What Is Recommended For Car Insurance Coverage

Securing adequate car insurance coverage is an essential aspect of responsible vehicle ownership. The recommended coverage levels can vary based on several factors, including your personal circumstances, the value of your vehicle, and the specific laws and regulations in your region. This comprehensive guide aims to delve into the intricacies of car insurance coverage, offering insights and recommendations to help you make informed decisions about your policy.

Understanding Car Insurance Coverage Options

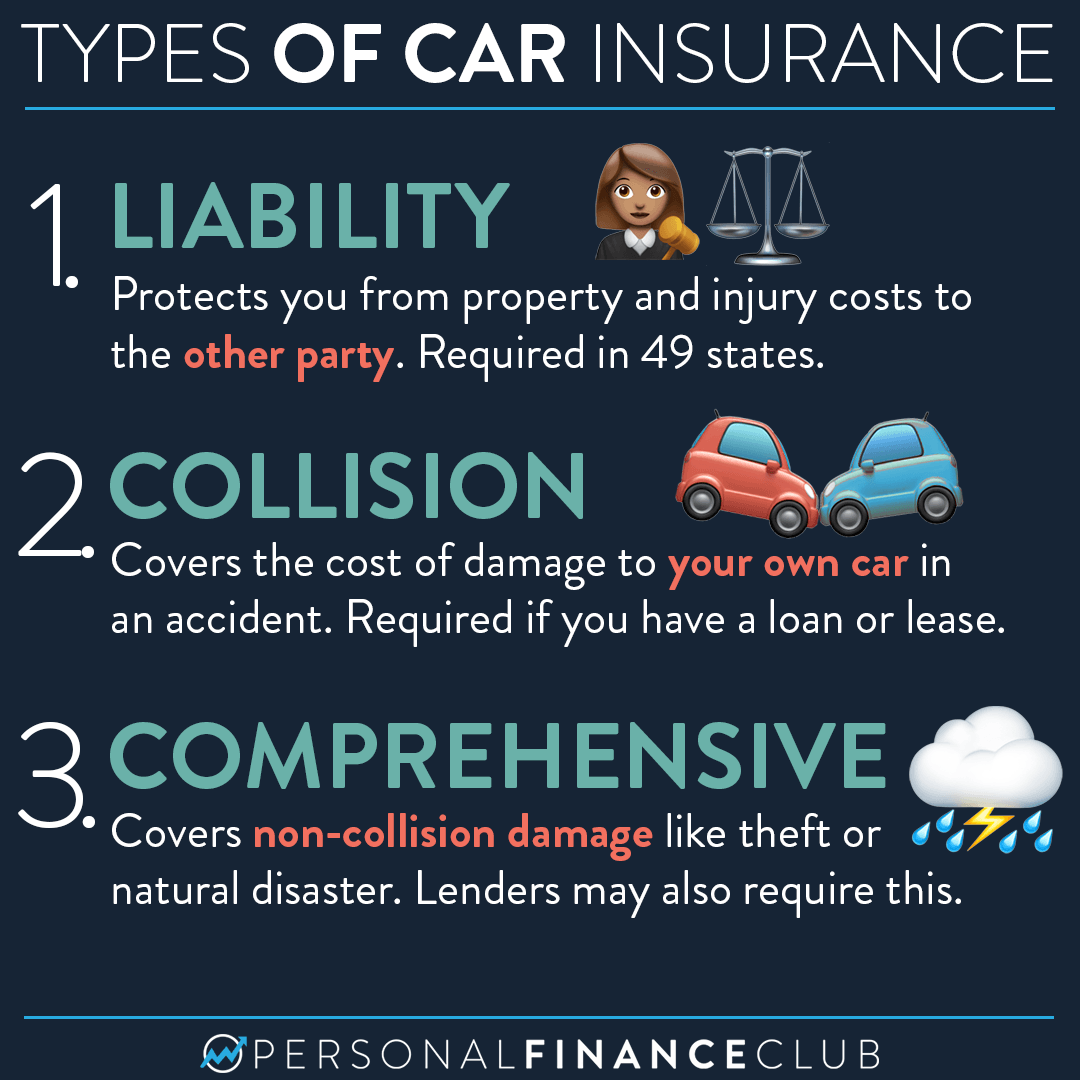

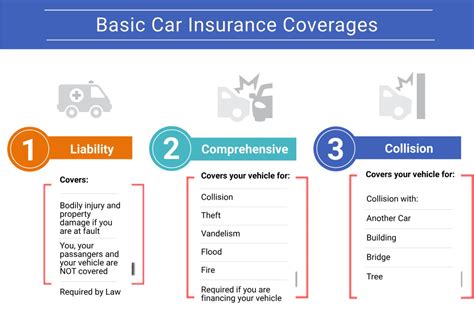

Car insurance policies typically consist of various coverage types, each designed to address specific risks and liabilities associated with vehicle ownership. Here's a breakdown of the key coverage options and their significance:

Liability Coverage

Liability coverage is a fundamental component of any car insurance policy. It protects you financially in the event that you are found legally responsible for causing bodily injury or property damage to others in an accident. This coverage is mandatory in most states and is typically divided into two categories:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other related costs for individuals injured in an accident for which you are held responsible.

- Property Damage Liability: This coverage covers the cost of repairing or replacing damaged property, including other vehicles, fences, buildings, and even roadside signs, if you cause an accident.

It's crucial to ensure that your liability coverage limits are adequate to protect your assets. The recommended minimum limits vary by state and can be influenced by factors such as the cost of living and medical expenses in your area.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional add-ons to your car insurance policy, but they are highly recommended for comprehensive protection.

- Collision Coverage: This coverage pays for the repair or replacement of your vehicle if it's damaged in a collision with another vehicle or object, regardless of who is at fault. It's particularly beneficial if you own a newer or more expensive vehicle.

- Comprehensive Coverage: Comprehensive coverage provides protection against damages caused by non-collision incidents, such as theft, vandalism, natural disasters (e.g., hail, storms), or collisions with animals. It offers peace of mind for vehicle owners facing unpredictable circumstances.

Medical Payments (MedPay) and Personal Injury Protection (PIP)

Medical Payments and Personal Injury Protection are coverage options designed to provide financial assistance for medical expenses incurred by you or your passengers after an accident, regardless of fault.

- Medical Payments (MedPay): MedPay covers reasonable and necessary medical expenses, such as doctor visits, hospital stays, and even funeral expenses. It can be a valuable addition to your policy, especially if you have high out-of-pocket healthcare costs.

- Personal Injury Protection (PIP): PIP coverage is more comprehensive than MedPay and may include additional benefits like income loss, child care, and funeral expenses. The specific coverage limits and benefits can vary by state and policy.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an essential safeguard against financial losses resulting from accidents caused by drivers who either lack insurance or have inadequate coverage. This coverage can provide compensation for medical expenses, lost wages, and other related costs in such scenarios.

Recommended Coverage Levels

The recommended car insurance coverage levels can vary based on several factors. Here's a comprehensive guide to help you determine the appropriate coverage for your situation:

Liability Coverage

The recommended liability coverage limits can be influenced by several factors, including:

- State Requirements: Every state has minimum liability coverage requirements, which typically range from $25,000 to $50,000 for bodily injury per person and $50,000 to $100,000 for bodily injury per accident. These limits may not be sufficient to fully protect your assets in the event of a severe accident, so it's advisable to consider higher limits.

- Cost of Living and Medical Expenses: Areas with higher costs of living and medical expenses may warrant higher liability coverage limits. This ensures that you have adequate protection in the event of a serious accident.

- Asset Protection: If you have significant assets, such as a home, investments, or savings, it's crucial to have liability coverage that exceeds the minimum requirements. This safeguards your financial stability in the event of a major accident for which you are held responsible.

| Recommended Liability Coverage Limits | Explanation |

|---|---|

| Bodily Injury Liability: $100,000 per person / $300,000 per accident | This level of coverage provides a reasonable balance between cost and protection, ensuring that you have adequate coverage for most scenarios. |

| Property Damage Liability: $100,000 per accident | This limit is generally sufficient to cover most property damage claims, but consider increasing it if you frequently drive in areas with high property values. |

Collision and Comprehensive Coverage

Whether you should opt for collision and comprehensive coverage depends on several factors, including the age and value of your vehicle.

- Vehicle Age and Value: If your vehicle is older and has a lower resale value, the cost of collision and comprehensive coverage may outweigh the benefits. In such cases, you might consider forgoing these coverages to save on premiums.

- Financial Stability: If you have sufficient savings or assets to cover the cost of repairing or replacing your vehicle in the event of an accident or other covered loss, you may opt for higher deductibles or even forego collision and comprehensive coverage.

- Risk Factors: Consider your driving habits and the risk factors associated with your vehicle. If you drive in high-risk areas or have a history of accidents, collision and comprehensive coverage can provide valuable protection.

| Recommended Coverage Levels | Considerations |

|---|---|

| Collision Coverage: Deductible of $500 | A $500 deductible is a common choice, providing a balance between affordability and coverage. Consider adjusting the deductible based on your financial situation and risk tolerance. |

| Comprehensive Coverage: Deductible of $500 | Similar to collision coverage, a $500 deductible is a standard choice. Evaluate your risk factors and adjust the deductible accordingly. |

Medical Payments and Personal Injury Protection

Medical Payments (MedPay) and Personal Injury Protection (PIP) coverage can be crucial for covering medical expenses after an accident. The recommended coverage levels depend on several factors, including:

- Healthcare Costs: If you have high out-of-pocket healthcare costs, it's advisable to opt for higher MedPay or PIP limits. This ensures that your medical expenses are fully covered in the event of an accident.

- State Requirements: Some states mandate specific MedPay or PIP limits. Ensure that you meet these requirements and consider increasing the limits to provide additional protection.

| Recommended Coverage Limits | Explanation |

|---|---|

| MedPay: $5,000 per person | This limit provides a reasonable level of coverage for medical expenses, but consider increasing it if you have high healthcare costs or frequently travel with passengers. |

| PIP: Varies by State | PIP coverage limits can vary significantly by state. Consult your insurance provider or local regulations to determine the appropriate limits for your area. |

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an essential safeguard against financial losses resulting from accidents caused by uninsured or underinsured drivers. The recommended coverage limits can be influenced by several factors, including:

- State Requirements: Some states mandate specific UM/UIM coverage limits. Ensure that you meet these requirements and consider increasing the limits to provide additional protection.

- Financial Stability: If you have significant assets or a high income, it's crucial to have adequate UM/UIM coverage to protect your financial well-being in the event of an accident with an uninsured or underinsured driver.

| Recommended Coverage Limits | Explanation |

|---|---|

| Uninsured Motorist Bodily Injury: $100,000 per person / $300,000 per accident | This level of coverage provides a reasonable balance between cost and protection, ensuring that you have adequate coverage for most scenarios involving uninsured drivers. |

| Underinsured Motorist Bodily Injury: $100,000 per person / $300,000 per accident | Similar to uninsured motorist coverage, this level provides sufficient protection against financial losses caused by underinsured drivers. |

Additional Considerations and Recommendations

When determining your car insurance coverage, it's essential to consider your unique circumstances and needs. Here are some additional factors to keep in mind:

Multiple Vehicles

If you own multiple vehicles, you may benefit from bundling your car insurance policies. Many insurance companies offer discounts when you insure multiple vehicles with them. This can result in significant savings on your premiums.

Discounts and Savings

Explore various discounts and savings opportunities offered by insurance providers. Common discounts include safe driver discounts, multi-policy discounts, and loyalty discounts. By taking advantage of these savings, you can reduce your insurance costs while maintaining adequate coverage.

Roadside Assistance and Rental Car Coverage

Consider adding roadside assistance and rental car coverage to your policy, especially if you frequently travel long distances or rely on your vehicle for daily commuting. These coverages can provide valuable peace of mind in the event of a breakdown or accident.

Personalized Insurance Advice

It's always beneficial to consult with an insurance professional who can provide personalized advice based on your specific needs and circumstances. They can help you understand the intricacies of car insurance coverage and guide you toward the most suitable policy for your situation.

Frequently Asked Questions

What is the difference between liability coverage and collision coverage?

+

Liability coverage is designed to protect you financially if you cause bodily injury or property damage to others in an accident. Collision coverage, on the other hand, provides coverage for damages to your own vehicle if it’s involved in a collision, regardless of fault.

Do I need comprehensive coverage if I have collision coverage?

+

While collision coverage protects against damages resulting from collisions, comprehensive coverage provides protection for non-collision incidents, such as theft, vandalism, and natural disasters. Consider adding comprehensive coverage to your policy for more comprehensive protection.

What happens if I don’t have enough liability coverage in an accident?

+

If you don’t have adequate liability coverage and are found at fault in an accident, you may be held personally liable for any damages exceeding your policy limits. This can result in significant out-of-pocket expenses, so it’s crucial to ensure you have sufficient liability coverage.