What Is Out Of Pocket In Health Insurance

Understanding Out-of-Pocket Costs in Health Insurance

Health insurance is a vital aspect of modern healthcare, providing financial protection and access to essential medical services. One crucial concept within health insurance is the idea of out-of-pocket costs, which play a significant role in determining the financial responsibility of policyholders. In this comprehensive guide, we will delve into the intricacies of out-of-pocket expenses, exploring their various forms, how they impact healthcare expenses, and strategies to manage and minimize these costs effectively.

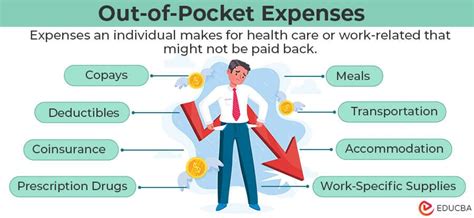

Out-of-pocket costs refer to the expenses that an individual or family must pay directly for healthcare services, which are not fully covered by their insurance plan. These costs are an essential component of health insurance, as they encourage policyholders to make informed decisions about their healthcare and promote the efficient use of medical resources. Understanding out-of-pocket expenses is crucial for individuals to make informed choices about their health insurance plans and to effectively manage their healthcare finances.

Types of Out-of-Pocket Costs

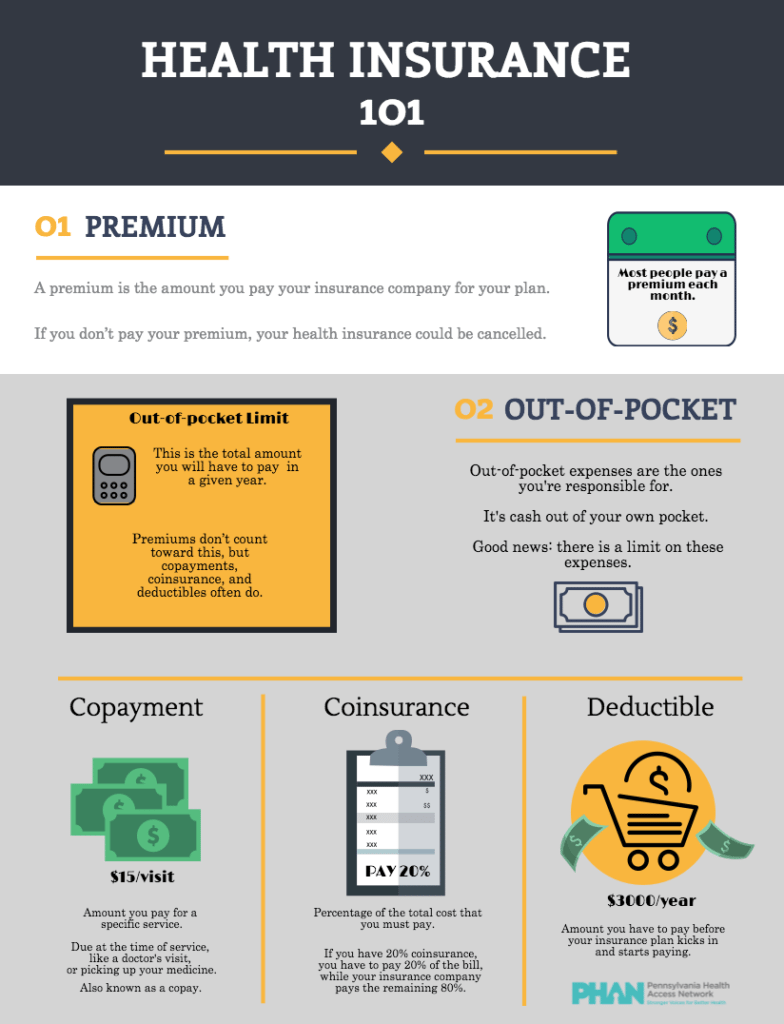

Out-of-pocket costs can manifest in several forms, each serving a specific purpose within the healthcare system. The primary types of out-of-pocket expenses include:

Deductibles: Deductibles are a fixed amount that policyholders must pay before their insurance coverage begins. For example, if you have a 1,500 deductible, you will need to pay for the first 1,500 of your medical expenses before your insurance plan starts covering the costs. Deductibles can vary widely depending on the insurance plan and can be a significant factor in the overall cost of healthcare.

Coinsurance: Coinsurance is the percentage of medical costs that the policyholder is responsible for paying after the deductible has been met. For instance, if your insurance plan has an 80⁄20 coinsurance ratio, you will pay 20% of the medical expenses, while the insurance company covers the remaining 80%. Coinsurance rates can differ based on the type of service and the specific insurance plan.

Copayments: Copayments, or copays, are fixed amounts that policyholders pay for specific healthcare services, regardless of the overall cost of the service. For example, you might have a 25 copay for a doctor's office visit or a 50 copay for a prescription medication. Copays are typically set by the insurance company and can vary based on the type of service and the policyholder’s plan.

Maximum Out-of-Pocket Limit: The maximum out-of-pocket limit, or out-of-pocket maximum, is the maximum amount that a policyholder will pay for covered services in a given year. This limit includes deductibles, coinsurance, and copays. Once the policyholder reaches this limit, the insurance company covers 100% of the covered expenses for the remainder of the year. Maximum out-of-pocket limits vary by insurance plan and are designed to provide financial protection to policyholders.

Excluded Services: Certain healthcare services may not be covered by insurance plans and are considered excluded services. Policyholders are responsible for paying the full cost of these services out of pocket. Examples of excluded services can include cosmetic procedures, alternative therapies, or certain types of medical devices. It is essential to review the details of your insurance plan to understand which services are excluded.

The Impact of Out-of-Pocket Costs

Out-of-pocket expenses can significantly influence healthcare decisions and financial planning. Here’s how they impact policyholders:

Financial Protection: Out-of-pocket costs, particularly deductibles and maximum out-of-pocket limits, provide financial protection to policyholders. They ensure that individuals do not face catastrophic medical expenses, as the insurance plan covers a significant portion of the costs once the out-of-pocket limits are reached.

Incentivizing Cost-Effective Care: By requiring policyholders to pay a portion of their healthcare expenses, out-of-pocket costs encourage individuals to make cost-conscious decisions. This can lead to the efficient use of medical resources and discourage unnecessary or excessive healthcare utilization.

Impact on Access to Care: High out-of-pocket costs can potentially hinder access to healthcare for individuals with limited financial means. Policyholders may delay or forego necessary medical treatments or procedures due to the financial burden, which can have adverse health consequences.

Comparing Insurance Plans: Out-of-pocket expenses are a critical factor when comparing and selecting health insurance plans. Policyholders must consider the balance between premiums, deductibles, coinsurance, and copays to find a plan that aligns with their healthcare needs and financial situation.

Strategies to Manage Out-of-Pocket Costs

Managing out-of-pocket expenses is essential to ensure financial stability and access to necessary healthcare services. Here are some strategies to consider:

Choose the Right Insurance Plan: Select an insurance plan that aligns with your healthcare needs and financial situation. Consider factors such as premium costs, deductibles, coinsurance rates, and the types of services covered. Research and compare plans to find the best fit for your circumstances.

Utilize Preventive Care: Many insurance plans cover preventive services, such as annual check-ups, vaccinations, and screenings, at no additional cost. Taking advantage of these services can help detect potential health issues early on, potentially reducing the need for more costly treatments in the future.

Negotiate Medical Bills: If you receive a medical bill that seems excessive or contains errors, it is within your rights to negotiate the amount. Contact the healthcare provider or billing department to discuss the charges and explore options for reducing the cost. Many providers are open to negotiations, especially for self-pay patients.

Consider Health Savings Accounts (HSAs): Health Savings Accounts are tax-advantaged accounts that allow individuals to save money specifically for healthcare expenses. HSAs are often paired with high-deductible health insurance plans, providing a way to set aside pre-tax funds to cover out-of-pocket costs. The funds in an HSA can be used to pay for qualified medical expenses and can be carried over year to year.

Seek Financial Assistance: If you are facing significant financial challenges due to medical expenses, explore options for financial assistance. Many hospitals and healthcare organizations offer financial aid programs, and there may be government-funded programs or charitable organizations that provide support for individuals with low incomes or specific medical conditions.

The Future of Out-of-Pocket Costs

The landscape of health insurance and out-of-pocket costs is continually evolving. Here are some key trends and developments to consider:

Increasing Deductibles: In recent years, there has been a trend towards higher deductibles in health insurance plans. This shift is driven by the desire to control healthcare costs and encourage policyholders to take a more active role in managing their healthcare expenses. However, it is essential to strike a balance between affordability and access to care.

Value-Based Care Models: Value-based care models, such as accountable care organizations (ACOs) and patient-centered medical homes (PCMHs), are gaining traction in the healthcare industry. These models aim to improve the quality of care while reducing costs by incentivizing healthcare providers to coordinate care and focus on patient outcomes. As these models become more widespread, they may impact the structure of out-of-pocket costs.

Telehealth and Digital Health: The COVID-19 pandemic has accelerated the adoption of telehealth and digital health solutions. These technologies offer convenient and cost-effective alternatives to traditional in-person healthcare. As telehealth becomes more integrated into the healthcare system, it may influence the structure of out-of-pocket costs, potentially reducing expenses for certain services.

Consumer-Driven Healthcare: Consumer-driven healthcare models, such as health reimbursement arrangements (HRAs) and reference-based pricing, are gaining attention. These models aim to empower consumers by providing them with more control over their healthcare decisions and expenses. While these models have the potential to reduce costs, they also come with certain risks and complexities that policyholders should be aware of.

Conclusion

Out-of-pocket costs are an integral part of health insurance, shaping the financial responsibility of policyholders and influencing healthcare decisions. Understanding the different types of out-of-pocket expenses, their impact, and strategies to manage them is crucial for individuals to navigate the complex world of healthcare finances effectively. As the healthcare industry continues to evolve, staying informed about trends and developments in out-of-pocket costs will empower individuals to make informed choices and take control of their healthcare journey.

What is the difference between a deductible and a copay?

+A deductible is a fixed amount that you must pay before your insurance coverage begins, while a copay is a set amount you pay for specific healthcare services regardless of the overall cost. Deductibles are typically larger amounts and are paid once per year, whereas copays are smaller and more frequent.

How can I reduce my out-of-pocket expenses?

+You can reduce out-of-pocket expenses by choosing an insurance plan with lower deductibles and coinsurance rates, utilizing preventive care services, negotiating medical bills, and exploring financial assistance programs.

Are there any exceptions to out-of-pocket costs?

+Yes, some insurance plans offer exceptions or waivers for certain out-of-pocket costs. For example, some plans may waive copays for emergency room visits or cover certain preventive services at no cost. It’s important to review your insurance plan’s details to understand any exceptions.