What Is Full Coverage Car Insurance

Full coverage car insurance is a comprehensive insurance policy that provides financial protection to vehicle owners in a wide range of situations. It goes beyond the basic liability coverage, offering additional protection against damage, theft, and other unforeseen events. In this article, we will delve into the intricacies of full coverage car insurance, exploring its components, benefits, and considerations for drivers.

Understanding Full Coverage Car Insurance

Full coverage car insurance is designed to offer a higher level of protection compared to standard liability insurance. It typically includes two main components: collision coverage and comprehensive coverage. Let’s break down these elements and understand how they work together to provide comprehensive protection.

Collision Coverage

Collision coverage is a vital aspect of full coverage insurance. It steps in when your vehicle sustains damage in an accident, regardless of who is at fault. Here’s a closer look at how collision coverage operates:

- Accidental Damage: This coverage handles repairs or replacements for your vehicle when it’s involved in a collision. Whether you collide with another car, a stationary object, or even roll over, collision coverage has you covered.

- At-Fault Accidents: In cases where you are deemed at fault for an accident, collision coverage ensures that the repairs to your vehicle are taken care of, providing peace of mind during challenging situations.

- Deductibles: Collision coverage usually comes with a deductible, which is the amount you pay out of pocket before the insurance kicks in. Deductibles can vary based on your policy and personal preferences.

Comprehensive Coverage

While collision coverage focuses on accidents, comprehensive coverage casts a wider net, protecting your vehicle from various non-collision incidents. Here’s what comprehensive coverage entails:

- Theft and Vandalism: If your vehicle is stolen or damaged by vandals, comprehensive coverage steps in to cover the costs, ensuring you’re not left footing the entire bill.

- Natural Disasters: From hailstorms to floods, comprehensive coverage has your back. It provides financial protection against damages caused by natural events, offering a safety net when Mother Nature unleashes her fury.

- Animal Collisions: Hitting an animal on the road can be an unexpected and costly event. Comprehensive coverage includes coverage for damages resulting from such incidents, providing much-needed financial relief.

- Glass Coverage: Many comprehensive policies include coverage for damaged windshields and windows, ensuring you don’t have to pay for costly glass repairs out of pocket.

The Benefits of Full Coverage

Full coverage car insurance offers a range of advantages that make it an attractive option for many drivers. Here are some key benefits to consider:

- Peace of Mind: With full coverage, you can drive with confidence, knowing that you’re protected against a wide array of potential incidents. It provides a sense of security, allowing you to focus on the road ahead without worrying about unforeseen expenses.

- Financial Protection: Full coverage insurance safeguards your investment in your vehicle. Whether it’s repairing accident damage, replacing a stolen car, or dealing with natural disasters, the financial burden is significantly reduced, ensuring your finances remain stable.

- Resale Value: Maintaining full coverage on your vehicle can positively impact its resale value. Buyers often prefer vehicles with a clean history and comprehensive insurance coverage, making it easier to sell your car down the line.

- Loan and Lease Requirements: If you have a car loan or lease, the lender may require full coverage insurance as a condition of the agreement. This ensures that the vehicle’s value is protected, benefiting both the lender and the borrower.

Considerations and Factors

While full coverage insurance offers numerous benefits, it’s essential to consider a few factors before making a decision:

Cost

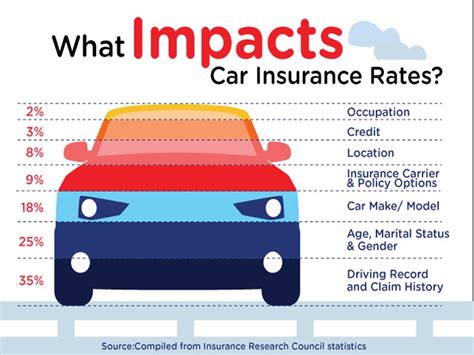

Full coverage insurance typically comes at a higher premium compared to basic liability coverage. The cost can vary based on several factors, including your driving history, the make and model of your vehicle, and the coverage limits you choose. It’s crucial to balance the cost with the level of protection you desire.

Vehicle Value

The value of your vehicle plays a significant role in determining the need for full coverage. If your car is older and has a lower resale value, the cost of full coverage may outweigh the potential benefits. On the other hand, for newer or luxury vehicles, full coverage can provide essential protection against significant financial losses.

Personal Preferences

Your individual preferences and risk tolerance are crucial factors. Some drivers prioritize peace of mind and opt for full coverage, while others may prefer to save on premiums by choosing more basic coverage. Assessing your comfort level and financial situation is key to making an informed decision.

Performance Analysis

To provide a deeper understanding of full coverage car insurance, let’s examine some real-world scenarios and how full coverage can make a difference:

Accident Scenario

Imagine you’re involved in a collision with another vehicle. With full coverage insurance, here’s how the process unfolds:

- Collision Coverage: Your insurance provider covers the repairs or replacement of your vehicle, ensuring it’s restored to its pre-accident condition.

- Liability Protection: If you’re found at fault, full coverage includes liability protection, covering the damages caused to the other party, including their vehicle and any medical expenses.

- No-Fault Benefit: Even if the accident wasn’t your fault, full coverage ensures that your vehicle is repaired without the hassle of dealing with the other driver’s insurance company.

Theft and Vandalism

In the unfortunate event of your vehicle being stolen or vandalized, comprehensive coverage steps in:

- Vehicle Replacement: If your car is stolen and not recovered, comprehensive coverage provides funds to replace it, ensuring you’re not left without transportation.

- Vandalism Repairs: In cases of vandalism, such as broken windows or damaged paintwork, comprehensive coverage covers the costs of repairs, getting your vehicle back to its original condition.

Natural Disaster

Natural disasters can cause extensive damage to vehicles. Here’s how comprehensive coverage can help:

- Flood Damage: If your car is submerged during a flood, comprehensive coverage provides coverage for the repairs or replacement, ensuring you’re not left with a non-functional vehicle.

- Hail Damage: In areas prone to hailstorms, comprehensive coverage covers the costs of repairing or replacing the damaged parts, including dented panels and shattered windshields.

Evidence-Based Future Implications

The world of insurance is constantly evolving, and full coverage car insurance is no exception. Here are some future implications and trends to consider:

Technological Advancements

With the rise of autonomous vehicles and advanced driver-assistance systems, insurance companies are exploring new ways to assess risk and offer tailored coverage. Full coverage policies may adapt to incorporate these technological advancements, providing specialized protection for self-driving cars.

Environmental Considerations

As environmental concerns grow, insurance companies are likely to incorporate eco-friendly practices and incentives into their policies. Full coverage insurance may include additional benefits for electric or hybrid vehicles, encouraging greener transportation choices.

Personalized Insurance

The future of insurance is moving towards personalized policies. Full coverage insurance may offer customizable options, allowing drivers to choose specific coverage limits and add-ons based on their unique needs and driving habits.

| Coverage Type | Key Benefits |

|---|---|

| Collision | Repairs or replacements for accident-related damage |

| Comprehensive | Protection against theft, vandalism, natural disasters, and more |

What is the difference between full coverage and liability insurance?

+

Full coverage insurance includes collision and comprehensive coverage, providing protection against a wide range of incidents. Liability insurance, on the other hand, only covers damages caused to others in an accident. Full coverage offers more extensive protection for your vehicle.

How much does full coverage insurance cost?

+

The cost of full coverage insurance varies based on factors like your driving history, vehicle type, and coverage limits. It’s typically more expensive than basic liability coverage, but it provides a higher level of protection.

Is full coverage insurance required by law?

+

While full coverage insurance is not legally mandated, lenders often require it for car loans and leases. Additionally, some states have specific requirements for comprehensive and collision coverage.

Can I customize my full coverage policy?

+

Yes, full coverage policies can be customized to meet your specific needs. You can choose coverage limits, deductibles, and even add optional coverages like rental car reimbursement or roadside assistance.