What Type Of Life Insurance Is Best

Life insurance is an essential financial tool that provides peace of mind and security for individuals and their loved ones. With various types of life insurance policies available, choosing the best option can be a daunting task. However, understanding the unique features and benefits of each type can help individuals make informed decisions based on their specific needs and circumstances.

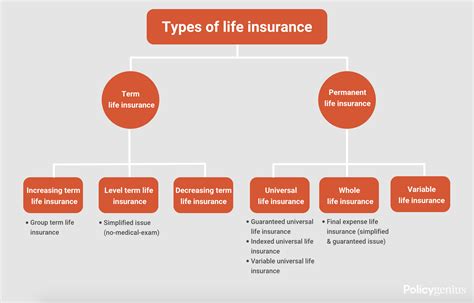

Term Life Insurance: The Flexible Option

Term life insurance is one of the most common and flexible types of life insurance policies. It offers coverage for a specified period, known as the term, typically ranging from 10 to 30 years. During this term, the policyholder pays a fixed premium, and in the event of their death, the beneficiaries receive a tax-free lump sum payment.

One of the key advantages of term life insurance is its affordability. Compared to other types of life insurance, term policies often have lower premiums, making them an attractive option for individuals on a budget. This type of insurance is particularly suitable for those who have temporary financial obligations, such as young families with children or individuals with significant debt.

Renewal and Conversion Options

Term life insurance policies often come with the option to renew or convert them into permanent insurance. At the end of the term, policyholders can choose to renew their coverage, usually at a higher premium due to increased age and potential health risks. Alternatively, some term policies allow conversion to a permanent plan without the need for a medical exam, ensuring continued coverage.

| Renewal Option | Conversion Option |

|---|---|

| Increased premium | No medical exam required |

Renewal and conversion options provide flexibility and peace of mind, allowing individuals to adapt their coverage as their financial situation and needs evolve.

Whole Life Insurance: Permanent Protection

Whole life insurance, also known as permanent life insurance, provides lifelong coverage and is a popular choice for individuals seeking long-term financial protection. Unlike term insurance, whole life policies do not expire and remain in effect until the policyholder’s death, provided premiums are paid.

One of the key benefits of whole life insurance is its cash value component. This unique feature allows policyholders to build savings within their insurance policy. A portion of each premium payment goes towards the death benefit, while the remainder accumulates as cash value, which can be accessed through loans or withdrawals.

Guaranteed Benefits and Premium Payments

Whole life insurance offers guaranteed benefits, meaning the death benefit amount remains fixed throughout the policy’s lifetime. Additionally, the premiums for whole life insurance are typically level, meaning they remain the same from the start, providing predictability and stability for policyholders.

| Benefits | Premium Payments |

|---|---|

| Guaranteed death benefit | Level premiums |

| Cash value accumulation | Fixed throughout the policy |

Whole life insurance is an attractive option for individuals seeking long-term financial security and a way to pass on wealth to their beneficiaries. The guaranteed benefits and cash value accumulation make it a reliable choice for estate planning and legacy building.

Universal Life Insurance: Customizable Coverage

Universal life insurance is a flexible type of permanent insurance that allows policyholders to customize their coverage and premiums. This policy combines a death benefit with a savings component, similar to whole life insurance, but with added flexibility.

One of the key advantages of universal life insurance is its adjustable premiums. Policyholders can choose to pay more or less than the standard premium, providing them with the ability to adapt their coverage to their changing financial circumstances. The savings component within the policy can be used to cover any premium adjustments, ensuring the policy remains in force.

Flexibility and Investment Opportunities

Universal life insurance policies offer a high degree of flexibility in terms of death benefit amounts and premium payments. Policyholders can increase or decrease their death benefit as their needs change, and they have control over the timing and amount of premium payments. This flexibility makes universal life insurance an attractive option for individuals with fluctuating income or those seeking investment opportunities within their insurance policy.

| Premium Payments | Death Benefit Flexibility |

|---|---|

| Adjustable | Customizable |

| Controlled by policyholder | Adaptable to changing needs |

The savings component within universal life insurance policies can be invested in various options, such as mutual funds or fixed-income securities. This investment feature allows policyholders to potentially earn higher returns on their savings, adding to the overall value of their policy.

Comparative Analysis: Choosing the Right Fit

When deciding on the best type of life insurance, it’s essential to consider individual needs and financial circumstances. Term life insurance is ideal for those seeking temporary coverage or budget-friendly options. Whole life insurance offers permanent protection and guaranteed benefits, making it suitable for long-term financial planning and estate building.

Universal life insurance provides a balance between term and whole life, offering flexibility in coverage and premium payments. It is an attractive choice for individuals who want control over their policy and the potential for investment growth.

Key Considerations

Here are some key factors to consider when choosing the best life insurance type:

- Financial goals and obligations

- Desired coverage period

- Budget and affordability

- Need for flexibility in coverage and premiums

- Investment opportunities and savings potential

By evaluating these factors and understanding the unique features of each life insurance type, individuals can make informed decisions and secure the best coverage for their specific needs.

The Future of Life Insurance

The life insurance industry is continuously evolving, with advancements in technology and changing consumer preferences. As digital transformation takes hold, life insurance companies are embracing innovative solutions to enhance the customer experience and improve policy accessibility.

One notable trend is the integration of digital tools and artificial intelligence (AI) into the insurance process. AI-powered chatbots and online platforms offer efficient and convenient ways for individuals to research, compare, and purchase life insurance policies. These digital solutions provide instant quotes, personalized recommendations, and streamlined application processes, making it easier for consumers to navigate the complex world of life insurance.

Enhanced Customer Experience

The future of life insurance lies in creating a seamless and personalized customer experience. Insurance companies are investing in data analytics and customer relationship management (CRM) systems to better understand consumer needs and preferences. By leveraging advanced analytics, insurers can offer tailored coverage options and provide personalized advice, ensuring that individuals receive the right type of life insurance for their unique circumstances.

Additionally, the rise of parametric insurance and microinsurance models is reshaping the industry. Parametric insurance, which pays out based on predefined parameters rather than individual claims, offers a more affordable and accessible option for individuals with limited resources. Microinsurance, on the other hand, provides small-scale coverage to underserved populations, ensuring that everyone has access to some form of life insurance protection.

| Digital Tools and AI | Enhanced Customer Experience |

|---|---|

| AI-powered chatbots | Data analytics |

| Online platforms | CRM systems |

| Instant quotes | Tailored coverage options |

As the life insurance industry embraces these technological advancements and innovative models, the future looks promising. Consumers can expect more efficient and personalized services, while insurers can enhance their reach and cater to a wider range of individuals, ensuring that life insurance remains an accessible and valuable financial tool for all.

What is the main difference between term life insurance and whole life insurance?

+The primary difference lies in the duration of coverage and the associated costs. Term life insurance provides coverage for a specified term, typically 10-30 years, and has lower premiums. Whole life insurance, on the other hand, offers permanent coverage with level premiums and includes a cash value component, making it more expensive but providing long-term financial benefits.

Can I convert my term life insurance policy into a permanent one?

+Yes, many term life insurance policies offer a conversion option, allowing you to convert your term policy into a permanent one without a medical exam. This provides long-term coverage and the benefits of permanent insurance.

How does universal life insurance differ from whole life insurance?

+Universal life insurance offers more flexibility in terms of premium payments and death benefit amounts. It allows policyholders to adjust their coverage and premiums based on their financial circumstances. Whole life insurance, on the other hand, has fixed premiums and death benefits, providing guaranteed benefits and long-term financial protection.

Are there any tax benefits associated with life insurance policies?

+Yes, life insurance policies offer tax advantages. The death benefit received by beneficiaries is typically tax-free, providing financial security without the burden of taxes. Additionally, the cash value component in permanent life insurance policies can offer tax-deferred growth, making it an attractive savings option.