What Is A Coinsurance In Health Insurance

Coinsurance is a fundamental concept in health insurance that significantly impacts how policyholders pay for their medical expenses. Understanding coinsurance is crucial for individuals seeking to make informed decisions about their healthcare coverage and financial responsibilities.

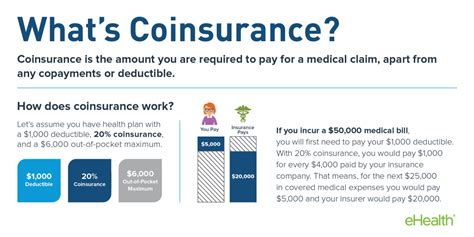

In the context of health insurance, coinsurance refers to the predetermined percentage of covered medical costs that an insured individual must pay after meeting their deductible. This arrangement is designed to share the financial burden of healthcare expenses between the insurance company and the policyholder. Coinsurance is a common feature in many health insurance plans, particularly those with higher deductibles, and it plays a vital role in managing healthcare costs for both insurers and insured individuals.

How Coinsurance Works

Coinsurance is activated once an individual's deductible has been met. The deductible is the initial amount of medical expenses the policyholder must pay out of pocket before the insurance coverage kicks in. After the deductible is satisfied, coinsurance takes over, and the insured is responsible for a specific percentage of the remaining covered medical expenses.

For instance, if an individual has a health insurance plan with a 20% coinsurance and a $1,000 deductible, they would first pay the $1,000 deductible. Once the deductible is met, the insured would then pay 20% of any additional covered medical expenses, while the insurance company covers the remaining 80%.

Example Scenario

Let's consider a hypothetical situation. John has a health insurance plan with a $1,500 deductible and a 30% coinsurance rate. John recently had a medical procedure that cost $5,000. Here's how the coinsurance would work in this case:

- First, John pays the $1,500 deductible.

- Since the deductible is met, coinsurance comes into play. John's insurance company will cover 70% of the remaining $3,500 (the difference between the total cost and the deductible), which is $2,450.

- John, on the other hand, will be responsible for the remaining 30%, which amounts to $1,050.

So, in this scenario, John's out-of-pocket expenses for the medical procedure would be the $1,500 deductible plus the $1,050 coinsurance payment, totaling $2,550.

| Expense Category | Amount |

|---|---|

| Total Medical Expenses | $5,000 |

| Deductible | $1,500 |

| Coinsurance (30%) | $1,050 |

| Insurance Coverage | $2,450 |

Coinsurance and Out-of-Pocket Maximums

While coinsurance helps spread the cost of healthcare, it's essential to understand the concept of out-of-pocket maximums. This is the maximum amount an insured individual will have to pay for covered medical expenses in a given year. Once the out-of-pocket maximum is reached, the insurance company covers 100% of eligible expenses for the remainder of the year.

For instance, if John's health insurance plan has an out-of-pocket maximum of $5,000, and he has already paid $4,000 in deductibles and coinsurance for various medical services, any additional covered expenses for the rest of the year would be fully covered by the insurance company.

Key Takeaways

- Coinsurance is a shared cost arrangement between the insured and the insurance company, activated after the deductible is met.

- Coinsurance rates can vary, impacting the policyholder's financial responsibility for covered medical expenses.

- Out-of-pocket maximums limit the insured's financial exposure, providing comprehensive coverage once the maximum is reached.

Tips for Navigating Coinsurance

Understanding coinsurance is crucial for making informed decisions about health insurance plans. Here are some tips to help navigate coinsurance effectively:

- Compare Plans: When choosing a health insurance plan, compare coinsurance rates alongside deductibles and other factors to find the best fit for your healthcare needs and financial situation.

- Estimate Costs: Use online tools or consult with insurance providers to estimate your potential out-of-pocket expenses based on your expected healthcare utilization.

- Review EOBs: Carefully review your Explanation of Benefits (EOB) statements from your insurance company to understand the breakdown of costs, including deductibles, coinsurance, and other expenses.

- Negotiate: If you anticipate significant medical expenses, consider negotiating with healthcare providers for discounts or payment plans to manage your out-of-pocket costs more effectively.

The Future of Coinsurance

As the healthcare landscape evolves, the role of coinsurance in health insurance plans may also undergo changes. With increasing healthcare costs and a focus on value-based care, insurance providers and policymakers are exploring innovative ways to manage costs and improve patient access to care.

One emerging trend is the shift towards more consumer-friendly coinsurance structures. Some insurance companies are experimenting with plans that offer lower coinsurance rates for preventive care and essential health services, encouraging policyholders to prioritize their health and seek necessary medical attention without incurring excessive out-of-pocket expenses.

Additionally, the integration of technology and data analytics is expected to play a significant role in shaping the future of coinsurance. Advanced analytics can help insurance providers more accurately predict healthcare utilization and costs, allowing for more precise setting of coinsurance rates and potentially reducing financial uncertainty for policyholders.

Key Considerations for the Future

- Consumer-Centric Coinsurance: Insurance providers may offer plans with reduced coinsurance for preventive care, promoting better health outcomes.

- Data-Driven Rates: Advanced analytics can lead to more accurate coinsurance rates, providing greater financial predictability for policyholders.

- Value-Based Care: The focus on value-based care models may influence coinsurance structures, encouraging cost-effective and high-quality healthcare.

How does coinsurance differ from copayments?

+Coinsurance and copayments are both methods of cost-sharing in health insurance, but they differ in how they are applied. Copayments are fixed amounts paid for specific services or prescriptions, regardless of the total cost. Coinsurance, on the other hand, is a percentage of the total cost after the deductible, making it more variable.

Can I choose my coinsurance rate when selecting a health insurance plan?

+Yes, when selecting a health insurance plan, you often have the option to choose from different plan types, each with its own coinsurance rate. Plans with lower coinsurance rates typically have higher premiums, while plans with higher coinsurance rates may have lower premiums. It’s essential to consider your healthcare needs and financial situation when making this choice.

Are there any exceptions to coinsurance coverage?

+Yes, some health insurance plans may have specific exceptions or limitations to coinsurance coverage. For example, certain services or treatments might be subject to different coinsurance rates or may not be covered at all. It’s crucial to review your plan’s coverage details and exclusions carefully to understand any potential limitations.