Whats The Difference Between Term Life And Whole Life Insurance

Understanding the nuances between different types of life insurance policies is crucial for making informed decisions about your financial future. Among the various options available, term life and whole life insurance stand out as two distinct categories, each with its own set of advantages and considerations. This comprehensive guide aims to demystify these policies, providing a detailed analysis to help you choose the coverage that aligns best with your needs and goals.

Term Life Insurance: A Temporal Solution

Term life insurance is a straightforward and affordable option, designed to provide financial protection for a specific period of time, often ranging from 10 to 30 years. It is ideal for individuals who seek coverage during a particular life stage, such as raising a family or paying off a mortgage.

Key Features and Benefits

- Affordability: Term life policies are generally more cost-effective compared to whole life insurance, making them accessible to a wider range of budgets.

- Flexibility: The duration of coverage can be tailored to fit your needs, allowing you to choose a term that aligns with your financial responsibilities.

- Pure Protection: The primary purpose of term life insurance is to offer a death benefit to your beneficiaries if you pass away during the policy term.

- Level Premiums: You can expect consistent premium payments throughout the term, providing budget predictability.

- Renewal Options: Most policies offer the ability to renew at the end of the term, though premiums may increase with age.

Real-World Example

Consider a 35-year-old individual with a family and a mortgage. A 20-year term life insurance policy with a $1 million death benefit can provide peace of mind, ensuring their family’s financial stability if the unexpected were to occur. The policy’s affordability allows for additional savings or investments, catering to short-term financial goals.

Performance and Analysis

| Category | Term Life Insurance |

|---|---|

| Coverage Period | 10–30 years |

| Premium Flexibility | Limited, but renewable |

| Death Benefit | Typically higher due to temporary nature |

| Cash Value | None |

| Suitability | Short-term financial protection needs |

Whole Life Insurance: A Lifetime Commitment

Whole life insurance, also known as permanent life insurance, is a comprehensive coverage option that provides financial protection for your entire life. This type of policy not only offers a death benefit but also accumulates cash value over time, making it a versatile financial tool.

Key Attributes and Advantages

- Lifetime Coverage: Whole life insurance ensures you are covered for your entire life, regardless of changes in health or circumstances.

- Cash Value Accumulation: A portion of your premiums is invested, growing tax-deferred over time, which can be borrowed against or withdrawn if needed.

- Guaranteed Death Benefit: Unlike term life, the death benefit remains stable throughout your life, providing long-term financial security for your beneficiaries.

- Fixed Premiums: Premium payments remain the same throughout your life, offering long-term budget predictability.

- Policy Loans: The cash value accumulated can be used as collateral for policy loans, providing access to funds without surrender penalties.

Real-World Application

Imagine a 40-year-old business owner who wants to ensure their business’s future and provide for their family’s long-term financial stability. A whole life insurance policy can serve as a stable financial foundation, offering a death benefit to secure the business’s future and providing the policyholder with the flexibility to access funds through policy loans or withdrawals.

Performance Metrics

| Category | Whole Life Insurance |

|---|---|

| Coverage Period | Lifetime |

| Premium Flexibility | Fixed throughout life |

| Death Benefit | Stable and guaranteed |

| Cash Value | Accumulates over time |

| Suitability | Long-term financial planning and stability |

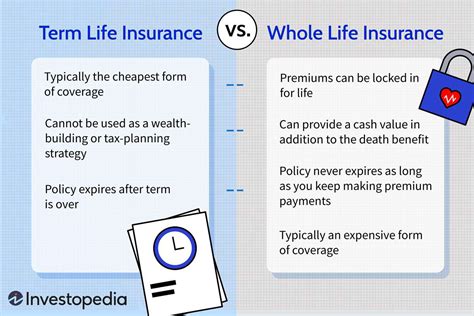

Comparative Analysis: Term Life vs. Whole Life

Choosing between term life and whole life insurance depends on your unique financial situation and goals. Term life is ideal for temporary coverage needs, offering affordability and flexibility, while whole life provides long-term financial security and the added benefit of cash value accumulation.

Key Differences

- Coverage Duration: Term life is temporary, while whole life is permanent.

- Cost: Term life is generally more affordable, but whole life offers fixed premiums.

- Death Benefit: Term life offers higher benefits, while whole life guarantees a stable benefit.

- Cash Value: Whole life policies accumulate cash value, providing additional financial flexibility.

- Flexibility: Term life offers more flexibility in terms of coverage duration and renewability.

Choosing the Right Option

When deciding between term life and whole life insurance, consider your financial goals, the duration of coverage needed, and your budget. Term life is an excellent choice for short-term financial protection, while whole life provides a comprehensive solution for long-term financial planning and stability.

Expert Tips

- Evaluate your financial responsibilities and goals to determine the appropriate coverage period.

- Compare quotes from multiple insurers to find the best rates and coverage for your needs.

- Consider the impact of policy loans and withdrawals on your whole life insurance policy’s cash value.

- Seek professional advice to ensure you make an informed decision tailored to your unique circumstances.

Frequently Asked Questions

Can I convert my term life insurance to whole life insurance?

+Yes, many term life insurance policies offer a conversion option, allowing you to convert your term policy to a permanent life insurance policy, such as whole life, without undergoing a new medical exam.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, you will no longer be covered. However, you may have the option to renew the policy for a longer term or convert it to a permanent life insurance policy.

Are there any tax benefits associated with whole life insurance policies?

+Yes, whole life insurance policies offer tax advantages. The cash value within the policy grows tax-deferred, and withdrawals or policy loans can be tax-free up to the amount of premiums paid. Additionally, the death benefit is typically tax-free for beneficiaries.

By understanding the differences between term life and whole life insurance, you can make an informed decision that aligns with your financial goals and provides the peace of mind that comes with comprehensive financial protection.