townhouses, and mobile homes. They understand the unique needs of different types of residences and tailor their coverage accordingly.

Are there any exclusions or limitations in Westfield’s policies?

+Like most insurance policies, Westfield’s homeowners insurance has certain exclusions. These may include damage caused by earthquakes, floods, or nuclear incidents, as these perils often require separate coverage. It’s important to review the policy’s terms and conditions to understand any limitations or exclusions.

How can I get a quote for Westfield Homeowners Insurance?

+Obtaining a quote for Westfield Homeowners Insurance is straightforward. You can start by visiting their official website, where you’ll find an online quote tool. Alternatively, you can contact their customer service team, who will be happy to guide you through the quoting process and answer any questions you may have.