What Is Liability Insurance For Car

Unveiling the Essentials: Understanding Liability Insurance for Your Vehicle

In the intricate world of automotive ownership, liability insurance stands as a cornerstone, providing a critical safety net for drivers and vehicle owners. This form of coverage, often a legal requirement, is designed to protect policyholders from financial ruin in the event they are found legally responsible for causing injury or property damage to others in an accident. As such, it's a vital component of any responsible driver's insurance portfolio, offering peace of mind and a crucial layer of financial protection.

This article aims to provide an in-depth exploration of liability insurance for cars, delving into its various facets, benefits, and considerations. By the end, readers should have a comprehensive understanding of this essential insurance type, its role in automotive liability, and how it can be tailored to meet individual needs.

The Core of Liability Insurance: Understanding the Basics

Liability insurance for cars is a form of coverage that primarily focuses on the policyholder's legal liability for bodily injury or property damage to others as a result of a vehicular accident. It serves as a financial safeguard, ensuring that the policyholder is protected from potentially catastrophic costs that could arise from such incidents. This coverage is typically divided into two main categories: bodily injury liability and property damage liability.

Bodily Injury Liability

Bodily injury liability coverage is designed to cover the costs associated with injuries sustained by other parties involved in an accident caused by the policyholder. These costs can include medical expenses, rehabilitation costs, lost wages, and even pain and suffering damages. The policy will provide a specified amount of coverage, typically up to a set limit, to cover these expenses. For example, a policy with a $100,000 limit for bodily injury liability would cover up to $100,000 in expenses for each person injured in an accident, with a total of $300,000 available per accident if multiple people are injured.

Property Damage Liability

Property damage liability coverage, on the other hand, is responsible for covering the costs associated with damage to another person's property caused by the policyholder's vehicle. This could include damage to other vehicles, fences, buildings, or any other type of property. Similar to bodily injury liability, this coverage also has a specified limit, beyond which the policyholder would be responsible for covering costs out of pocket. For instance, if a policy has a $50,000 limit for property damage liability and an accident results in $60,000 worth of property damage, the policyholder would be responsible for the $10,000 excess.

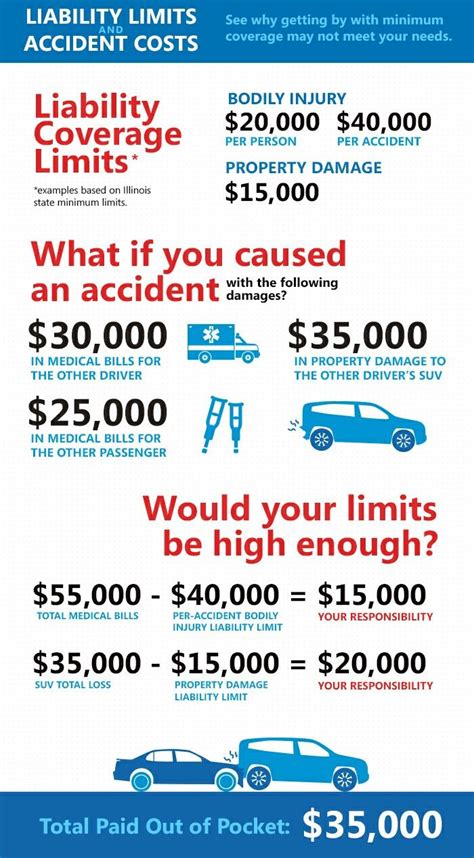

The Importance of Adequate Coverage Limits

Choosing appropriate coverage limits for liability insurance is a critical decision. While higher limits can provide greater financial protection, they also come with a higher premium. However, the potential costs of an accident can far exceed standard liability limits, especially in cases involving severe injuries or significant property damage. Therefore, it's crucial to strike a balance between affordable coverage and sufficient protection.

Consider a scenario where a policyholder, due to a severe accident, is found legally responsible for causing injuries that result in $500,000 in medical expenses and lost wages. If their bodily injury liability coverage limit is only $100,000, they would be personally responsible for the remaining $400,000, which could have devastating financial consequences. This is where the concept of "umbrella" or excess liability insurance comes into play. These policies provide additional coverage limits, offering an extra layer of protection beyond the standard liability limits of a car insurance policy.

Exploring Umbrella Liability Coverage

Umbrella liability insurance is an additional form of coverage that sits above a policyholder's existing liability policies, including their car insurance. It provides an extra layer of protection by offering higher liability limits, typically starting at $1 million and going up from there. This type of insurance is particularly beneficial for individuals who have substantial assets to protect or who face an increased risk of being sued due to their profession or lifestyle.

For instance, consider a doctor who, despite taking all necessary precautions, faces the risk of being sued for medical malpractice. With an umbrella liability policy, they can ensure that their assets, including their home, savings, and investments, are protected in the event of a costly lawsuit. The policy would cover any amount above the limits of their primary liability insurance, providing a crucial safety net.

The Role of Liability Insurance in Personal Injury Claims

Liability insurance plays a pivotal role in personal injury claims arising from vehicular accidents. When an individual is injured in an accident caused by another driver, their bodily injury liability coverage is often the first line of defense in covering the costs associated with their injuries. This can include immediate medical expenses, ongoing treatment costs, rehabilitation, and even lost wages due to an inability to work.

For example, let's consider a scenario where a pedestrian is hit by a car and sustains severe injuries, including a broken leg and head trauma. The pedestrian's medical expenses quickly mount, including ambulance fees, emergency room costs, surgery, and physical therapy. If the driver at fault has adequate liability insurance, this policy would cover these expenses, providing financial support to the injured party during their recovery.

The Impact of Liability Insurance on Property Damage Claims

Liability insurance is equally crucial in addressing property damage claims resulting from vehicular accidents. When a driver's vehicle causes damage to another person's property, their property damage liability coverage is activated to cover the costs of repairs or replacement. This can include damage to other vehicles, homes, fences, or any other type of property impacted by the accident.

Imagine a scenario where a driver loses control of their vehicle and crashes into a neighbor's fence, causing significant damage. In this case, the driver's property damage liability coverage would be responsible for covering the cost of repairing or replacing the fence. If the damage is extensive and the fence requires specialized repairs, the policy would provide the necessary funds to restore the property to its pre-accident condition.

Navigating the Process: Filing a Liability Insurance Claim

Filing a liability insurance claim involves a series of steps that policyholders should be familiar with. The process typically begins by reporting the accident to the insurance company as soon as possible. This initial report should include details about the accident, such as the date, time, location, and a description of what occurred. It's essential to provide accurate and detailed information to ensure a smooth claims process.

Once the claim is reported, the insurance company will initiate an investigation to determine liability. This may involve collecting statements from witnesses, reviewing police reports, and analyzing any available evidence. Based on the findings, the insurance company will determine whether the policyholder is at fault and responsible for covering the costs of the accident.

If liability is established, the insurance company will then assess the extent of the damages and the associated costs. This may involve requesting estimates or invoices for repairs, medical expenses, or other relevant costs. Once the damages are quantified, the insurance company will process the claim and provide payment up to the policy limits.

The Future of Liability Insurance: Technological Innovations and Changing Dynamics

The landscape of liability insurance is evolving, driven by technological advancements and changing societal dynamics. One significant trend is the increasing adoption of telematics, which uses data from sensors and GPS systems in vehicles to monitor driving behavior. This technology can provide insurance companies with real-time data on factors such as speed, acceleration, braking, and mileage, which can then be used to offer more personalized and accurate insurance rates based on individual driving habits.

Additionally, the rise of autonomous vehicles and shared mobility services is prompting a reevaluation of traditional liability models. As these technologies become more prevalent, questions arise about who is liable in the event of an accident involving an autonomous vehicle or a shared ride. Insurance companies are actively researching and developing new liability frameworks to address these emerging challenges.

Conclusion: A Comprehensive Approach to Liability Insurance

Liability insurance for cars is an indispensable component of responsible automotive ownership. By providing financial protection against the potential costs of causing injury or property damage to others, it offers peace of mind and crucial safeguards. Understanding the various aspects of liability insurance, from its core components to the importance of adequate coverage limits, is essential for making informed decisions about personal insurance needs.

As the field of automotive liability insurance continues to evolve, staying informed about the latest trends and innovations is crucial. From the increasing role of technology in personalizing insurance rates to the complex liability questions posed by autonomous vehicles, the future of liability insurance promises to be both challenging and exciting. By adopting a comprehensive and forward-thinking approach to liability coverage, drivers can ensure they are well-protected in an ever-changing automotive landscape.

What is the difference between liability insurance and collision insurance?

+

Liability insurance covers the costs associated with injuries or property damage caused to others by the policyholder’s vehicle. Collision insurance, on the other hand, covers the policyholder’s own vehicle in the event of an accident, regardless of who is at fault. It pays for repairs or replacement if the vehicle is damaged or totaled in a collision.

How do I choose the right liability insurance coverage limits?

+

Choosing the right liability limits involves balancing the need for adequate protection with affordability. Consider your personal assets and the potential costs of an accident. It’s generally recommended to have limits that are high enough to protect your assets but also manageable in terms of premium costs. Consulting with an insurance agent can help you determine the appropriate limits for your situation.

Can liability insurance cover legal expenses in the event of a lawsuit?

+

Yes, liability insurance often includes coverage for legal defense costs in the event of a lawsuit. This means that the insurance company will provide legal representation and cover the associated costs if you are sued for an accident that falls under your policy’s coverage. However, it’s important to note that liability insurance typically only covers the costs associated with defending the lawsuit and does not cover punitive damages or settlements.