What Does Homeowners Insurance Cover

Homeowners insurance is a vital policy for any homeowner, providing financial protection and peace of mind. Understanding what homeowners insurance covers is essential to ensure you have the right level of protection for your home and belongings. In this comprehensive guide, we will delve into the specifics of homeowners insurance coverage, exploring the various aspects it encompasses and how it can benefit you in different scenarios.

Understanding Homeowners Insurance Coverage

Homeowners insurance, also known as home insurance, is a contract between a homeowner and an insurance provider. This contract outlines the terms and conditions of coverage, including the types of incidents or perils it protects against and the financial limits of that protection.

The coverage provided by homeowners insurance can be categorized into several key areas, each addressing different aspects of homeownership and potential risks. Let's explore these categories in detail.

Dwelling Coverage

One of the primary components of homeowners insurance is dwelling coverage, which protects the physical structure of your home. This coverage applies to the main residence and any attached structures, such as a garage or carport. In the event of damage or destruction caused by a covered peril, dwelling coverage will help you rebuild or repair your home.

Some common perils covered under dwelling coverage include:

- Fire: Whether caused by electrical faults, candles, or natural disasters, fire damage is often covered.

- Lightning Strikes: If lightning damages your home, this coverage can help with repairs.

- Wind Damage: Strong winds, including those from hurricanes and tornadoes, are typically covered.

- Hail: Hail damage to the roof, siding, or other exterior features is often included.

- Explosions: In the unlikely event of an explosion, dwelling coverage can assist with repairs.

- Vandalism: Intentional damage to your home, such as graffiti or broken windows, may be covered.

- Smoke Damage: Smoke from a fire, even if it doesn't directly cause a fire, can be covered.

It's important to note that some perils, such as earthquakes and floods, often require additional coverage, as they are typically excluded from standard homeowners insurance policies.

Personal Property Coverage

Homeowners insurance also extends protection to your personal belongings, known as personal property coverage. This coverage applies to items like furniture, electronics, clothing, and other valuables within your home.

Personal property coverage typically includes:

- Theft: If your belongings are stolen from your home or even while you're away on vacation, this coverage can reimburse you.

- Fire or Smoke Damage: If your possessions are damaged in a fire, smoke, or related incident, personal property coverage can help replace them.

- Vandalism: Similar to dwelling coverage, personal property coverage can cover intentional damage to your belongings.

- Water Damage: In the event of a burst pipe or other water-related incidents, this coverage may assist with replacing damaged items.

It's crucial to understand that personal property coverage often has limits and exclusions. For instance, high-value items like jewelry, artwork, or antiques may require separate endorsements or riders to ensure adequate coverage.

Liability Coverage

Liability coverage is a vital aspect of homeowners insurance, providing protection against legal claims and financial losses arising from accidents or injuries that occur on your property.

Some key scenarios where liability coverage can come into play include:

- Guest Injuries: If a visitor slips and falls on your property, liability coverage can help cover medical expenses and potential legal costs.

- Dog Bites: If your dog bites someone, liability coverage can assist with medical bills and potential lawsuits.

- Property Damage: If your dog or child damages a neighbor's property, liability coverage may help cover the cost of repairs.

- Legal Defense: In the event you are sued, liability coverage can provide legal representation and cover associated expenses.

It's important to note that liability coverage has limits, and understanding these limits is crucial to ensure you have adequate protection. Additionally, certain activities or situations, such as operating a business from your home, may require additional coverage.

Additional Living Expenses (ALE) Coverage

In the unfortunate event that your home becomes uninhabitable due to a covered peril, Additional Living Expenses (ALE) coverage steps in to help. This coverage reimburses you for the extra costs you incur while living elsewhere temporarily.

ALE coverage typically includes expenses such as:

- Hotel or Rental Accommodations: If you need to stay in a hotel or rent a temporary residence, these costs are often covered.

- Meals: Eating out or buying groceries while displaced can be reimbursed.

- Transportation: Additional transportation costs, such as gas or parking fees, may be covered.

It's essential to review your policy to understand the specific limits and duration of ALE coverage, as it can vary between insurance providers.

Other Structures Coverage

Homeowners insurance often extends coverage to other structures on your property that are separate from your main residence. This can include:

- Fences: Damage to fences, whether caused by weather or vandalism, may be covered.

- Sheds: Sheds and other outdoor storage buildings can be protected against damage.

- Detached Garages: If you have a detached garage or workshop, this coverage can help with repairs or replacement.

- Swimming Pools: Some policies may offer coverage for swimming pools and related structures.

Like dwelling coverage, other structures coverage has limits and may not cover all types of damage or perils.

Medical Payments Coverage

Medical payments coverage, often referred to as “med pay,” is a crucial component of homeowners insurance. It provides coverage for medical expenses incurred by guests or passersby who are injured on your property, regardless of fault.

This coverage can be particularly valuable in situations where someone sustains minor injuries on your property and seeks medical attention. It can help cover the cost of treatment, including emergency room visits, doctor's fees, and other related expenses.

It's important to note that medical payments coverage has its own limits, which can vary between insurance providers. Understanding these limits is essential to ensure you have adequate protection for potential medical emergencies on your property.

Exclusions and Limitations

While homeowners insurance provides comprehensive coverage, it’s important to be aware of the exclusions and limitations that may apply. These can vary depending on your insurance provider and the specific policy you choose.

Some common exclusions and limitations include:

- Earthquakes: Standard homeowners insurance policies typically exclude damage caused by earthquakes. If you live in an earthquake-prone area, you may need to purchase separate earthquake insurance.

- Floods: Flood damage is often excluded from homeowners insurance policies. To protect against flood-related losses, you may need to obtain a separate flood insurance policy.

- Mold and Mildew: While some policies may cover mold and mildew resulting from a covered peril, they often exclude damage caused by long-term moisture issues or maintenance-related problems.

- Water Backup: Damage caused by water backing up through sewers or drains is often excluded, requiring a separate endorsement or rider for coverage.

- Neglect: Homeowners insurance may not cover damage resulting from neglect or intentional acts.

- War and Nuclear Hazards: Damage caused by war, including acts of terrorism, and nuclear hazards is typically excluded.

It's crucial to carefully review your policy documents and discuss any concerns or questions with your insurance agent to ensure you understand the exclusions and limitations specific to your policy.

Choosing the Right Coverage

Selecting the right homeowners insurance policy involves considering your unique needs and circumstances. Here are some factors to keep in mind when choosing coverage:

Coverage Limits

Understanding the coverage limits of your policy is essential. This includes the dwelling coverage limit, which should be sufficient to rebuild your home in the event of a total loss. Additionally, review the personal property coverage limits to ensure they align with the value of your belongings.

Deductibles

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Choosing the right deductible can impact your premium. A higher deductible may result in a lower premium, but it’s important to ensure you can afford the deductible in the event of a claim.

Additional Coverages

Consider whether you need additional coverages, such as:

- Personal Injury Coverage: This coverage protects against non-physical damages, such as libel, slander, or invasion of privacy.

- Identity Theft Coverage: Offers assistance and reimbursement for expenses related to identity theft.

- Scheduled Personal Property: Allows you to add coverage for high-value items that may not be adequately covered under standard personal property coverage.

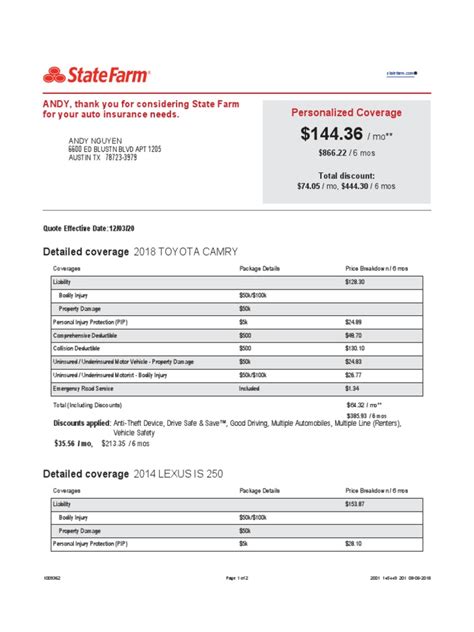

Bundle and Save

If you have multiple insurance needs, such as auto and homeowners insurance, consider bundling your policies with the same insurance provider. Bundling can often result in significant savings and simplified management of your insurance portfolio.

Making a Claim

In the event of a covered loss, knowing how to navigate the claims process is crucial. Here’s a step-by-step guide to help you through the process:

Step 1: Contact Your Insurance Company

As soon as you become aware of a potential covered loss, contact your insurance company or agent. They will guide you through the claims process and provide the necessary forms and instructions.

Step 2: Document the Damage

Take photos and videos of the damage, both inside and outside your home. Document any personal belongings that were damaged or lost. This documentation will be crucial when filing your claim.

Step 3: Complete the Claim Form

Your insurance company will provide you with a claim form. Ensure you complete it accurately and provide all the required information. Include detailed descriptions of the damage and any supporting documentation.

Step 4: Await Adjustment

Once you’ve submitted your claim, an insurance adjuster will be assigned to your case. They will review your claim, assess the damage, and determine the value of your claim. This process may involve an inspection of your property.

Step 5: Receive Payment

After the adjuster has evaluated your claim, you will receive a settlement offer. If you agree with the offer, you’ll receive payment for your claim. It’s important to understand that the payment may be subject to your policy’s deductible.

Step 6: Monitor and Follow Up

Keep track of your claim’s progress and follow up with your insurance company if you have any concerns or questions. Ensure that all repairs are completed to your satisfaction and that you receive reimbursement for any additional living expenses you may have incurred.

Conclusion

Homeowners insurance is a vital tool for protecting your home and belongings. By understanding the different types of coverage, exclusions, and the claims process, you can make informed decisions and ensure you have the right protection in place. Remember, your insurance policy is a contract, and it’s important to review it regularly to ensure it aligns with your changing needs and circumstances.

FAQ

What is the difference between dwelling coverage and personal property coverage in homeowners insurance?

+Dwelling coverage protects the physical structure of your home, including attached structures like a garage. On the other hand, personal property coverage safeguards your personal belongings, such as furniture, electronics, and clothing.

Are natural disasters like earthquakes and floods covered by standard homeowners insurance policies?

+No, natural disasters like earthquakes and floods are typically excluded from standard homeowners insurance policies. Separate policies or endorsements are often required to obtain coverage for these perils.

What should I do if I need to file a claim with my homeowners insurance provider?

+If you need to file a claim, contact your insurance company or agent as soon as possible. They will guide you through the claims process, which typically involves documenting the damage, completing a claim form, and awaiting an adjuster’s evaluation.

How can I choose the right coverage limits for my homeowners insurance policy?

+When choosing coverage limits, consider the cost to rebuild your home and the value of your personal belongings. Ensure that your dwelling coverage limit is sufficient to cover the cost of rebuilding and that your personal property coverage aligns with the value of your possessions. It’s a good idea to regularly review and update your coverage limits as your circumstances change.