What Is Hra In Health Insurance

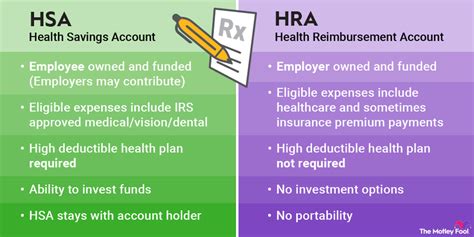

The healthcare industry is a complex network of services, policies, and regulations aimed at providing accessible and quality medical care to individuals. Among the myriad of terms and abbreviations, one that often sparks curiosity is HRA, which stands for Health Reimbursement Account or Health Reimbursement Arrangement.

An HRA, in essence, is a tax-advantaged savings account specifically designed to help individuals and families cover their medical expenses. It is a popular feature of many employer-sponsored health insurance plans, offering a unique way to manage healthcare costs effectively.

Understanding the Basics of Health Reimbursement Accounts

A Health Reimbursement Account is an employer-funded benefit plan that allows employers to reimburse their employees for qualified medical expenses. These expenses can include a wide range of healthcare services and products, providing a flexible and personalized approach to healthcare financing.

The key benefit of an HRA is its tax efficiency. Contributions made by the employer are tax-deductible, and the funds within the account grow tax-free. This means that employees can use the money in their HRA to pay for eligible expenses without incurring additional taxes, making it a highly attractive component of health insurance plans.

Eligibility and Coverage

Eligibility for an HRA typically depends on the specific plan offered by the employer. Some plans may cover all employees, while others might have certain criteria, such as minimum hours worked or full-time employment status. It's essential to review the details of your employer's plan to understand your eligibility.

In terms of coverage, HRAs can reimburse a variety of medical expenses, including doctor visits, prescription medications, dental and vision care, and even over-the-counter medications with a prescription. However, it's crucial to note that not all health-related expenses are eligible. For instance, cosmetic procedures and most fitness-related costs are generally not covered.

| Eligible Expenses | Non-Eligible Expenses |

|---|---|

| Doctor visits | Cosmetic procedures |

| Prescription medications | Most fitness expenses |

| Dental care | Nutritional supplements |

| Vision care | Non-prescription items |

How HRAs Work: A Step-by-Step Guide

The process of utilizing an HRA is straightforward, but it's important to understand each step to make the most of this benefit.

1. Enrollment and Funding

When an employer offers an HRA as part of their health insurance plan, employees typically have the option to enroll during the annual open enrollment period. During this time, employees can review the HRA terms, understand the eligible expenses, and decide if they want to participate.

Once enrolled, the employer funds the HRA account, contributing a predetermined amount for the plan year. This amount is often based on factors like the employee's position, years of service, or other criteria set by the employer.

2. Incurring Eligible Expenses

Throughout the plan year, employees incur eligible medical expenses. This can include routine check-ups, necessary treatments, or even unexpected health events. It's important to keep track of these expenses and retain the necessary documentation, such as receipts or itemized bills, as proof of the expense.

3. Reimbursement Process

Employees can then submit their eligible expenses for reimbursement. This process typically involves completing a reimbursement form and providing the required documentation. The employer or a designated HRA administrator reviews the claim and, if approved, reimburses the employee for the eligible amount.

Reimbursements can be made in various ways, including direct deposit, check, or even a prepaid card linked to the HRA account. Some plans may also allow for real-time reimbursement, where eligible expenses are automatically reimbursed at the point of sale, providing immediate financial relief.

4. Rollover and Annual Limits

One of the key advantages of HRAs is their rollover feature. Unlike some other health savings accounts, HRAs often allow unused funds to roll over to the next plan year. This means that employees don't lose the money contributed by their employer, providing a cumulative savings benefit over time.

However, it's important to note that HRAs typically have annual contribution limits set by the employer or regulatory bodies. These limits ensure that the accounts remain tax-advantaged and prevent excessive accumulation of funds.

Benefits and Considerations of Health Reimbursement Accounts

Health Reimbursement Accounts offer a range of advantages, both for employers and employees. For employers, HRAs can be a cost-effective way to provide comprehensive health insurance while managing their contribution levels. They also promote employee satisfaction and retention by offering a flexible and beneficial healthcare benefit.

From an employee's perspective, HRAs provide control over their healthcare spending. Employees can choose the healthcare providers and services that best suit their needs, knowing that eligible expenses will be reimbursed. This level of flexibility can be especially beneficial for those with unique healthcare needs or preferences.

Key Benefits of HRAs

- Tax advantages: HRAs offer tax-deductible contributions and tax-free growth, reducing the financial burden of medical expenses.

- Flexibility: Employees have the freedom to choose their healthcare providers and services, ensuring personalized care.

- Rollover feature: Unused funds can roll over to the next plan year, providing a cumulative savings benefit.

- Employer control: Employers can manage their contributions and set annual limits, making HRAs a cost-effective solution.

Considerations for HRAs

- Eligibility criteria: Not all employees may be eligible for an HRA, depending on the employer's plan.

- Expenses not covered: Certain health-related expenses, like cosmetic procedures, are generally not eligible for reimbursement.

- Administrative process: Submitting and managing reimbursement claims can be a task, requiring employees to keep track of expenses and documentation.

Health Reimbursement Accounts: A Future Perspective

The landscape of healthcare is continually evolving, and HRAs are no exception. As the demand for flexible and cost-effective healthcare solutions grows, HRAs are likely to become an increasingly popular component of health insurance plans.

Looking ahead, we can anticipate several trends and developments in the realm of HRAs:

1. Expanded Coverage

Many employers are already expanding the coverage of their HRAs to include a wider range of eligible expenses. This trend is likely to continue, offering employees greater financial support for their healthcare needs. For instance, some plans may start covering certain wellness programs or mental health services, recognizing the holistic nature of healthcare.

2. Digital Integration

With the increasing adoption of digital health technologies, we can expect HRAs to integrate more seamlessly with digital health platforms. This integration could streamline the reimbursement process, making it more efficient and user-friendly. For example, real-time reimbursement via mobile apps or digital wallets could become more common, providing immediate financial relief to employees.

3. Personalized Benefits

As the healthcare industry moves towards personalized medicine and precision health, HRAs could play a pivotal role in financing these tailored treatments. Employers may start offering customized HRA plans based on an employee's health profile, risk factors, or even genetic predispositions. This level of personalization could revolutionize the way we approach healthcare financing, ensuring that individuals receive the specific care they need.

4. Regulatory Changes

The regulatory environment surrounding health insurance is constantly evolving. While it's challenging to predict specific changes, we can anticipate ongoing efforts to simplify and standardize the complex landscape of health insurance benefits. This could impact the structure and administration of HRAs, potentially making them more accessible and easier to manage for both employers and employees.

Conclusion

Health Reimbursement Accounts are a valuable component of health insurance plans, offering tax efficiency, flexibility, and personalized healthcare financing. As we navigate the complexities of the healthcare industry, understanding the role and benefits of HRAs becomes increasingly important. Whether you're an employer seeking cost-effective solutions or an employee looking to maximize your health insurance benefits, HRAs are a powerful tool to consider.

Can I have an HRA if I’m not employed full-time?

+

Eligibility for an HRA often depends on the specific plan offered by the employer. While some plans may require full-time employment, others might have more flexible criteria. It’s best to check with your employer’s HR department to understand your eligibility.

Are there any limitations on how I can use my HRA funds?

+

Yes, HRA funds are intended for eligible medical expenses. While the exact eligible expenses may vary by plan, they typically include doctor visits, prescriptions, dental care, and vision care. It’s important to review your plan’s summary of benefits to understand what expenses are covered.

What happens if I leave my job? Can I keep my HRA funds?

+

When you leave your job, your access to the HRA may vary depending on the plan. Some plans allow you to keep any unused funds, while others may require you to spend down the balance within a certain timeframe. It’s crucial to understand the terms of your specific plan to know your options.