Whole Life Cash Value Life Insurance

Welcome to this comprehensive guide on understanding and maximizing the benefits of Whole Life Cash Value Life Insurance, a type of permanent life insurance policy that offers long-term protection and unique financial advantages. In today's fast-paced world, where financial security is a top priority, having a solid understanding of this often-misunderstood insurance product can be a game-changer for your financial planning.

Whole Life Cash Value Life Insurance, also known as cash value life insurance or permanent life insurance, is designed to provide coverage for your entire life, ensuring that your loved ones are financially protected in the event of your passing. But its benefits go far beyond just the death benefit. The cash value component of this policy acts as a savings account, offering policyholders the opportunity to build a substantial sum over time, which can be accessed through withdrawals or loans.

The Fundamentals of Whole Life Cash Value Life Insurance

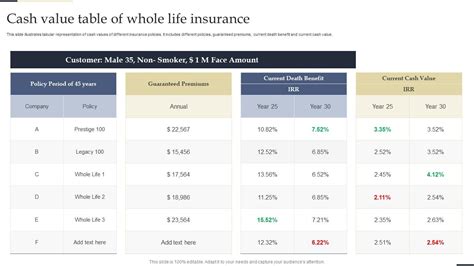

Whole Life Cash Value Life Insurance is a long-term financial commitment, typically spanning several decades. The policy is structured to provide coverage for your entire life, with the added benefit of a cash value component that grows over time. This growth is fueled by a portion of the premiums you pay, which are invested by the insurance company.

The premiums for Whole Life Cash Value Life Insurance are typically higher than those for term life insurance, as they cover both the death benefit and the cash value growth. However, these premiums remain level throughout the policy, providing stability and predictability in your financial planning.

Understanding Cash Value

The cash value in a Whole Life policy is a key differentiator from term life insurance. This value accumulates over time and can be used in several ways. Policyholders can borrow against this cash value, use it to pay future premiums, or withdraw it for any purpose.

It's important to note that any withdrawals or loans against the cash value will reduce the policy's death benefit and the overall cash value. However, if the policy is managed effectively, the cash value can provide a substantial financial cushion for retirement or other long-term financial goals.

Benefits and Advantages of Whole Life Cash Value Life Insurance

Whole Life Cash Value Life Insurance offers a range of benefits that make it an attractive option for long-term financial planning.

Lifetime Protection

The primary benefit of Whole Life Insurance is the guarantee of lifetime protection. Unlike term life insurance, which provides coverage for a set period, Whole Life policies remain in force as long as the premiums are paid. This means that your loved ones are protected, no matter what life throws your way.

Cash Value Accumulation

The cash value component of Whole Life Insurance allows policyholders to build a substantial savings account over time. This value can grow significantly, providing a valuable financial asset that can be used for various purposes, such as funding retirement, paying for a child’s education, or covering unexpected expenses.

Flexibility

Whole Life Insurance policies offer flexibility in how the cash value is utilized. Policyholders can borrow against the cash value, use it to pay for future premiums, or withdraw it outright. This flexibility allows individuals to adapt their financial strategy to changing life circumstances.

Tax Advantages

The cash value growth within a Whole Life policy is tax-deferred, meaning it grows without being taxed annually. This can result in significant tax savings over time. Additionally, withdrawals or loans from the cash value are generally tax-free, as long as they do not exceed the amount of premiums paid.

How to Maximize the Benefits of Whole Life Cash Value Life Insurance

Maximizing the benefits of Whole Life Cash Value Life Insurance requires a thoughtful and strategic approach. Here are some key considerations and strategies to help you make the most of this policy.

Understanding the Policy Terms

Before committing to a Whole Life policy, it’s essential to thoroughly understand the terms and conditions. This includes knowing the premium structure, the rate of cash value growth, and any restrictions or limitations on withdrawals or loans.

Optimizing Cash Value Growth

To maximize the cash value growth, consider paying your premiums consistently and on time. Additionally, you may want to explore the option of paying more than the minimum premium, as this can accelerate the growth of the cash value. Some policies also offer the ability to make additional contributions to the cash value, which can further boost its growth.

Using the Cash Value Strategically

The cash value in your Whole Life policy can be a valuable financial tool. Consider using it strategically to meet your financial goals. For example, you might borrow against the cash value to fund a child’s education or use it to pay for a major purchase, such as a home renovation. However, it’s important to remember that any loans or withdrawals will impact the death benefit and overall cash value.

Managing Premiums

While the premiums for Whole Life Insurance are generally level, it’s still important to manage them effectively. Ensure that you have a clear understanding of your financial situation and can afford the premiums over the long term. If your financial situation changes, you may have the option to reduce the death benefit or convert the policy to a less expensive option, although this could impact the cash value growth.

Whole Life Cash Value Life Insurance: Real-World Examples and Success Stories

Whole Life Cash Value Life Insurance has helped countless individuals and families achieve their financial goals and provide security for their loved ones. Here are a few real-world examples of how this type of insurance has made a difference.

Mr. Johnson’s Legacy

Mr. Johnson, a successful businessman, purchased a Whole Life Cash Value policy when he was in his 40s. Over the years, the cash value in his policy grew significantly, providing him with a substantial financial cushion for retirement. When Mr. Johnson passed away, his policy left a legacy for his family, ensuring they were financially secure and able to maintain their lifestyle.

The Smith Family’s Education Fund

The Smith family, with three children, decided to purchase a Whole Life policy to ensure their children’s future. Over time, the cash value in their policy grew, and they were able to use it to fund their children’s college education. This allowed the Smith family to provide their children with a quality education without incurring significant debt.

Ms. Davis’ Peace of Mind

Ms. Davis, a single mother, purchased a Whole Life policy to ensure her daughter’s future. The policy’s cash value grew steadily, and Ms. Davis was able to use it to cover her daughter’s living expenses while she attended college. This provided Ms. Davis with peace of mind, knowing that her daughter was financially secure during her academic pursuits.

Future Implications and Considerations

Whole Life Cash Value Life Insurance offers a unique blend of financial protection and savings opportunities. However, it’s important to consider the future implications and potential challenges when choosing this type of policy.

Long-Term Commitment

Whole Life Insurance is a long-term financial commitment, often spanning several decades. It’s essential to ensure that you can maintain the premiums over this period. Life circumstances can change, and it’s important to have a plan in place to manage any potential financial challenges that may arise.

Flexibility vs. Restrictions

While Whole Life policies offer flexibility in terms of cash value utilization, there are also restrictions to consider. Withdrawals and loans against the cash value can impact the death benefit and overall cash value growth. It’s important to carefully consider your financial goals and the potential implications of any withdrawals or loans.

Policy Performance and Growth

The performance and growth of the cash value in a Whole Life policy can vary based on several factors, including the insurance company, the policy’s terms, and market conditions. It’s important to understand the potential range of outcomes and ensure that the policy’s performance aligns with your financial expectations.

Alternatives and Comparisons

Whole Life Cash Value Life Insurance is just one of many financial products available. It’s important to compare it to other options, such as term life insurance or other investment vehicles, to ensure it aligns with your financial goals and risk tolerance. Consider seeking advice from a financial advisor to determine the best approach for your unique situation.

Conclusion: Whole Life Cash Value Life Insurance - A Powerful Financial Tool

Whole Life Cash Value Life Insurance is a powerful financial tool that offers a unique blend of long-term protection and savings opportunities. By understanding the fundamentals, benefits, and strategies associated with this type of insurance, you can make informed decisions to maximize its potential. Whether you’re looking to provide for your loved ones, build a substantial financial cushion, or achieve other financial goals, Whole Life Cash Value Life Insurance can be a valuable asset in your financial planning.

What is the difference between Whole Life and Term Life Insurance?

+Whole Life Insurance provides coverage for your entire life, along with a cash value component that grows over time. Term Life Insurance, on the other hand, provides coverage for a set period, typically 10, 20, or 30 years, and does not offer a cash value component.

Can I withdraw all the cash value from my Whole Life policy?

+Yes, you can withdraw all the cash value from your Whole Life policy. However, it’s important to consider the potential impact on your death benefit and overall cash value growth. Withdrawing the full cash value may result in the policy lapsing, so it’s advisable to consult with a financial advisor before making such a decision.

Are there any tax implications for the cash value in a Whole Life policy?

+The cash value growth within a Whole Life policy is tax-deferred, meaning it grows without being taxed annually. Withdrawals or loans from the cash value are generally tax-free as long as they do not exceed the amount of premiums paid. However, it’s important to consult with a tax advisor to understand the specific tax implications in your situation.