What Does Allianz Travel Insurance Cover

Allianz Travel Insurance is a comprehensive travel insurance provider offering a range of plans to protect travelers during their journeys. With a focus on providing coverage for unexpected events and emergencies, Allianz aims to give travelers peace of mind while exploring the world. This article will delve into the specific aspects of Allianz Travel Insurance, covering its various policies, benefits, and features, to help travelers make informed decisions about their travel protection.

Comprehensive Coverage for Peace of Mind

Allianz Travel Insurance offers a suite of plans designed to cater to different travel needs and preferences. These plans provide coverage for a wide range of unexpected situations, ensuring travelers are well-prepared for any unforeseen circumstances that may arise during their trip.

Medical and Dental Emergencies

One of the primary concerns for travelers is access to quality medical care in a foreign country. Allianz Travel Insurance addresses this concern by providing comprehensive coverage for medical and dental emergencies. Whether it’s an unexpected illness, injury, or a sudden dental issue, Allianz’s plans offer coverage for medical expenses, including hospital stays, doctor visits, and even emergency dental treatments. This ensures that travelers can receive the necessary care without worrying about the financial burden.

Additionally, Allianz Travel Insurance includes a 24/7 global assistance hotline, providing travelers with access to medical professionals who can offer advice and guidance in the event of an emergency. This hotline also assists with arranging medical evacuations and transportation to appropriate medical facilities, ensuring travelers receive the best possible care.

Trip Cancellation and Interruption

Travel plans can often be disrupted due to unforeseen circumstances, such as severe weather, natural disasters, or even personal emergencies. Allianz Travel Insurance’s trip cancellation and interruption coverage helps travelers recover financially in such situations. If a trip needs to be canceled or interrupted due to a covered reason, Allianz’s plans provide reimbursement for prepaid and non-refundable expenses, including airfare, hotel accommodations, and other trip-related costs.

Moreover, Allianz offers additional benefits, such as coverage for missed connections, delayed departures, and even lost or delayed baggage. These features ensure that travelers are not left stranded or financially burdened due to unforeseen travel delays.

Baggage and Personal Belongings

Travelers often carry valuable items with them, from luggage and electronic devices to jewelry and personal documents. Allianz Travel Insurance understands the importance of protecting these belongings, and its plans include coverage for lost, stolen, or damaged baggage and personal effects. This coverage provides reimbursement for the replacement or repair of these items, ensuring travelers can continue their journey without financial stress.

Travel Delay Assistance

Delays are an inevitable part of travel, and Allianz Travel Insurance aims to make these situations more manageable. Their plans include coverage for travel delays, providing reimbursement for additional expenses incurred during the delay, such as meals, accommodation, and transportation. This ensures that travelers are not left stranded or out of pocket due to unexpected delays.

Adventure Sports and Activities

For travelers seeking adventure, Allianz Travel Insurance offers coverage for a wide range of sports and activities. Whether it’s skiing, snowboarding, hiking, or even extreme sports like bungee jumping or scuba diving, Allianz’s plans provide coverage for injuries sustained during these activities. This ensures that thrill-seekers can explore their passions without worrying about the financial implications of potential accidents.

Specialized Coverage for Specific Needs

Allianz Travel Insurance understands that travelers have unique needs, and their plans offer specialized coverage to cater to these requirements. For example, certain plans provide coverage for pre-existing medical conditions, ensuring travelers with existing health issues can still enjoy the benefits of travel insurance. Additionally, Allianz offers coverage for cruise vacations, golf trips, and even coverage for students studying abroad, ensuring a comprehensive approach to travel protection.

Customizable Plans and Benefits

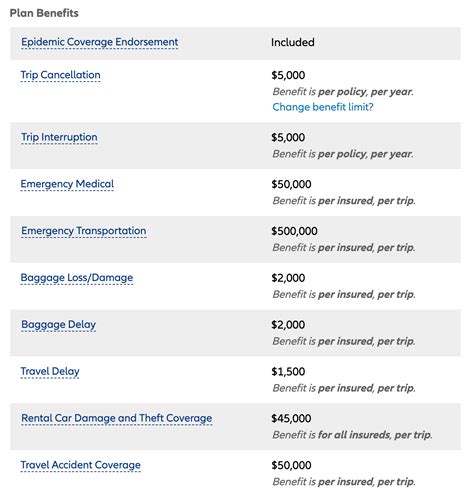

Allianz Travel Insurance recognizes that every traveler’s needs are different, and their plans are designed to be customizable to meet these specific requirements. Travelers can choose from various coverage levels, from basic plans to more comprehensive options, ensuring they receive the right level of protection for their trip.

Plan Options and Pricing

Allianz offers a range of plan options, including:

- Basic Plan: Suitable for budget-conscious travelers, this plan provides essential coverage for medical emergencies and trip cancellations.

- Classic Plan: A mid-range option offering a balanced level of coverage, including medical, trip cancellation, and baggage protection.

- Premium Plan: Designed for travelers seeking the highest level of protection, this plan covers all aspects of travel, including medical, trip cancellation, baggage, and specialized coverage for adventure activities.

The pricing for Allianz Travel Insurance plans varies based on the coverage level, trip duration, and destination. Typically, the more comprehensive the plan, the higher the premium. However, Allianz offers competitive rates and provides online quotes, allowing travelers to easily compare and choose the most suitable plan for their needs.

Additional Benefits and Services

In addition to the core coverage, Allianz Travel Insurance offers a range of additional benefits and services to enhance the travel experience. These include:

- Travel Assistance Services: Access to a dedicated team of professionals who can assist with travel-related issues, such as lost passports, legal referrals, and emergency cash transfers.

- Identity Theft Protection: Coverage for expenses related to identity theft, including legal fees, credit monitoring, and re-issuance of important documents.

- Trip Delay Compensation: Reimbursement for additional expenses incurred during a trip delay, ensuring travelers are not left stranded or out of pocket.

- 24⁄7 Customer Support: Travelers can reach Allianz’s customer support team at any time, providing assistance and guidance throughout their journey.

Real-Life Examples and Testimonials

Allianz Travel Insurance has a strong track record of providing support and assistance to travelers in real-life situations. Here are a few examples of how Allianz has helped travelers in their time of need:

| Scenario | Coverage Provided |

|---|---|

| A traveler was injured in a skiing accident during a winter vacation. Allianz provided coverage for medical expenses, including emergency transportation and treatment. | Medical Emergency Coverage |

| A family's trip was canceled due to a severe storm at their destination. Allianz reimbursed them for non-refundable expenses, including airfare and hotel bookings. | Trip Cancellation Coverage |

| A student studying abroad experienced a theft of their personal belongings. Allianz's travel insurance plan covered the cost of replacing the stolen items. | Baggage and Personal Belongings Coverage |

These real-life examples showcase how Allianz Travel Insurance has provided essential support and peace of mind to travelers facing unexpected situations. By offering comprehensive coverage and efficient claim processing, Allianz has earned a reputation for reliability and customer satisfaction.

Choosing the Right Allianz Travel Insurance Plan

Selecting the most suitable Allianz Travel Insurance plan involves careful consideration of your specific travel needs and preferences. Here are some factors to keep in mind when choosing your plan:

- Trip Duration and Destination: Assess the length of your trip and the destination you plan to visit. Some destinations may have higher risks or specific requirements, influencing your choice of coverage.

- Activities and Adventures: If you plan to engage in adventure sports or activities, ensure your plan covers these specific activities. Allianz offers specialized coverage for various adventure pursuits.

- Pre-Existing Medical Conditions: If you have any pre-existing medical conditions, choose a plan that provides coverage for these conditions. Allianz offers plans tailored to address such needs.

- Budget and Affordability: Evaluate your budget and the level of coverage you require. Allianz offers a range of plans with different coverage levels and pricing to suit various financial situations.

- Additional Benefits: Consider the extra benefits and services provided by Allianz, such as travel assistance, identity theft protection, and trip delay compensation. These can further enhance your travel experience and provide added peace of mind.

By carefully evaluating your travel plans and needs, you can select the Allianz Travel Insurance plan that best suits your requirements, ensuring a safe and enjoyable journey.

How do I file a claim with Allianz Travel Insurance?

+To file a claim with Allianz Travel Insurance, you can visit their official website and navigate to the claims section. There, you will find detailed instructions and a step-by-step guide on how to initiate and complete the claims process. It’s important to have all the necessary documentation and information ready, including medical reports, receipts, and any other relevant evidence to support your claim.

Can I purchase Allianz Travel Insurance after my trip has started?

+In most cases, Allianz Travel Insurance plans must be purchased before your trip begins. It is designed to provide coverage from the moment you leave home until your return. However, it’s always best to check the specific terms and conditions of the plan you’re interested in to ensure you understand the eligibility requirements and any potential restrictions.

What happens if I need to cancel my trip due to a covered reason under Allianz Travel Insurance?

+If you need to cancel your trip due to a covered reason under Allianz Travel Insurance, you may be eligible for reimbursement of certain non-refundable expenses. The specific coverage and reimbursement amount will depend on the plan you have chosen and the terms and conditions outlined in your policy. It’s important to review your policy carefully and contact Allianz’s customer support team for guidance on the claims process.